* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download AS/AD Model

Edmund Phelps wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

2000s commodities boom wikipedia , lookup

Full employment wikipedia , lookup

Refusal of work wikipedia , lookup

Long Depression wikipedia , lookup

Stagflation wikipedia , lookup

Nominal rigidity wikipedia , lookup

Post-war displacement of Keynesianism wikipedia , lookup

Business cycle wikipedia , lookup

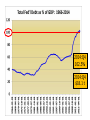

Macro Theory: The AS/AD Model Part 1 – The Basics Part 2 – The Keynesian View Dr. D. Foster – ECO 285 – Macroeconomics Part 1 – The Basics Warning .. Warning .. Warning • Aggregate Supply and Aggregate Demand are not like market supply & demand !!!!! • The “static” analysis only hints at dynamic interpretation. • Ceteris Paribus assumption problematic to the point of being wholly inappropriate. Keynesian model notes: • Descriptive analysis. • No numerical interpretation. • Only AS/AD graphical representation. The Aggregate Demand Schedule P P = Price Level; CPI or GDP deflator Q = real output; Real GDP A P2 B P1 AD = Agg. Demand; From 4 sectors – HH, Bus, G, Foreign AD1 Q1 Q2 Q or R-GDP Aggregate Demand • The price level and real output demanded are inversely related. • A fall in the price level will increase quantity demanded. • Why? -- the Wealth Effect • • • • All prices and wages change. But, the fixed wealth is … well, still fixed! So, with lower prices we feel wealthier. Woo Hoo! And, so we want to buy more stuff. Aggregate Demand • What about: Interest effect Foreign trade effect Exchange rate effect Can’t do “all else equal.” e.g. Lower prices: Consumption, but one price is wages!!! If they fall, then we’d see a Consumption!!! • AD can shift to the left or right. Increase AD – shift to the right. Decrease AD – shift to the left. Whenever C, I, G, net X increase/decrease. Why? Due to changes in optimism & pessimism, and due to fiscal & monetary policies. The Aggregate Demand Schedule P Increases in C, I, G, net X Decreases in C, I, G, net X AD3 AD2 AD1 Q or R-GDP Long Run Equilibrium between Aggregate Demand and Aggregate Supply P AS1 • There is an Aggregate Supply that reflects fully employed resource use. • Output level: Q* or RGDP* or potential RGDP • Shifts in AD can only change the price level and not real output (nor employment). P1 Classical Model of the Economy AD1 Q or R-GDP What affects the Aggregate Supply? • Labor force participation. • Labor productivity. • Marginal tax rates on wages. • Provision of government benefits that affect household incentives w.r.t. supply labor. • State of technology. • Capital stock. A change in these factors can AS (shift right) or AS (shift left) Short Run Aggregate Supply – Wage Inflexibility • Nominal wages are sluggish upwards: A rise in prices has delayed effect on wages. • Nominal wages are inflexible downwards: A fall in prices will result in employment and income. • Workers have money illusion: Higher nominal wages are viewed as real wage. So, more workers available even though real wage has not risen. e.g. if prices rise 5% and wages rise 3%… Short Run Aggregate Supply • What about: Sticky prices Misperception Intertemporal substitution Unnecessary complications to explain the SR AS. Inflexible wages is all we need. What happens if there is a AD? • The Short Run will adjust to the Long Run: An AD will P and Q, but only in the SR. Prices rise but wages lag. Firms employment and output. Eventually, workers realize their real wages (W/P) are falling, get comparable wage, AS. The temporary profit motive has been eliminated. From SR to LR Aggregate Supply P ASLR AS3 An increase in AD triggers events. AS2 AS1 Prices rise, wages lag, output rises. P3 Eventually, wages catch up and AS declines. P2 P1 AD2 AD1 Q* Q2 Q or R-GDP In LR, only prices rise. AS/AD Model – Hints at 4 types of changes P ASLR AS1 • Inflation with growth due to rising AD. • Depression with deflation due to falling AD. • Growth with deflation due to rising AS. • Depression with inflation due to falling AS. (stagflation) P1 AD1 Q* Q or R-GDP Macro Theory: The AS/AD Model II Keynesian Version Dr. D. Foster – ECO 285 – Macroeconomics Part 2 – The Keynesian View P AS/AD Model – Long Run & Short Run ASLR AS1 AD shows demand from 4 sectors of economy. AS in LR shows full employment of resources. AS in SR shows effect of inflexible wages. P1 Keynesian argument AD1 Q* Q or R-GDP The Keynesian Perspective • The short run is more important to us. • We live our lives through the SR not the LR and the LR may take too long! • We need a theory of the SR to smooth out the business cycle. • Equilibrium occurs when planned spending equals realized spending. In fact, Keynes didn’t really have a business cycle theory (“animal spirits”). He had a theory of how to deal with a business cycle. Equilibrium in the Keynesian Model • When planned spending = realized spending • Assumes planned C, G, net X = realized C, G, net X • But, planned I may not equal realized I If AD>AS then Ip>Ir and inventories fall unexpectedly. And business will I which production and income/employment. If AD<AS then Ip<Ir and inventories build up unexpectedly. And business will I which production and income/employment. Recall from our discussion of GDP = the change in business inventories, although very small in absolute terms, is a closely watched variable because it tells us what will happen to business investment … Details of the Keynesian Model • Changes in spending have a multiplier effect on income. C=$100 will Y=$100; some of this is spent, so C=$80 which Y=$80; some of this is spent, so C=$64 which Y=$64 … True for in C, I, G, net X • This only applies when there is no inflation. All income changes are “real.” • In a recession, additional resources can be employed without raising wages/prices. Keynesian theory in AS/AD Model Introduce a flat AS. P ASLR Introduce disequilibrium at Q1 with AD2. AS1 Equilibrium process moves us to Q2. AD2 But, we still have a depression. AD3 If we can further increase spending to AD3 we can boost employment and output. AD1 Q1 Q 2 Q 3 Q* Q or R-GDP Continue until we reach Q*. Fiscal Policies • Government spending & taxes. • G has a direct effect on AD (just as C, I, net X) • Since G is discretionary, it can be controlled, unlike others. • Taxes have a more complicated effect. To keep things simple, assume “lump sum taxes.” T will affect both consumption and saving. e.g., if taxes are raised by $400 then maybe consumption will fall by $320, and saving will fall by $80 to compensate. Since changes in income are driven by multiplier effects on spending, the effects are not offsetting!!!! [T = lesser C Y] Odd Keynesian balanced budget multiplier = 1, where ∆G = ∆T = ∆Y Fiscal Policies • Transfer payments can be included here. Recall that they are not included as G in GDP. But, we can consider these as “negative taxes.” That is, total government spending = G + TP, while total government revenue = T + TP. So an TP can be thought of as an equivalent T An TP will C and S, so overall Y just like a T • Some fiscal policies may be “automatic stabilizers.” With unemployment, transfer payments rise automatically. e.g., Unemployment insurance, food stamps, welfare. This would tend to boost AD without explicit Congressional approval. Also, taxes serve this purpose. As the economy slides into recession, incomes fall and so do tax payments. Taxes, Spending, Debt & Deficits • A change in taxes should affect AD & AS Is the effect on AS larger? • The Laffer Curve and tax collection. Of course the purpose isn’t to maximize tax revenues! • If G is financed by borrowing, how will we react? Ricardian equivalence - do we plan on a future tax burden? The “crowding out” issue. • Should budget be set to balance at full employment? Keynes – No! Balance over the business cycle. Buchanan – Politicians will never do that! “Structural deficit” – what remains at full employment. 2014:Q4 102.5% 2014:Q4 $18.1 t 2014 2.78% 2014 $485 b 2014:Q4 $3.9 t. CBO; By 2038 %GDP: Fed’l spending 26% Fed’l revenue 19.5% Interest on debt 5% 2014:Q4 $420.5 b. Macro Theory: The AS/AD Model Part 1 – The Basics Part 2 – The Keynesian View Dr. D. Foster – ECO 285 – Macroeconomics