* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download 9 BMO Guardian Global High Yield Bond Fund Advisor Series

Survey

Document related concepts

Transcript

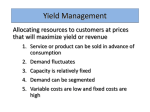

BMO Guardian Global High Yield Bond Fund Advisor Series Tactical appeal of high yield Global range of opportunities Active Management by PIMCO Canada Corp. BMO Guardian Global High Yield Bond Fund Advisor Series The tactical appeal of high yield Investors want equity-like returns without equity volatility Enter high yield investments Potential for: 1. Higher returns than traditional fixed income 2. Less risk than equities 2 BMO Guardian Global High Yield Bond Fund Advisor Series High yield bonds Superior risk-adjusted returns 3 BMO Guardian Global High Yield Bond Fund Advisor Series High yield bonds Favourable correlations 4 BMO Guardian Global High Yield Bond Fund Advisor Series High yield bonds Strong risk-adjusted returns 5 BMO Guardian Global High Yield Bond Fund Advisor Series High yield bonds Strong during early stages of recovery 6 BMO Guardian Global High Yield Bond Fund Advisor Series Why high yield now? Attractive spreads Versus investment-grade bonds 7 BMO Guardian Global High Yield Bond Fund Advisor Series Why high yield now? Attractive along quality curve 8 BMO Guardian Global High Yield Bond Fund Advisor Series Limited high yield options in Canada Canadian investors need global high yield for two diversification reasons: 1. Limited number of opportunities • Many investors chasing 2. Limited range of opportunities • Concentrated in issues from income trusts and Canadian banks* *DBRS Canada Newsletter, Volume 2, Issue 9, March 3, 2010. 9 BMO Guardian Global High Yield Bond Fund Advisor Series Canadian investors missing out Global markets – multitude and range of issues across many countries: •Investment-grade corporate bonds •Emerging-market corporate bonds •Sovereign credits •Non-core credit sectors 10 BMO Guardian Global High Yield Bond Fund Advisor Series What about high-yield risk? The new normal • • • • 11 High yield ≠ high risk Many emerging-market countries carry lower debt levels than developed countries and some major corporations Some emerging-market businesses – very clean balance sheets Prospect of higher economic growth – likely to lead to sustainable higher yields “When you have some countries with better balance sheets than many well-known corporations, you need to readjust your assessment of risk to the new normal.” -Curtis Mewbourne, Executive VP and Portfolio Manager, PIMCO BMO Guardian Global High Yield Bond Fund Advisor Series Risk/return comparisons Credits vs. equities 12 BMO Guardian Global High Yield Bond Fund Advisor Series Not all high yield bond funds are equal Experienced security selection is key 13 BMO Guardian Global High Yield Bond Fund Advisor Series 5 Reasons to pick BMO Guardian Global High Yield Bond Fund Advisor Series 1. Open investing and managers around the globe 2. Active and holistic • Top-down economic view, bottom-up security analysis and selection 3. Four-point investment process 4. Embedded hedge currencies 5. PIMCO Canada – Access to expert and largest pool of fixed-income managers in the world 14 BMO Guardian Global High Yield Bond Fund Advisor Series 1. Open Investing Finding opportunities around globe 1. 2. 3. 4. 15 Investment-grade global corporate bonds Emerging-market corporate bonds Sovereign credits Non-core credit securities BMO Guardian Global High Yield Bond Fund Advisor Series 2. Active and holistic Top-down economic view Bottom-up security analysis and selection 1. Strategic exposure across a broad array of global credit markets and credit selection 2. Bottom-up active management analyzing and selecting individual securities 16 BMO Guardian Global High Yield Bond Fund Advisor Series 3. Four-Point investment process 1. 2. 3. 4. 17 Outlook: interest rates and macroeconomics View on Country: interest rates, credit trends and economic conditions Portfolio targets: sector, quality, weightings Portfolio construction: individual security analysis and selection, risk controls and liquidity BMO Guardian Global High Yield Bond Fund Advisor Series 4. Embedded hedge currencies 1. Not all bond funds offer currency hedging 2. Most currencies fluctuating 3. Skilful hedging reduces volatility – can result in steadier returns 18 BMO Guardian Global High Yield Bond Fund Advisor Series 5. PIMCO (Parent of PIMCO Canada Inc.) PIMCO Fixed Income Manager of Decade* 1. As large as Canada’s GDP, PIMCO manages more than US$1 trillion 2. 450 investment professionals around the globe and in Canada 3. 30 years of managing money 4. Low default rate *According to Morningstar 19 BMO Guardian Global High Yield Bond Fund Advisor Series Guarding against risk Diversification •Global 1. More selection and range – developed and emerging markets •Blended portfolio – developed, emerging, corporate, sovereign, other core and non-core credit sectors Active and holistic •Top-down view and bottom-up security selection Embedded currency hedging – against fluctuations Income specialists •Expert and largest fixed-income managers in the world Close monitoring – lower defaults than benchmarks for past 16 years 20 BMO Guardian Global High Yield Bond Fund Advisor Series At the helm • • • • 21 Curtis A. Mewbourne Managing director, head of portfolio management for PIMCO's New York office Generalist portfolio manager – manages institutional accounts and mutual funds across a wide range of strategies 18 years of trading and portfolio management experience Curtis A. Mewbourne Executive VP and Portfolio Manager BMO Guardian Global High Yield Bond Fund Advisor Series Disclaimers ®Registered trade-mark of Bank of Montreal, used under licence. For information only. The information contained herein is not, and should not be construed as investment advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. BMO Guardian Funds refers to certain mutual funds and/or series of mutual funds offered by BMO Investments Inc., a financial services firm and a separate legal entity from Bank of Montreal. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the mutual fund before investing, their values change frequently and past performance may not be repeated. 22