* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download SHOPS Quarterlies

Survey

Document related concepts

Transcript

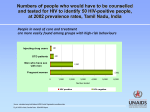

Findings from the Private Health Sector in West Africa: A Six-country Macro-level Assessment Bettina Brunner Regional Manager, Francophone Africa, SHOPS SHOPS is funded by the U.S. Agency for International Development. Abt Associates leads the project in collaboration with Banyan Global Jhpiego Marie Stopes International Monitor Group O’Hanlon Health Consulting West Africa Macro PSAs and mHealth Scan • Macro-level private health sector assessments in six countries to explore opportunities for USAID’s flagship family planning (AGIR-PF) and HIV and AIDS (PACTE-VIH) projects • mHealth landscape of 17 countries to identify regional opportunities for public-private mhealth partnerships Benin, Burkina Faso, Cameroon, Cape Verde, Gambia, Ghana, Guinea, Guinea Bissau, Cote d’Ivoire, Liberia, Mali, Mauritania, Niger, Nigeria, Senegal, Sierra Leone, Togo Macro-Level Private Sector Assessment 5 components Legal and regulatory review Recommendations for partnerships Role of the private sector Public private partnerships (PPP) & CSR Key NGOs and FBOs Timeline Cameroon Niger Dec. 8-17, 2013 Jan. 11-19, 2014 Côte d’Ivoire Togo Jan. 13-17 Mar. 17-21, 2014 Feb. 1-10, 2014 Country Visit Mauritania Mar. 1-10, 2014 Event Burkina Faso Feb. 22 Mar. 2, 2014 Ghana Implementing Partners Meeting Mar. 19-20, 2014 Final report publication Ghana Dissemination Event May 20-21, 2014 May 2014 Methodology 1. Plan Draft scope of work Select assessment team Engage stakeholders Finalize scope of work 2. Learn Desk review Prepare field survey instruments Fieldwork Debrief key stakeholders 3. Analyze Analyze data Formulate recommendations Draft report 4. Share Disseminate draft report • Validate and prioritize recommendations • Finalize the report Health Stakeholders Interviewed Commercial private sector Health care providers Nonprofit private sector (e.g., doctors, nurses, midwives) Health care facilities Health insurance Diagnostic services (e.g., laboratories) Multinational companies (e.g., mining companies) Professional and medical associations Civil society organizations companies Faith-based organizations Pharmaceutical distributors health care delivery (e.g., hospitals, clinics, pharmacies) NGOs engaged in Public sector Business coalitions Corporate social Ministries of Health, International donors (e.g., Works, Investment foundations, Promotion foreign national Departments, governments) Professional councils Public hospitals Central medical stores Government commissions on HIV and AIDS Finance, Public and regulatory boards responsibility NGOs Development partners Government health dialogue platforms Multilateral organizations (e.g., UN, WHO, World Bank) Key Motors for Change in West Africa • Regional program in RH & HIV • with KfW • • Diagnostic survey of private health sector • • eHealth Strategy underway • Six local manufacturers identified • for local production of ARVs • Assistance to 5 laboratories to provide quality control 1 million new FP users by 2015 “De-medicalize, de-centralize, democratize” Engagement of countries in collaboration with donors Relaunch of FP strategies in all USAID West Africa focus countries except Cameroon FP and HIV in Six Focus Countries • Extremely low contraceptive prevalence rate coupled with high total fertility rate • Provision of FP & ART by private forprofit providers varies by country • Pharmacies are major source of FP products • Strong stigma against PLHIV and MSMs in most countries • Service delivery highly concentrated in urban areas • Contraceptive security committees not operationalized Public Private Dialogue • Strong public sector dialogue with NGOs and FBOs in FP and HIV service delivery • Poor engagement with private for-profit sector • Dialogue mechanisms exist but not operationalized • Private sector not included in health information systems • Wide range of professional bodies but poor interface with MOH • Regulatory environment is weak Corporate Social Responsibility • Nascent local concept in West Africa • Low presence of multinationals, except in extractive industries, large-scale agriculture • Company foundations active in HIV • Main CSR actors: Private sector coalitions for HIV, chambers of commerce, CSR associations, patronat Examples of CSR in West Africa Potential Impact Togo: Brasserie BB finances Espoir Vie’s work with OVC Mauritania: BMCI finances STOPSIDA’s activities with fishermen Community Burkina & Cameroon: Total Foundation finances activities of NGO for HIV activities with truck drivers Families Regional: Training and outreach on sexually transmitted diseases Employees PPPs and Partnerships • Lots of contracting out with NGOs & FBOs, much less with private for-profit sector • Health PPP idea nascent in region • No health PPP units among 6 focus countries • No health PPP guidelines in health • No private sector strategies in place (Burkina’s is underway) Burkina Faso Private Health Structures, 2012 Type de Structure Total Clinic 40 Polyclinic 9 Medical Center 482 Hospital 0 Medical Office 17 Dental office 5 Nursing Facilities 179 Birthing Clinic 14 CPSP 36 Other 3 Total 361 Source: Burkina Faso Ministry of Health 2013 Private Health Structures, 2012 Category Total Private for-profit 261 Association 37 Faith-based organization 54 NGO 9 Total 361 • Donor coordination committee and coordinating meeting on contraceptives meet irregularly • APROCLIB is key private sector player • WBG has strong public-private dialogue program Cote d’Ivoire Health Facilities by Type, 2010 Type of Facility Number Percent Public sector health facilities, 2009–2010 Semi-public facilities and institutions Public health sector administrative services, 2009–2010 Authorized private health facilities (2009) Unauthorized private health facilities 1887 11 102 554 1482 Private faith- and community-based health facilities Total 99 4135 45.63 0.27 2.47 13.40 35.84 2.39 100 Government of Cote d’Ivoire, 2013 Number of Sites Providing HIV and AIDS Services by Sector (2010) Type of Facility Public NGO Communitybased Private for-profit Faith-based Workplace Total CT 641 15 PMTCT 559 6 ART 387 5 Lab with CD4 106 10 63 4 25 19 767 31 2 20 11 629 33 4 27 12 468 8 2 7 5 138 Source: Barnes et al, 2013 • Private health facilities are 52% of total • Of 2,036 private health facilities, 73% were unauthorized (2009) • Growing manufacturing sector (7), but only supply 4% of market • Over 800 pharmacies • Strong professional organizations: ACPCI, SYNAMEPI • Strong business coalitions (CECI) COSCI Cameroon Cameroon Hospital Attendance, 2012 Public health facilities (District hospitals, CMAs & Health centers) Faith-Based health facilities (Hospitals & health centers) 2,566,653 Private For Profit health facilities (Hospitals, clinics & health centers) 1,755,109 5,003,710 681,948 Funding for HIV by Source, 2012 Source Public funds Private funds International/donor funds Total Amount (CFA) 6,837,745,597 4,215,189,546 19,435,236,055 Percent 22.4 13.8 63.7 30,488,171,198 100 • Of 4,351 health facilities identified in 2011, 44% in private sector • 34% of health personnel active in private sector • PPP exists with Confederation of Private Enterprises for distribution of ARVs • Coca Cola Africa Foundation provides medical supplies to Ad Luchem Foundation clinics including malaria & HIV medicines work over $15 million • AFD has invested 22.8 Euros to standardize and streamline the contracting out process with the MOH. Mauritania CPR, Any modern method, by location • Private for profit facilities in Nouakchott & Nouadhibou include: • • • • • 15 medical & surgical facilities 47 medical consulting offices 15 primary health stations 118 pharmacies 280 shops selling pharma products • Private sector Engagement • No public private forum (FP Multisectoral working group doesn’t include private for profit sector) • Private for-profit poorly represented in MCH and HIV, but private nonprofit well integrated with public sector Niger Niger Private Health Sector Number of private pharmacies in Niamey Number of private pharmacies outside of Niamey Total number of private pharmacies in Niger Number of private physicians, pharmacists, and dental surgeons registered with the local regulatory body 85 17 Health PPPs in Niger Private entity AREVA (commercial corporation) Public entity MOH/CILS 102 750 Estimated total number of private 900-1000 health providers in Niger Estimated number of wholesalers 22 Private providers MOH SIM (FBO) MOH Private pharmacies MOH Major commercial businesses MOH Description CILS provides support to AREVA to procure ARVs and reactives for HIV testing. AREVA provides all health services to Arlit population for free. In Niamey, AREVA subsidizes materials for several laboratories. Doctors at private clinics are contracted by the government to test patients, after which they are referred to CTAs. SIM operates 2 hospitals in Maradi (Danja) and Zinder (Galmi). Through funding from the Global Fund, the MOH heavily subsidizes malaria test kits in public and private pharmacies across the country. Anecdotally, major private companies in Niger have workplace health programs that have PPPs with the MOH. Togo Togo Private Health Sector Overview Total number of private pharmacies in Togo Number of private pharmacies in Lomé 180 Number of private pharmacies outside of Lomé 18 Number of private physicians registered with the local regulatory body (in 2013) Estimated total number of private health providers in Togo 200 162 2000** • 51% health-related spending is out of pocket (2010 CARMMA) • For profit private sector is 33% of total • Platforms exist but not functioning well: Comité de Coordination du Secteur de la Santé (CCSS), Groupe Inter Bailleur Santé Thank you Bettina Brunner [email protected] SHOPS is funded by the U.S. Agency for International Development. Abt Associates leads the project in collaboration with Banyan Global Jhpiego Marie Stopes International Monitor Group O’Hanlon Health Consulting