* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Crisis and the Impact on China

Survey

Document related concepts

Transcript

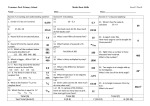

Determinants of Growth Danyang Xie Fall 2013 Outline • • • • • A Tale of Two Nations: Philippines and South Korea Growth Makes a Difference How can a country grow faster A Daring Plan: Charter Cities Convergence – OECD Convergence – Convergence among US States – Evidence from China Provincial Data • Sources of Economic Growth – Why China Grow so Fast? – HK versus Singapore Philippines and South Korea 1960 • Per Capita GDP $ 640 • Population 28 million • 27 % of people lives in Manila • Per Capita GDP $ 640 • Population 25 million • 28% of people lives in Seoul By 2003, per capita income in South Korea is about 12 times as large as that in Philippines Is there some action a government of Philippines could take that would lead the Philippines’ economy to grow like South Korean? If so, what exactly? If not, why not? “Once one starts to think about these questions, it is hard to think about anything else” Lucas, 1988 Growth Makes a Difference Calculating Growth Rate • The growth rate of x from time t to t+1 is given by x ( t 1) x ( t ) x( t ) 100 % • Rule of 70 – If the growth rate of x is 2%, then it takes 70/2=35 periods to double x Growth Makes the Difference • Between 1960 and 1980 – India’s growth rate of income was 1.4% per year – South Korea’s growth rate was 7% per year • As a result – Indian income will double every __ years – Korean income will double every __ years Growth Makes the Difference • Between 1960 and 1980 – India’s growth rate of income was 1.4% per year – South Korea’s growth rate was 7% per year • As a result – Indian income will double every 50 years – Korean income will double every 10 years What a Difference! • An Indian will, on average, be twice as well off as his grandfather • A Korean will be __ times as well off as his grandfather What a Difference! • An Indian will, on average, be twice as well off as his grandfather • A Korean will be 32 times as well off as his grandfather How can a country grow faster? • “Simply advising a society to follow the Korean model is like advising an aspiring basketball player to follow the Michael Jordan model.” Robert E. Lucas, Jr., 1993 How can a country grow faster? • Some suggestions – Encourage human capital accumulation – Subsidize basic scientific research – Open up the economy – Import Ideas – Promote on the job training – Develop financial sector? – Build a Democratic Society? Empirical Results from 4 million regressions (Xavier Sala-i-Martin, 1997) • Sala-i-Martin ran regressions that include 1960 per capita GDP, 1960 Primary School Enrollment, and 1960 Life Expectancy and tested the significance of other 59 variables • He found that 21 out of the 59 variables are significant for economic growth at 95 percent level The significant 21 variables Equipment Investment Number of Years Open Economy Fraction of Confucius Rule of Law Fraction of Muslim Less Political Rights Latin American Dummy Sub-Sahara African Dummy Less Civil Liberty Revolution and Coups Fraction of GDP in Mining S.D. Black Market Premium Primary Exports in 1970 Degree of Capitalism War Dummy Non-Equipment Investment Absolute Latitude Exchange Rate Distortions Fraction of Protestant Fraction of Buddhist Fraction of Catholic + + + + + + + + + + - Regional Variables Equipment Investment Number of Years Open Economy Fraction of Confucius Rule of Law Fraction of Muslim Less Political Rights Latin American Dummy Sub-Sahara African Dummy Less Civil Liberty Revolution and Coups Fraction of GDP in Mining S.D. Black Market Premium Primary Exports in 1970 Degree of Capitalism War Dummy Non-Equipment Investment Absolute Latitude Exchange Rate Distortions Fraction of Protestant Fraction of Buddhist Fraction of Catholic + + + + + + + + + + - Political variables Equipment Investment Number of Years Open Economy Fraction of Confucius Rule of Law Fraction of Muslim Less Political Rights Latin American Dummy Sub-Sahara African Dummy Less Civil Liberty Revolution and Coups Fraction of GDP in Mining S.D. Black Market Premium Primary Exports in 1970 Degree of Capitalism War Dummy Non-Equipment Investment Absolute Latitude Exchange Rate Distortions Fraction of Protestant Fraction of Buddhist Fraction of Catholic + + + + + + + + + + - Market Distortions and Market Performance Equipment Investment Number of Years Open Economy Fraction of Confucius Rule of Law Fraction of Muslim Less Political Rights Latin American Dummy Sub-Sahara African Dummy Less Civil Liberty Revolution and Coups Fraction of GDP in Mining S.D. Black Market Premium Primary Exports in 1970 Degree of Capitalism War Dummy Non-Equipment Investment Absolute Latitude Exchange Rate Distortions Fraction of Protestant Fraction of Buddhist Fraction of Catholic + + + + + + + + + + - Variables not strongly related to growth • • • • • • • Government spending Inflation rate Inflation variance Tariff restrictions Index of Democracy 1965 Urbanization Rate … A Daring Plan: Charter Cities • Paul Romer: TED Lecture • Rules are important – North Korea vs South Korea – Haiti vs Dominican Republic – Hong Kong – Honduras Convergence Hypothesis • Poor countries should grow faster than rich countries because: – Capital stock is low relative to labor, the return to capital should be high in poor countries – Poor countries can free ride on the technologies developed in the rich countries – Migration is a third source of convergence Empirical findings • There is no unconditional convergence No unconditional convergence Empirical findings • There is no unconditional convergence • Convergence does occur among countries with similar characteristics (conditional convergence) Conditional Convergence (OECD) China: Provincial Convergence • Convergence is significant for the period 197889 • Convergence is insignificant for the period 1989-97 Source: Table 3.3. China: Competing in the Global Economy. IMF 2003. Conditional Convergence (US States) Openness Helps Convergence Openness Helps Convergence Lucas: Trade and Diffusion of the Industrial Revolution, NBER August 2007 Sources of economic growth • Technological progress (TFP growth) • Increases in capital inputs • Increases in labor inputs Growth Accounting Production function: Y = A F(K, N) In terms of growth: Y A K N a b Y A K N elasticity of Y w.r.t. N elasticity of Y w.r.t K Total factor productivity growth In the US economy a = 0.36 and b = 0.64 Y A K N 0.36 0.64 Y A K N • 10% increase in A raises Y by 10% • 10% increase in K raises Y by 3.6% • 10% increase in N raises Y by 6.4% How to estimate the elasticities? • The elasticities a and b are often estimated by capital income share and labor income share, respectively. • b = labor income / GDP • a=1–b • This approach works well in economies with competitive markets and constant returns to scale. Growth accounting exercise I Why China Grows So Fast? China: Sources of Growth, 1952-94 Period Output TFP Capital Labor 1952-78 5.8 1.1 6.2 2.5 1979-94 9.3 3.9 7.7 2.7 Source: Hu and Khan (1996) In-Class Number Crunching III: If we use labor income share as an approximation for the labor elasticity, what is the average labor income share since economic reform in 1979? China: Percentage Contribution to Output Growth Period TFP Capital Labor 1952-78 18 65.2 16.8 1979-94 41.6 45.6 12.8 Source: Hu and Khan (1996) Percentage contribution from capital to output growth after reform: a*(growth rate of capital)/(output growth) Will China continue to grow? • 120 million of rural labor is yet to be fully employed • Plenty of room for improvement on rule of law • Incentive mechanism in the financial system remains to be put in place • Human capital accumulation • Much catching up to do: per capita income in China is estimated to be about $6,200 in 2012, ranked 87th, still far behind The precondition for growth is social stability Growth accounting exercise II A tale of two cities A tale of two cities Percentage Contribution to Output Growth TFP Capital Labor Hong Kong 30 42 28 Singapore -5 73 32 Source: Alwyn Young (1995) Non-parametric estimation TFP growth estimate (%) Conventional Country Capital Labor Nonparametric Elasticity Income share Elasticity Income share 4.1 3.4 0.41 0.37 0.71 0.63 2.8 2.3 3.7 0.18 0.29 0.81 0.71 Singapore 0.5 1.8 3.7 0.17 0.49 0.63 0.51 Taiwan Province of China 3.8 2.1 3.8 0.19 0.26 0.76 0.74 Young Collins Hong Kong SAR 4.1 Korea Source: Iwata, Khan, and Murao (IMF Staff Papers 2003) Summary • Growth makes a difference • Besides the three variables that are commonly believed to influence growth (initial GDP, initial school enrollment, initial life expectancy), there are 21 variables that strongly related to growth. Rules that provide the right incentives are extremely important. • No unconditional convergence; but conditional convergence exists and is strong among the economies that are open. • Pay attention to TFP growth. Its estimation is sensitive to the estimates of the elasticities.