* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Elasticity Elasticity measures the degree of one variable‟s

Survey

Document related concepts

Transcript

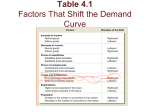

Elasticity Elasticity measures the degree of one variable‟s dependence on another variable, or the “sensitivity” of one variable to a change in another variable. While calculating elasticity, changes are expressed in relative (percentage) terms. The main reason: We don‟t want the size of the market or the choice of measurement units affect our result. Dealing with relative changes makes our result „cleaner‟ and less dependent of any arbitrary conventions. The relative change is calculated as the “nominal” change (measured in the same units as the variable), divided by some reference value. P %P 100% P What is used as the reference value: • Either the current value • Or, in cases when we are discussing elasticity over some interval of values, the average value Which approach should be used is usually clear from the context. The most common use of the elasticity concept: The own price elasticity of demand, EQX , PX is the percentage change in the quantity demanded, Q, divided by the corresponding percentage change in the price, P: EQX , PX %Q X %PX (the variable causing the change is in the denominator, the affected (“dependent”) variable – in the numerator.) •Since QD and P always change in the opposite directions, EQX , PX %QX %PX is always negative. The convention: When saying “more elastic” about own price elasticity of demand, we will refer to a greater variation in QD given a certain change in price, therefore a greater absolute value of a negative number for elasticity. For example, demand with elasticity of –3 is more elastic than demand with elasticity –1.4 because in the first case the same relative change in the price of the good causes a larger relative change in quantity demanded (stronger reaction from consumers, consumers are more sensitive to price) The convention: When saying “more elastic” about own price elasticity of demand, we will refer to a greater variation in QD given a certain change in price, therefore a greater absolute value of a negative number for elasticity. For example, demand with elasticity of –3 is more elastic than demand with elasticity –1.4 because in the first case the same relative change in the price of the good causes a larger relative change in quantity demanded (stronger reaction from consumers, consumers are more sensitive to price) Note it is uncommon to say “more/less elastic” about any other application of elasticity! Demand is called •“elastic with respect to price” or “price elastic” or simply “elastic” if %QX %PX This implies EQX , PX 1 • “inelastic” if %QX %PX and •“unitary elastic” if %QX %PX 1 EQX ,PX 0 and EQX , PX 1 What factors does own price elasticity of demand depend on? 1. Number of substitutes More substitutes – more choices for consumers – – the more freely they switch among products – – more elastic demand Price elasticity of air-travel demand over the North Atlantic is – 1.2. The elasticity of demand for air travel inside the U.S. is – 1.98. What factors does own price elasticity of demand depend on? 2. How expensive is the product, in relation to consumers‟ income? A 10% change in price matters to consumers more when the product is expensive, or when consumers are poor More expensive product – more elastic demand Wealthier consumers – less elastic demand The price elasticity of white pan bread in Chicago appeared to be – 0.69, while for premium white pan bread elasticity was measured at – 1.01. What factors does own price elasticity of demand depend on? 3. How much time do consumers have to react to the change in price? Adapting to changes takes time Therefore the greater the time period between the change in price and the moment when Qd is recorded, the more elastic the demand will look. The price elasticity of the demand for coffee is – 0.2 in the short run and – 0.33 in the long run. Ceteris paribus, would you rather be producing a good with high or with low elasticity of demand? Why? It is better to deal with consumers who have little choice but to buy your product, In other words, It is better to face less elastic demand. That would give you greater ability to vary your price; specifically, to set price above the marginal cost and still remain profitable. (Such ability is called “pricing power” or “market power”) What can producers do to reduce the elasticity of demand for their product? One of the reasons to care about elasticity – The relationship between elasticity and revenue. (Total) Revenue, TR = P ∙ Q Not the best measure of overall firm performance (profit is a much better one) but is often used nevertheless. Elasticity has a lot to do with how price affects revenue. When demand is elastic, then Q changes more than P: Price up, P x Q = TR Price down, P x Q = TR Price and revenue move in the opposite directions. When demand is inelastic, then Price up, P x Q = TR Price down, P x Q = TR Price and revenue move in the same direction. Elasticity along a linear demand curve P 6 P = $2 QD = 6 – P = 4 EQX , PX b ED=–5 5 P QD 2 (1) 0.5 4 4 3 2 ED=–0.5 P = $5 QD = 6 – P = 1 P QD 5 Q (1) 5 0 1 2 3 4 5 6 1 Along a linear demand curve, the slope is constant but elasticity is not! 1 EQX , PX b We can also trace what happens to the revenue from sales as we move along the demand curve. Q P TR 0 6 1 5 0 5 2 4 3 3 4 2 5 1 6 0 8 9 8 5 0 E –∞ –5 –2 –1 –.5 –.2 0 P TR is not directly proportional to the quantity produced because in this case in order to sell more, the firm needs to lower its price. 6 5 4 3 2 1 0 1 2 3 4 5 6 Q P 6 –5 5 –2 4 –1 3 –.5 2 –.2 1 0 1 2 3 4 5 6 Q D is elastic, P up – TR down, P down – TR up P 6 –5 5 –2 4 –1 D is inelastic, P up – TR up 3 –.5 2 –.2 1 0 1 2 Revenue is MAX where ED= –1 3 4 5 6 Q Other applications of elasticity: • Income elasticity of demand EQX , M %QX %M where M stands for consumer income. What can be said about the income elasticity of demand for normal goods? If %M 0, then %QX 0 therefore EQX , M 0 … for inferior goods? EQX ,M 0 3. Cross-price elasticity of demand, EQX , PY %QX %PY measures the effect of a change in the price of good Y on the quantity of good X demanded. What values of EQX ,PY should we expect for “complementary” or “substitute” goods, respectively? Complements: %PY 0, %QX 0 EQX , PY 0 %PY 0, %QX 0 EQX , PY 0 Substitutes: Elasticity under linear demand specification: If the demand equation is QD = 6 – 2P, then for each $1 decrease by 2 units incremental increase in P, QD will _________________ or QD 2 P QD b If the demand equation is QD = A + b P, then P %QD QD P P and EQX , PX b 0 %P QD P QD where P, QD are the current price and quantity demanded. The same holds for more complex equations such as QD = A + b P + c Pother + d M + e T Elasticity under the log-linear specification Log-linear specification establishes a relationship not between the actual values of the variables but between rates of their change. For example, a log-linear equation such as lnQD,X = 6.4 – 1.3 lnPX + 0.4 lnPY – lnM says, “If own price increases by 10%, and everything else stays the decrease same, the unit sales of our product would ______________ by 13 percent _____________.” But be careful: What does such an equation imply about the effect of price variations on revenue? Demand is elastic… the more we drop the price, the more our revenue will grow. This doesn‟t sound right. Two problems on revenue maximization: 1. (Problem 13 on p.112 in the text) You are a manager at the Chevrolet division of General Motors. If your marketing department estimates that the semiannual demand for the Chevy Tahoe is QD = 100,000 – 1.25P, what price should you charge in order to maximize revenues from sales of the Tahoe? We can solve it either by using the fact we just learned about elasticity, or by using derivatives. Problem 2. The manager of a grocery store experiments with prices. On some days a bag of store brand bagels is priced at $1.99. On such days, 67 bags are sold on average. On other days, the price for the same item is reduced to $1.49, in which case the average quantity sold increases to 88 bags per day. Given this information, what price would most likely maximize the daily revenue from selling bagels? This problem is different from the previous one in that we don’t have a demand equation. We do, however, have two points on what we believe to be the demand curve. The most important takeaway points: You need to be able to • Use your knowledge of elasticity formulas to predict changes in relevant variables; • Derive information about elasticities from a demand equation which is -linear -log-linear; • List and elaborate on the factors that affect elasticity of demand for a product; • Explain how elasticity affects the relationship between price and revenue; • Find the revenue-maximizing price-quantity pair when given a linear demand equation.