* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Introduction

Survey

Document related concepts

Transcript

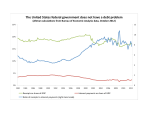

INTERNATIONAL MONETARY AND FINANCIAL ECONOMICS Third Edition Chapter 1 Keeping Up with a Changing World Trade Flows, Capital Flows, and the Balance of Payments Joseph P. Daniels David D. VanHoose Copyright © South-Western, a division of Thomson Learning. All rights reserved. International Economic Integration • International economic integration refers to the extent and strength of real-sector and financial-sector linkages among national economies. • Real Sector: The sector of the economy engaged in the production and sale of goods and services. • Financial Sector: The sector of the economy where individuals trade in financial assets. • Though economists tend to measure activity in these two sectors separately, an important point of this chapter is to show that they are linked. 2 Importance of the Global Market for Goods and Services • Over the last 35 years, the volume of world trade in goods and services has grown by almost 6 percent annually. • The cumulative effect of this growth is more than a five-fold increase in world trade. • As measured by the share of overall real-sector activity, world trade in goods and services has become more important to advanced and developing economies alike. 3 Growth of World Exports During the past thirty years, world trade in goods and services has exhibited positive growth rates for all but two years. SOURCE: International Monetary Fund, Economic Outlook, and authors’ estimates. 4 Selected Nation’s Trade The global market for goods and services has become more important for individual nations. The percentage shown reflects each nation’s trade as a share of its overall economic activity. SOURCE: International Monetary Fund, International Financial Statistics, various issues, and authors’ estimates. 5 Growth of Trade and Foreign Exchange Transactions FOREIGN EXCHANGE TURNOVER AND WORLD EXPORTS Foreign Exchange World Exports of Goods Turnover ($ trillion) ($ trillion) 1979 $17.5 $1.5 Ratio 12:1 1986 75.0 2.0 38:1 1989 190.0 3.1 61:1 1992 252.0 4.7 54:1 1995 297.5 5.0 60:1 1998 372.5 5.4 69:1 2001 300.0 6.6 45:1 2004 367.2 7.0 52:5 SOURCES: Held, David, Anthony McGrew, David Goldblatt and Jonathan Perraton, Global Transformations, p. 209; Bank for International Settlements, Central Bank Survey of Foreign Exchange and Derivatives Market Activity, 1998, p. 5; International Monetary Fund, World Economic Outlook, 1998, p. 200, and authors’ estimates. 6 Cross-Border Transaction in Bonds and Equities In Germany, the United States, and the United Kingdom, international transactions in bonds and equities have grown by more than 3,000 percent, 1000 percent, and 700 percent respectively. SOURCE: Bank for International Settlements, International Financial Statistics, and authors’ estimates. 7 Top Twenty Globalized Nations 1. Ireland 2. Switzerland 3. Singapore 4. Netherlands 5. Sweden 6. Finland 7. Canada 8. Denmark 9. Austria 10. United Kingdom 11. Norway 12. United States 13. France 14. Germany 15. Portugal 16. Czech Republic 17. Spain 18. Israel 19. New Zealand 20. Malaysia Source: Foreign Policy 8 The Top Global Companies Ranked by Foreign Assets Rank Company Home Country Industry 1 Vodaphone United Kingdom Telecommunication 2 General Electric United States Electrical 3 ExxonMobile United States Petroleum 4 Vivendi Universal France Diversified 5 General Motors United States Motor Vehicles 6 Royal Dutch/Shell United Kingdom / Netherlands Petroleum 7 BP United Kingdom Petroleum 8 Toyota Motor Japan Motor Vehicles 9 Telefónica Spain Telecommunications 10 Fiat Italy Motor Vehicles 9 Transnationality • Are the activities of the world’s largest firms really spread out globally? • A transnationality index measures this. • It is calculated by averaging the ratios of – Foreign assets to total assets – Foreign sales to total sales – Foreign employees to total empolyees. 10 An Example • General Electric, a U.S. TNC, ranks second on the list of the world’s largest non-financial TCS based on foreign assets. • Foreign assets are 159,188, total assets 437,006, foreign sales 49,528, total sales 129,853, foreign employment 145,000 and total employment 313,000. • Its TNI is only 40.3 and it does not appear on the list of the top ten TNCs by TNI. 11 Calculation 159,188 49,528 145,000 437,006 129,853 313,000 3 40.3% 12 The Top Global Companies Based on Transnationality Ranking Company Home Country Industry 1 Rio Tinto U.K. / Australia Mining 2 Thomson Canada Media 3 ABB Switzerland Machinery and Equipment 4 Nestlé Switzerland Food and Beverages 5 British American Tobacco United Kingdom Tobacco 6 Electrolux Sweden Electronic Equipment 7 Interbrew Belgium Food and Beverage 8 Anglo American United Kingdom Mining 9 Astrazeneca United Kingdom Pharmaceuticals Netherlands Electronic Equipment 10 Phillips Electronics 13 Balance of Payments Accounting • To understand how economists measure international transactions in the real and financial sectors of an economy, and how these sectors are linked, we turn to the balance of payments (BOP) accounting system. • A system of accounts which is a subset of the National Income and Production Accounts. • A double-entry system. • Debit Entries: Transactions that generate a payment outflow (e.g., import). • Credit Entries: Transactions that generate a payment inflow (e.g., export). 14 Balance of Payments • The current account is the broadest measure of a nation’s real sector trade. • Includes: – – – – Goods Services Income Receipts and Payments Unilateral Transfers 15 Current Account • Goods: Exports and imports of tangible items. • Services: Exports and imports of services, for example: – Typical business services such as banking and financial services, insurance, and consulting. – Tourism 16 Current Account • Income Receipts: Includes items such as – Investment income on US-owned assets abroad. – Receipts of income on US direct investment abroad. – Government income receipts • Income Payments: Includes items such as – Investment income on foreign-owned assets in the United States. – Payments of income on foreign direct investment in the United States – US Government income payments 17 Current Account • Unilateral Transfers: Includes items such as: – Government grants abroad – Private remittances – Private grants abroad • The current account balance is the sum of the debit and credit entries in the accounts just described. • A current account deficit occurs when the sum of the debit entries exceeds the sum of the credit entries. A current account surplus occurs when the sum of the credit entries exceeds the sum of the debit entries. 18 US Current Account (2003) Exports Millions Goods Services Income Receipts Imports Goods Services Income Payments Unilateral Transfers Current Account Balance 1,314,888 713,122 307,381 266,799 -1,778,117 -1,260,674 -256,337 -261,106 -67,439 -530,668 19 Balance of Payments The Financial Sector • The Capital and Financial Account tabulates the flows of financial assets between domestic residents and foreign residents and governments. • The private capital account tabulates flows among private domestic residents and foreign private residents. 20 The Capital Account • The Capital and financial Account: – Records international transactions in the financial sector. – Includes portfolio and foreign direct investment. – Includes changes in banks’ and brokers’ cash deposits that arise from international transactions. • The main accounts are: – US-Owned Assets Abroad: Increase or decrease in US ownership of foreign financial assets. – Foreign-Owned Assets in the US: Increase or decrease in foreign ownership of domestic assets. – Reserve Assets: Primarily the assets of central banks. 21 Portfolio and Foreign Direct Investment • Portfolio Investment: Individual or business purchase of stocks, bond, or other financial assets or deposits. (An income strategy) • Foreign Direct Investment (FDI): Purchase of financial assets that results in a 10 percent or greater ownership share. (A financial control strategy) 22 Capital and Financial Account Capital Account, Net Financial Account US-Owned Assets Abroad US Official Reserve Assets US Government Assets US Private Assets -3,079 -283,414 -1,523 537 -285,474 Foreign-Owned Assets Foreign Official Assets Other Foreign Assets 829,173 248,573 580,600 Net Financial Account Flows 545,759 23 The Balance of Payments The Statistical Discrepancy • The sum of the debit and credit entries in all of the BOP should total zero. • Of course there are errors and omissions resulting in a non-zero balance. • An offsetting entry to this non-zero balance is made in the statistical discrepancy account. • In this way, the total of the debit and credit entries equals zero. Balance on Current Account -530,668 Capital Account, net -3,0790 Net Financial Flows 545,759 Statistical Discrepancy -12,012 24 BOP Examples U.S. company imports an automobile valued at $50,000 Goods Debits (imports) Credits (exports) Services Income Payments and Receipts UT Capital -50,000 50,000 25 BOP Examples U.S. government sends $1 million in humanitarian supplies to Afghanistan Goods Debits (imports) Credits (exports) Services Income Payments and Receipts UT Capital -1 million 1 million 26 BOP Examples U.S. resident buys a UK Tbill equivalent in value to $1,000 Goods Services Income Payments and Receipts UT Capital Debits (imports) -1,000 Credits (exports) 1,000 27 BOP Examples U.S. resident receives $100 in interest on a foreign asset they own Goods Services Income Payments and Receipts Debits (imports) Credits (exports) UT Capital -100 100 28 BOP Examples A Marquette University student goes to Mexico on break and spends $500 Goods Debits (imports) Credits (exports) Services Income Payments and Receipts UT Capital -500 500 29 BOP Examples Total Goods Services Income UT Capital -1 mil -1,000 -100 Payments and Receipts Debits (imports) -50,000 Credits (exports) 1 mill Current Account -50,400 -500 1,000 50,000 500 100 Capital Account 50,400 30 Net Creditor and Net Debtor Status • A net creditor is a nation whose total claims on foreign residents exceed the total claims of foreign residents on the residents of the domestic nation. • A net debtor is a nation whose total claims on foreign residents are less than the total claims of foreign residents on the residents of the domestic nation. • It is not necessarily good nor bad to be either a net debtor or net creditor. 31 The United States as a Net Debtor The United States has been a net debtor at various times in its history. The United States was a net debtor in the late 1800s. SOURCE: Data from Economic Review of the federal Reserve Bank of Kansas City. 32 The Relationship Between the Current Account and the Capital Account • Expenditures Approach to National Income – National income is the sum of expenditures in the following categories; consumer expenditures, private investment expenditures, government expenditures, and net export expenditures, y= c + ip + g + (x-m) • Let the current account, ca equal ca = (x – m) • Then y=c + ip + g + ca 33 The Relationship Between the Current Account and the Capital Account • Income Approach – Income has three possible uses; it can be spent on current consumption, it can be saved (private saving), and we pay taxes to the government y= c + sp + t • Because both approaches equal national income, we can set the two identities equal: c + sp + t = c +ip + g + ca • or, sp – ip – (g - t) = ca 34 The Relationship Between the Current Account and the Capital Account • Private Saving – Private saving can be used to purchase three types of assets, domestic private investment, government debt (g – t) or to accumulate foreign assets (fa), sp = ip + (g – t) + fa • where fa is the (net) accumulation of foreign assets (domestic residents’ purchases of foreign assets in excess of foreign residents’ purchases of domestic assets). • Then, by rearrangement sp – ip – (g – t) = fa 35 The Relationship Between the Current Account and the Capital Account • Putting the two together: ca = sp – ip – (g – t) = fa • In words, private domestic saving less private domestic investment less the fiscal balance (government saving) equals the current account balance, which also equals the (net) accumulation of foreign assets. 36 An Example of the Relationship Between the Current Account and the Capital Account • Using the equality we derived, ca = sp – ip – (g – t) = fa • Suppose a nation’s private saving rate is 5.2 percent of its total output, its private investment rate is 7.3 percent, and its fiscal budget deficit is 3.3 percent ca = fa = 5.2 – 7.3 – 3.3 = -5.4. • In words, this nation’s residents must borrow from abroad (fa = -5.4) to finance their investment expenditures, resulting in a current account deficit in the amount of 5.4 percent of total output. 37