* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download introducingDeficits and Debt

Survey

Document related concepts

Transcript

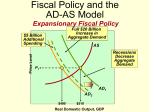

Chapter 15 introducing Deficits and Debt Chapter Goals Define the terms deficit, surplus, and debt and distinguish between a cyclical deficit and a structural deficit Differentiate between real and nominal deficits and surpluses Explain why the debt needs to be judged relative to assets Describe the historical record for the U.S. deficit and debt Defining Deficits and Surpluses A deficit is a shortfall of revenues under payments A surplus is an excess of revenues over payments In the Short Run Deficit Short Run In the short run, if the economy is below potential, deficits are good because deficits increase expenditures moving output closer to potential In the Long Run Surpluses Long-Run • Long-run surpluses are good because they provide saving for investment We Are Back To Trade Off Short Run Deficit Good Long Run Surplus Good Short Run or Long Run? Who Makes Fiscal Policy? • The President and Congress make fiscal policy – This is complicated and can be time consuming, especially when one political party controls Congress while the president belongs to the other party – No one seems to be in charge of making fiscal policy Copyright 2002 by The McGraw-Hill Companies, Inc. All rights reserved. 12-33 The Deficit Dilemma** • Deficits, Surpluses, and the Balanced Budget – When government spending is greater than tax revenue, we have a federal budget deficit • The government borrows to make up the difference • Deficits are prescribed to fight recession Copyright 2002 by The McGraw-Hill Companies, Inc. All rights reserved. 12-35 Deficits Spending Tax Revenue The Deficit Dilemma • Deficits, Surpluses, and the Balanced Budget –When the budget is in a surplus position, tax revenue is greater than government spending • Budget surpluses are prescribed to fight inflation Copyright 2002 by The McGraw-Hill Companies, Inc. All rights reserved. 12-36 Surplus Spending Tax Revenue The Deficit Dilemma • Deficits, Surpluses, and the Balanced Budget –We have a balanced budget when government expenditures are equal to tax revenue • We’ve never had an exactly balanced budget Copyright 2002 by The McGraw-Hill Companies, Inc. All rights reserved. 12-37