* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Macroeconomics

Virtual economy wikipedia , lookup

Production for use wikipedia , lookup

Real bills doctrine wikipedia , lookup

Nominal rigidity wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Phillips curve wikipedia , lookup

Business cycle wikipedia , lookup

Helicopter money wikipedia , lookup

Gross domestic product wikipedia , lookup

Monetary policy wikipedia , lookup

Interest rate wikipedia , lookup

Stagflation wikipedia , lookup

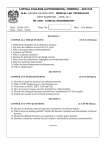

Macroeconomics Mid-Term Examination 23rd November 2006 Time Allowed: 1 hour 30 minutes Answer ALL THREE questions. Question 1 (20 Marks) Discuss TWO of the following; a) The Marginal Propensity to Consume b) Open Market Operations c) The Money Multiplier d) Nominal and Real GDP e) Paradox of thrift (saving) Question 2 (40 Marks) Suppose that you are provided with the following information Prices € Butter Cars Oil Quantities Butter 2003 1.0 500 100 2003 500 2004 1.0 550 150 2004 500 2005 1.2 570 160 2005 480 Cars 300 350 400 Oil 700 750 770 a) Assuming that the economy produces these three and only these three goods, calculate nominal GDP for all three years and real GDP with base year 2003 . (12 Marks) b) Calculate the inflation rate for 2004 and 2005 using the GDP deflator. (8 Marks) c) Suppose a Consumer Price Index (CPI) is constructed using weights corresponding to quantities produced in 2003, what is the rate of inflation in 2004 and 2005 as measured by the CPI index? (10 Marks) d) Suppose now that oil is exported. How do the answers to parts b and c change? Calculate the relevant changes. (10 Marks) (Please turn over) Question 3 (40 marks) Consider the following numerical version of the IS-LM model: C = 800 + 0.7YD I = 500 – 2000i + 0.1Y G = 500 T = 500 Real money demand (M/P)d = 0.2Y – 4000i Real money supply (M/P)s = 400 a) Find the equation for the IS curve. (5 Marks) b) Find the equation for the LM curve. (5 Marks) c) Solve for equilibrium real output (Y), disposable income (YD) the equilibrium interest rate (i), consumption (C), investment (I) and private saving (S). (5 Marks) d) Verify that production equals demand and that total savings equals investment. (5Marks) e) Suppose that government spending increases to 800. Solve again for Y, i, C and I, and once again verify that production equals demand. Summarise and explain using words and diagrams the effects of this expansionary fiscal policy on Y, i, C and I. (10 Marks) f) Setting all variable back to their original levels, suppose now that the money supply increases to 900. Solve again for Y, i, C and I, and verify that production equals demand. Summarise and explain using words and diagrams the effects of this expansionary monetary policy on Y, i, C and I. (10 Marks)