* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Devaluation of the Naira: Implication for Businesses in Nigeria

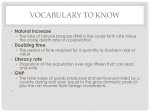

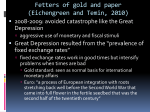

Nominal rigidity wikipedia , lookup

Balance of payments wikipedia , lookup

Non-monetary economy wikipedia , lookup

Currency war wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

2000s commodities boom wikipedia , lookup

Transformation in economics wikipedia , lookup

Fear of floating wikipedia , lookup

Exchange rate wikipedia , lookup

Devaluation of the Naira: Implication for Businesses in Nigeria [email protected] Introduction The global economy is currently evolving through a difficult phase in a typical business cycles. Current phase of the economic cycle is sustained by continued fall in the global oil price, slow and lagging growth in the Euro zone countries, increase in world crude oil supply, slow and declining growth in China and rising incidence on global terrorism (BH/ISILISIS/Crisis in Middle East/Crisis in Ukraine). Intensification of regional tension amid declining growth in China, Russia, Euro zone, Asia and political upheaval in Egypt, Libya, Ukraine, Syria and Brazil has further compounded the demand supply dynamics of crude oil in the international market. Nigeria like most countries oil exporting and oil dependent economies is not left out in the global crisis as the country is current caught in the web of the famous “Dutch Disease” Introduction Nigeria’s GDP was recently rebased with the result placing the country as Africa’s largest economy with an annual GDP of $510 billion. Nigeria’s population and the size of the market has remained an attraction for FDI inflow with the current population estimate projected at 183 million people in 2015 (growing at a projected growth rate of 2.82%) The country is currently ranked the 7th most populous country in the world and has enjoyed a positive GDP growth rate in the last 10 years and a relatively stable exchange rate regime. Between Q1:2013 and Q4:2014 Nigeria posted an average GDP growth rate of 5.8%, a single digit inflation of 8.2% in Q4:2014 and a relatively stable exchange rate regime. Introduction By end of second quarter 2014, crude oil price started a free fall with OPEC reference basket declining from US$105.38/barrel in February 2014 to US$54.06/barrel in February 2015 and currently US$50.92/barrel at 24th March 2015 CBN in reaction to the falling oil and dwindling international reserves devalued the Naira from N155/$1 to N168/$1 and further to N199/$1. The series of devaluation that followed since November 2014, has created new risks in the form of transactions losses for local firms and translation losses for multinational corporation and firms exposed to dollar denominated debt. In the face of dwindling foreign reserves, declining oil price, unstable political environment, election cycle, rising government borrowing and tight monetary & fiscal policies, firms in Nigeria are confronted new and rising cost of doing business. In this presentation, we will examine the source of the current declining global oil price, the reaction of the CBN, the effect on domestic firms and the way out of the current crisis. Source of the Current Declining World Crude Oil Price Generally, crude oil price is determined in the international market by the interacting forces of demand for crude and the supply of crude oil. When global demand for crude oil is greater than supply of crude oil prices will rise in the international market. When global supply is greater than demand oil prices will fall. The current scenario of falling oil price was triggered by; Slow world global economic growth compounded by sustained debt crisis in Euro zone countries, declining output and productivity in China, recession and declining output in Russia, escalating global tension in Ukraine and the Middle East, technological breakthrough in oil drilling and improvement in hydraulic fracturing in the US. These changes in the form of demand-side shocks and supply-side shocks is responsible for the sustained fall in oil price. Source of the Current Declining World Crude Oil Price Supply Side Shocks Driven by improvement in horizontal fracturing and drilling techniques in US. Since 2004, US oil production has risen by almost 56% The result is supply glut Current demand-supply dynamics is such that oil price is responding negatively to rising geopolitical tensions rather than the usual positive impact. Demand Side Shocks Declining demand is triggered by slowing productivity in China and very slow recovery of the Eurozone Areas. Global demand shock also driven by rising geopolitical tension across the world. Horizontal drilling techniques & hydraulic fracturing technology likely to be unsustainable should oil price fall below a threshold of US$60 /barrel Source of the Current Declining World Crude Oil Price Bonny Light Crude Oil Price 2006-2015 160 140 120 100 80 Crude Oil Price, 61.88 60 40 20 Jan-15 Jul-14 Jan-14 Jul-13 Jan-13 Jul-12 Jan-12 Jul-11 Jul-10 Jan-11 Jan-10 Jul-09 Jan-09 Jul-08 Jul-07 Jan-08 Jan-07 Jul-06 0 Jan-06 USD/Barrel As at 24th March 2015, crude oil price traded at US$55.14/barrel (bunny light) and US$50.92/barrel (OPEC reference basket price) Declining oil price has implication for the advanced economy and the domestic economy. For the advanced economy, falling oil price produces a +ve impact on the economy through a rise in discretionary income. For developing oil exporting nations, falling oil price will mean loss of revenue to the government, pressure on the country’s foreign reserves, and an exchange rate crisis. Link Between Falling Oil Price, External Reserves and Exchange Rates A well known link exist between oil price external reserves and exchange rate for oil exporting countries that relies on over 90% of her annual revenue crude oil sales. The link is such that an oil dependent economy relies on a robust foreign reserves to pay for her import demands. During periods of high and sustained crude oil price, the domestic currency (Naira) tends to appreciate in value because of sustained inflow of FDI and foreign capital. When oil price is declining, the revenue from crude oil sales falls exerting pressures on the foreign reserves. The result is fluctuation in exchange rate and a resultant rise in capital flight. It is this reason that breeds the so called “Dutch Disease” for a mono product economy. Link Between Falling Oil Price, External Reserves and Exchange Rates How Falling Oil Price Feeds into the Economy Declining Oil Price Declining Government Revenue Reduces the External Reserves Exchange Rate Devaluation Budgetary Constraints Falling price of export in relation to import Rise in interest rate and cost of borrowing Government borrowing crowds out private sector investment Inflationary pressure on the economy Rising inventory and cut in production by firm Declining Output Rising Misery Index Reduction in Government Spending Increased Government Borrowing Tight Fiscal Policy Increased Tariff, VAT and Tax Link Between Falling Oil Price, External Reserves and Exchange Rates 150 100 50 Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Jul-09 Apr-09 Jan-09 Oct-08 Jul-08 Apr-08 Jan-08 Oct-07 Jul-07 Apr-07 Jan-07 Oct-06 Jul-06 Apr-06 0 Jan-15 200 Oct-14 10 5 INTBR, 197.8 0 -5 -10 crude oil price, 61.88 -15 App/DEP, -18.6 -20 Jul-14 250 Jan-06 USD/NAIRA/USD/Barrel Exchange Rate, Crude Oil Price & Currency Devaluation The chart above captures the relationship between exchange rate, crude oil price and currency devaluation. Between October 2008 and July 2009 oil price declined slightly below US$50/barrel this was followed by rising exchange rate and a massive devaluation of the Naira. Similarly, between October 2014 and February 2015 oil price fell below S$50/barrel this again triggered a rise exchange rate and a massive devaluation of the Naira from N155/$1 to N199/$1. Currently, IFXEM is trading at N199.7/US$ while the BDC is trading at between N225/US1$ and N227/US1$ Question: Why the need for devaluation and how does this impact on firms? Reason for Currency Devaluation & Reaction of Central Bank The term currency devaluation is often used loosely to mean the same thing as currency depreciation. It refers to the deliberate lowering of the value of a country’s currency in relation to other country’s currency within the context of a fixed exchange rate management system Devaluation or depreciation of a country’s currency is usually triggered when the country is experiencing an adverse BOP/BOT crisis or by worsening economic conditions transmitted into the domestic economy from the foreign market. The current devaluation of the Naira is linked to shocks emanating from the falling oil price driven by a global supply glut and a declining world demand for crude oil. Reason for Currency Devaluation & Reaction of Central Bank Nigeria’s economy is a mono product economy that relies on crude oil sales for over 85-90 % of her annual revenue. Between 2006 and February 2015, Bonny Light crude oil price averaged $94/ barrel while the average monthly oil price between 2010 and end 2014 stood at $104.4 /barrel. Despite the positive windfall gains arising from the benchmark oil price of $79, $77.5 and $65 in 2013, 2014 and 2015 respectively, the country’s external reserves declined precipitously from $53.6 Billion in 2008 to the current to $30.9 billion in March 2015. This declining trend in external reserves reflects the current concern of the Central Bank of Nigeria as continuous defending of the Naira in the face od dwindling reserves became unsustainable . Reason for Currency Devaluation & Reaction of Central Bank Before the spate of currency devaluation that has taken place since November 2014, Nigeria operated a “dirty float” exchange rate management system where the Central Bank allows the exchange rate to float around a band. The official exchange rate was allowed to float around a midpoint of N155/US$ within a band of +/-3% with MPR held constant at 12% between the 2012 and 2014. Reacting to the declining global oil price, the government advised business operators not to panic but responded by coming up with series of drastic macroeconomic policy measures ; Reason for Currency Devaluation & Reaction of Central Bank Increased Monetary Policy Rate (MPR) by 100 basis points to 13% from 12% with a symmetric corridor of +/-200 basis points Increased Cash Reserve Requirement (CRR) on private sector funds to 20% from its initial 15%. Ban in the sales of dollars to importers of telecommunication equipment, power generators and finished products at the CBN foreign exchange auction. Restriction of lenders and discount houses from placing more than N7.5 billion as deposits with the CBN. CBN moved the mid-point of the official exchange rate to N168/US$ from N155/US$ and increased the band around the foreign exchange rate to +/-5% from 3% signaling a devaluation of the naira by 8 percent. The closure of the Retail and Wholesale Dutch Auction System of the foreign exchange market signaling a further devaluation of the exchange rate from N155/US$ N168/US$ to N199.7/US$. Implications on SME,s and the Current Structure of the Economy The current structure of the Nigerian Economy is such that Nigeria currently is the largest economy in Africa, and the 24th economy in the world in terms of the country’s output. With the conclusion of the rebasing exercise, there was a notable shift in the structure of the Nigeria from the dominance of Agriculture to a Service Sector -driven economy. Service Sector accounted for the largest share in GDP in Q4-2014 and was the fastest growing sector in the economy. The current structure of the economy shows a declining output between Q1:2013 and Q4 :2014. Real GDP growth of 5.94 % in Q4: 2014 dropped below the corresponding growth of 6.77% in Q4: 2013 as shown in the figure below. Implications on SME,s and the Current Structure of the Economy Real GDP Growth (year-on-year) 8 7 6.77 Growth Rate (%) 6.54 6.21 6 5.4 5 6.23 5.94 5.17 4.45 4 3 2 1 0 Q1 Q2 Q3 2013 Q4 Q1 Q2 Q3 Q4 2014 In terms of the current sectors driving economic growth and sectors driving GDP the service sector which houses most of the SME’s and micro enterprises sits on the drivers sit Question : What does this sector produce? How does the increased demand for import by this sector affect foreign exchange market? Where does the current exchange rate dynamics leave the productive sector? Sector Contribution to GDP Q4:2014 16.27 8.97 4.34 0.01 0 0.14 0.35 0.71 0.25 0.5 4.44 8.76 3.67 2 2.3 0.35 0.02 1 1.25 0.18 1.03 0.99 0 0.01 0.1 0.08 0.03 0.27 0.07 0.18 0.27 0.25 0.01 0.24 0.08 0.49 0.55 0.1 8.3 Sector Real GDP Growth Rate Q4:2014 32.01 32.92 29.5630.69 30.74 26.59 24.28 23.13 20.17 17.85 5.16 1.18 -25.15 23.37 21.35 17.56 14.1815.6 18.08 13.32 12.79 6.78 27.44 12.66 6.47 2.81 11.43 5.32 5.14 12.05 7.91 2.83 10.98 2.48 8.2 7.76 5.96 3.1 Implications on SME,s and the Current Structure of the Economy In terms of growth and contribution to the Nigerian economy, the service sector is the most active sector in 2014-2015. It is this sector that houses micro enterprises, small enterprises and medium scale enterprises. By definition, the National Policy on Small and Medium-sized Enterprises categorizes of SMEs into the following groups. Categorization /Grouping of SME’s Category No. of Employees Assets Excluding Land & Building (N’M) Micro Enterprises Less than 10 Less than N5M Small Enterprises 10-49 >N5M but <N50M Medium Enterprises 50-199 >N50M but <N500M Implications on SME,s and the Current Structure of the Economy In the current structure of the Nigerian economy, micro enterprises, small medium-sized enterprises and large firms can be found operating in; Wholesale Retail Trading Sector, Agriculture & agribusiness food chain sector Fast Moving Consumers Goods sector (FMCGs), Telecommunication & ICT Sector, Health Care, Transport and Construction sector Education & Health Care Services, Hotels &Hospitality, Movie and Motion Picture Industry. These sector required substantial amount of foreign exchange and current burdened by the high cost of fund and transactions losses. Implications on SME,s and the Current Structure of the Economy Continuous devaluation of the naira against the UD dollar implies rising cost of imports at the expense of Exports. The current tight monetary policy stance of the CBN also implies rising cost of borrowing. In addition to rising cost of borrowing is the issue of increased government borrowing which creates two major effects on SME’s. - Government borrowing crowds out private sector investment - Increased government borrowing increases the risk of debt overhang Both factors constrains the ability of the Government to create the much needed environment for business to thrive. Implications on SME,s and the Current Structure of the Economy In addition to tightening liquidity, currency devaluation tends to create a bearish capital market through rising interest rate and rising inflation. This directly impacts on the capital market through it effects on; Fixed income securities As interest rate rises following currency devaluation , the preferences of portfolio holders will move from existing bonds and treasury bills to new issues. This exist because of the inverse relationship existing between fixed income securities’ prices and interest rates. The result is a bearish capital market. Implications on SME,s and the Current Structure of the Economy Effect on Share Prices For the domestic companies operating in Nigeria, currency devaluation will boost export sales but the feedback effect of high cost of imported raw materials can have a negative effect on corporate profits. The effect of this changes is usually transmitted into the economy through a decline in all share price index. Asset Portfolio Shift Currency devaluation usually leads to a shift in portfolio preferences From the Capital market to the Money Market as a result of the new prevailing high and attractive interest rate in the money market. Shrinking Market Liquidity A fall out of currency devaluation is shrinking market liquidity usually triggered my movement of “hot money” in the form of capital flight. Current Market Reaction to Currency Devaluation & Tight MP The Central Bank appear to be winning the game of currency devaluation at a high cost of speculative market activities At the current crude oil price of US$55/barrel, the IFEM rate appears to be converging with the BDC to a fair market value. Cost of doing business now vary high for SMEs and corporate firms with firm heavily exposed to dollar denominated debt resulting to cutting back in production and reducing the size of their workforce. Election cycle further compounding the situation. Government in the face of dwindling oil revenue will most certainly embark on fiscal policy restructuring to boost revenue drive (Contractionary fiscal policy) immediately after the conclusion of the election . Current Market Reaction to Currency Devaluation & Tight MP Oil Price, IFEM, Naira App/Dep 140 Oil Price, BDCDollar, Naira App/Dep 250 140 250 120 120 200 100 200 100 80 150 60 80 150 60 40 100 20 40 100 20 0 50 0 50 -20 -20 -40 0 Oil Price App/Dep IFEMDollar -40 0 Oil Price App/Dep BDCDollar Way Out for Firms Prudent management of cash/during periods of economic cycles cash is usually described as king. Innovation and move away from import dependent consumables. One interesting phenomenon of the Nigerian market is that the products are not competitive in the international market hence do not attract dollar value. Firms should diversify their production base by moving to value added sectors as opposed to trading in imported goods and services. Currently production base still largely at the unfinished goods state. Effort should be geared towards goods that commands premium price in the international market. Way Out for Firms A clear gap in the industry today is the absence of the much needed skill and innovation to drive productivity. To boost productivity, the private sector must play a leading role in encouragement of research and development by funding research and linking up with the various institutions in the country. At the beginning of the slide in oil price, government clearly said businesses should not panic but the reality on ground is that the government panicked and came up with all kinds of policy response. Going forward, business survival in the current political dispensation requires continuous tracking of policy and non policy indicators as well as diversification of production base to reflect the country’s competitiveness. Thank You Any Question?