* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Attacking the Untapped Middle Market

Advertising campaign wikipedia , lookup

Service parts pricing wikipedia , lookup

Grey market wikipedia , lookup

Market analysis wikipedia , lookup

Global marketing wikipedia , lookup

Customer relationship management wikipedia , lookup

Product planning wikipedia , lookup

Darknet market wikipedia , lookup

Market penetration wikipedia , lookup

E-governance wikipedia , lookup

Marketing channel wikipedia , lookup

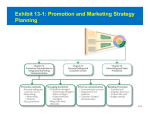

Attacking the Untapped Middle Market – A New Business Model for Profitable Growth © 2000 Booz•Allen & Hamilton Inc. Marty Hyman Ragu Gurumurthy Debjani Deb-Phalke Yogesh Pathak Attacking the Untapped Middle Market – A New Business Model for Profitable Growth Information technology providers traditionally focused on large businesses to sell their most sophisticated products and to drive their profitable growth. But with the rise of “middle market” businesses and the lowering costs of technology, there is abundant opportunity for information service providers to profit from pursuing this heretofore neglected business segment. I n recent years, the speed with which information competitive with the larger players as well. technology has revolutionized the way enterprises Going forward, technology will continue do business has been nothing less than startling. to be a great equalizer for some medium- No less impressive is the agility that information sized companies in several different industries. service providers — including applications service providers (ASPs), telecommunications service The Middle Market Is Large, Growing Quickly and Hungry providers and Internet service providers (ISPs) — for New Services have demonstrated in delivering state-of-the-art According to the Small Business Administration, information services in different ways. In doing so, small businesses are responsible for 39% of the U.S. the vast majority of these service providers have GNP and 44% of all sales. They also provide 57% concentrated their efforts on the largest enterprises. of all private sector employment. More importantly, They reasoned that middle market businesses — they are growing more quickly than large enter- those having roughly 100 to 500 employees — prises; four out of five jobs added to the U.S. didn’t have the scale or the resources to employ economy are attributable to smaller businesses. their most sophisticated and lucrative offerings. While smaller businesses have not commonly had However, as information technology has become access to the most sophisticated offerings of the vastly more sophisticated and dramatically less information service providers, they clearly appre- costly — and profit margins for service providers ciate information technology and are eager to get have been increasingly squeezed — new markets more of it. According to a survey by Sherwood for growth are needed. Research, middle market companies already The middle market provides much opportunity for those service providers willing to adjust their business paradigm. The new business paradigm has account for 47% of the total IT market. And more than 70% of these companies are connected to the Internet. been enabled by revolutionary technology advances. Recent qualitative research conducted by This “e-revolution,” in turn, enables information Booz •Allen & Hamilton shows that medium-sized service providers to satisfy their customer’s needs businesses are spending on average $3,000 per in innovative ways — especially in terms of both month per employee in cumulative IT support. offerings and channels. Their expertise can help Most importantly, our research found that the their customers reduce cost of operations to stay majority of these businesses are increasing their 1 technology investments as the “new paradigm” information services that middle market businesses takes hold. Most recently, these companies have are using and upgrading. We further found that indicated a willingness to invest aggressively in new these requirements can be grouped into five basic services such as e-commerce, unified messaging, segments (see Exhibit 1). Traditionally, service Internet access, IP VPN and a few hosted applica- providers have relied primarily on the size of a tions such as customer relationship management company or its spending on telecommunications (CRM) and collaboration. But these customers services as primary attributes for segmentation. would need training in how to use the new services, Our analysis of the information indicated that along with a clear articulation of the value propo- middle business requirements are determined largely sition for them. This remains a core challenge for by the following three factors: the service providers. • Technical sophistication of the company — The more technological the business of the company, the higher the demand for sophisticated communications Needs for Applications and Services Vary by Segment — and So Does Their Channel Preference • Growth of the company — The faster the pace of growth, the more likely a company is willing to invest in better communications Where are they committing their money? We found that there is significant variance in the kinds of Exhibit 1: Segment Profile Segment High Tech and Harried Remotely Local Movers and Sellers Growth Frequency of Contact Technology products or services High level of post-sales support to customers Move data quickly: they need speed Flexibility to accommodate fast growth Fast turnaround and high reliability Convenience (bundling) Many remote sites within local area: quarries, job sites, fields, boats Limited customer universe Mobile communications within a defined local area Fast voice line provisioning interval Telecommunications service advice Products require tracking Mobility and global reach equals high telecommunications spending Mobility solutions (for U.S. and international) at competitive prices Effective handling of high incoming call volume Messages to mobile staff Track product Automate for the People Many repeated customer requests on same topics Large customer universe Automated solutions for repeated customer requests Disseminate information to customers Low Needs, Low Maintenance Price-sensitive, but, at the same time, concerned with reliability Basic voice communication Want low price and reliability at the same time extremely important Source: Booz•Allen & Hamilton analysis 2 Technical Sophistication Profile and Needs very important somewhat important low priority lowest priority • Audiences of the company — The more complex and varied the internal and external audiences, the greater the range and sophistication of communications desired The profiles of these five segments are given as follows: resellers (VARs) who are trained and knowledgeable or through direct call centers. Thus it is clear that even though a direct salesforce is the most preferred option, there are other indirect options with adequate support mechanisms to target the middle market aggressively. Exhibit 1: Segment Profiles Our research revealed that both the communications needs and the level of pre- and post-sales support required differs significantly by segment. For example, companies in the “high tech and harried” and “automate for the people” segments generally want more sophisticated services such as IP VPN, e-commerce and several other scalable Findings That Service Providers Can Use to Target Middle Market Opportunities Our research uncovered several common themes among most middle market businesses we investigated that savvy service providers can use to identify potential opportunity. services, in addition to superior reliability, faster Middle market businesses require a high degree of provisioning and 24 X 7 tier 2 customer support. service dependability yet do not want to manage or On the other hand, companies in the “movers and maintain the services themselves — Surprisingly, sellers” segment typically want more outsourcing none of the businesses we researched — even the type functions, which include tier 1 and tier 2 technologically advanced — wanted to establish customer support, in addition to a different set of in-house and independent resources to stay current services such as unified messaging, IP Fax, hosted with communications needs. They all wanted these applications like CRM and wireless data/messaging capabilities to be managed from an outside resource; integrated with wireline services. A detailed synthesis of needs from our research is shown in Exhibit 2, with services such as messaging, hosting and e-commerce emerging as high-need services across all the segments. some indicated they would like a “service bureau” to understand their needs and provide all the support required. The differences across different segments originated primarily in the level of advice and help that they needed to develop an optimum solution that could then be externally managed. Exhibit 2: Application Needs by Segment According to our findings, the propensity to purchase from various channels also differs by segment. For example, the “high tech and harried” customers were more willing to purchase services over the Internet, including receiving e-billing and support. On the other hand, “remotely local” customers tended to purchase from a direct sales Middle market customers are looking for simple, packaged one-stop shopping — They don’t want to have to juggle services from a variety of providers. They want cost-effectiveness, topcaliber support, rapid turnaround and a single point of contact. And, if possible, they want local vendor relationships. force and from specialized industry groups/organi- Middle market businesses want to “look like a zations — trade associations who better understand bigger company” — They are increasingly aware their needs. Other segments such as “movers and that to capture the most sophisticated customers sellers” and “automate for the people” were more they need to implement the most sophisticated willing to purchase services from value-added offerings of the larger companies where possible. 3 Exhibit 2: Applications Needs by Channel Small Business Medium Business Comments Unified Messaging Internet Access Web Hosting and Design High Tech and Harried Telecom Consulting High tech and harried require more sophisticated applications even within small companies Voice Mail High-Speed Data Lines E-Commerce IP Telephony and Fax VPNs Network Mgmt and Integration Voice Mail Internet Access Remotely Local Networking needs emerge as remotely local companies grow to become medium businesses Integrated Cellular and Two-Way Radio Telecom Consulting VPNs Network Mgmt and Integration Internet Access Movers and Sellers Telecom Consulting VPNs Voice Mail Network Mgmt and Integration Unified Messaging ISS and Call Centers Needs increase dramatically as movers and sellers grow to become medium businesses E-Commerce IP Telephony and Fax Internet Access Automate for the People Telecom Consulting Interactive Support Systems and Call Centers Voice Mail Low Needs, Low Maintenance Increased dependence on communications network for enhancing productivity Network Mgmt and Integration Voice Mail Internet Access Simple needs mean simple applications, even as companies grow Source: Booz•Allen & Hamilton analysis They are looking for similar products and services technology planning and management. As a result, to those employed by large businesses but with their technology landscape evolves into a mixture of fewer “bells and whistles” and for lower prices. legacy and state-of-the-art systems. When making They are looking for service providers who understand their needs — Middle market customers are often mistaken for being “tough sells” when they really are simply price-sensitive. They can’t waste any new investments, the decision makers are skeptical about issues like hidden costs and interoperability. They need a technology evolution plan, a framework for expanding their systems in a cost- employee time or resources in searching for effective and evolutionary way over time. appropriate solutions. They are typically “half They are looking for simple, cost-effective means for ready” to commit, meaning that they will not pull learning about new products and services — A the trigger until they are convinced they have a dedicated salesforce and/or call center contact have well-articulated value proposition. not been cost effective for either service providers or They are looking for systems that can evolve cost- middle market businesses. The businesses need easy, effectively over time — Middle market businesses cost-effective access to new products and services. usually lack the resources and capital required for The rise of the Internet presents service providers 4 and middle market businesses alike a great oppor- ability to offer new products and services to middle tunity to find each other. market businesses by themselves, especially considering the investment restraints of those businesses. A New Approach to Gain Profitable Growth From A way around this hurdle is partnerships. Middle Market Businesses Partnerships can effectively defray the costs and risks involved in getting to a market first. As we The first step information service providers need scan the environment, we see that some in the IT to take to gain profitable growth from the middle industry — particularly the software and hardware market is to ask themselves three simple questions. vendors, as well as the systems integrators — have First, can they see areas of opportunity in the already traversed this path and have shown that middle market that warrant their pursuit? Second, partnerships work. do they have existing and planned offerings that could be tailored to serve the market? And third, do they think they could understand the needs of middle market customers and structure service delivery and channels in a way that would create a win-win situation for all partners? If the answer to these questions is “yes,” then service providers are ready to consider the steps necessary to change their business paradigm to pursue this sector. In our view, any new business model used to pursue the sector requires a foundation of three core themes: • Rapid Service Deployment to satisfy unique needs of customers • Innovative ways to Access the Customers to communicate the core benefit proposition of offerings and to understand their evolving needs • Providing Superior Support to the customers while keeping the total cost of service low Rapid Service Deployment — In almost every industry, a major factor for success is to be first — or at least a fast follower — to market with a significant innovation. The same is true with the information services industry. Those service providers who are quick to market with innovative, well-serviced and well-priced products have the best chances for success. For example, partnerships with applications and content providers would allow service providers to minimize risk and decrease the time to market. Our discussions with software and hardware vendors as well as system integrators indicate that this partnership opportunity will be mutually beneficial. Additional reasons for this include: • Most IT vendors are not interested in being service providers on their own. They consider this outside their core competence. • IT vendors are interested in long-term relationships with service providers. They consider such services an additional channel for their software or hardware platform. System integrators are also interested in relationships where they can provide application integration or act as a channel. • IT vendors realize the potential for the middle market and are open to partnerships that focus downstream. • Most established IT vendors are flexible about revenue-sharing arrangements, more so in opportunities concerning emerging data services. • Most IT vendors are busy releasing Internetenabled versions of their packages/platforms. They realize the Internet’s role as a service delivery medium and are eager to participate in Internet-based services. Partnerships with players with varying positioning and competencies are already evident. Exhibit 3 However, in light of the costs and risks in being demonstrates this trend in the emerging area of first to market, few service providers have the Application Hosting Services. 5 Exhibit 3: Segment Profile Best-of-breed applications are at the center of application outsourcing services. IBM has recently made announcements to bring hosted applications to the “neglected middle market” through a series of partnerships. This includes ERP applications from JD Edwards and industry-leading accounting software from Great Plains. USInternetworking (USi) is another player in the hosted applications market. It sources data centers and network infrastructure from US West, which also has an equity stake in USi. USi’s applications partners include Siebel (CRM), Broadvision (e-commerce), PeopleSoft (HR) and Microsoft (messaging). Interliant has bet on groupware infrastructure outsourcing. Based on its partnership with Lotus, it provides “rental apps” for the Notes platform. Applications like Instant Teamroom can be rented in real time by visiting Interliant’s Apps-Online catalog. Cisco has established the Cisco Resource Network for growing businesses. Toward this end they have partnered with managed application services providers like Employease, Netmosphere, eCompany, SalesLogix and Great Plains. Source: Booz•Allen & Hamilton analysis Exhibit 3: Examples of Partnerships in Applications Exhibit 4: Channel Models and Their Equivalents in Cyberspace Hosting Services Consider some of these relationships at work: Access the customers — The middle market can be effectively addressed through a combination of existing and new channels. Innovative channel strategies may be necessary for several reasons. Current channels of a provider may be inadequate to effectively address the middle market. Needs- Umbrella of certified VARs supplementing a call center for lead generation (establish channel from scratch) — In many cases, the VARs may not be direct employees of the service provider. While the VARs own the customer interface, the service provider still owns the customer relationship. Sears based segmentation may call for completely new Home Central and Protection One provide good channel strategies tailored along customer needs. examples of this model. The provider typically sets In addition, most new service models are based up a network of independent VARs from scratch or on partnerships rather than vertical integration. uses an existing network of channel partners. For Especially in the data arena, it is possible to example, if an application service provider includes exploit synergies from a wide variety of channel Microsoft applications in its portfolio, it may partners like software VAR networks and partners consider using Microsoft VARs as a channel. Such of vendors. an arrangement enables the provider to offer Based on our customer research, understanding of the industry drivers and the economics around customer access/reach, we believe that three “full service” — including pre-sales consulting, provisioning/integration and post-sales support — to the customers. channel models are most applicable for the service Affinity marketing on an already established portal providers to target the middle market effectively (cyberspace equivalent) — This structure involves and efficiently. These are “establish channel from the use of a portal to establish a relationship with scratch, “leverage existing channel” and “leverage a customer and facilitates the selling process. existing vertical/local relationships.” Portals draw traffic that allows providers to set 6 up a relationship with customers. Services such customer base to a whole group of businesses. as Excite, Netcenter and Yahoo guarantee repeat Examples of communities of interest include an visits due to their rich content and features like agency of multiple listings for real estate, the local free e-mail, personalized start pages, etc. Service chamber of commerce or an association of non- providers have already started using portals as a profit businesses. Several companies have used this serious lead generation channel. AT&T is selling “hub and spoke” approach to market. For example, long distance services and Internet access on Yahoo. IBM is targeting accounting firms to comply to its AOL has set up an online mall for its e-commerce Great Plains platform, thus reaching the small and customers. Quicken has set up a small business medium-sized businesses that use the accounting portal which vendors like Office Depot leverage for firm. This enables very creative bundling — and e-sales. Other vendors who extensively use portals affinity marketing—in addition to direct access to as sales channels include Amazon.com, Dell and customers in a concentrated fashion. Computer Discount Warehouse (CDW). Partner with a player having existing relationships Affinity marketing through vertical interest groups — in a vertical — This approach enables superior “Central interest points” or “communities of targeting of key verticals and has the same interest” could be used to connect a fragmented economic benefits of a “hub and spoke” approach. Exhibit 4: Channel Models and Their Equivalents in Cyberspace Marketing Strategy Channel Partner Relationships Establish Channel Leverage Existing Channel Cyberspace Equivalent Setup network of certified VARs YOURPORTAL.COM Example: Sears Home Central Leverage the VAR network of a software vendor Set up your own portal for business customers Example: Intuit Quickensmallbiz.com THEIRPORTAL.COM Affinity marketing on a vertical community portal Example: Microsoft of Novell VARs Existing eyeballs relationship Examples: • CDW on Yahoo Small Business • Excite Small Business by Quicken Leverage Existing Vertical/Local Relationships Partner with a player having existing relationships in a vertical NICHEPORTAL.COM Examples: IBM and HBOC Partner with membership organization in a vertical/local community Affinity marketing on a vertical community portal Eyeballs from a vertical Example: VerticalNet Examples: ADP and IBM Service Provider Channel Partner VARs Customers Source: Booz•Allen & Hamilton analysis 7 A case in point is HBO and Company (HBOC). success in the middle market sector need a similar HBOC is a top provider in the $13 billion one-two punch — underscored by the need for healthcare information industry. It has formal cost-effective delivery. partnership programs with various hardware and software vendors. It generates revenues through an extensive software product portfolio, a services group focused on system integration and a network solutions group focused on network design and implementation. HBOC’s partner for network transport is IBM Global Services, through which it provides a number of value-added services. These include online medical database gateways, Internet access, a portal with web links to journals, clinical information and drug interaction services and paid A consistent and integrated strategy of support is also a crucial concern in determining what kind of channel selection and revenue sharing model to select. Regardless of how fine a product is, customers will not stay pleased over time if their service concerns are not adequately addressed. If a provider does select outside channels, it is also very important to brand the service aggressively so that the power of the brand can overshadow the on-site contact between the VAR and the customer. services like Physicians Online and Medline. In this In light of the ever-constant demands of cost, model, IBM has found an effective vertical-focused service providers also need to devise service channel in HBOC. strategies whereby various routine or simple All these different options, as discussed, have services can be self-provisioned over time. Such different capabilities and require a different revenue- arrangements can be successfully triggered once a sharing approach — from flat commissions for customer is confident that a strong relationship referrals to sharing a percentage of customer revenue exists and will continue to exist. on a yearly basis. Formulas depend on the inherent While it is too early to tell how easily and cost- value of the channel to convert leads to customers. effectively state-of-the-art information services Providing superior support — As mentioned can be transitioned downstream to middle market earlier, an important key to success in the infor- businesses, there is little doubt that continuing mation services industry is to get a new product or advances in technology combined with lowering service to a market first. But this is rarely the key costs will facilitate the process over time. At this to lasting success. Excellent and pervasive service is. point there is no surefire way to identify who the Over recent years, for example, many companies winners in this process will be, and the field is introduced promising digital cellular telephony wide open. Nonetheless, it is very likely that those technology with initial success only to experience a service providers who quickly and objectively rapid decline. More recently, Sprint PCS introduced analyze their capabilities, identify logical middle a digital cellular telephony package that quickly market opportunities where those capabilities are gained momentum. Largely accountable for this potentially attractive — and then go after those success has been a nationally coordinated service opportunities with a sense of urgency — will have program. Information service providers looking for the best prospects for success. 8 About Our Firm B ooz •Allen & Hamilton is a global management and technology consulting firm committed steel, telecommunications, textiles, tourism, transportation and utilities. to helping senior management improve the perfor- With our in-depth understanding of industry issues mance of their organizations. In more than 90 and our expertise in strategy, systems, operations, offices, in hundreds of the world’s leading industrial, organization and technology, we assist our clients service and governmental organizations, our team of in developing the capabilities they need to compete 9,000 professionals has one common goal — to help and thrive in the global marketplace. our clients achieve and sustain success. We judge the quality of our work just as our clients Our broad experience in the world’s major do, by the results. Their confidence in our abilities business and industrial sectors includes aerospace, is reflected in the fact that more than 85% of the automotive, banking, chemicals, consumer goods, work we do is for clients we have served before. construction, defense, electronics, energy, engineering, Since our founding in 1914, we have always food service, health care, heavy industry, insurance, considered client satisfaction our most important oil and gas, pharmaceuticals, publishing, railways, measure of success. The Writers Marty Hyman is a Vice President and Partner Debjani Deb-Phalke is a Senior Associate with with Booz •Allen & Hamilton’s Communications, Booz •Allen & Hamilton and is a member of the Media and Technology practice in New York. His Communications, Media and Technology practice. background includes a wide range of product Much of her work has focused on market entry development and marketing strategy, business devel- strategies for telecommunications carriers, opment, strategic planning and cost restructuring equipment vendors and e-commerce players. experience within the telecommunications industry over a period of twenty years. Yogesh Pathak is an Associate with Booz •Allen & Hamilton in the Commercial Communications Ragu Gurumurthy is a Principal with Booz •Allen Technology group in McLean, VA. He primarily & Hamilton in the Communications, Media and works with communications and technology Technology practice in New York. He works companies developing new product/service primarily with communications service providers strategies and Internet-related growth initiatives. and equipment vendors to develop growth and For more information contact: market share enhancement strategies, focusing on New York new business models, global distribution strategies, Marty Hyman — Vice President [email protected] 212·551·6594 Ragu Gurumurthy — Principal [email protected] 212·551·6708 technology forecasting, new product development and innovation processes and M&A opportunity assessment. Worldwide Offices Abu Dhabi Melbourne Amsterdam Mexico City Atlanta Milan Auckland Munich Bangkok New York Bogotá Paris Boston Philadelphia Buenos Aires Rio de Janeiro Caracas Rome Chicago San Diego Cleveland San Francisco Dallas Santiago Düsseldorf Sa~o Paulo Frankfurt Seoul Hong Kong Singapore Houston St. Louis Jakarta Stockholm Lima Sydney London Tokyo Los Angeles Vienna Madrid Warsaw McLean Washington, D.C. CORP 217 3M: 2/00 PRINTED IN U.S.A.