* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download File - Learn2Econs

Survey

Document related concepts

Transcript

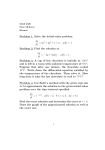

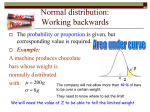

HWA CHONG INSTITUTION C2 Block Test 2 2015 Higher 2 ECONOMICS 9732/01 Paper 1 1 July 2015 2 hour 15 minutes Additional materials: Writing paper READ THESE INSTRUCTIONS FIRST Write your name and CT on all the work you hand in. Write in dark blue or black pen on both sides of the paper. You may use a soft pencil for any diagrams, graphs or rough working. Do not use staples, paper clips, highlighters, glue or correction fluid and tape. Answer all questions. At the end of the examination, you are to fasten the answer sheets to case study question 1 and question 2 SEPARATELY together with the respective cover page. The number of marks is given in brackets [ ] at the end of each question or part question. You are advised to spend several minutes reading through the questions before you begin writing your answers. You are reminded of the need for good English and clear presentation in your answers. This document consists of 8 printed pages and 1 blank page. HWA CHONG INSTITUTION [Turn over 2 Answer all questions. Question 1 The world market for cocoa bean and the chocolate industry Extract 1: World price of cocoa bean could more than double by 2020 if output lags World price of cocoa bean could more than double by 2020, rallying to a level last seen 36 years ago, if production fails to catch up with demand. There has been a shortage of cocoa beans, which are roasted and ground to make chocolate. In Ivory Coast, where 70% of the world’s cocoa beans are produced, diminished rainfall and extreme heat could hinder the development of the April 2013 to September 2014 mid-crop. Even under normal weather circumstances, only a small proportion of a cocoa tree’s flowers develop into fruit over a period of about five months. And it takes a whole year’s crop from one tree to make 450 grams of chocolate, which is approximately 90 Hershey’s Kisses chocolate. Every day, 70 million Hershey’s Kisses are produced. The supply shortfall is emerging just as Americans and Europeans are buying more chocolate, particularly the darker varieties, for health reasons. Dark chocolate often requires more cocoa beans per ounce than milk chocolate. As the world price of cocoa bean remains among the highest in years, companies like Mars and Hershey have not only raised their chocolate prices to cover increasing costs, but also turned to a cheaper cocoa variety developed in Ecuador. “A price increase was necessary to protect our margins,” said Hershey's Chief Executive John P. Bilbrey. In fact, despite rising costs, Hershey’s quarterly profits rose 5.4% in July 2014. But chocolate lovers will not let higher chocolate prices keep them from their craving, said Bilbrey. Craving for chocolate can be attributed to the release of a chemical called anandamide, which induces a relaxing feeling and improves one’s mood. Moreover, unlike other foods like cheese and brewed coffee, the aroma and taste match up with the pleasure of anticipation and reward in eating, thus making eating chocolate a highly pleasurable experience. Source: Various, Mar 2013 – May 2015 Figure 1: Market share (in percentage) of the leading chocolate companies in the United States in 2014 Hershey 44.2 Mars 29.5 Nestlé 5.8 Lindt/Ghirardelli 4.8 Russell Stover 4.4 Others 11.3 0 10 20 30 40 50 Source: Statista 2015 ©HCI C2 BT2 2015 9732/01/J/15 3 Extract 2: Why so little chocolate variety? The 1960s’ diverse chocolate market did not last, as the bigger players began eating up their smaller rivals. This has helped thin the market down to around 150 chocolate producers in the US today. Chocolate is a US$16 billion industry in the US, but the bulk of the profits end up with the bigger players. Size tilts the playing field, enabling bigger players to dish out huge sums in “slotting fees” for shelf space, ensuring that you will see the same pattern of brands prominently displayed in any WalMart, Giant or 7-11 store. The barriers to entry today are formidable, Steve Almond, author of CandyFreak, learned. “Most of the equipment intended for chocolate making is for larger-scale production, and the equipment designated for smaller batches is extremely expensive. I’d have to have billions of dollars just to be able to scale up production enough to make a decent quality bar at a competitive price,” he said. “And if it posed any threat to the big players, they would do what giant chocolate companies do: introduce a similar chocolate bar.” Lamenting the disappearance of a diverse chocolate market is not just nostalgia. Fewer companies concocting means dominant players have fewer reasons to innovate. Earlier this month, the industry buzzed over the major news of the season: Hershey’s first new and original product in 30 years – Lancaster, which is not acquired and not spun-off an existing brand. Source: Time, 1 November 2013 Extract 3: US chocolate price fixing suit against Hershey, Mars and Nestlé melts A US$727 million chocolate price-fixing lawsuit against Hershey, Mars and Nestlé has been thrown out by the US Middle District Court of Pennsylvania as Chief Judge Conner ruled that the firms’ actions could not be proven to be the result of concerted and collusive action. The firms were alleged to be spurred by the success of a price-fixing conspiracy in Canada and to have agreed to collude to raise prices in tandem in the US. However, the firms contended that the price increases, which were between 2-4 cents for singles and king-size chocolate bars, were driven by rising ingredient, manufacturing and distribution costs. Source: Confectionary News, 27 February 2014 Extract 4: The next big thing in chocolate Consumer demand for healthier and more natural ingredients is prompting a growing number of corporate giants, including Hershey and Nestlé USA, to overhaul iconic products that they sell. Paul Bakus, head of corporate affairs, said that some of the new ingredients will be more expensive for Nestlé. "The consumer is pretty much in the driver's seat," said Sophie Terrisse, chief executive of a brand-management firm. "A consumer can make or break a brand with a post, with a review, with a comment and an idea. Any brand has to listen today harder than they've ever listened." Despite dominance in the US chocolate market by a handful of multinational giants, a trend in favour of bean-to-bar chocolate is growing. Bean-to-bar chocolate, which can cost two to three times as much as a regular chocolate bar, is made from scratch by small-scale chocolate makers who buy cocoa beans direct from the farmers who grew them. Though bean-to-bar was a tiny part of the US$17.7 billion in chocolate sales in 2014, there are at least 75 established bean-to-bar chocolate makers in the US in 2015. This micro-produced chocolate is more interesting and diverse, with individual chocolate makers allowing the flavours of very small batches of cocoa beans from individual areas to emerge. ©HCI C2 BT2 2015 9732/01/J/15 4 In view of changing consumer demand, both Mars and Hershey have delved into the premium chocolate (typically characterised by an emphasis on the pursuit of quality) realm previously occupied primarily by smaller-scale specialty manufacturers, including bean-to-bar chocolate makers. Consumer familiarity gives these brands an advantage over others. In addition, most average consumers are unaware of the difference between smaller specialty and larger premium chocolate manufacturers, said Judy Ganes-Chase, president of J Ganes Consulting. She added that the shine of chocolate health claims will soon fade as consumers become desensitised to the fad of value-added superfoods, especially if economic uncertainty were to arise. Source: Various, Jan 2009 – Apr 2015 Questions (a) (b) Explain either one demand or one supply factor that has led to a rise in the world price of cocoa bean. [2] What can you conclude from evidence in Extract 1 about the value of the price elasticity of supply of cocoa beans in Ivory Coast? [2] (c) Using a relevant elasticity concept, explain the statement in Extract 1, “But chocolate lovers will not let higher chocolate prices keep them from their craving.” (d) Substantial internal economies of scale is a form of barriers to entry. Using information from Extract 2: [2] (i) Explain the type of internal economies of scale that can be reaped by firms in the US chocolate market. [2] Explain one other form of barriers to entry facing potential entrants into the US chocolate market. [2] Identify the type of market structure that exists in the US chocolate market and explain the reason for your choice. [2] Discuss whether monopoly power in the US chocolate market is beneficial to consumers. [8] To what extent are cocoa bean shortage and changing consumer tastes likely to threaten the existing large profits of the big chocolate firms? [10] (ii) (e) (f) (g) [Total: 30] ©HCI C2 BT2 2015 9732/01/J/15 5 Question 2 Economic recovery and free trade in a globalised world Extract 5: The "three arrows" of Abenomics Deflation, a sustained fall in the general price level, poses clear risks to the economy. One familiar danger is that consumers will put off buying in the hope that things will get cheaper later on, muting demand. On the other hand, when prices fall across an economy but wages do not, it hurts producers who would hold back their expansion and hiring plans causing employment to stagnate or even decline. Thus, deflation can be bad for jobs and growth. To help Japan escape from deflation and spur recovery, the “three arrows” of Prime Minister Abe’s economic program, commonly known as "Abenomics" were formulated. Generally, Abenomics consists of: (i) monetary easing, (ii) fiscal stimulus and (iii) structural reforms. First Arrow - Quantitative Easing: The first of the three arrows entails aggressive quantitative easing (QE). It involves substantial open market operations to boost liquidity in the financial system in order to stimulate the weak economy. However, some analysts opined that the most significant effect of Japan's quantitative easing is on its currency and not on the wider economy due to sluggish domestic loan demand. The yen has depreciated over 45 percent against the US dollar in nominal terms since 2012, which is largely attributed to the first round of QE. In addition, the Bank of Japan put further depreciation pressure on the yen after announcing at the end of October 2014 that it would conduct more QE. Second Arrow - Fiscal Stimulus: In Oct 2012, Japan's cabinet approved a 422.6 billion yen (US$5.3 billion) economic stimulus package of subsidies and tax grants. However, large public debt makes it difficult for Japan to use fiscal policy to pump-prime the economy. Japan has a staggering public debt of 160 percent of GDP. As a result, fiscal consolidation, a policy aimed at reducing government deficits and debt accumulation is on the cards as Japanese authorities seek to put their public finances on a more sustainable footing. As part of fiscal consolidation, the consumption tax was hiked in April 2014 from 5 to 8 percent, and a planned second-stage increase to 10 percent at the end of 2015 was announced. Third Arrow – Structural Reform: Over the medium and long term, the Japanese government will take ambitious structural reforms to permanently increase domestic demand. This would include measures to raise household income through greater labour force participation and higher earnings. In addition, the third arrow would also include measures to facilitate new domestic opportunities for investment, by opening up domestic sectors, particularly services, to new products and new competition through deregulation. The measure of the third arrow will be its success in raising Japan’s potential growth rate. The first two arrows were actively employed at the launch of Abenomics in 2012. Aggressive monetary policy and initial expansionary fiscal policy contributed to a recovery from the late-2012 slump and real GDP grew by 1.6 percent in 2013. However, in the second quarter of 2014, after the introduction of a 3 percentage point increase in the consumption tax, economic growth fell sharply. As a result, attention has now turned to the sustainability of the recovery as nominal wage growth has failed to offset the impact of the consumption tax hike. In early 2014, prices have fallen on the back of plunging global oil prices, and the country may again face deflation in the coming year. Going forward, more progress on the third arrow of structural reform may be required to raise long-term growth prospects in Japan. Source: Various, dated Oct-Dec 2014 ©HCI C2 BT2 2015 9732/01/J/15 6 Extract 6: Durable economic recovery in Japan As Japan adopts Abenomics to bring about a durable recovery, it is vital for the global and Japanese economies that its economic policies work primarily through an increase in domestic demand. Sustaining domestic demand growth will depend on sustained rise in business investment and household consumption that need to be supported by nominal wage increases that exceed inflation. In this respect, it is important that Japan carefully calibrate the pace of overall fiscal consolidation. This is because expansionary monetary policy cannot offset the effects of excessive fiscal consolidation. Above all, boosting the waning consumer confidence remains a key challenge in the prevailing deflationary climate. Source: Report to US Congress on International Economic and Exchange Rate Policies, 15 Oct 2014 Extract 7: Globalisation poses challenges to free trade According to David Ricardo, the gains from trade come from our differences, not our similarities; and the greater the differences, the larger the potential gains. When a trading country is no longer constrained to making products and services to only match domestic demand, both consumers and producers win. However, the complexity of today’s interconnected global markets sometimes creates challenges for supporters of this approach towards international trade. One prime challenge is the conduct of rampant unfair trade practices, key being currency manipulation, which has vexed the United States for many years. In essence, currency manipulation allows governments of foreign countries to suppress the value of their currencies to lower the prices of their exports and increase the prices of their imports. As most of the intervention takes place in US dollars, the dollar has been pushed to overvalued levels compared to her trading partners, such as Japan. Recent remarks from Japanese Prime Minister Shinzo Abe underscore Japan’s dependence on a weak yen as an export-driven growth policy, “No matter how much sweat they put in, no matter how good their ideas, businesses couldn’t compete due to the strong yen, and many jobs were lost.” As a result of currency manipulation, the US current account deficit has averaged $200 billion to $500 billion per year higher and it was estimated that “the United States has lost 1 million to 5 million jobs due to currency manipulation.” Several other countries, including the weak euro area economies, emerging-market countries such as Brazil and India, and many small and poor countries, have also suffered the ill effects of currency manipulation, such as increased unemployment. In light of large and widespread trade effects due to currency manipulation, the US has called for free trade agreements to address these issues and help ensure that participating countries benefit from the gains from trade. One such agreement is the Trans Pacific Partnership (TPP), a preferential free trade agreement currently being negotiated by countries such as Japan, Malaysia, Mexico, New Zealand, Singapore, Vietnam and the United States. Bridging both sides of the Pacific, the TPP will bring together one third of world trade. It is recommended that adding a "currency chapter" in the TPP, including clear obligations to avoid currency manipulation in the TPP and sanctions against violators could help to deter future currency manipulation. Source: Various Sources dated Oct 2014 - Jan 2015 ©HCI C2 BT2 2015 9732/01/J/15 7 Table 1: Japan - Selective Economic Indicators 2011 – 2014 Annual percentage change Real GDP Composition of GDP: Private Consumption Public Consumption Gross fixed capital formation Exports (goods and services) Imports (goods and services) % GDP (in 2013) 100 2011 2012 2013 2014 (forecasted) 0.4 -0.5 1.8 1.6 61.1 0.3 2.3 2.1 -1.0 20.6 1.2 1.7 1.9 0.3 21.7 1.4 3.4 3.2 2.9 16.2 -0.4 -0.2 1.5 7.8 19.0 5.9 5.3 3.1 6.5 Other Macroeconomic Indicators: Inflation Rate (%) -0.3 0.0 0.4 - Unemployment Rate (%) 4.6 4.3 4.0 3.7 Interest rate (%) 0.10 0.10 0.10 0.10 Exchange rate (Yen per USD) 76.96 86.75 105.3 - Population (million) 128.0 127.9 127.6 - Source: http://www.focus-economics.com/countries/japan Figure 2: Japan Balance of Trade (JPY Billion) Jul 2012 Jan 2013 Jul 2013 Jan 2014 Source: tradingeconomics.com ©HCI C2 BT2 2015 9732/01/J/15 8 Questions (a) (i) (ii) (b) (i) (ii) (c) (i) (ii) (d) (e) Using Table 1, what evidence is contained in the data to suggest that Japan experienced a deflation? [1] Using AD-AS analysis, explain how deflation can be "bad for jobs". (Extract 5) [2] Explain how a fall in a country's interest rate might affect its exchange rate. [2] Explain why "expansionary monetary policy cannot offset the effects of excessive fiscal consolidation." (Extract 6) [3] Using Figure 2, describe what happened to Japan's balance of trade over the period Jul 2012 to Jan 2014. [2] Explain one factor that limits the extent to which "currency manipulation" by Japan can benefit its balance of trade. [2] Discuss whether Japan should let its economic policies work primarily through an increase in domestic demand or external demand to achieve economic recovery. [8] The complexity of today’s interconnected global markets sometimes creates challenges for supporters of free trade. (Extract 7) In the light of the data provided, discuss the extent to which free trade is beneficial in a globalised world. [10] [Total: 30] ©HCI C2 BT2 2015 9732/01/J/15 9 Blank Page Copyright acknowledgements: Question 1 Extract 1: @ Global Cocoa Prices Could More than Double by 2020 if Output Lags – Petra; Reuters; 26 Mar 2013; http://www.reuters.com/article/2013/03/26/indonesia-cocoa-deficit-idUSL3N0CI13Q20130326 @ Chocolate Craving Comes from Total Sensory Pleasure; BBC News; 27 July 2013; http://www.bbc.com/news/health-23449795 @ Chocolate Prices Soar in Dark Turn: Consumer Shift to Dark Chocolate Further Squeezing Cocoa Supplies; The Wall Street Journal; 22 September 2013; http://www.wsj.com/articles/SB10001424052702303983904579091120112729130 @ Hershey Profit Up 5.4% Despite Rising Costs; The Wall Street Journal; 24 July 2014; http://www.wsj.com/articles/hershey-posts-profitincrease-despite-rising-costs-1406201376 @ Artisanal, Hand-Crafted Chocolate is a Growing Niche; Los Angeles Times; 28 February 2015; http://www.latimes.com/business/la-fiartisan-chocolate-20150228-story.html#page=1 @ Harvesting and Processing Cocoa Beans: ‘Theobroma Cacao’ – The Cocoa Tree; Mondelez Australia Pty Ltd and Mondelez Austrialia (Foods) Ltd.; accessed 6 May 2015 https://www.cadbury.com.au/about-chocolate/harvesting-and-processing-cocoa-beans.aspx Question 1 Figure 1: Statista, 2015 Question 1 Extract 2: Why so little chocolate variety?, Time, 1 November 2013 Question 1 Extract 3: US chocolate price fixing suit against Herseys, Mars, Nestle melts, Confectionary News, 27 Feb 2014 Question 1 Extract 4: @ Premium Chocolate Holds Steady in Tough Economy; The Wall Street Journal; 7 January 2009; http://www.wsj.com/articles/SB123129657237259887 @ Why Doesn’t Britain Make Its Own Chocolate from Scratch?; The Telegraph; 14 October 2013; http://www.telegraph.co.uk/foodanddrink/10370161/Why-doesnt-Britain-make-its-own-chocolate-from-scratch.html?mobile=basic @ The Revival of Bean-to-Bar Chocolate-Makers; On the Cocoa Trail; 22 November 2013; http://onthecocoatrail.com/2013/11/22/1741/ @ African cocoa traders want bigger slice of the profits; BBC News; 13 June 2014; http://www.bbc.com/news/business-27831038 @ I Should Cocoa: Why We’re All Going Made for Bean-to-Bar Chocolate; The Telegraph; 3 January 2015; http://www.telegraph.co.uk/foodanddrink/11319304/I-should-cocoa-why-were-all-going-mad-for-bean-to-bar-chocolate.html @ Artisanal, Hand-Crafted Chocolate is a Growing Niche; Los Angeles Times; 28 February 2015; http://www.latimes.com/business/la-fiartisan-chocolate-20150228-story.html#page=1 @ Going All Natural: Major Food Companies Taking Out Artificial Ingredients; www.guampdn.com; 9 April 2015; http://www.guampdn.com/article/20150409/LIFESTYLE/304090014/Going-all-natural-Major-food-companies-taking-out-artificialingredients Question 2 Extract 5: @ Report to Congress on International Economic and Exchange Rate Policies, 15 October 2014 @ Currency Manipulation and its Distortion of Free Trade, 1 December 2014 Question 2 Extract 6: Report to Congress on International Economic and Exchange Rate Policies, 15 October 2014 Question 2 Extract 7: @ Report to Congress on International Economic and Exchange Rate Policies, 15 October 2014 @ Currency Manipulation and its Distortion of Free Trade, 1 December 2014 @ Currency Manipulation And Its Impact On Free Trade, Forbes / Opinion, dated 21 January 2015 Question 2 Table 1: http://www.focus-economics.com/countries/japan Question 2 Figure 2: Tradingeconomics.com Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every reasonable effort has been made to the publisher to trace copyright holders, but if any items requiring clearance have unwittingly been included, the publisher will be pleased to make amends at the earliest possible opportunity. ©HCI C2 BT2 2015 9732/01/J/15