* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download AGRICULTURE, FOOD AND RESOURCE POLICY AGEC 430

Survey

Document related concepts

Transcript

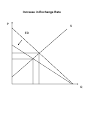

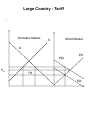

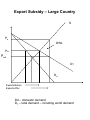

Chapter 5 - Trade & Macro 5.1 Macroeconomic Factors – exchange rates – interest rates – government fiscal balance 5.2 International Agricultural Trade –Trade agreements 5.3 Trade Theory –Gains from trade –Distortions (tariffs & subsidies) –Farm programs 1) Exchange Rates Affects the competitiveness of agr. Products Early 1970’s – floating exchange rates Policy – over or under value exchange rate What is the impact of a ER distortion? Example 1: Argentina: Overvalued Exchange Rate (exporter) Shift of excess demand function Lower producer price Lower quantity exported Loss of producer surplus Source: International Monetary Fund -IFS Increase in Exchange Rate P S ED Q Interest Rates: Why interest rates are important: 1) Value of currency – prices received and paid Most commodities are US$ denominated 2) Cost of borrowing: Agriculture is capital intensive (borrowing) Inputs: seed, fertilizer, machinery 1980’s - high interest rates – low grain prices - debt crisis Cost of borrowing: How is it determined ? Role of central bank (Bank of Canada) Role of the market Government intervention (interest subsidies) Canadian Prime Rate % (1960-2004) 20 18 16 14 12 10 8 6 4 2 0 1960 1965 1970 1975 1980 1985 1990 1995 2000 100 Basis points = 1% Src. Globe & Mail - March 8, 2008 Government Fiscal Balance Consequences for Agricultural Policy 1 – interest rate - more borrowing = higher rates "crowding out effect" - higher cost for farm borrowing 2001 Average capital/farm Total farm capital = $800,000 = $ 200 Billion 1% change in interest rates => $ 2 Billion (1971 - 2002) - Net market income - 1.8 $B (2002) 3.3 $B (1975) 2 – capacity to fund interventions - deficits = limited marge de manouvre - reduced scope for intervention Debt/GDP Canada (61-2003) 80 70 60 50 40 30 20 10 0 1961-62 1969-70 1977-78 1985-86 1993-94 2001-02 Deficit/GDP Canada (1961-03) 4 2 0 1961-62 -2 -4 -6 -8 -10 1966-67 1971-72 1976-77 1981-82 1986-87 1991-92 1996-97 2001-02 Fiscal Deficit - Debt Service (1961-2003) ($Millions) 60000 50000 40000 30000 20000 10000 0 1961-62 -10000 -20000 -30000 -40000 1966-67 1971-72 1976-77 1981-82 1986-87 1991-92 1996-97 2001-02 5.2 International TRADE Gains from trade: > increase in output due to specialization based on comparative advantage • each country – concentrates on producing goods and that it produces relatively efficiently – trading to obtain goods that it does not Trade Distortions • • • many forms of distortion (welfare reducing) tariffs, taxes, subsidies, quantitative measures non-tariff barriers (health, safety reg’s) Trade Agreements • • institutional arrangement – restraint on behaviour multi-lateral (regional), bilateral • Levels of cooperation – Range of goods (agr vs industrial) – Scope of instruments included – Customs union – full economic integration (EU) Reasons for Protection • new industry (infant industry argument) • national health + phyto-sanitary • unfair foreign trade policy • Defend domestic programs • improve balance of payments • improve “Terms of Trade” • generate revenue • slow down painful economic adjustment • Political economy benefits of additional trade are spread thinly among many individuals but the cost is high for only a few firms or groups Trade Theory • Why do nations trade? • What are the benefits? • Implications of trade distortions Theory • comparative advantage (Ricardo) • absolute advantage PA PM US PA PM CA • Ohlin (1933) • comparative advantage – due to resource endowments – Canada land rich, capital poor – => export agr & import manufactures Gains from trade • Trade allows for specialization – increased welfare Gains from Trade P1 . Agr. W1 W2 P2 Manufactures ES/ED Framework • Excess Demand (ED) • Excess Supply (ES) Gains from trade (versus no trade) • depend on the impact of a country on world prices • Small country – no price impact • Large country – prices adjust, impacts smaller 2 Country Model – 1 good • e.g. US/Canada cattle market • Assume: Canada - low cost producer • How are consumers and farmers affected by trade between the two countries? • Winners and losers – distribution effects – US – consumers gains, farmers lose – CA – consumers lose, farmers gain Gains from Trade . Canada Trade Sector ES US PUS WUS PW WCA PCA ED Trade Analysis: Trade Distortions 1 ) Import Tariff • Fixed-tariff rate vs ad valorem • Small country (fixed tariff) – domestic price increases – Supply increases, demand decreases – imports reduced – Net dead weight loss • Large country – domestic price increases – world price decreases – Imports decrease; domestic output increases – Consumers lose; producers gain – Government gains tariff revenue – Net welfare gain – Potential to compensate consumers Import Quota • Binding quota – if it restricts imports below free trade imports • Similar price effects to a tariff – – – – Imports lower Domestic price higher World price lower Rents to importers • Quota value: right to import – Based on difference between new world price and domestic price Large Country – Import Quota . Domestic Market World Market S D ES ED0 PQ Pw PWQ Q IQ Large Country - Tariff . Domestic Market World Market S D ES ED0 Pw TR ED1 Import tariff – Small Country S PT Pw b G income a D Government income – few transactions Export Subsidy • Used extensively – – – – – • Purpose: support domestic income (price) support Subsidy to export the excess supply US (EEP) starting in 1985 EU (ERP) – export restitutions – 1970’s not unique to agriculture – e.g. Bombardier price support program – increases ES • Subsidy Impacts – – – – world price falls (large country) Domestic price falls Exports expand Government payments = (Ps-PWs)*exports • value of exports increase relative to free trade • Deadweight loss – – – – Consumers gain Producers gain Foreign importers gain Taxpayer loses Export Subsidy – Large Country S Ps DWL Pw Pws DT Dd Exports Before Exports After Dd – domestic demand DT – total demand – including world demand Export Tax • Tax exporters • Exporting government gain revenue from export taxes • Producers in exporting country lose Export Cartel Assumptions: • • • • • 2 countries Cartel: importer + domestic supplier Suppliers maximize joint profits Price according to joint supply function MR = MC (joint MC) Results: • • • • Domestic price increases Imports and domestic production decrease Foreign surplus increases Deadweight loss Export Cartel . Exporter Importer Sd S ST PC a c Pw b D MR QE Qd Sd – domestic supply ST – domestic + foreign supply Exporter gain = (a-b) Deadweight loss = c Q Decoupled Subsidies • Programs that do not distort trade – within the green box category under GATT • policies that lead to a per-unit payment to producers are not decoupled • trade distorting => affects trade and prices • Is any farm program completely decoupled ?