* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

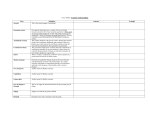

Download Has India emerged? Business cycle stylized facts from a

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Nouriel Roubini wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

Transition economy wikipedia , lookup

Fear of floating wikipedia , lookup

Chinese economic reform wikipedia , lookup

Transformation in economics wikipedia , lookup