* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Banks and Interest

History of the Federal Reserve System wikipedia , lookup

Peer-to-peer lending wikipedia , lookup

Financialization wikipedia , lookup

Yield spread premium wikipedia , lookup

Present value wikipedia , lookup

Syndicated loan wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Global saving glut wikipedia , lookup

History of pawnbroking wikipedia , lookup

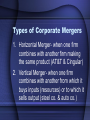

Chap. 10.1 Production, Consumption, and Time Objectives: Explain why production requires savings. (P 289) Explain why people often pay more to consume now. (P290) Production and Time •Production takes time- it cannot occur without savings from prior periods •Investment takes time- if you want to utilize a capital good you have to compare current opportunity cost to future stream of benefits Production and Time Contd. Capital Goods Increases Labor Productivityfor the economy as a whole more investment means more capital goods increasing the economy’s ability to produce in the future Production depends on saving because production of both consumer goods and capital goods takes time Production and Time Cont’d Financial Intermediaries: • The Interest rate is the price of borrowing; the annual interest expressed as a percentage of the amount borrowed. • In our economy, producers no longer have to depend solely on their life savings b/c of banks. Market Interest Rate • This brings borrowers and savers together to determine the market interest rate (aka- equilibrium interest rate) Consumption and Time • Consumers care more about what they consume now than later • Paying more to consume now– because of the previous fact, consumers are willing to pay more to consume now. (Ex: Hot Pizza) • Impatience and uncertainty is why consumers will pay more Chap. 10.2 Banks and Interest Objectives To explain the role of banks in bringing borrowers and savers together. To understand why interest rates differ. Banks as Financial Intermediaries • Banks serve both producers and consumers by bringing borrowers and savers together to try and earn a profit. -Banks are also known as Financial Intermediaries • Banks serve producers by granting them loans & charging interest on the loans. • Banks serve consumers by paying them to let the bank borrow their money (interest rate) in a savings account. Banks as Intermediaries Banks have 4 main tasks: 1. They serve savers and borrowers. 2. They specialize in Loans. 3. They reduce risk through diversification. 4. They open Lines of Credit. (an arrangement with a bank through which a business can quickly borrow needed cash) Why Interest Rates Differ Prime Rate- this is lowest interest rate that lenders charge borrowers. These are usually granted to the most trustworthy clients. Collateral- this is any assets owned by the borrower that can be sold to pay off the loan in case the loan defaulted. Cont’d Interest Rates differ for 3 main reasons: 1. Risk- the higher the risk, the higher the interest rates. Before banks issue loans, they usually require collateral due to this increased risk. 2. Duration of the Loan- The longer the duration of the loan, the higher the interest rate. Why??? Cont’d 3. Cost of Administration of the Loanthis is the costs of executing the loan agreement, monitoring the loan, and collecting payments. The relative cost of administering a loan declines as the size of the loan increases, thus reducing the interest rate for larger loans. Chap. 10.3 Business Growth Objectives Recognize the role of profit in business growth. Identify the types of corporate mergers. Identify the multinational corporation as a source of business growth. Profitable Firms • Profitable Firms can grow faster b/c: 1. More profits can be reinvested into the firm 2. Owners are willing to invest more of their own money in such firms 3. Banks are more willing to lend to such firms. Types of Corporate Mergers 1. Horizontal Merger- when one firm combines with another firm making the same product (AT&T & Cingular) 2. Vertical Merger- when one firm combines with another from which it buys inputs (resources) or to which it sells output (steel co. & auto co.) Cont’d 3. Conglomerate Merger- this is a combination of firms in different industries (plastics maker and an electronic firm) Multinational Corporations (MNC) • Multinational Corporations (MNC)these are corporations that operates globally. • A.K.A.- international corporations and global corporations. • What are some problems with MNC’s?