* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Public goods

Economics of digitization wikipedia , lookup

Steady-state economy wikipedia , lookup

History of economic thought wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

Rebound effect (conservation) wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Laffer curve wikipedia , lookup

Chicago school of economics wikipedia , lookup

History of macroeconomic thought wikipedia , lookup

Development economics wikipedia , lookup

Supply-side economics wikipedia , lookup

Ancient economic thought wikipedia , lookup

Microeconomics wikipedia , lookup

Economic policy of the George W. Bush administration wikipedia , lookup

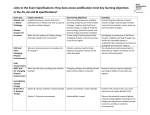

Policy Making as “Rational Choice” Assumptions: 1. Rational D-M process increases probability of obtaining desired result 2. D-M judged by process not outcomes 1.Problem recognition and definition 2. Goal selection 3. Identification of alternatives 4. Choice • Cost-benefit calculations – “values” • Risk * Harm calculations - Katrina/Cal – levees • Unintended v. undesired v. unanticipated consequences • Crisis D-M = catastrophic event, compressed time for D, imperfect information. CBA: To WAR! or not TO WAR! (That is the Question) Costs • Lives • $ • Opportunity Cost • Blowback Benefits •Access to oil •WMD •Dictator •Spread Democracy If C>B then don’t do, If C<B then do When is action/response demanded? Risk * Harm/Probability* Impact Sorenson’s Eight Steps 1. Agree on the facts 2. Agree on the policy objective 3. Precisely define problems 4. Consider all possible solutions 5. List possible consequences of all solutions 6. Recommend one option 7. Communicate the selected option 8. Provide for the execution of the option (9. Bundenthal Addendum: Feedback and adaptation) Impediments to Rational Choice • Bounded rationality – Simon: constraints on objective rationality • Satisficing – 1st option that meets minimally acceptable stds • Cognitive dissonance – Rejecting information that conflicts with pre-existing strongly held beliefs. • Prospect theory – Levy: tendency toward valuing “bird in hand.” “sunk-cost fallacy” = cling to failed policies to minimize fallout. • Muddling through – Lindblom: “incrementalism” trial and error DM • Janis: “Grouthink” Janis: Groupthink • • • • Groupthink = fear of saying the “King has no clothes.” Janis divided the pressures into three groups: Type I - overestimation of the power and morality of the group. Ironically, this can lead to ignoring the ethical or moral consequences of decisions. It manifests itself in vilification of the enemy and couching the conflict only as a battle between good and evil. Type II is closed mindedness. This includes stereotyped views of enemy leaders as too evil to warrant genuine attempts to negotiate, or as too weak to counter whatever risky attempts are made to defeat the groups' purposes. The result is known as a "risky shift" to more dangerous policies. Type III -Pressures toward uniformity, including direct pressure on those who express arguments against the group’s consensus, and the emergence of "mindguards" who protect what information is disseminated in and to the group. Public goods (finiteness) • In economics, a public good is a product or service • A “public good” is a product or service which benefits everyone in the community but often is not feasible or efficient to provide without the effort of the community (or some aggregation of interests above the individual – ie, a “group”). – The number and critical nature of PGs has increased due to modernization and complex interdependence. Roads, Defense, Schools, Air, Water, Health are all PGs – Is non-rejectable, non-rivalrous, and non-excludable. • Non-rivalrous means that the consumption of the good by one individual does not reduce the amount of the good available for consumption by others.[1] For example, if one individual eats a cake, there is no cake left for anyone else; but breathing air does not significantly reduce the amount of air available to others. • The term public good is often used to refer to goods that are non-excludable as well. This means it is not possible to exclude individuals from the good's consumption. Fresh air may be considered a public good as it is not generally possible to prevent people from breathing it. • Non-rejectable – cannot refuse the impact/effect • Paul Samuelson • Mancur Olsen The Logic of Collective Action: Public Goods and the Theor , he theorized that “only a separate and ‘selective’ incentive will stimulate a rational individual in a latent group to act in a group-oriented way”; that is, only a benefit reserved strictly for group members will motivate one to join and contribute to the group. This means that individuals will act collectively to provide private goods, (BECAUSE they are rivalrous and excludable) but not to provide public goods. • THUS, public goods are often underprovided Externality • Is a cost or benefit from an economic transaction that parties "external" to the transaction receive. Externalities can be either positive, when an external benefit is generated, or negative, when an external cost is imposed upon others. It is a form of side effect though not necessarily an unintended consequence. • Every decision made by a decision maker (economic agent) will not only have an impact on the decision maker himself but will also have an impact(s) on the other members of the society which are known as externalities. • An externality occurs when a decision causes costs or benefits to third parties (stakeholders), often, though not necessarily, from the use of a public good (for example, production which causes pollution may impose costs on others, making use of the public good air). In other words, the participants do not bear all of the costs or reap all of the gains from the transaction. As a result, in a competitive market too much or too little of the good may be produced and consumed from the point of view of society, depending on incentives at the margin and strategic behavior. Free rider problem • Are actors who consume more than their fair share of a resource, or shoulder less than a fair share of the costs of its production. • A common example of a free rider problem is defense spending: no person can be excluded from being defended by a state's military forces, and thus free riders may refuse or avoid paying for being defended, even though they are still as well guarded as those who contribute to the state's efforts. Therefore, it is usual for the government to avoid relying on volunteer donations, using taxes and conscription instead. • Socialized Risk/Privatized Profit • “The owners, employees and creditors of these institutions are rewarded when they succeed, but it is all of us, the taxpayers, who are left on the hook if they fail. This is called private profits and socialized risk. Heads, I win. Tails you lose. It is a reverse-Robin Hood system.” David Einhorn Greenlight Capital • Apple locating in Reno, although HQ in Cupertino, ERs for HC Government as Promoter of Economic Interests 1. Theoretical Background 2. Policy Approaches 3. Environmental Issues 4. Globalization Conflicting Goals? • Promoting Business • Promoting Labor • Promoting Agriculture GDP = C + I + G + (X - M) • Where: C = household consumption expenditures / personal consumption expenditures I = gross private domestic investment G = government consumption and gross investment expenditures X = gross exports of goods and services M = gross imports of goods and services • Note: (X - M) is often written as XN, which stands for "net exports" Adam Smith One of the main points of The Wealth of Nations is that the free market, while appearing chaotic and unrestrained, is actually guided to produce the right amount and variety of goods by a so-called "invisible hand". If a product shortage occurs, for instance, its price rises, creating incentive for its production, and eventually curing the shortage. The increased competition among manufacturers and increased supply would also lower the price of the product to its production cost, the "natural price". Smith believed that while human motives are often selfish and greedy, the competition in the free market would tend to benefit society as a whole anyway. Nevertheless, he was wary of businessmen and argued against the formation of monopolies. • Smith vigorously attacked the antiquated government restrictions which he thought were hindering industrial expansion. In fact, he attacked most forms of government interference in the economic process, including tariffs, arguing that this creates inefficiency and high prices in the long run. This theory, now referred to as "laissez-faire", influenced government legislation in later years, especially during the 19th century. However, Smith criticized a number of practices that later became associated with laissez-faire capitalism, such as the power and influence of Big Business and the emphasis on capital at the expense of labor. • Caveat Emptor – buyer beware • Sympathy v. Self Interest - Theory of Moral Sentiments • THE TRUTH IS: THERE IS NO FREE MARKET UNLESS THERE IS GOVERNMENT REGULATION OF THE MARKET. • Without government regulation, “Caveat Emptor” means people die. Karl Marx • Das Kapital 1867 – Marx argued that a free market system is exploitative because producers, through their control of markets, can compel workers to labor at a wage below the value they add to production and can force consumers to pay higher prices for goods than are justified by the cost of production. • Not an advocate of authoritarian/command economy • History/economics is defined by struggle between classes over power David Ricardo – Iron Law • In economics, the subsistence theory of wages states that wages in the long run will tend to the minimum value needed to keep workers alive. The justification for the theory is that when wages are higher, more workers will be produced, and when wages are lower, some workers will die, in each case bringing supply back to a subsistence-level equilibrium. • The subsistence theory of wages is generally attributed to David Ricardo, and plays a large role in Marxist economics. Most modern economists dismiss the theory, arguing instead that wages in a market economy are determined by marginal productivity. (but flat wages in US since 1980 are because wages have NOT increased with Productivity.) • (Abortion, birth control, immigration) • • • • • American CEOs saw their pay spike 15 percent last year, after a 28 percent pay rise the year before, according to a report by GMI Ratings cited by The Guardian. Meanwhile, workers saw their inflation-adjusted wages fall 2 percent in 2011, according to the Labor Department. That's in line with a trend that dates back three decades. CEO pay spiked 725 percent between 1978 and 2011, while worker pay rose just 5.7 percent, according to a study by the Economic Policy Institute released on Wednesday. That means CEO pay grew 127 times faster than worker pay. Income inequality between CEOs and workers has consequently exploded, with CEOs last year earning 209.4 times more than workers, compared to just 26.5 times more in 1978 -- meaning CEOs are taking home a larger percentage of company gains. That trend comes despite workers nearly doubling their productivity during the same time period, when compensation barely rose. Worker productivity spiked 93 percent between 1978 and 2011 on a per-hour basis, and 85 percent on a per-person basis, according to the Federal Reserve Bank of St. Louis. Meanwhile, workers saw their inflation-adjusted wages fall in recent years as corporations postponed giving raises while adding to their record corporate profits. John Maynard Keynes • (pronounced Kayns) (June 5, 1883 – April 21, 1946) • An English economist whose radical ideas had a major impact on modern economic and political theory as well as on Franklin D. Roosevelt's New Deal. He is particularly remembered for advocating interventionist government policy, by which the government would use fiscal and monetary measures to aim to mitigate the adverse effects of economic recessions, depressions and booms. He is considered by many to be the founder of modern macroeconomics. Keynes (often contrasted to Friedman or Hayek) • Keynes's theory suggested that active government policy could be effective in managing the economy. Rather than seeing unbalanced government budgets as wrong, Keynes advocated what has been called counter-cyclical fiscal policies, that is policies which acted against the tide of the business cycle: deficit spending when a nation's economy suffers from recession or when recovery is long-delayed and unemployment is persistently high -- and the suppression of inflation in boom times by either increasing taxes or cutting back on government outlays. He argued that governments should solve short-term problems rather than waiting for market forces to do it, because "in the long run, we are all dead." (when your house is on fire, you have to worry about paying the firemen later) Galbraith • In his most famous work, The Affluent Society (1958), which became a bestseller, Galbraith outlined how post-World War II America was becoming wealthy in the private sector but remained poor in the public sector, lacking social and physical infrastructure, and perpetuating income disparities. • Galbraith also critiqued the assumption that continually increasing material production is a sign of economic and societal health. Because of this Galbraith is sometimes considered one of the first post-materialists. In this book, he coined the phrase "conventional wisdom." USA annual real GDP from 1910–60, with the years of the Great Depression (1929–1939) highlighted Unemployment rate in the US 1910–1960, with the years of the Great Depression (1929–1939) highlighted. What is Gov’t supposed to do? Control Inflation and Unemployment • Inflation – a general rise in the Price of goods and services • “Too much money chasing too few goods” • 2-3%? 5%? • State control of money supply: Fiscal – G tax and expenditures Monetary – money supply, % rates, discount rate, reserve requirement • Hyperinflation • The “Fed” Alan Greenspan, Ben Bernanke Janet Yellen? Employment • • • • • • • Definitions? Had job, seeking job Natural rate: 5-6%? 10%? What is role of state? Connect back to Maslow Transitions in global economy Agricultural industrial service Outsourcing, ISI, WTO ???? Phillips Curve • A supposed inverse relationship between inflation and unemployment. The British economist A.W. Phillips observed an inverse relationship between inflation and unemployment in the British economy in the century up to 1958 -- when inflation was high, unemployment was low, and viceversa. As seen to the right, when drawn on a graph with the inflation rate on the vertical axis and the unemployment rate on the horizontal axis, the relationship between the variables showed a downward sloping curve, the Phillips curve (PC). Supply-side economics • • • • (Friedman, Hayek, Chicago School) A school of macroeconomic thought which emphasizes the importance of tax cuts and business incentives in encouraging economic growth, in the belief that businesses and individuals will use their tax savings to create new businesses and expand old businesses, which in turn will increase productivity, employment, and general well-being. While all macroeconomics involves both supply and demand, supply-side economics emphasizes the importance of encouraging increases in supply. Reaganomics - - Voodoo Economics (Pres. Bush) Trickle down v. Rising tide Supply-side economics • Principally a response to perceived failings of Keynesian ideas that had steadily risen to dominance following the Great Depression. In particular, the point of disagreement was the question of the stagflation of the 1970s, and the failure of Keynesian policies to produce growth without inflation, and the failure to provide a clear solution for the series of recessions which occurred in the wake of the oil crisis in 1973. • Effect of Wars? Government as Regulator of the Economy – Which Value do we want? • Efficiency Through Government Intervention • Equity Through Government Intervention Fiscal Policy: What Congress/Pres do Monetary Policy: What the “FED” does Managing distribution to address inequality: Is this a task of government? • Regressive v. Progressive tax Pro= as income increases, % tax increases Reg= as income increases, % tax decreases or same amount/% regardless of income • People in US end up paying about equal to the difference in wealth. IE, someone who makes 250k pays about 5* someone who makes 50k • Almost 50% end up not paying income tax ( AGI/ CGI < 33k) • equality of outcomes v. equality of results? 2010 income brackets and tax rates Marginal Tax Rate[5] 10% 15% 25% 28% 33% 35% Single $0 – $8,375 $8,376 – $34,000 $34,001 – $82,400 $82,401 – $171,850 $171,851 – $373,650 $373,651+ Married Filing Jointly or Married Filing Head of Qualified Widow(er) Separately Household $0 – $0 – $16,750 $0 – $8,375 $11,950 $8,376 – $11,951 – $16,751 – $68,000 $34,000 $45,550 $34,001 – $45,551 – $68,001 – $137,300 $68,650 $117,650 $117,651 $68,651 – – $137,301 – $209,250 $104,625 $190,550 $209,251 – $373,650 $373,651+ $104,626 – $190,551 $186,825 $373,650 $186,826+ $373,651+ Historical marginal income tax rates for Married Filing Jointly at stated income levels.[3] Year 1930 1932 1934 1936 1938 1940 1942 1944 1946 1948 1950 1952 1954 1956 1958 1960 1962 1964 1966 - 1976 1980 $10,001 6% 10% 11% 11% 11% 14% 38% 41% 38% 38% 38% 42% 38% 26% 26% 26% 26% 23% 22% 18% $20,001 10% 16% 19% 19% 19% 28% 55% 59% 56% 56% 56% 62% 56% 38% 38% 38% 38% 34% 32% 24% $60,001 21% 36% 37% 39% 39% 51% 75% 81% 78% 78% 78% 80% 78% 62% 62% 62% 62% 56% 53% 54% $100,001 25% 56% 56% 62% 62% 62% 85% 92% 89% 89% 89% 90% 89% 75% 75% 75% 75% 66% 62% 59% $250,001 25% 58% 58% 68% 68% 68% 88% 94% 91% 91% 91% 92% 91% 89% 89% 89% 89% 76% 70% 70% 47% • The Laffer curve is used to illustrate the concept of Taxable income elasticity, the idea that government can maximize tax revenue by setting tax rates at an optimum point. The curve was popularized by Arthur Laffer though it had been widely postulated by economists. Bush tax cuts • The tax cuts have been largely opposed by American economists, including the Bush administration's own Economic Advisement Council. [10] In 2003, 450 economists, including ten Nobel Prize laureates, signed the Economists' statement opposing the Bush tax cuts, sent to President Bush stating that "these tax cuts will worsen the long-term budget outlook... will reduce the capacity of the government to finance Social Security and Medicare benefits as well as investments in schools, health, infrastructure, and basic research... [and] generate further inequalities in after-tax income." [11] • …there is a broad consensus among even conservative economists (including current and former top economists of the Bush Administration such as Greg Mankiw) that the tax cuts have had a substantial net negative impact on revenues (i.e., revenues would have been substantially higher if the tax cuts had not taken place), even taking into account any stimulative effect the tax cuts may have had and any resulting revenue feedback effects. [13] • The Tax Policy Center reported that the various tax cuts under the Bush administration were "extraordinarily expensive" to the Treasury:[30] • The congressional Joint Committee on Taxation calculated a score, or revenue change, for each of the seven major tax cut bills passed during the Bush administration: their combined cost sums to over $2.0 trillion from 2001-17. Extending these tax cuts into the future would carry a similar cost: the Congressional Budget Office (CBO) recently estimated the cost of extending them through 2017 at $1.9 trillion, not counting the costs of debt service, and not counting the cost of indexing the alternative minimum tax (AMT) to inflation to prevent it from undoing much of the cuts...if one takes into account the direct effects of the tax cuts, extra interest payments, and the extra "interaction" cost of reforming the AMT while extending the Bush tax cuts, the combined cost of extending the tax cuts through 2017 adds up to $2.8 trillion. • Medicare Plan D= ? • GWOT = 3 + Trillion The velocity of money is the average frequency with which a unit of money is spent in a specific period of time. If, for example, in a very small economy, a farmer and a mechanic, with just $50 between them, buy goods and services from each other in just three transactions over the course of a year: Farmer spends $50 on tractor repair from mechanic. Mechanic buys $40 of corn from farmer. Mechanic spends $10 on barn cats from farmer -then $100 changed hands in course of a year, even though there is only $50 in this little economy. That $100 level is possible because each dollar was spent an average of twice a year, which is to say that the velocity was 2 / yr. Globalization and the Environment Important Concepts • Scarcity and Excess • Carrying capacity: the maximum biomass that can be sustained by a given territory • Tragedy of the Commons – William Foster Lloyd – Garrett Hardin – rationally self-interested behavior may have a destructive collective impact – overgrazing of animals on the village green – applies to human behavior and ecological systems Ecopolitics • Politics of scarcity: scarce resources can undermine security and lead to military conflict • Environmental security: environmental threats can be as important as military threats • Sustainable development: economic growth that does not deplete the resources needed to maintain growth Population Growth • Annual population growth rate: – 2.2% (maximum) in 1964 – currently 1.3% • >7 billion people • ZPG • • Growth highest in Global South – 95% of total growth – often unable to deal with social, economic and environmental problems of larger population Demographic transition model: – high death and birth rates replaced by first by low death and later low birth rates – Europe and North America 1750-1930 – a part of modernization – however, Global South has high birth rates and low death rates, with minimal modernization The Rule of 70 The Rule of 70 is useful for financial as well as demographic analysis. It states that to find the doubling time of a quantity growing at a given annual percentage rate, divide the percentage number into 70 to obtain the approximate number of years required to double. For example, at a 10% annual growth rate, doubling time is 70 / 10 = 7 years. Similarly, to get the annual growth rate, divide 70 by the doubling time. For example, 70 / 14 years doubling time = 5, or a 5% annual growth rate. The following table shows some common doubling times: Growth Rate (% per Year) Doubling Time in Years 0.1 700 0.5 140 1 70 2 35 3 23 4 18 5 14 6 12 7 10 10 7 Malthusian Catastrophe • Essay on the Principle of Population: population growth would eventually outrun food supply. This prediction was based on the idea that population, if unchecked, increases at a geometric rate, whereas the food supply could only grow at an arithmetic rate. Mathematically, any increasing geometric sequence (e.g. 2,4,8,16) will eventually overtake all arithmetic sequences (e.g. 1,2,3,4). The resulting decrease in food per person will eventually lead to subsistence-level conditions. According to Malthus, the catastrophe can only be prevented by self-restraint or vice—which for him included contraception and abortion. • For every person saved today (from starvation, disease, war, etc. – earth’s natural controlling mechanisms) X people will die in the future. 5 times? 10 times? Ecopolitics of Energy • United States has highest per capita oil use • Kyoto Accord – Established targets for signers’ reduction of greenhouse gas emissions – Bush refused to sign in 2001 – McCain supported it – Warsaw 2013? Battle between Rich and Poor nations • Organization of Petroleum Exporting Countries (OPEC) – – – cartel that sets production quotas/prices monopoly power high oil prices lower economic growth The Potential for Renewable Energy to Supply the World’s Energy Needs by the Year 2100 SOURCE: Adapted from Crump (1998), 193 (left) and 223 (right). Climate Change Muller • Greenhouse effect – science and stewardship • US = 4% of world pop, 25% of greenhouse gases. China = 75% from coal • World temp. to rise 3.6 degrees C by 2100 (unless action is taken?) • Sea level: 3-foot rise • Increases in severe weather • Shifts in rainfall patterns and regional climate • Destruction of entire ecosystems IPCC 4th Report • • Working Group I dealt with the "Physical Science Basis of Climate Change." The Working Group I Summary for Policymakers (SPM) was published on 2 February 2007[7] and revised on 5 February 2007[8]. There was also a 2 February 2007 press release[9]. The full WGI report[10] was published in March. The key conclusions of the SPM were that [11]: Warming of the climate system is unequivocal. • Most of (>50% of) the observed increase in globally averaged temperatures since the mid-20th century is very likely (confidence level >90%) due to the observed increase in anthropogenic (human) greenhouse gas concentrations. • Hotter temperatures and rises in sea level "would continue for centuries" no matter how much humans control their pollution [12], although the likely amount of temperature and sea level rise varies greatly depending on the fossil intensity of human activity during the next century (pages 13 and 18)[13]. • UPDATE: Confidence level now 95% IPCC 4th Report • • • • The probability that this is caused by natural climatic processes alone is less than 5%. World temperatures could rise by between 1.1 and 6.4°C (1.98 and 11.52°F) during the 21st century (table 3) and that: – Sea levels will probably rise by 18 to 59 cm (7.08 to 23.22 in) [table 3]. – There is a confidence level >90% that there will be more frequent warm spells, heat waves and heavy rainfall. – There is a confidence level >66% that there will be an increase in droughts, tropical cyclones and extreme high tides. Both past and future anthropogenic carbon dioxide emissions will continue to contribute to warming and sea level rise for more than a millennium. Global atmospheric concentrations of carbon dioxide, methane, and nitrous oxide have increased markedly as a result of human activities since 1750 and now far exceed pre-industrial values over the last 650,000 years Precautionary Principle • A phrase first used in English circa 1988, is the idea that if the consequences of an action are unknown, but are judged to have some potential for major or irreversible negative consequences, then it is better to avoid that action. The principle can alternately be applied in an active sense, through the concept of "preventative anticipation" [1], or a willingness to take action in advance of scientific proof of evidence of the need for the proposed action on the grounds that further delay will prove ultimately most costly to society and nature, and, in the longer term, selfish and unfair to future generations. In practice the principle is most often applied in the context of the impact of human civilization or new technology on the environment, as the environment is a complex system where the consequences of some kinds of actions are often unpredictable. Costs • What is the real/actual cost of things? – The true “cost” of a car? Etc… The actual costs of much of modern society are not paid on usage, instead being deferred to some point in the future We do not know what those actual costs are. We will eventually have to pay them. Are we trapped in an arrested adolescence where we refuse to consider the implications of our actions and take responsibility for them? Rising Average Global Temperatures at the Earth’s Surface since 1867 SOURCE: Vital Signs 2002, p. 51. Copyright © 2002 Worldwatch Institute. www.worldwatch.org Map 10.2 Global Warning about Global Warming SOURCE: From TIME, April 9, 2001, p. 30–31. Copyright © 2001 TIME, Inc. Reprinted by permission. Counter points? • • • Muller WSJ Chevron Himalaya • There are Scientists that contest the view that humanity's actions have played a significant role in increasing recent temperatures. However, uncertainties do exist regarding how much climate change should be expected in the future, and a hotly-contested political and public debate exists over what, if anything, should be done to reduce or reverse future warming, and how to cope with the consequences. The Role of Uncertainty The projected temperature increase for a range of stabilization scenarios (the colored bands). The black line in middle of the shaded area indicates 'best estimates'; the red and the blue lines the likely limits. From the work of Working Group III. Other Environmental Challenges • Acid precipitation • Ozone layer destruction – 1987 Montreal Protocol and CFCs • • • • • Deforestation Desertification Biodiversity loss Cost v. Benefit / Risk * Harm Collective Goods and Free Riders redux Origins and theory • The substance of the precautionary principle is not really new. The essence of the principle is captured in cautionary aphorisms such as 'An ounce of prevention is worth a pound of cure', 'Better safe than sorry', and 'Look before you leap'.[3] The precautionary principle may be interpreted as a generalization of the ancient medical principle, associated with Hippocrates, of "first, do no harm".[4] It may also be compared with the "beyond a reasonable doubt" standard of proof often used in criminal law, which may be seen as the application of the precautionary principle to the assumption of "innocent until proven guilty" (because society sees convicting the innocent as far worse than acquitting the guilty). Origins and theory – “Fram” • In economics, the precautionary principle has been analyzed in terms of the effect on rational decisionmaking of the interaction of irreversibility and uncertainty. Authors such as Epstein (1980) and Arrow and Fischer (1974) show that irreversibility of possible future consequences creates a quasi-option effect which should induce a risk-neutral society to favor current decisions that allow for more flexibility in the future. Gollier et al (2000) conclude that "more scientific uncertainty as to the distribution of a future risk — that is, a larger variability of beliefs — should induce Society to take stronger prevention measures today." You can pay me now or pay me later A penny saved… An ounce of prevention.. Mitigation of global warming • Mitigation of global warming involves taking actions aimed at reducing the extent or likelihood of global warming. • Adaptation to global warming involves taking action to take advantage of the positive effects of global warming while preventing or minimizing the negative effects of global warming. • The increasing scientific consensus on global warming, together with the precautionary principle and the fear of non-linear climate transitions [1] is leading to increasing action to mitigate global warming. • The European Union has set a target of limiting the global temperature rise to 2 °C compared to preindustrial levels, of which 0.8 °C has already taken place and another 0.5 °C is already committed. • The 2 °C rise is typically associated in climate models with a carbon dioxide concentration of 400-500 ppm by volume; the current level is 379 ppm by volume, and rising at 2 ppm annually. Hence, to avoid a very likely breach of the 2 °C target, CO2 levels would have to be stabilised very soon; this is generally regarded as unlikely, based on current programs in place to date. [2]. Mitigation • There are four categories of actions that can be taken to mitigate global warming: – – – – Reduction of energy use (conservation) Shifting from carbon-based fossil fuels to alternative energy sources Carbon capture and storage Carbon sequestration • Strategies for mitigation of global warming include development of new technologies, wind power, nuclear power, renewable energy, biodiesel, electric or hybrid automobiles, fuel cells, and energy conservation, carbon taxes and carbon sequestration schemes. Globalization • “the increasingly close international integration of markets both for goods and services and for capital” --IMF • makes state boundaries less important • global dissemination of Western culture • increased interdependence • global village: rapid communication • provokes strong reactions pro and con The Next Milieu Rosenau and Etzioni