* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Dissing U.S. Disinflation Talk

Survey

Document related concepts

Transcript

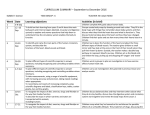

Douglas Porter, CFA, Chief Economist, BMO Financial Group November 28, 2014 Feature Article Page 8 How to Spur Global Growth: Dig Deep U.S. and Canada: Solid Q3 Growth… Won’t Be Repeated in Q4 OPEC: No Change… Crude Hits 4-Year Lows, C$ Drops Inflation Slows in Europe and Japan… Pressure Builds on ECB and BoJ U.S. Equities on Track for 6th Straight Weekly Gain BMO Capital Markets Economics www.bmocm.com/economics 1-800-613-0205 Please refer to page 16 for important disclosures Our Thoughts Page 2 of 16 Focus — November 28, 2014 Commodities: From Super Cycle to Spin Cycle T o think that just a few short weeks ago the biggest concern for the Canadian energy industry was access to global markets. How quaint. OPEC’s decision this week to hold its production ceiling steady at 30 million bpd dealt yet another heavy blow to already reeling oil prices. WTI fell 13% this week alone, down by more than $10 to $66 by Friday, the lowest in more than four years (back when oil was still climbing back from the deep hole hit in early 2009, when prices bottomed in the $30s). This brings the cumulative decline in both WTI and Brent to 35% since the heady days of summer, and even the H1 average price ($101 for WTI). We will not attempt to get into the heads of the Saudis, and try to guess their intentions and time frames and what that means for oil prices looking ahead, but it’s reasonable to plan for the worst, and only hope for something better for the Canadian outlook. Assuming current prices are sustained for some period of time, here are the key macro implications for Canada: Real GDP growth will get dinged, especially through capital spending. While production is likely to hold up, drilling will ebb; and, eventually, some new projects will slow. The old estimate is that every 10% drop in oil shaves real GDP by about 0.1%. However, those models are based on history, when production was far less than today (oil output has doubled in the past 20 years). Plus, the impact is not linear—it probably gathers importance as prices sag deeper. GDP growth will at best hold at 2.4% in 2015 even as the U.S. hits 3.0%. Incomes will feel the most pain. Corporate profits, government revenues, and even personal income growth will be pinched by the drop, and will be captured by the GDP price deflator in the next two quarters. Merchandise trade is poised to dip back into the red after a solid surplus in Q3. The regional growth backdrop is shifting before our eyes. Oil producers Alberta, Saskatchewan and Newfoundland will likely sag back to the national average (or even below) in 2015, while Ontario and Quebec, to a lesser extent, will benefit from a stronger U.S. economy, a lower dollar and, yes, lower energy costs. Headline inflation should recede back below 2% after popping to 2.4% in October. That’s the good news. The bad news is that Canada currently has the highest underlying rate of inflation in the industrialized world. The Canadian dollar will remain under pressure. Arguably, the surprise is that the currency has not suffered even more, though it did slide to a five-year low of 87.5 cents ($1.143/US$) on Friday. We estimate that the loonie should weaken by 3-to-5 cents for every $10 drop in oil prices. The only thing holding the currency back from even deeper damage has been a run of surprisingly upbeat domestic data. Lower bond yields. Ten-year Canada’s careened below 1.9% on Friday and 30year Treasuries fell to just 2.9%. A steep tumble in headline inflation could prove temporary; but, it can still weigh on expectations, at least for a spell. The TSX will be under pressure, at least relative to most other industrialized markets. Even with this week’s big setback in the energy group (down more than 10%), the sector still has a 21.5% weight in the index. Douglas Porter, CFA Chief Economist [email protected] 416-359-4887 Our Thoughts Page 3 of 16 Focus — November 28, 2014 Notably, because this impending dent in the Canadian economy arrives amid a series of robust data, the Bank of Canada will likely remain firmly on the sidelines. All else equal, lower oil prices would point to lower interest rates in Canada, due to their net dampener on growth and inflation. Meantime, other commodities are providing no offset for the sag in oil, as the Bank’s non-energy commodity price index has also stepped back in the past six months amid weaker farm prices and still-soft metals prices (importantly, copper dipped below $3 this week). Despite this relatively dour take on the crude calculations for Canada, we would continue to pound the point that lower oil prices are not a negative for global growth—quite the opposite in fact. While some of the recent slide is due to somewhat dimmer growth prospects in Europe, Japan and China, it still seems that bountiful oil supplies are the major driver of the price decline. In other words, this is mostly a supply-side shock (in reverse), which is a net positive for global growth. And, that goes for the U.S. as well, despite the big run-up in domestic production in the past three years. (Crude oil output has vaulted up more than 50% in that time from less than 6 million bpd to 9 million now, but the U.S. still imports 5 million bpd net.) And, who are even bigger winners from the dive in oil prices? None other than Japan, Europe, and China, the world’s biggest oil importers. While the positives can take time to develop, make no mistake that periods of lower oil prices have consistently proven to be a powerful tonic for global growth over the past 40 years. Inflation Expectations are more a Mosaic than Metrics M uch has been made lately about U.S. inflation expectations, particularly since the October 29th FOMC statement said “market-based measures of inflation compensation have declined somewhat; survey-based measures of longer-term inflation expectations have remained stable.” And, in the weeks that followed, some surveybased measures began ebbing as well. Because “well anchored” longer-term inflation expectations are a prerequisite for policy rates to remain unchanged for a “considerable time,” some analysts suggest that the recent signs of possible un-anchoring—to the downside—could cause the Fed to postpone liftoff. The problem with this thinking is that the Fed tends not to look at the various measures of longer-term inflation expectations as individual metrics but as pieces of a mosaic that also incorporate the technical and temporary factors that might be impacting them and, most importantly, the economic context in which they are occurring. Against the current background of real GDP growth averaging above 4% in four of the past five quarters (not Q1), the jobless rate at 5.8% and payroll employment growing at a solid 200k-plus pace, the policy toleration for ebbing longer-term inflation expectations is higher than it otherwise would be. And it’s hoisted even higher amid the current drop in crude oil prices (particularly since the drop is being driven more by supply factors and a strong greenback than weakening global demand). The consumer, survey-based measures of longer-term inflation expectations are influenced by such startling headlines and their implications for gasoline and heating oil costs. The University of Michigan metric dipped to a recession-low-matching 2.6% in November, after a 43-month run in the 2.7%-to-3.0% range. In the context of recent economic and oil market developments, the Fed can easily still deem this as being “well anchored”. Michael Gregory, CFA Deputy Chief Economist [email protected] 416-359-4747 Our Thoughts Page 4 of 16 Focus — November 28, 2014 The same could be said about the results from the Philly Fed’s Survey of Professional Forecasters. In its quarterly (November) tally, the 5-year-ahead expectation for CPI inflation dipped 11 bps to 2.09%, but the 10-year call was unchanged at 2.20%. Meanwhile, the medium-term expectation for PCE price inflation slipped 10 bps to 1.90%, but the long-term call was unchanged at 2.00%. Interestingly, part of this group’s ebbing CPI expectation might also reflect next year’s introduction of a new and improved CPI. The Bureau of Labor Statistics is calling this the most significant change to the CPI in 25 years, designed to account for greater substitution among items owing to relative price changes. This means the new CPI should show lower inflation than the old CPI (to some degree) as cheaper goods are substituted more readily for more expensive ones, and should track the PCE price index more closely. Bottom Line: Don’t expect the Fed to deviate from its “well anchored” talk anytime soon. U.S. Economy Could End Year Like a Lamb, But Should Roar in New Year D espite an upward revision to Q3 GDP growth (to 3.9% from 3.5%), we took another scalpel to our growth estimate for Q4 (to 2.3% from 2.5%) amid several disappointing reports this week. Consumer spending rose moderately in October, keeping its yearly rate (of 2.2%) little better than the norm of the past three years. After trending higher, consumer confidence did an about-face in November, reflecting reported weakness in employment. As if on cue, weekly jobless claims popped above 300,000 for the first time in over two months. Business investment, the economy’s main driver at up 7.2% y/y to Q3, looks to have cooled somewhat, as “core” capital goods orders fell in three of the past four months. The housing recovery continues to take one step back for every two forward. Fewer pending home sales and a downward revision to new home sales suggest the recovery, though well established, lacks momentum, as indicated by slower price appreciation. Still, the U.S. economy is growing meaningfully faster than in recent years. Including our Q4 tally, growth will have averaged 2.8% in the past six quarters compared with 2.1% in the first four years of the recovery. The economy has largely shaken off its financial-crisis shackles, as households have cut $1 trillion in debt since 2008 (-7.6%). Borrowing has picked up, and it’s only a matter of time before less unemployment translates into substantive wage gains. Meantime, spending power will receive a boost from lower gasoline prices. The 85-cents/gallon decline since early summer will stoke holiday shopping spirits, and could lift personal consumption about 1% in the year ahead. In two other non-recession periods when oil prices fell sharply—1986 to 1988 and 1997 to 1998—personal consumption grew strongly, averaging 4.0% and 5.1%, respectively. The spending boost to the economy should more than offset a reduction in shale energy production. Positive economic shocks have been rare since the Great Recession. For most Americans, this is one to be thankful for. Sal Guatieri Senior Economist [email protected] 416-359-5295 Our Thoughts Page 5 of 16 Focus — November 28, 2014 Bank of Canada Preview: Still Dovishly Neutral T he Bank of Canada is universally expected to hold policy rates steady at 1% for the 34th consecutive meeting—or over four years—on December 3. Since the October meeting and MPR, Canada’s economic backdrop has changed, but not enough to alter the Bank’s dovishly-tilted neutral stance. Benjamin Reitzes Senior Economist [email protected] 416-359-5628 Inflation has continued to accelerate, rising more than the October MPR forecast. Higher inflation will be noted, but will likely be classified as transitory. Expect a similar brush off of inflation worries as we saw in the last statement. Admittedly, the Bank has a solid case on this front, with clothing, reading materials, meat and communications (just 14% of the core CPI basket; the first two are import-heavy and partially driven by the weaker C$) contributing about 0.9 ppts to core inflation, 0.6 ppts more than if they were climbing at a 2% rate. And, the steep decline in energy prices will also ease any concerns about inflation. Look for the Bank to remain cautious on the economic backdrop, driven by the slide in oil prices and weak global outlook. The former is likely the bigger concern, as the lack of OPEC production cuts suggests oil prices still have meaningful downside. A weaker Canadian dollar and lower gasoline prices will provide some offset, but that takes time to evolve. Business investment will likely get hit hard by lower energy prices, dampening the BoC’s expectations for a rotation toward capex. However, the shift toward export-driven growth is coming along nicely and that isn’t expected to change, with the loonie likely to test cycle-lows following the drop in commodity prices. Meantime, auto sales remain on a record pace and housing is still firm. Accordingly, the concerns about household imbalances aren’t likely to diminish. One positive for the economy was the sizeable 0.8% upward revision to the GDP level and above-potential growth in five of the past seven quarters, but that will likely only get a cursory mention at best. However, the strong GDP report highlights the risk that the output gap could close earlier than the Bank forecast in October (though the drop in oil prices says otherwise). Overall, while the statement will change materially since it’s not accompanied by an MPR, the message from Governor Poloz will be that the Bank of Canada is comfortable remaining on the sidelines for some time yet, as the drop in oil prices weighs on the outlook for growth and inflation. It’s Go Time for the ECB (Just not right now) T he case for the ECB to make outright purchases of government debt became that much stronger this week. The data alone are pushing for it. Let’s rhyme them off: Private sector lending remained low at -1.1% y/y and the flash reading for November Euro Area inflation came in at 0.3% y/y, the slowest in five years. Meantime, the jobless rate held in double-digit territory at 11.5% (true, Germany’s rate is half of that, but Italy is at a record high 13.2%). Oh, and did I mention that inflation is at 0.3%? The ECB’s mandate is to keep inflation at or near 2%. As the ECB’s Vítor Constâncio put it, “we’re in a situation of very low inflation that is very far away from our objective”. Jennifer Lee Senior Economist [email protected] 416-359-4092 Our Thoughts Page 6 of 16 Regardless, the December 4th ECB meeting is likely too soon to pull the trigger. The central bank has cut rates twice (June, September), and started buying covered bonds in October, and asset-backed securities last week, all part of the Septemberannounced plan to help ease credit conditions. Plus, there’s been only one targeted longer-term refinancing operation (TLTRO) so far and there are eight more to go. ECB President Draghi wants to see how the next installment of the TLTRO plays out on December 9-11th, particularly after the first take-up of €82.6 bln was disappointing. (Actually, he described it as “within the range of take-up values we had expected”, but that the September and December TLTROs “should be assessed in combination”.) So at a minimum, both take-ups have to disappoint before the ECB decides to step up their game. But the sense of urgency is ramping up. In Mr. Draghi’s words last week, “It is essential to bring back inflation to target and without delay. Monetary policy can and will do its part to achieve this.” Even Pope Francis weighed in during an address to the European Parliament, suggesting: “The time has come to promote policies which create employment.” The Bottom Line: Look for the ECB to take the next easing step in early 2015. Focus — November 28, 2014 Recap Page 7 of 16 Focus — November 28, 2014 Jennifer Lee Senior Economist [email protected] 416-359-4092 Canada GDP growth stronger-thanexpected in Q3… and final sales solid… …but oil price decline will weigh in coming months United States GDP growth stronger-thanexpected in Q3 but Q4 not starting off well S&P 500 and Dow at or near record highs Japan Worrying sign: inflation slows further Europe ECB’s Draghi and Constâncio give more hints of sovereign debt purchases Government 10-year yields tumble to record lows Slowing inflation a concern Other Good News Bad News Real GDP +2.8% a.r. (Q3) Real GDP at Basic Prices +0.4% (Sep.) Retail Sales +0.8% (Sep.)—volumes up 1% Current Account Deficit narrowed to $33.6 bln a.r. (Q3) Industrial Product Prices -0.5% (Oct.) Raw Material Prices -4.3% (Oct.) Ottawa’s Budget Deficit improves to $0.7 bln (Apr.-toSep.)—from $10.3 bln a year ago Conference Board’s Consumer Confidence Index -1.4 pts to 82.7 (Nov.) Real GDP revised higher to +3.9% a.r. (Q3 P) Real Personal Spending +0.2% (Oct.)—but soft S&P Case-Shiller Home Price Index +0.3% (Sep.) FHFA House Price Index unch (Sep.) New Home Sales +0.7% to 458,000 a.r. (Oct.) U of M Consumer Sentiment Index +1.9 pts to 88.8 (Nov. F)—a 7-year high Conference Board’s Consumer Confidence Index -5.4 pts to 88.7 (Nov.) Initial Claims +21k to 313k (Nov. 22 week) Pending Home Sales -1.1% (Oct.) Core Durable Goods Orders -1.3% (Oct.) Chicago PMI -5.4 pts to 60.8 (Nov.) Industrial Production +0.2% (Oct. P) Jobless Rate -0.1 ppts to 3.5% (Oct.) Consumer Prices +2.9% y/y (Oct.) Retail Sales -1.4% (Oct.) Eurozone—Economic Confidence +0.1 pts to 100.8 (Nov.) Eurozone—Jobless Rate unch at 11.5% (Oct.)— did not worsen Germany—Ifo Survey +1.5 pts to 104.7 (Nov.)—first improvement in 7 months Germany—Unemployment -14,000 (Nov.) Germany— Retail Sales +1.9% (Oct.) Germany— GfK Consumer Confidence +0.2 pts to 8.7 (Dec.) U.K.—Nationwide House Prices +0.3% (Nov.) Eurozone—Consumer Prices +0.3% y/y (Nov. P) Eurozone—Private Sector Lending -1.1% y/y (Oct.)—still shrinking but pace slowed Germany—Consumer Prices +0.5% y/y (Nov. P)—slowest pace since 2010 France—Consumer Spending -0.9% (Oct.) Italy—Jobless Rate +0.3 ppts to 13.2% (Oct. P) Italy—Retail Sales -0.1% (Sep.) Spain—Consumer Prices -0.5% y/y (Nov.)—2nd slowest pace since 2009 U.K.—GfK Consumer Confidence unch at -2 (Nov.) India—Real GDP +5.3% y/y (Q3) Brazil—Real GDP -0.2% y/y (Q3) OPEC decides to maintain production ceiling of 30 mbpd China reportedly set to launch deposit insurance Indications of stronger growth and a move toward price stability are good news for the economy. Feature Page 8 of 16 Focus — November 28, 2014 How to Spur Global Growth: Dig Deep Chart 1 Benjamin Reitzes, Senior Economist • [email protected] • 416-359-5628 Real GDP Could this be as good as it gets for global growth? After all, we’re five years from the worst of the financial crisis, and the improvement in economic conditions appears to be levelling off. For Canada, Douglas Porter recently highlighted many reasons to appreciate the current state of the economy—the jobless rate is close to normal, consumer spending and housing remain firm, strong household net worth is a good counterbalance to high debt levels and government finances are improving. Could this also be as good as it gets for Canada? The short answer is no, especially for global growth. The current backdrop suggests there is meaningful room for improvement. Unfortunately, outside of the U.S., economic prospects are not particularly bright, suggesting that global growth will be hardpressed to reach the 4%+ average rate seen in the decade prior to the Great Recession (Chart 1). While we’re optimistic about the U.S. outlook for 2015, Europe will continue to struggle, Japan is at risk of entering the New Year in recession, and there’s little doubt China is decelerating. Policymakers have struggled to provide a significant lift to growth, with monetary policy doing most of the heavy lifting amid generally tightening fiscal positions. Policymakers can do more to improve global economic fortunes, and they should take their cues from financial markets. Global investors can’t get enough high-quality government debt, driving long-term bond yields to record lows in many countries (Chart 2). Governments should take advantage of exceptionally cheap financing to make long-term capital investments. While there’s no single proof-point, there is little doubt that infrastructure investment has been lacking in recent years, as governments have been austerity minded (Chart 3). Canada and Japan have been a bit more active, but more still could be done. Now is the time act on this pressing need and introduce a global infrastructure push. Global Growth: Serially Disappointing (ann % chng) 13 14e 15f 16f World Emerging Markets G7 3.3 3.2 3.5 3.6 4.6 4.3 4.5 4.8 1.5 1.7 2.1 2.0 China India Asia¹ Canada U.S. Latin America² Euro Area Japan Brazil 2015 2014 2013 2012 -2 0 2 4 6 8 Ranked by 2015 ex. China, Japan, India ex. Brazil e = estimate f = forecast Source: [2015-16] BMO Capital Markets forecasts 1 2 Chart 2 Borrowing Costs at Generational Lows (percent) 10-Year Government Bond Yields 10 Canada 8 6 U.S. 4 Germany Japan 2 0 95 00 05 10 15 Chart 3 Fiscal Austerity Hit Investment (2009 = 100) Government Investment In Toronto (which comes to mind first since it’s home), the primary issue in this year’s municipal election was transportation infrastructure, as the gridlock punishing the city is only getting worse. Broad government involvement is essential, as is the need to look beyond public transit. The rest of Canada, and other countries throughout the world, certainly have projects that would be welcomed by taxpayers. Not only does infrastructure provide long-term benefits, but it provides short-term stimulus as well. 115 A globally coordinated effort, perhaps a 1% of GDP infrastructure spending plan among the G20 over the next year or two, would 85 110 Japan 105 100 Canada U.S. 95 90 European Union 09 10 11 12 13 14 Feature Page 9 of 16 provide a significant boost to the global economy. This would square with the G20’s agreement to boost GDP by 2 ppts. Perhaps it would even be enough to push growth out of the serial disappointment phase coined by BoC Governor Poloz. Such an effort is made more essential by the fact that, in much of the world, demographics are going to drive a deceleration in potential GDP growth over the coming decades. In addition to the short-term boost, infrastructure can provide long-term support to growth. For example, easing gridlock in major cities throughout the world would have numerous benefits such as improving economic efficiency, not to mention the societal and environmental aspects. Focus — November 28, 2014 Chart 4 Government Debt Concerns G7 (% of GDP) Net Government Debt Japan Greece Italy U.S. Spain France U.K. Germany Canada 143 95 91 92 125 120 86 56 73 22 71 43 64 30 This is clearly an ambitious plan and it’s naïve to think that every 29 country will be a willing participant, or even be able to pass such a 0 25 50 75 100 125 sizeable infrastructure package through their own legislatures, but that doesn’t mean they shouldn’t try. The age of government Source: OECD Economic Outlook, November 2014 austerity has weighed on growth and has not eased debt burdens. Indeed, generational lows in bond yields come despite elevated debt in much of the developed world (Chart 4). Perhaps the biggest issue with such a plan is that government isn’t the ideal delivery vehicle for an efficient use of capital. But it’s the only sector that can provide the scale necessary to be effective. Private sector partnerships might offset some of those concerns. Even so, significant oversight on project selection and spending would be necessary. China is an excellent example of the challenges facing such a sizeable endeavor. Bridges to nowhere, empty apartment complexes, corruption and wastefulness are significant problems. Indeed, each country will have idiosyncratic issues, highlighting the exceptional challenge to implementing a global infrastructure spending plan. While more infrastructure spending comes with ongoing costs, the focus on containing government program spending and operating budgets needs to remain sharp. Infrastructure projects can pay for themselves over time, but excessive program spending and operating costs are not sustainable in the long run. Indeed, large European economies are good examples, with Italy and France needing to enact significant reforms and control spending to get their debt burdens under control. The Government of Canada’s recently announced infrastructure spending of $5.8 bln over three years is a good start, but the scale is modest. Even the 10-year $70 bln New Building Canada Plan is insufficient, equaling about one-third of one percent of GDP annually. Meantime, the European Union is reportedly on the verge of agreeing to a €315 bln infrastructure plan, funded by €21 bln in seed money from national governments. Whether the modest sum the public sector is putting up is enough to drive that amount of private-sector spending is debatable, but at least the overall scale is there at more than 2% of GDP. Bottom Line: There is no reason to acquiesce to secular stagnation or accept persistently soft economic growth. There is a fundamental need for significant infrastructure projects on a global basis, and long-term borrowing costs remain exceptionally attractive— negative in real terms, in some cases. We will need to strengthen our infrastructure at some point: why not now, when growth is weak and borrowing costs are low. 2014 42 42 41 2008 150 175 Economic Forecast Page 10 of 16 Focus — November 28, 2014 Economic Forecast Summary for November 28, 2014 BMO Capital Markets Economic Research 2014 2015 Annual Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2013 2014 2015 Real GDP (q/q % chng : a.r.) 1.0 3.6 2.8 2.2 1.9 2.2 2.4 2.5 2.0 2.4 2.4 Consumer Price Index (y/y % chng) 1.4 2.2 2.1 2.2 1.7 1.4 1.7 2.1 0.9 2.0 1.7 Unemployment Rate (percent) 7.0 7.0 6.9 6.6 6.6 6.5 6.4 6.4 7.1 6.9 6.5 175 197 199 188 189 186 184 181 188 190 185 Current Account Balance ($blns : a.r.) -45.0 -39.6 -33.6 -43.5 CANADA Housing Starts (000s : a.r.) -52.1 -49.2 -45.7 -41.1 -56.3 -40.5 -47.0 (average for the quarter : %) Interest Rates Overnight Rate 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.25 1.00 1.00 1.05 3-month Treasury Bill 0.87 0.93 0.94 0.90 0.90 0.90 0.90 1.16 0.97 0.91 0.96 10-year Bond 2.47 2.35 2.14 2.04 2.07 2.16 2.32 2.56 2.26 2.25 2.28 Canada-U.S. Interest (average for the quarter : bps) Rate Spreads 90-day 82 90 91 88 88 81 57 60 91 88 72 10-year -30 -27 -35 -31 -31 -32 -33 -35 -9 -31 -33 -2.1 4.6 3.9 2.3 2.9 3.0 2.8 2.7 2.2 2.3 3.0 Consumer Price Index (y/y % chng) 1.4 2.1 1.8 1.6 1.7 1.7 2.0 2.2 1.5 1.7 1.9 Unemployment Rate (percent) 6.7 6.2 6.1 5.8 5.6 5.4 5.2 5.0 7.4 6.2 5.3 0.93 0.99 1.03 1.02 1.11 1.19 1.27 1.31 0.93 0.99 1.22 Current Account Balance ($blns : a.r.) -408 -394 -388 -408 -400 -400 -440 UNITED STATES Real GDP (q/q % chng : a.r.) Housing Starts (mlns : a.r.) -420 -434 -445 -459 (average for the quarter : %) Interest Rates Fed Funds Target Rate 0.13 0.13 0.13 0.13 0.13 0.21 0.46 0.71 0.13 0.13 0.38 3-month Treasury Bill 0.05 0.03 0.03 0.02 0.02 0.09 0.33 0.56 0.06 0.03 0.25 10-year Note 2.76 2.62 2.50 2.35 2.38 2.48 2.65 2.90 2.35 2.56 2.60 EXCHANGE RATES (average for the quarter) US¢/C$ 90.6 91.7 91.8 88.7 87.8 86.8 85.8 85.1 97.1 90.7 86.4 C$/US$ 1.103 1.090 1.089 1.127 1.139 1.153 1.166 1.175 1.030 1.103 1.158 ¥/US$ 103 102 104 112 116 117 118 120 98 105 118 US$/Euro 1.37 1.37 1.32 1.26 1.24 1.23 1.22 1.20 1.33 1.33 1.22 US$/£ 1.66 1.68 1.67 1.60 1.58 1.56 1.55 1.53 1.56 1.65 1.55 Blocked areas represent BMO Capital Markets forecasts Up and down arrows indicate changes to the forecast Key for Next Week Page 11 of 16 Focus — November 28, 2014 Canada Bank of Canada Policy Announcement Wednesday, 10:00 am Employment Friday, 8:30 am Nov. (e) +15,000 (+0.1%) Consensus +5,000 (+0.03%) Oct. +43,100 (+0.2%) Nov. (e) Unemployment Rate 6.6% Oct. 6.5% Nov. (e) Oct. Average Hourly Wages +1.7% y/y +1.5% y/y Consensus 6.6% Merchandise Trade Balance Friday, 8:30 am Oct. (e) +$200 mln Consensus +$50 mln Sep. +$710 mln The Bank of Canada is expected to hold interest rates steady at 1% for a 34th straight meeting. For an in-depth look at the Bank of Canada policy announcement, see Page 5. Benjamin Reitzes Senior Economist [email protected] 416-359-5628 Canada’s labour market appears to have woken from a year-long slumber, with big job gains in September and October. Even the underlying details and sector composition of hiring were encouraging, with manufacturing recording solid increases. However, given the volatility of the survey, we’re not quite convinced job growth has kicked into a higher gear. November’s report will be the litmus test, as three months of solid data would be difficult to ignore. Given the economy’s solid performance since the start of 2013—five of seven quarters with above-potential growth—job growth should be trending at, or slightly above, 1%. We’re calling for a 15,000 increase in employment, which would confirm the solid trend and suggest the economy may have been stronger than the Bank of Canada thought (though the drop in oil prices will dampen any enthusiasm). Watch involuntary part-time employment, which is a measure of slack Governor Poloz has highlighted. Our employment call would push the jobless rate up a tick to 6.6%, still well down from a year ago and close to what has been traditionally thought of as levels close to full-employment. Canada’s October merchandise trade account is expected to be in surplus for the seventh month in the past nine. There are likely to be some upward revisions as well, with the current account data pointing to a wider surplus in Q2 and Q3 than initially reported in the monthly trade figures. Exports are expected to be down modestly, due entirely to the drop in energy prices—and they fell meaningfully further in November, suggesting a potential return to deficit. Better non-energy exports, benefiting from solid U.S. demand and a weaker C$, will provide some offset. Imports look to be up slightly, consistent with persistently firm consumption. While the goods surplus will probably shift to a deficit over the next few months, the move will be due largely to price shifts, suggesting that it won’t necessarily be a negative for GDP growth. United States Manufacturing ISM Monday, 10:00 am PMI Nov. (e) 58.0 Prices Paid 52.0 Oct. 53.5 Consensus 57.9 59.0 52.5 Nonmanufacturing ISM Wednesday, 10:00 am Nov. (e) 57.1 Consensus 57.5 Sep. 57.1 While factories in Asia and Europe are struggling, Michael Gregory, CFA American firms are on an upswing. After jumping to three- Deputy Chief Economist year highs, the ISM manufacturing index is expected to [email protected] 416-359-4747 recede only slightly to 58.0 in November. Last month, 16 of Sal Guatieri 18 industries reported growth, and respondent comments Senior Economist were upbeat. Although a stronger dollar has curbed exports, [email protected] 416-359-5295 strength in business investment and construction is fuelling a manufacturing rebound. Production is up 3.4% y/y to October, versus a half-century norm of 2.9%, and is poised to top pre-recession highs. Although the ISM nonmanufacturing index ebbed in the past two months after reaching nine-year highs in the summer, it likely stabilized in November. Domestic oil production is (so far) holding firm, despite plunging crude prices, while retail spending is expected to improve moderately this holiday season, supported by intense discounting and lower gasoline prices. However, winter’s early arrival likely dented construction and transportation. Almost all major industries (16 of 18) reported Key for Next Week Page 12 of 16 Focus — November 28, 2014 growth in October. However, the respondents’ comments were mixed, with “cautious optimism” summarizing the prevailing mood. Beige Book Wednesday, 2:00 pm Nonfarm Payrolls Friday, 8:30 am Nov. (e) +230,000 Consensus +225,000 Oct. +214,000 Nov. (e) Unemployment Rate 5.8% Oct. 5.8% Nov. (e) Average Hourly Earnings +0.2% Oct. +0.1% Consensus 5.8% Consensus +0.2% Goods & Services Trade Deficit Friday, 8:30 am Oct. (e) $40.9 bln Consensus $41.2 bln Sep. $43.0 bln The Beige Book will cover the period from early October to mid-November. It seems unlikely that the previous overall conclusion of “modest to moderate” economic growth across the Fed’s 12 districts will change, particular given the softer tone to some of October’s indicators. (For the record, the previous district tally was 6 “moderate”, 5 “modest” and 1 “mixed”.) However, not all October indicators were softer (the employment report was particularly solid). And, an early look at November could reveal whether residential real estate activity has picked up from October’s mixed pace and whether the falling jobless rate is imparting any pressure on wages. Upward pressure on wages for the highly skilled was noted by half the regions in the prior report, although it concluded that “overall wage pressures remain contained across most Districts.” Nonfarm payrolls are expected to increase 230,000 in November, close to the fourmonth average and a step up from October’s 214,000 gain. Almost every industry has created jobs this year, with firms both capable and willing to expand. The unemployment rate should remain at six-year lows of 5.8%, assuming some payback from October’s outsized (683,000) increase in household survey employment. However, other measures of slack should improve, with declines in the number of involuntary part-time workers and marginally attached persons, and in the duration of joblessness. While average hourly earnings remain sedate, rising at a 2% annual pace, broader wage indicators, such as the employment cost index and hourly compensation, have turned higher, though neither signals an imminent rise in inflation. October’s goods and services trade balance will reflect the push and pull of opposite forces, similar to the past several months. Pulling the overall deficit wider, we look for continued deterioration in the deficit in non-petroleum goods trade, which is already at its largest level in more than 7½ years ($47.2 billion). This reflects relatively stronger growing U.S. domestic demand compared to foreign counterparts and a stronger U.S. dollar. In October, the greenback appreciated 1.3% against the broad basket of currencies (+5.2% y/y). This also reflects the labour dispute at America’s west coast ports. Eyeing the recent July 1st end of the port workers’ contract (and with 2002’s strike still in memory), importers have been expediting their shipments for several months; so much so that port congestion has now become a problem. (Note that, because of unsuccessful contract negotiations, select labour disruptions started on October 31st). Pushing the trade gap narrower, we look for continued improvement in the deficit in petroleum goods, which is already at its smallest level in nearly 4½ years ($14.0 billion). This reflects rising domestic (shale) crude oil production and, partly because of this feedstock, increasing exports of refined and semi-refined products. In October, imports of all petroleum products averaged their lowest level in at least 23 years, and exports averaged their highest level in as long a period. Meanwhile, crude oil prices plummeted 9.5% in October (-16.1% y/y). We judge the pushing forces overwhelmed the pulling ones in the month, allowing the overall trade deficit to shrink. Financial Markets Update Page 13 of 16 Focus — November 28, 2014 Nov 28 ¹ Nov 21 Week Ago 4 Weeks Ago Dec. 31, 2013 Canadian Money Market Call Money Prime Rate 1.00 3.00 1.00 3.00 0 0 (basis point change) 0 0 U.S. Money Market Fed Funds (effective) Prime Rate 0.25 3.25 0.25 3.25 0 0 0 0 0 0 3-Month Rates Canada United States Japan Eurozone United Kingdom Australia 0.91 0.01 -0.05 0.08 0.55 2.76 0.91 0.01 -0.02 0.08 0.56 2.74 0 0 -2 0 0 2 2 0 -5 0 0 4 0 -6 -11 -21 3 16 2-Year Bonds Canada United States Canada United States Japan Germany United Kingdom Australia 1.02 0.50 1.89 2.20 0.42 0.70 1.92 3.03 1.06 0.50 2.01 2.31 0.46 0.77 2.05 3.26 -5 0 -12 -11 -4 -7 -13 -24 -1 1 -16 -13 -4 -14 -33 -26 -12 12 -87 -83 -32 -123 -110 -121 12.4 23 60 328 12.9 23 64 344 -0.5 pts 0 -4 -16 -1.6 pts 0 -4 -12 10-Year Bonds Risk Indicators VIX TED Spread Inv. Grade CDS Spread ² High Yield CDS Spread ² Currencies US¢/C$ C$/US$ ¥/US$ US$/€ US$/£ US¢/A$ Commodities CRB Futures Index Oil (generic contract) Natural Gas (generic contract) Gold (spot price) Equities S&P/TSX Composite S&P 500 Nasdaq Dow Jones Industrial Nikkei Frankfurt DAX London FT100 France CAC40 S&P ASX 200 ¹ = as of 10:30 am ² = One day delay 87.40 1.144 118.54 1.2465 1.565 85.01 89.02 1.123 117.79 1.2391 1.566 86.70 0 0 -1.3 pts 5 -2 22 -1.8 — 0.6 0.6 -0.1 -1.9 (percent change) -1.5 — 5.5 -0.5 -2.2 -3.4 -7.2 — 12.6 -9.3 -5.5 -4.7 259.69 69.07 4.22 1,182.86 269.11 76.51 4.42 1,201.55 -3.5 -9.7 -4.4 -1.6 -4.5 -14.2 9.0 0.8 -7.3 -29.8 -0.2 -1.9 14,838 2,073 4,804 17,870 17,460 9,956 6,722 4,368 5,313 15,111 2,064 4,713 17,810 17,358 9,733 6,751 4,347 5,304 -1.8 0.5 1.9 0.3 0.6 2.3 -0.4 0.5 0.2 1.5 2.7 3.7 2.8 6.4 6.7 2.7 3.2 -3.9 8.9 12.2 15.0 7.8 7.2 4.2 -0.4 1.7 -0.7 Global Calendar: December 1 – December 5 Wednesday December 3 Capital Spending Q3 (e) +2.0% y/y Q2 +3.0% y/y Composite PMI Nov. Oct. 49.5 Manufacturing PMI Nov. F (e) 52.1 Oct. 52.4 Services PMI Nov. Oct. 48.7 EURO AR Manufacturing PMI Nov. F (e) 50.4 Oct. 50.6 ITALY Real GDP Q3 F (e) -0.1% Q3 P -0.1% Q2 -0.2% U.K. Japan Tuesday December 2 Euro Area Monday December 1 Manufacturing PMI Nov. (e) 53.0 Oct. 53.2 EA EURO AREA Producer Price Index Oct. (e) -0.3% -1.3% y/y Sep. +0.2% -1.4% y/y EURO AREA Composite PMI Nov. F (e) 51.4 Oct. 52.1 Retail Sales Oct. (e) +0.5% Sep. -1.3% Construction PMI Nov. (e) 61.0 Oct. 61.4 Friday December 5 Leading Index Oct. P (e) 104.1 Sep. 105.6 Services PMI Nov. F (e) 51.3 Oct. 52.3 -0.4% y/y -0.4% y/y -0.3% y/y Thursday December 4 EURO AREA Retail PMI Nov. Oct. 47.0 ECB Monetary Policy Meeting +1.6% y/y +0.6% y/y Real GDP Q3 P (e) Q3 A Q2 EURO AREA +0.2% +0.8% y/y +0.2% +0.8% y/y +0.1% +0.8% y/y GERMANY Factory Orders Oct. (e) +0.5% unch y/y Sep. +0.8% -1.0% y/y Composite PMI Nov. (e) 56.3 Oct. 55.8 Services PMI Nov. (e) 56.5 Oct. 56.2 Other Bank of England Monetary Policy Meeting (Dec. 3-4) CHINA Manufacturing PMI Nov. (e) 50.5 Oct. 50.8 HSBC Manufacturing PMI Nov. F (e) 50.0 Oct. 50.4 AUSTRALIA Building Approvals Oct. (e) +5.0% -6.5% y/y Sep. -11.0% -13.4% y/y Reserve Bank of Australia Monetary Policy Meeting INDIA Reserve Bank of India Monetary Policy Meeting HSBC PMI Nov. Oct. CHINA Composite Services 51.7 52.9 Non-manufacturing PMI Nov. Oct. 53.8 AUSTRALIA Real GDP Q3 (e) +0.7% +3.1% y/y Q2 +0.5% +3.1% y/y BRAZIL Central Bank of Brazil Monetary Policy Meeting AUSTRALIA Retail Sales Oct. (e) +0.1% Sep. +1.2% Trade Deficit Oct. (e) A$1.8 bln Sep. A$2.3 bln MEXICO Central Bank of Mexico Monetary Policy Meeting North American Calendar: December 1 – December 5 Canada Monday December 1 9:30 am Nov. Oct. RBC Manufacturing PMI Tuesday December 2 Wednesday December 3 Quebec Economic and Fiscal Update 10:00 am BoC Policy Announcement 5:30 pm BoC Governor Poloz gives an interview at The Economist’s Canada Summit in Toronto 55.3 Auto Sales D Nov. Oct. Thursday December 4 10:00 am Nov. Oct. Friday December 5 Ivey Purchasing Managers’ 8:30 am Index (s.a.) Nov. (e) Employment +15,000 (+0.1%) 51.2 Oct. 8:30 am Nov. (e) +43,100 (+0.2%) Unemployment Rate 6.6% Oct. 8:30 am Nov. (e) Oct. 8:30 am Oct. (e) 6.5% Average Hourly Wages +1.7% y/y +1.5% y/y Merchandise Trade Balance +$200 mln Sep. 8:30 am Q3 (e) Q2 +$710 mln Labour Productivity -0.2% +1.8% 8:30 am Nov. (e) Nonfarm Payrolls +230,000 +6.5% y/y Consensus +5,000 (+0.03%) Consensus 6.6% Consensus +$50 mln United States 10:35 am 3-, 6- & 12-month T-bill auction $10 bln (new cash -$4.4 bln) 9:45 am Markit Manufacturing PMI 7:45 am ICSC Same-Store Sales (Nov. F) Nov. 29 Nov. 22 (mtd) +2.2% +1.7% y/y 10:00 am Manufacturing ISM 8:30 am Fed Chair Yellen speaks in PMI Prices Paid Washington Nov. (e) 58.0 52.0 8:55 am Redbook Same-Store Sales Consensus 57.9 52.5 Nov. 29 Oct. 59.0 53.5 Nov. 22 (mtd) -0.8% +4.0% y/y Total Vehicle Sales D 10:00 am Construction Spending Nov. (e) 16.5 mln a.r. Oct. (e) +0.3% Consensus 16.5 mln a.r. Consensus +0.6% Oct. 16.4 mln a.r. Sep. -0.4% 11:00 am Business Roundtable CEO Economic Outlook Survey (Q4) 30-year real return bond auction announcement 7:00 am Nov. 28 Nov. 21 MBA Mortgage Apps -4.3% 7:30 am Nov. Oct. 8:15 am Nov. (e) ADP National Employment Report +225,000 8:30 am Initial Claims Nov. 29 (e) 295k (-18k) C Nov. 22 313k (+21k) Oct. 8:30 am Nov. (e) +214,000 Unemployment Rate 5.8% Oct. +230,000 8:30 am Oct. 8:30 am Nov. (e) 5.8% Average Hourly Earnings +0.2% Q3 F (e) Productivity Unit Labour Costs +2.4% a.r. unch a.r. 8:30 am Nov. 22 Nov. 15 Q3 P Q2 +2.0% a.r. +2.9% a.r. 10:00 am Nov. (e) Nonmanufacturing ISM 57.1 Oct. 2:00 pm 57.1 Beige Book Consensus +221,000 Consensus +2.2% a.r. +0.2% a.r. +0.3% a.r. -0.5% a.r. Consensus 57.5 Fed Speakers: New York’s Dudley (12:15 pm); Vice Chair Fischer (1:00 pm) 11:00 am 4-week bill auction announcement 11:30 am 13- & 26-week bill auction $50.0 bln C = consensus D = date approximate R Fed Speakers: Vice Chair Fischer (8:10 am); Governor Brainard (12:00 pm) 11:30 am 4-week bill auction = reopening Fed Speakers: Philadelphia’s Plosser (12:30 pm); Governor Brainard (2:00 pm); Dallas’ Fisher (7:30 pm) Challenger Layoff Report +11.9% y/y Continuing Claims 2,316k (-17k) ICSC Chain-Store Sales Nov. (e) +4.1 % y/y Oct. +4.6% y/y Consensus +225,000 Consensus 5.8% Consensus +0.2% Oct. +0.1% 8:30 am Oct. (e) Goods & Services Trade Deficit $40.9 bln Sep. 10:00 am Oct. (e) $43.0 bln Factory Orders -0.3% Sep. 3:00 pm Oct. (e) -0.6% Consumer Credit +$16.0 bln Consensus $41.2 bln Consensus unch Fed Speakers: Cleveland’s Mester (8:30 Consensus +$16.5 bln am); Governor Brainard (12:30 pm) Sep. +$15.9 bln 11:00 am 13-, 26- & 52-week bill, 3-& 10R-year note, 30R-year Fed Speakers: Cleveland’s Mester (8:45 bond auction am); Vice Chair Fischer (2:45 pm) announcements Upcoming Policy Meetings | Bank of Canada: Jan. 21, Mar. 4, Apr. 15 | FOMC: Dec. 16-17, Jan. 27-28, Mar. 17-18 Page 16 of 16 Focus — November 28, 2014 General Disclosure “BMO Capital Markets” is a trade name used by the BMO Investment Banking Group, which includes the wholesale arm of Bank of Montreal and its subsidiaries BMO Nesbitt Burns Inc., BMO Capital Markets Ltd. in the U.K. and BMO Capital Markets Corp. in the U.S. BMO Nesbitt Burns Inc., BMO Capital Markets Ltd. and BMO Capital Markets Corp are affiliates. Bank of Montreal or its subsidiaries (“BMO Financial Group”) has lending arrangements with, or provide other remunerated services to, many issuers covered by BMO Capital Markets. The opinions, estimates and projections contained in this report are those of BMO Capital Markets as of the date of this report and are subject to change without notice. BMO Capital Markets endeavours to ensure that the contents have been compiled or derived from sources that we believe are reliable and contain information and opinions that are accurate and complete. However, BMO Capital Markets makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to BMO Capital Markets or its affiliates that is not reflected in this report. The information in this report is not intended to be used as the primary basis of investment decisions, and because of individual client objectives, should not be construed as advice designed to meet the particular investment needs of any investor. This material is for information purposes only and is not an offer to sell or the solicitation of an offer to buy any security. BMO Capital Markets or its affiliates will buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. BMO Capital Markets or its affiliates, officers, directors or employees have a long or short position in many of the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. The reader should assume that BMO Capital Markets or its affiliates may have a conflict of interest and should not rely solely on this report in evaluating whether or not to buy or sell securities of issuers discussed herein. Dissemination of Research Our publications are disseminated via email and may also be available via our web site http://www.bmonesbittburns.com/economics. Please contact your BMO Financial Group Representative for more information. Conflict Statement A general description of how BMO Financial Group identifies and manages conflicts of interest is contained in our public facing policy for managing conflicts of interest in connection with investment research which is available at http://researchglobal.bmocapitalmarkets.com/Public/Conflict_Statement_Public.aspx. ADDITIONAL INFORMATION IS AVAILABLE UPON REQUEST BMO Financial Group (NYSE, TSX: BMO) is an integrated financial services provider offering a range of retail banking, wealth management, and investment and corporate banking products. BMO serves Canadian retail clients through BMO Bank of Montreal and BMO Nesbitt Burns. In the United States, personal and commercial banking clients are served by BMO Harris Bank N.A., Member FDIC. Investment and corporate banking services are provided in Canada and the US through BMO Capital Markets. BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A, BMO Ireland Plc, and Bank of Montreal (China) Co. Ltd. and the institutional broker dealer businesses of BMO Capital Markets Corp. (Member SIPC), BMO Nesbitt Burns Securities Limited (Member SIPC) and BMO Capital Markets GKST Inc. (Member SIPC) in the U.S., BMO Nesbitt Burns Inc. (Member Canadian Investor Protection Fund) in Canada, Europe and Asia, BMO Capital Markets Limited in Europe, Asia and Australia and BMO Advisors Private Limited in India. “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited, used under license. “BMO Capital Markets” is a trademark of Bank of Montreal, used under license. "BMO (M-Bar roundel symbol)" is a registered trademark of Bank of Montreal, used under license. ® Registered trademark of Bank of Montreal in the United States, Canada and elsewhere. TM Trademark Bank of Montreal © COPYRIGHT 2014 BMO CAPITAL MARKETS CORP. A member of BMO Financial Group