* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Unit_2_Notes

Survey

Document related concepts

Transcript

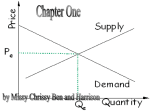

Unit 2: Microeconomics Microeconomics: Is the area of economics that deals with behavior and decision making by small units, such as individuals and firms. Circular Flow Model—illustrates the flow of economic activity between households and firms. See figure 1.3, pg. 15. Market: is a location or mechanism that allows buyers and sellers to exchange goods and services. Markets can be local, regional, national, or global in scope. There are 2 types. Product Market: A market where firms sell their goods and services to consumers. Firms supply goods and services while households demand goods and services. Factor Market: A market where resources are bought and sold. Households supply their resources and firms demand resources. When households sell/supply their resources to firms they receive income in return. Land-- rental income Labor—Wages or salary income Capital—interest income Entrepreneur—Profit income Barter: A moneyless economy that relies on trading goods for goods or goods for services. 3 Functions of money Medium of Exchange: Something accepted by all parties as payment for goods/services. Measure of Value: A common denominator that can be used to express worth in terms that most people can understand. Store of Value: Allows purchasing power to be saved until needed. Commodity Money: Money that has an alternative use as an economic good, or commodity. Fiat Money: Money by government decree. Specie: Money in the form of coins made from silver or gold. Characteristics of Money 1. Portable 2. Durable 3. Divisible 4. Limited in supply Consumers represent the demand side of the market. They purchase goods and services to satisfy their economic wants. Demand: Is the desire and ability of consumers to buy a good or service. Desire without ability does not constitute demand. Porshe—I lack the ability, not the desire McDonald’s value meal—I lack the desire, not the ability Demand Schedule: Is a table or schedule that shows the various quantities demanded by consumers of a particular product at all prices that might prevail in the market at a given time. Figure 4.1, pg. 90. Demand Curve: Is the graphical representation of the demand schedule. As you look at the demand schedule, notice how price and quantity demanded are related to each other. Law of Demand: States that the quantity demanded of a good/service varies inversely with its price. Inversely means opposite. When price goes up, Quantity goes down. When price goes down, quantity goes up. This should be common sense to all consumers. Market Demand Curve: Represents all consumers in the market. Figure 4.2, pg. 92. Change in Quantity Demanded: This is a movement along the demand curve and shows a change in the quantity purchased in response to a change in price. Figure 4.3, pg. 96. This is simply a restatement of the law of demand. Change in Demand: Occurs when people are now willing to buy different amounts of the product at the same prices as before. Figure 4.4, pg. 98. This is shown as a shift in the curve, not a movement along the curve. Increase in demand—rightward shift Decrease in demand—leftward shift There are 6 factors that can cause the demand curve to shift. They include: Consumer Income: An increase in income allows consumers to buy more of most goods/services so the curve shifts right. A decrease in income would cause a decrease in demand and therefore a leftward shift of the curve. Tastes & Preferences: This reflects our likes and dislikes. Advertising, news reports, fashion trends, seasonal changes, and others can affect our tastes. Substitutes: Are products that can be used in place of other products. When the price of one good goes up, the demand for the substitute will also go up. Butter and Margarine Oil and Natural Gas Coffee and Tea Coke and Pepsi Complements: Are products that are used together. When the price of one good goes up, the demand for the complement will go down. Cameras and film Milk and cereal Pc’s and software P&J Change in expectations: Demand may change because of the expectation of some future event. If I expect prices to rise in a few weeks, I might buy more now. If I think I might lose my job soon, I’ll begin to spend less now. Number of Consumers: More buyers in the market will lead to an increase in demand. Fewer buyers will lead to a decrease in demand. Demand Elasticity: The extent to which a change in price causes a change in the quantity demanded. Elasticity = Responsiveness. In essence, we want to know how much the quantity changes in response to a change in price. 3 Ranges of Elasticity 1. Elastic Demand: When a given change in price causes a relatively larger change in the quantity demanded. Figure 4.5, pg. 103. 2. Inelastic Demand: When a given change in price causes a relatively smaller change in the quantity demanded. 3. Unit Elastic: When a given change in price causes a proportional change in the quantity demanded. Determinants of Demand Elasticity—Figure 4.6, pg. 106 1. Can the purchase be delayed? Yes-- elastic No-- inelastic 2. Are adequate substitutes available? Yes-- elastic No-- inelastic 3. Does the purchase use a large portion of income? Yes-- elastic No-- inelastic The other side of demand is supply. This represents producers or firms that use resources to make goods and services. Producers attempt to maximize profits by selling what consumers want and by producing as efficiently as possible. Supply: Is the amount of a product that firms are willing to offer for sale at all possible prices that might prevail in the market. Supply Schedule: A table or schedule that shows the various quantities supplied of a product at all prices that might prevail in the market at a given time. Figure 5.1, pg. 114. Supply Curve: The graphical representation of the supply schedule. As you look at the supply schedule notice how price and quantity supplied are related to each other. Law of Supply: States that the price and the quantity supplied are directly related to each other. Direct means both variables move together. As price increases, so does quantity supplied. As price decreases, so does quantity supplied. The resulting supply curve is upsloping. The reason is that it is assumed that costs increase as output increases. Market Supply Curve: Represents all producers in the market. Figure 5.2, pg. 115. Change in Quantity Supplied: Is a movement along the supply curve showing a change in the quantity of product supplied in response to a change in price. This is simply a restatement of the law of supply. Change in Supply: When firms are now willing to offer different amounts of the product for sale at the same prices as before. Figure 5.3, pg. 117. This is shown as a shift in the curve, not a movement along the curve. Increase in Supply-- rightward shift Decrease in Supply-- leftward shift There are 7 factors that can cause the supply curve to shift. They include: Cost of inputs/resources: When the firm pays less for its land, labor, or raw materials, it is willing to supply more now. The reason is that the firm is making more profits as their costs fall. If the cost of resources increases, the firm will supply less. Productivity: When workers are more efficient they can produce more. The result is that costs fall, so firms are willing to supply more than before. When workers are not as productive, costs rise and the firm is not as willing to supply. Technology: The introduction of a new machine or process will lower the firm’s costs and will result in an increase in supply. Think about flat screen tv’s and computers. What has happened to their costs over the last several years? Taxes: Firms view taxes as an increase in their costs and therefore supply will fall. Taxes will always shift the supply curve to the left. Subsidies: Are the opposite of a tax. In this case the government gives money to firms to encourage or protect a certain type of economic activity. Subsidies lower costs and increase supply. Government Regulations: When the government regulates a firm’s product, costs rise and supply falls. Ask yourself how much more expensive it is to comply with federal standards on exhaust emissions on cars. More regulation means less supply. Less regulation means more supply. Number of Sellers: More firm’s leads to more supply, fewer firm’s leads to less supply. Supply Elasticity: The extent to which a change in price causes a change in the quantity supplied. Elasticity = Responsiveness. In essence, we want to know how much the quantity changes in response to a change in price. Figure 5.4, pg. 119. 3 ranges of elasticity 1. Elastic Supply: When a given change in price causes a relatively larger change in quantity supplied. 2. Inelastic Supply: When a given change in price causes a relatively smaller change in quantity supplied. 3. Unit Elastic Supply: When a given change in price causes a proportional change in quantity supplied. Price is the monetary value of a product/service and is established by supply and demand. Prices act as signals that help us make our economic decisions. Prices communicate information and provide incentives to buyers and sellers. Ex. High price: Firm produces more Buyer buys less Low price: Firm produces less Buyer buys more How would society allocate goods/services and resources without a system of prices? One possible method could be rationing. Rationing: Is a system under which an agency such as government decides everyone’s fair share. Problems with rationing include: Fairness Administration costs Diminished incentives Rebate: A partial refund of the original price of the product. We now want to bring supply and demand together to determine how prices are established in a market economy. It is a process of trial and error. Market Equilibrium: Is a situation in which prices are relatively stable and the quantity supplied is equal to the quantity demanded. Figure 6.1, pg. 143, and Figure 6.2, pg. 145. Surplus: When the quantity supplied is greater than the quantity demanded at a given price. The result of the surplus is that price will fall. (Qs > Qd ) Shortage: When the quantity demanded is greater than the quantity supplied at a given price. The result of the shortage is that price will rise. ( Qd > Qs ) Equilibrium Price: The price that clears the market by leaving neither a surplus nor a shortage. (Qs = Qd) Sometimes society may have to sacrifice some efficiency and freedom in order to achieve greater equity and security. Think back to the economic and social goals in unit 1. Sometimes 2 goals may conflict with each other. One common way to achieve more equity or security for a certain group of people is for the government to set prices at the socially desirable level. When this happens, prices are not allowed to adjust to reach equilibrium. Price Ceiling: The maximum legal price that can be charged for a product. Figure 6.5, pg. 151. Ex. Rent control on apartments creates a permanent shortage of 800,000 apartments. Price Floor: The lowest legal price that can be charged for a product. Figure 6.5, pg. 151. Ex. Minimum wage for labor creates a permanent surplus of workers of 14 million workers. Another example is farm products like wheat or corn. Legal Forms of Business—figure 3.1, pg. 58 1. Sole Proprietorship: A business owned and run by one person. This is the most common form of business numerically. 2. Partnership: A business jointly owned by 2 or more people. The 2 types are. a. General—all partners are responsible for the management and financial obligations of the business. b. Limited—At least 1 partner is not active in the daily operation of the business although they may have contributed funds to finance the operation. 3. Corporation: Is recognized by law as a separate legal entity having all the rights of an individual. Charter: Government document giving permission to create a corporation. Stock: Ownership certificates in a corporation. Stockholders: Investors who buy shares of stock in a corporation. Dividend: A check representing a portion of the corporations profits payed back to the stockholders. To compare the advantages and disadvantages of each form of business, look at pgs. 58 to 65. Profit Motive: This is the driving force that encourages people and organizations to improve their material well-being. Entrepreneurs start businesses to make the greatest amount of profit possible. Total revenue > Total cost = Profits Total revenue < Total cost = Losses Total revenue = Total cost = Breakeven Market Structure: Represents the nature and degree of competition among firms operating in the same industry. An industry represents all firms in the same market like airlines, or cars. We will examine 4 types of market structures by looking at various characteristics. See figure 7.2, pg. 169 for a summary. 1. Perfect Competition—Most competitive, 100’s to 1000’s of firms Large numbers of buyers and sellers who have no control over price. Buyers and sellers deal in an identical product, standardized. Buyers and sellers act independently. Buyers and sellers are reasonably well informed about products and prices. Buyers and sellers are free to enter or leave the market when they choose. Figure 7.1, pg. 165 shows what output firms will produce. 2. Monopolistic Competition—Next most competitive, 20 to 70 firms Has all the conditions of perfect competition except for identical products. These firms have a little bit of control over price. Product Differentiation: The real or imagined differences between competing products in the same industry. Ex. Store location store design Manner of payment delivery Packaging service Non-price competition: The use of advertising, giveaways, or other promotional campaigns to convince buyers that the product is somehow better than another brand. 3. Oligopoly—3rd most competitive, 3 to 12 firms. Few firms. Product can be identical or different. Firms tend to act together. Entry is difficult. Interdependent behavior: Whenever one firm acts it must consider how the other firms will respond. Ex. Raise price—ignore Lower price—lower Collusion: A formal agreement to set prices or behave in a cooperative manner to increase profits. This is illegal in the United States. Price-fixing: Agreeing to charge the same or similar price for a product. 4. Monopoly—Least competitive, 1 firm. Single seller of a good or service. Monopoly tends to be rare in the U.S. 4 Types of Monopoly 1. Natural Monopoly: When the costs of production are minimized by having a single firm produce the good. This is called economies of scale. 2. Geographic Monopoly: A single firm by virtue of its location such as a country store. 3. Technological Monopoly: A monopoly based on the ownership or control of a manufacturing method, process, or other scientific advance such as a patent or copyright. 4. Government Monopoly: A monopoly that the government owns and runs like the postal service, the city water company, or the TVA. Sometimes markets fail because of inadequate competition, inadequate information, resource immobility, externalities, and public goods. We will focus on 2 types of market failures. Externalities: A cost or benefit that accrues to a 3rd party not involved in the transaction. Look at the photo on page 175. Negative—Noise, air, or water pollution. Positive—Education, or immunizations. Public Goods: Goods or services that are collectively consumed by everyone, and whose use by 1 person does not diminish the satisfaction or value available to others. Public goods are non-rival and non-excludable. Examples include; Ex. National defense Police Lighthouses Flood control programs Firemen Parks