* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download ECN 111 Chapter 13 Lecture Notes

Pensions crisis wikipedia , lookup

Nominal rigidity wikipedia , lookup

Fear of floating wikipedia , lookup

Early 1980s recession wikipedia , lookup

Exchange rate wikipedia , lookup

Phillips curve wikipedia , lookup

Quantitative easing wikipedia , lookup

Monetary policy wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Real bills doctrine wikipedia , lookup

Helicopter money wikipedia , lookup

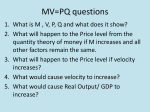

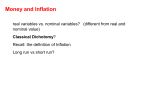

ECN 111 Chapter 13 Lecture Notes 13.1. Money and the Interest Rate A. The Real Economy Real factors, which are independent of the price level, determine potential GDP. B. The Money Economy The immediate impact and long-run impact of a change in the quantity of money are studied in Chapter 13. The intermediate impacts are studied in the next section of the book. C. The Demand for Money The amount of money that households and firms choose to hold is the quantity of money demanded. 1. Benefit of Holding Money The marginal benefit of holding money diminishes as the quantity of money held increases. 2. Opportunity Cost of Holding Money The opportunity cost of holding money is the interest forgone on an alternative asset. 3. Opportunity Cost: Nominal Interest is a Real Cost a. The nominal interest rate is the opportunity cost of holding money. b. Nominal interest rate = Real interest rate + Inflation rate 4. Other things remaining the same, the higher the nominal interest rate, the smaller is the quantity of money demanded. 5. The Demand for Money Schedule and Curve The demand for money is the relationship between the quantity of money demanded and the nominal interest rate, when all other influences on the amount of money that people wish to hold remain the same. The demand curve for money is downward sloping. D. Changes in the Demand for Money 1. The Price Level An increase in the price level increases the demand for money. The demand for money is proportional to the price level—an x percent rise in the price level brings an x percent increase in the quantity of money demanded at each nominal interest rate. 2. Real GDP An increase in real GDP increases the demand for money. 3. Financial Technology Changes in financial technology can increase the demand for money (ATMs) or decrease the demand for money (credit cards). E. Shifts in the Demand for Money Curve Changes in the price level, real GDP, and financial technology change the demand for money and shift the demand for money curve. F. The Nominal Interest Rate Equilibrium between the demand for money curve and the supply of money curve determines the equilibrium nominal interest rate in the money market. 1. The supply of money is the relationship between the quantity of money supplied and the nominal interest rate. The supply of money curve is a vertical line because the quantity of money supplied is determined by the actions of the banking system and the Fed. 2. The Interest Rate and Bond Prices Move in Opposite Directions. When the price of a bond rises, the interest rate falls; when the price of a bond falls, the interest rate rises. 3. Interest Rate Adjustment a. When the interest rate is above its equilibrium level, the quantity of money supplied exceeds the quantity of money demanded. As people try to get rid of money, the demand for other financial assets such as bonds increases, the prices of these assets rise, and the interest rate falls. b. The converse is true when the interest rate is below its equilibrium level. G. Changing the Interest Rate 1. The Fed can increase the nominal interest rate by decreasing the quantity of money. 2. The Fed can lower the nominal interest rate by increasing the quantity of money. 13.2. Money, the Price Level, and Inflation A. The Money Market in the Long Run 1. Potential GDP and Financial Technology In the long run, potential GDP and financial technology are determined by real factors. 2. The Nominal Interest Rate in the Long Run a. The nominal interest rate equals the equilibrium real interest rate plus the inflation rate. b. The real interest rate is independent of the price level. 3. Money Market Equilibrium in the Long Run The price level adjusts to make the quantity of money demanded equal to the quantity supplied. B. A Change in the Quantity of Money 1. In the short run, an increase in the quantity of money lowers the nominal interest rate. 2. In the long run, the nominal interest rate returns to its original value. 3. In the long run, the price level rises. In the long run, other things remaining the same, a given percentage change in the quantity of money brings an equal percentage change in the price level. C. The Quantity Theory of inflation The quantity theory of money is the proposition that when real GDP equals potential GDP, an increase in the quantity of money brings an equal percentage increase in the price level. 1. The Velocity of Circulation and Equation of Exchange a. The velocity of circulation is the number of times in a year that the average dollar of money gets used to buy final goods and services. The velocity of circulation, V is equal to (P Y) M, where P is the price level, and Y is real GDP, and M is the quantity of money. b. The equation of exchange states that the quantity of money multiplied by the velocity of circulation equals the price level multiplied by real GDP, or M V = P Y. 2. The Quantity Theory Prediction Rearrange the equation of exchange as P = M V Y. Then, 1) at full employment GDP equals potential GDP, and 2) the velocity of circulation is relatively stable and does not change when the quantity of money changes. So, if M increases with V and Y constant, P must increase by the same percentage that M increased. D. Inflation and the Quantity Theory of Money In rates of change, or growth rates, the equation of exchange is (Money growth) + (Velocity growth) = (Inflation) + (Real GDP growth) 1. Changes in the Inflation Rate a. If potential GDP growth and velocity growth do not change when the growth rate of the quantity of money changes, then if the growth rate of the quantity of money increases, the inflation rate rises by the same amount. E. Hyperinflation A hyperinflation is inflation at a rate that exceeds 50 percent a month. 13.3. The Cost of Inflation A. Tax Costs 1. Inflation is a tax because inflation transfers resources from households and businesses to government. 2. Inflation Tax, Saving, and Investment With an income tax levied on nominal interest, the higher the inflation rate, the lower is the after-tax interest rate received by lenders. With a low after-tax real interest rate, the incentive to save is weakened, so the supply of saving and investment decreases. B. Shoe-leather Costs The costs that arise from an increase in the velocity of circulation of money and an increase in the amount of running around that people do to try to avoid incurring losses from the falling value of money. C. Confusion Costs The difficulty in measuring costs and benefits when the price level is unstable. D. Uncertainty Costs The increased uncertainty of inflation makes long-term planning difficult and gives people a shorter-term focus. Investment falls and so the growth rate falls. E. How Big Is the Cost of Inflation? The cost of inflation depends on its rate and its predictability. The higher the rate, the greater is the cost. And the more unpredictable, the greater is the cost.