* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Lecture 6: Balance of Payments and Exchange Rates

Currency War of 2009–11 wikipedia , lookup

Currency war wikipedia , lookup

Real bills doctrine wikipedia , lookup

Monetary policy wikipedia , lookup

Global financial system wikipedia , lookup

Pensions crisis wikipedia , lookup

Balance of trade wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Okishio's theorem wikipedia , lookup

Interest rate wikipedia , lookup

Balance of payments wikipedia , lookup

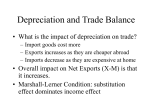

Lecture 6 Balance of Payments Accounting and Exchange Rates The National Income Accounts The Gross National Product (GNP) of a country is the value of all the final goods and services produced by its factors of production and sold on the market in a given time period. A country’s GNP equals its National Income which is the income earned in the same period by its factors of production. For calculating GNP it does not matter where the country’s factors of production are located: if a US company builds a plant in Ireland, the investment income from the plant is a part of US GNP but of Irish GDP. The Gross Domestic Product (GDP) of a country is the total volume of output produced within the country’s borders. Consequently: GNP = GDP + net receipts of factor income from abroad Note that Ireland’s GNP is considerably less than its GDP. National Income Identity in an Open Economy The basic National Income (NI) accounting identity for an open economy is: C + I +G+ X −M =Y (1) CA = X − M is defined as the current account balance: surplus (CA>0) or deficit (CA<0), and if Y − (C + G ) represents national savings, then: S − I = X − M = CA (2) Equation (2) says that if national savings exceed domestic investment, then the country’s balance of trade will be in surplus or, equivalently, it will be a net foreign lender. On the other hand, if national savings are not enough for domestic investment, then the country’s balance of trade will be in deficit or, equivalently, it will be a net foreign borrower. Private versus Public Saving Private Saving and public saving, denoted SP and SG, respectively, are defined as: S P = Y − T − C and S G = T − G ⇒ S P + S G = S In the light of equation (3), equation (2) can be rewritten as: S P = CA + I − S G Equation (4) shows that private saving can take three forms: 1. Lending to foreigners, through balance of trade surplus 2. Lending to domestic investors, through funding investment 3. Lending to government, through purchase of government debt (3) (4) Given a volume of private saving and investment, growing government deficits will be reflected in growing trade deficits: CA = S P − I + S G (5) National Income Statistics for the USA [Japan] (% of GDP) Year CA SP I SG 1981 0.2 19.1 18.2 -1.0 [0.4] [34.9] [30.7] [-3.8] 1983 -1.2 18.7 15.9 -4.1 [1.8] [33.3] [28.0] [-3.6] 1984 -2.6 19.5 18.9 -2.9 [2.8] [32.5] [27.7] [-2.1] 1986 -3.4 16.9 16.8 -3.4 [4.3] [32.4] [27.2] [-0.9] 1991 -0.1 15.6 12.8 -3.0 [1.2] [30.6] [32.3] [2.9] From 1981-83, CA went from surplus to deficit, in spite of a fall in investment, due to an increase in the government deficit. This was due to tax cuts under the Reagan administration. In 1984, the economy recovered, income and, therefore, tax revenues increased, and the government deficit fell; but the recovery in investment was so strong that the CA deficit increased. In 1986, private saving and investment were of identical magnitudes, and the government deficit was almost exactly mirrored in the CA deficit. In 1991, a new recession meant that investment fell and, in spite of a large government deficit, the CA deficit was small. A succession of CA deficits transformed the USA’s net foreign wealth from positive up to 1985, to negative thereafter. Mirroring this, Japan’s net foreign wealth became positive after 1985 – The Rockefeller Center in New York and Warner Bros. acquired Japanese owners. BoP accounting follows the principles of double-entry bookkeeping: every transaction is entered twice, once as a credit, once as a debit. Example: US consumer buys a Volkswagen car for $15,000 and pays for this with a dollar cheque. This transaction of $15,000 is entered as a debit item in the current account of the US BoP. The German supplier deposits the dollar cheque in his/her account and receives (say) 15,000 euros for the same. The $ assets of the European Central Bank increase by $15,000 and this item is entered as a credit item in the capital account (under Foreign Reserve Assets held in the USA) of the US BoP (see below) Balance of Payments Accounting USA, 1992 $ billion Current Account Exports of goods and services: Merchandise Other Services Credits 579.6 416.0 163.6 Debits Imports, of which: Merchandise Other Services 607.7 489.4 118.3 Balance of Trade 28.1 Investment Income Net Transfers 125.3 8.0 Balance on Current Account 108.9 3.7 In order to cover its CA deficit of $3.7 billion, the USA needed to borrow from abroad (sell assets to foreigners) worth $3.7 billion. These transactions, leading to a net capital inflow of $3.7 billion, along with other capital market transactions, are shown in the capital account. (Note an asset purchase is entered as a debit item, an asset sale as a credit item) Capital Account US non-reserve assets held abroad Foreign non-reserve assets held in US Credits 48.6 Balance on Capital Account Consolidated Current and Capital Account Balance on Current Account Balance on Capital Account Statistical Discrepancy Official Settlements Balance of which: US Reserve assets held abroad Foreign Reserve assets held in US Debits 68.0 19.4 Credits Debits 3.7 19.4 1.1 24.2 5.8 18.4 Exchange Rates An exchange rate represents the price of a country’s currency in terms of the currency of another currency (for example: $1.50/£ or Rs.40/$) An exchange rate appreciates if a country’s currency gains in value in terms of other currencies ($1.50/£ to $2.00/£) and it depreciates if a country’s currency loses in value in terms of other currencies ($1.50/£ to $1.00/£). When a country’s exchange rate appreciates/depreciates, the prices of its exports, expressed in foreign currencies rise/fall, and the prices of its imports expressed in the domestic currency fall/rise. The (expected) rate of return on an asset is the percentage increase in its value (expected) over a time period. The real rate of return is the rate of return less the inflation rate over the period. To compare rates of return on assets denominated in different currencies (£ and $), first, define the expected rate of depreciation of £ against $ as: 1 D£$e = ( E£$ − E£$0 ) / E£$0 1 where: E£$ is the exchange rate expected in period 1 and E£$0 is the current exchange rate1 If r£ and r$ are the current interest rats on 1-year £ and $ deposits, then £1 invested in a $ deposit will after 1 year become: 1 r 1 £ 0 + $0 E£$ E£$ E£$ and so the expected rate of return in £ on a 1-year $ deposit is: 1 1 r 1 r 1 E£$0 E1 r$£ = 0 + $0 E£$ − 1 = 0 + $0 E£$ − 0 = D£$e + r$ £$0 E£$ E£$ E£$ E£$ E£$ E£$ = D£$e + r$ 1 1 E£$ E£$ e + − = + + − 1 = D£$e + r$ + r$ D£$e r r D r r $ $ £$ $ $ 0 0 E£$ E£$ D£$e + r$ Consequently the difference in the rate of return on a £ asset versus a $deposit (from the point of view of a UK investor) is: r£ − r$£ = r£ − r$ − D£$e and the decision will be: invest in a £ ($) asset if UK interest rates exceed US interest rates by more (less) than the expected rate of depreciation in £. 1 The exchange rate is being expressed as the amount of the domestic currency required to buy one unit of the foreign currency (£0.60/$) The foreign exchange market is in equilibrium when deposits on all currencies offer the same expected rate of return: r£ − r$£ = r£ − r$ − D£$e = 0 ⇒ r£ − r$ = D£$e This is the interest rate parity condition. When is condition is satisfied, there will no excess supply of, or demand for, any currency. Current £/$ exchange rate (E£$0) £1.0/$ rate on £ deposits (r£) £0.75/$ $0.50/$ Expected £ return on $ assets (r$£) Rates of return in £ terms 1 Given an expected exchange rate, E£$ and current interest rates, r£ and r$, the expected £ return on $ assets ( r$£ ) will be low, the lower the current value of sterling2. In Figure 6.1, the equilibrium exchange rate is £0.75/$ or, equivalently, $1.33/£. If UK interest rates rise, £ becomes stronger: the expected rate of depreciation D£$e is now greater. If US interest rates rise, the curve showing the expected £ return on $ assets shifts outwards: £ becomes weaker and the expected rate of depreciation D£$e is now smaller. 1 If £ is expected to be weaker in the future ( E£$ to rise), then the expected depreciation rate is higher: the curve showing the expected £ return on $ assets shifts outwards because at every current exchange rate, the £ return on $ assets, r$£ , is higher. Forward Exchange Rates In order to be certain that a dollar investment (at a rate of return r$) will guarantee a given amount in £ one can buy £ forward at an exchange rate F£$: this guarantees that when the $ investment matures it will be converted to 2 e Because, the smaller will the expected depreciation, D£$ . £ at this exchange rate. The simultaneous purchase of a $ deposit at the current exchange rate and the sale of the principal and interest at the forward exchange rate is termed a covered transaction. The rate of return on a covered $ deposit is: F£$1 − E£$0 F£$1 − E£$0 £ 1 rˆ$ = r$ + + r$ r$ + P£$ 0 0 E£$ E£$ F1 − E0 where: P£$1 = £$ 0 £$ is the 1-year forward premium on $ against £. The E£$ covered interest rate parity condition is: r£ = rˆ$£ = r$ + P£$1 Comparing the covered interest rate parity condition with the uncovered interest rate parity condition: r£ = r$£ = r$ + D£$e the two conditions can both be true if and only if the forward exchange rate 1 currently quoted equals the exchange rate expected one year on: F£$1 = E£$ that is, if and only Example: A UK importer sells US computers for £1,000 and pays his US supplier $1,500. So his profit depends upon the exchange rate: at $1.50/£ he just breaks even; at $2.00/£ he makes a profit of £250 per computer and at exchange rates below $1.50/£ he makes a loss. Suppose the current exchange rate is $1.60/£ at which he would make a profit of £62.50 per computer. In order to ensure these profits (which will only be realised in 30 days time when the computers arrive and are sold), the UK importer enters into a 30-day forward exchange deal by which his bank agrees to sell him $ in 30 days time at $1.60/£. But, alternatively, the importer could have: 1. Borrowed $ from his bank: say £1 million for 1,000 computers 2. Converted £1 million into $1.5 million at current exchange rate 3. Deposited $1.5 million into a into a 30-day $ asset 4. Used the matured $ asset to pay US supplier $1.5 million 5. Used the revenue from computer sales to pay the bank and kept the interest earned on the $ deposit as his profits.