* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Slide 1

Survey

Document related concepts

Transcript

Final Notes on Growth and Saving

1

Agenda for this week

•

•

•

•

•

•

Paper assignment

Simulation of increased saving experiment

Advanced macro on “optimal economic growth”

An example from economics of global warming

Alternative schools: Real Business Cycles

Debt, deficits, and growth

2

Paper Assignment

The paper should be 3 to 5 pages (double-spaced, printed, plus tables, figures, and references).

It will count as 10 percent of the course grade.

The paper must left in the box outside Ms. King’s office at 28 Hillhouse Avenue before noon on

Thursday, December 10.

Guidelines are that the paper must: (a) be a topic in macroeconomics, (b) consider economic

history or policy, (c) present evidence and data, and (d) be an application of

macroeconomic analysis.

Some examples of topics would be the following:

- Administration X’s theories and policies, and their successes and/or failures

- The demise of the gold standard or Bretton Woods

- The role of the housing price decline in the current recession

- The legacy of Alan Greenspan, Paul Volcker, or Ronald Reagan

- The macroeconomic effects of protectionism in the Great Depression.

You should consult with your Teaching Fellow about your topic to make sure that it makes

sense and to get ideas for sources.

Consult rules on intellectual honesty and attribution, and don’t procrastinate.

See notes on web site for further information.

3

3

Numerical Example of Budget Surplus in

Neoclassical Growth Model

Assumptions:

1. Production is by Cobb-Douglas with CRTS

2. Labor plus labor-augmenting TC:

1.

n = 1.5 % p.a.; h = 1.5 % p.a.

3. Full employment; constant labor force participation rate.

4. Savings assumption:

a. Private savings rate = 18 % of GDP

b. Initial govt. savings rate = minus 2 % of GDP

c. In 1992, govt. changes fiscal policy and runs a surplus of 2 %

of GDP

d. All of higher govt. S goes into national S (i.e., constant

private savings rate)

5.

“Calibrate” to U.S. economy of 1997

4

Impact of Increased Government Saving on Major Variables

1990

1995

2000

2005

2010

35%

Percent change from baseline

30%

25%

20%

15%

Consumption per capita

GDP per capita

Capital per capita

NNP per capita

- Note that takes 10

years to increase C

-Political

implications

- Must C increase?

10%

5%

0%

-5%

5

-10%

Results on Growth Rates:

Growth rates of Potential

1982-1992

1992-2002

2002-2012

2012-2052

2052-2092

-

NNP

NNP per

capita

GDP per

capita

Consumption

per capita

3.02%

3.28%

3.11%

3.03%

3.02%

1.50%

1.75%

1.59%

1.51%

1.50%

1.50%

1.97%

1.69%

1.53%

1.50%

1.50%

1.47%

1.69%

1.53%

1.50%

Modest impact on growth in short run

Consumption down then up

No impact on growth in long run

GDP v NNP (gross v. net; national v. domestic)

6

Return to question of whether can have too

high a savings rate

- Recall question from last time of whether C has to

increase when S increases.

- This involves the question of whether K is above the

“Golden Rule” K.

- Golden Rule = maximum sustainable level of per capita

consumption

- Simple algebra (consider only net output):

Max f(k) – nk → f’(k) – n = 0 → r = n

or real interest rate = growth rate

7

1. Find k** where net interest rate equals n.

2. At that point c is maximized.

This is the golden rule savings rate.

y = f(k)

y

Yale?

c** = (1-s**)f(k**)

(n+δ)k

i = sf(k)

k**

k

8

More general approach: Ramsey-Koopmans model

The Ramsey problem is to determine the optimal savings rate.

Here, we treat that with labor-augmenting technological change

and a specific utility function.

max

{ ct }

t 0

LtU (c t )e t dt

c t C t / Lt (1 st ) F(K t , Et Lt )

dK t / dt st F(K t , Et Lt ) K t

U (c t ) [(c t1 1) /(1 )

We can use different techniques. One is the "calculus of variations,"

which leads to the following "Euler equation":

rt MPK t gt n , where gt rate of growth of per capita consumption

In steady state, t his is:

r * MPK * h n

9

Ramsey-Koopmans model (cont.)

In the polar case of =h=0, this yields the Golden Rule.

However, in cases with or h or >0, get higher r and lower net s.

Conventional discounting:

ρ = 2 % per year; h=2 %; n = 1 %; = 2 r = 5%; s** = 14%

Stern (British economist) argues for low discounting:

ρ = 0.1 %; h=1.3 %; n = 0 %; = 1 r = 1.4 %; s** = 31%

Current US savings rate about 5 - 10 %!

Policy importance:

Say you are worried about the damages from global warming in 2000 yrs.

Say damages are 50 % of output of $50 trillion plus growth

- With conventional discounting, .5*50*exp(200*.02)exp(-.05*200) = $.061

- With Stern discounting, .5*50*exp(200*.013)exp(-.014*200) = $20.5

10

Example of modeling: Yale RICE model

Regional Integrated model of Climate and the Economy

Integrates economic growth, CO2 emissions, climate

change, damages, and economic policy

Relies upon:

- Solow growth model

- Ramsey-Koopmans optimal growth theory

- Samuelson theory of public goods

- wide variety of geophysical theories

- Pigovian theory of externality taxes

11

Results of Solow-Ramsey-Koopmans model

60

GDP (trillions, 2005 US$)

50

40

US

EU

Japan

Russia

China

India

Latin America

30

20

10

0

2005 2015 2025 2035 2045 2055 2065 2075 2085 2095 2105

12

Integration with Climate model and alternative policies

6.0

Temperature

Optimal

Global mean temperature (degrees C)

Baseline

5.0

Lim T<2

Copenhagen trade

4.0

3.0

2.0

1.0

0.0

2005

2025

2045

2065

2085

2105

2125

2145

2165

2185

2205

13

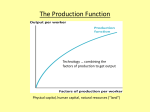

Growth Accounting (not covered in class)

Growth accounting is a widely used technique used to separate out the sources

of growth in a country relies on the neoclassical growth model

Derivation

Start with production function and competitive assumptions. For

simplicity, assume a Cobb-Douglas production function with laboraugmenting technological change:

(1) Yt = At Kt α Lt 1-α

Take logarithms and time derivatives:

(2) ∂ln(Yt)/∂t= gY = gA + α gK + (1 - α) gL

In the C-D, α is the competitive share of K = sh(K); (1 - α) = sh(L).

(3) gY = gA + sh(K) gK + sh(L) gL

From this, we estimate the rate of TC as:

(4) TFP growth = T.C. = gA = gY - sh(K) gK - sh(L) gL

Note that this is a very practical formula. All terms except h are observable.

Can be used to understand the sources of growth in different times and

places.

14

Some applications (not to be covered)

1. Clinton’s growth policy (see above)

2. U.S. growth since 1948

3. China in central planning and reform period

4. Soviet Union growth, 1929 - 1965

The very rapid (measured) growth in the Soviet economy

came primarily from growth in inputs, not from TFP growth.

5. Japanese growth, 1950-75

Japan had very large TFP growth after WWII. Wide variety

of sources, including adoption of foreign

[These are contained in the slides for growth theory.]

15

Classical themes in macroeconomics:

Real Business Cycle Theory

16

Schools of Macroeconomics

longrun

Classical

or non-classical?

(sticky wages

and prices, rational

expectations, etc.

Short run or long run?

(full adjustment of

capital,

expectations, etc.

shortrun

yes

no

yes

Classical

or non-classical?

(sticky wages

and prices, rational

expectations, etc.

no

Neo-classical

growth

model

Marxist theories?

Behavior growth theories?

Malthusian trap models?

Real business cycle (RBC);

supply-side economics;

structural models;

misperceptions models

Keynesian model

(sloping AS,

expectationsaugmented

PC, IS-LM, etc.)

Real Business Cycles

Basic idea: cycles are caused by productivity shocks; these are

propagated by changes in prices and then to labor supply.

Model Details

• Start with neoclassical growth model.

• Remember decomposition of output growth from growth accounting:

gY = α gK + (1-α) gL + θ, where θ = T.C.

• Changes in output come from two sources:

– Technological shocks: θ random.

– Changes in labor force participation: assumes very high

elasticity of labor supply with respect to wages.

• This then generates random output fluctuations, which RBC school

calls business cycles.

RBC recession

Price (P)

AS’

AS

P*

AD

Q*

Real output (Q)

1.12

1.10

Price of GDP

1.08

AS2004:Q4

1.06

1.04

AS2001:Q1

1.02

1.00

9,800 10,000 10,200 10,400 10,600 10,800 11,000

Real GDP

Policy implications of RBC models

• Output shocks are exogenous phenomena (earthquakes, Internet

revolution, terrorist strikes, wars, etc.).

• No role for monetary or fiscal policies in cycle:

– Economy and unemployment are efficient; no need for policies

– Cycles are supply-driven, cannot use AD policies to stabilize output.

– Money is “neutral” (M policy cannot affect real output), so cannot use

M policy

Problems in RBC models

1. Cyclical properties of classical models of the business cycle

- Hard to explain deep recessions and depressions (1930s, 200709) as technological regress.

2. Money and output: is money neutral?

- RBC predicts money neutral

- F/S and Keynesians: much evidence that M is non-neutral

3. Labor market features (such as quits and Beveridge curve)

Verdict: Economists deeply divided.

Personal view: Keynesian approach has not developed a complete

microeconomic justification, but it is most promising approach to

understanding sources and policies for business cycles.

Growth and savings in an open economy?

• For small open economy

– What happens if savings rate increases?

– In this case the marginal investment is abroad!

23

Open economy growth with mobile financial capital ( r = world r = rw)

NX = S - I

S0

r = real

interest rate

r = rw

Original

NX

deficit

I(r)

0

I, S, NX

24

Open economy growth

S1

S0

r = real

interest rate

Higher saving:

1. No change I

2. No change GDP

3. Higher foreign saving

4. Increase GNP, NNP

Final NX

surplus

r = rw

Original

NX

deficit

I(r)

0

I, S, NX

25

y = f(kd)+rkf

yd = f(kd)

(n+δ)k

sy

kd

k

k

26

What if savings in an open economy?

• For small open economy

– What happens if savings rate increases?

– In this case the marginal investment is abroad!

– Therefore, same result, but impact is upon net foreign

assets, investment earnings, and not on domestic capital

stock and domestic income.

– No diminishing returns to investment (fixed r=rw)

– Will show up in NNP not in GDP!

(Most macro models get this wrong.)

• Large open economy like US:

– Somewhere in between small open and closed.

– I.e., some increase in domestic I and some in increase net

foreign assets

27

1. Do Deficits Matter? The Ricardian Theory of the Debt

1. Robert Barro (Chicago/Harvard) introduced a theory in which

deficits do not affect national saving or output.

2. Chicago view of households: They are "clans" or "dynasties" in

which parents have children’s welfare in utility function:

Ui = ui (ci, Ui+1)

where Ui is utility of generation i and

ci is consumption of generation i

3. This implies by substitution:

Ui = ui (ci, ui+1(ci+1, Ui+2)) = vi(ci, ci+1, ci+2, ...)

which is just like an infinitely lived person!

4. Important result: Barro consumers are like a life-cycle model with

infinitely lived agents with perfect foresight:

there will be no impact of anticipated taxes (or deficits) on consumption or on

aggregate demand.

5. Controversial, but empirically questionable. Reasons are myopia,

singles, liquidity constraints, non-altruistic parents.

28