* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Economic 157b - Yale University

Economic growth wikipedia , lookup

Economic democracy wikipedia , lookup

Production for use wikipedia , lookup

Pensions crisis wikipedia , lookup

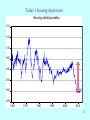

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Interest rate wikipedia , lookup

Gross fixed capital formation wikipedia , lookup

Okishio's theorem wikipedia , lookup

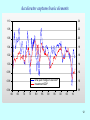

Economics 122. Investment Fall 2012 NOAA’s weather supercomputer PET Scan of PIB molecule 1 The Macroeconomics of Investment Capital • Produced, durable, used for further production • Examples: – tangibles (structures, equipment) – intangibles (software, human capital) Basic role of investment in macro • Short run: most volatile part of aggregate demand – See next slides • Long run: key determinant of growth of potential output and major way that governments affect economic growth – In growth theory 2 Gross Investment, US, 2011 Sector Counted as investment in National Accounts 2010 % of GDP GROSS DOMESTIC PRODUCT Total, investment type Residential/Household Durable goods Residential structures Gross busines domestic investment Fixed investment Structures Equipment and software Change in private inventories Government gross investment Federal National defense Nondefense State and local Other investment-type private spending Health Private education Research and development 15,076 100.0 1,485 39.6 9.9 1,516 10.1 480 3.2 2,484 16.5 1,146 339 1,480 405 1,075 37 National accounts include only a small part of “investment-like” spending: 12% of 40%. 109 52 320 1,752 252 480 3 Investment decline in the Depression 1.4 Real GDP (1929 = 1) Real I (1929 = 1) 1.2 1.0 0.8 0.6 0.4 0.2 0.0 29 30 31 32 33 34 35 36 37 38 39 40 Note on data: Very convenient place is “FRED”: http://research.stlouisfed.org/fred2 4 Investment in the Great Recession .20 .18 .16 .14 .12 .10 60 65 70 75 80 85 90 95 This is only gross domestic private investment. 00 05 10 5 Today’s housing depression Housing starts/population .014 .012 .010 .008 .006 .004 .002 .000 1960 1970 1980 1990 2000 2010 6 The major theories of investment 1. Accelerator theory: states that investment is a function of change in output 2. Neoclassical theory: Desired capital stock a function of output and cost of capital 3. Q theory: Investment a function of Tobin’s Q (Q =ratio of market value of K to replacement cost) 7 Summary of Neoclassical Theory of Investment • Define the user or rental cost of capital as uc = (r+δ) PK as implicit rental on capital. • Assume that Y is given by short-run aggregate demand • Cobb-Douglas for simplicity and pK = p = 1. 8 Summary of Neoclassical Theory of Investment • Define the user or rental cost of capital as uc = (r+δ) PK as implicit rental on capital. • Assume that Y is given by short-run aggregate demand • Cobb-Douglas for simplicity and pK = p = 1. Y AK L1 Profit maximization leads to MPK = user cost of capital. uc ( r ) MPK Y / K Y / K K Y / ( r ) In steady state, I ( g ) K , so I ( g )Y / ( r ) • So the demand for investment is inverse to the user cost of capital, and therefore also to the interest rate. 9 Now the details…. 10 1. Accelerator Theory - Oldest and simplest theory is the accelerator model. - Here, the idea is that there is a target capital-output ratio K* = v Y - Hence the desired change in investment is equal to the change in output (I is gross investment): I* = ΔK* + δK = v Δ Y + δK - The actual investment might differ from the desired, but this is a simple and useful model. It shows why there is a close relationship between investment and output change. 11 Accelerator captures basic elements 1.10 .24 1.08 .22 1.06 .20 1.04 .18 1.02 .16 1.00 .14 0.98 .12 One-year change in real GDP Investment/GDP 0.96 .10 0.94 .08 60 65 70 75 80 85 90 95 00 05 10 12 What is missing from accelerator? Financial markets! 1. Why does investment go down with tight money, high interest rates, and high risk premiums? (Neoclassical theory) 2. Why does investment decline when the market price of capital (e.g., housing) goes down? (Q theory) 13 Housing and interest rates with tight money 1981-1983 16 Mortgage interest rate 15 14 13 12 11 .003 .004 .005 .006 .007 .008 .009 Housing starts/population 14 Neoclassical Theory The mainstream theory is the neoclassical model. - This is closely related to the accelerator model. - The difference is that in the neoclassical model there is a variable capital-output ratio - Hence, K/Y depends upon relative factor prices, and in particular upon the user cost of capital and taxes. Using standard production theory Start with aggregate production function: Y = F(K,L) Next figure shows the difference of the accelerator and neoclassical models for an isoquant. 15 Isoquants with fixed capital-output ratio v. variable proportions L fixed K/L ratio in accelerator Cobb-Douglas in neoclassical K - fixed K/L corresponds to accelerator model - variable proportions (such as Cobb-Douglas) corresponds to neoclassical model 16 Investment Criteria – User cost of capital, uc • • • • Central concept in macro theories of investment Definition. Cost of renting capital for one period Appropriate for perfect capital market where Q=1 Estimate as imputed in most circumstances because firms own capital (also for housing in NIPA) 17 Formula for cost of capital uc ≈ (1+τ) pK [r + δ] where u = user cost of capital pK = price of capital good r = real interest rate δ = depreciation rate τ = effective rate of tax (or subsidy when negative) on capital goods Linkage to policy: - through real interest rate - through taxation of capital In practice, u is complicated to measure; off to B School! 18 Derivation and example: • Buy a car, rent it for one period, and then sell at the end. No inflation or taxes. Real interest rate = r = .05. • Pay $20,000 sell for 20,000(1-.1) = $18,000; collect rent u. • What cost of capital (u) would just break even? when pK = pK (1- δ)/(1+r) + u 20,000 = 18,000/(1.05) + u uc = 20,000 – 18,000/1.05 = 20,000 – 17,143 = 2857 ≈ pK (r+ δ) = 20,000(.15) = 3,000 19 Cost of capital with no taxes and P = 1 This is a slightly more realistic version that has both debt and equity capital. Real cost of capital (% per year) 14 12 10 8 6 4 2 0 60 65 70 75 80 85 90 95 00 05 10 Equal 0.3 x real bond rate + 0.7 x earnings-price ratio 20 Derivation of Basic Theory • Define the user or rental cost of capital as uc = (r+δ) PK as implicit rental on capital. • Assume that Y is given by short-run aggregate demand • Cobb-Douglas for simplicity and pK = p = 1. Y AK L1 Profit maximization leads to MPK = user cost of capital. uc ( r ) MPK Y / K Y / K K Y / ( r ) In steady state, I ( g ) K , so I ( g )Y / ( r ) • So the demand for investment is inverse to the user cost of capital, and therefore also to the interest rate. 21 - Note that the impact of interest rates on investment is powerful but depends importantly on the lifetime of the capital: User cost of capital Change in user Depreci- (per $ capital) cost with increase Lifetime ation rate at real interest rate: in r from 2% to 4% Investment item (years) 2% 4% δ Structures 50 0.02 4% 6% 50.0% Major equipment 10 0.10 12% 14% 16.7% Computers 3 0.40 42% 44% 4.8% Inventories 1 1.00 102% 104% 2.0% - Where biggest impacts? Housing - Where smallest? Computers and inventories 22 From demand for capital to demand for investment • What happens to demand for investment out of equilibrium? • Generally, go from demand for capital to demand for investment • Several approaches: - Costs of adjustment of investment (standard in modern macro) - Capacity in the capital goods industry (Boeing aircraft) - Construction lags (power plants) - Internal funds constraint 23 Now a major puzzle for neoclassical model: Housing and interest rates Housing price crash Tight money 2006 - 2010 16 6.8 15 6.4 Mortgage interest rate Mortgage interest rate 1981-1983 14 13 5.6 12 5.2 11 .003 4.8 .001 .004 .005 .006 .007 Housing starts/population .008 .009 ? 6.0 .002 .003 .004 .005 .006 .007 .008 Housing starts/population 24 A glut of cargo ships in 2009 25 Airplanes in mothballs (Tucson, Arizona) 26 More formally: Q = (market value of K)/(replacement cost of K) Example: - Cargo ships are selling for a Q of 0.25 - E.g., cost of production is $20 million, but ships sell for $5 million - How is this possible? • Inelastic supply and high demand for cargo → low rentals • PV of ships is low. • Therefore, little to no shipbuilding, and the stock gradually depreciates or is scrapped How does Q affect investment? - Because Q < 1, shipping firms buy old ships rather than build new ones - This depresses investment. - Therefore I/K = f(Q), f’(Q) > 0. 27 3. Q theory of investment Idea here is that investment is determined by relationship between the value of firms or houses and the cost of new or replacement capital. Keynes: “The daily revaluations of the Stock Exchange, though they are primarily made to facilitate transfers of old investments between one individual and another, inevitably exert a decisive influence on the rate of current investment. For there is no sense in building up a new enterprise at a cost greater than that at which a similar existing enterprise can be purchased; whilst there is an inducement to spend on a new project what may seem an extravagant sum, if it can be floated off on the Stock Exchange at an immediate profit.” Tobin: "It is common sense that the incentive to make new capital investments is high when the securities giving title to their future earnings can be sold for more than the investments cost, i.e., when q exceeds one." 28 Investment and Q Q I/K = f (Q) 1 I/K δ 29 Housing market collapse, 2006 – 2012+ 30 Investment ratio and Q for housing 1.7 900 I housing (right scale) 1.6 1.5 Housing bubble: 800 1.Note that Q rose about 50 percent from mid-1990s. 700 2. Note huge decline in 600 residential construction (I) Q of housing Residential construction (2005 $) 1.4 1.3 Q (left scale) 1.2 1.1 500 1.0 400 0.9 0.8 88 90 92 94 96 98 00 02 04 06 08 10 300 31 Housing Q and housing starts, 2006:m1 – 2010:m7 Housing Q (3 month moving average) 1.4 1.3 1.2 1.1 1.0 0.9 0.8 400 800 1,200 1,600 2,000 2,400 Housing starts (3 month moving average) 32 Summary of investment theory 1.. The major components of investment are residential, business plant and equipment, software, and inventories. 2. These are among the most volatile components of output in the short run. 3. In equilibrium, demand for capital determined where the cost of capital equals the marginal productivity of capital. 4. The major theories are the accelerator theory, the neoclassical theory, and the Q theory. These apply differently in different sectors. 5. Economic policy affects investment through both monetary and fiscal policy: • monetary policy through real interest rate and unconventional policies (buying mortgage backed securities) • fiscal policy through things like depreciation policy and investment tax credits. 33