* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The East Asian Miracle: Four Lessons for Development Policy

Survey

Document related concepts

Transcript

This PDF is a selection from an out-of-print volume from the National

Bureau of Economic Research

Volume Title: NBER Macroeconomics Annual 1994, Volume 9

Volume Author/Editor: Stanley Fischer and Julio J. Rotemberg, eds.

Volume Publisher: MIT Press

Volume ISBN: 0-262-05172-4

Volume URL: http://www.nber.org/books/fisc94-1

Conference Date: March 11-12, 1994

Publication Date: January 1994

Chapter Title: The East Asian Miracle: Four Lessons for Development

Policy

Chapter Author: John Page

Chapter URL: http://www.nber.org/chapters/c11011

Chapter pages in book: (p. 219 - 282)

JohnPage

THE WORLD BANK

The

East

Four

for

Asian

Miracle:

Lessons

Development Policy

Since the study of economic development began in earnest at the close

of the Second World War, academics and policymakers have debated

the appropriate role of public policy in developing economies. East Asia

has a remarkable record of high and sustained economic growth. From

1965 to 1990 its 23 economies grew faster than those of all other regions.

Most of this achievement is attributable to seemingly miraculous growth

in just eight high performing Asian economies (HPAEs)-Japan; the

"four tigers": Hong Kong, the Republic of Korea, Singapore, and

Taiwan; and the three newly industrializing economies (NIEs) of Southeast Asia, Indonesia, Malaysia, and Thailand.1 The East Asian economies

from Hong Kong's

provide a range of policy frameworks-extending

nearly complete laissez faire to the highly selective policy regimes of

Japan and Korea. The coexistence of activist public policies and rapid

Presented at the National Bureau of Economic Research, Ninth Conference on Macroeconomics. The findings, interpretations, and conclusions expressed in this paper are entirely

those of the author. They do not represent the views of the World Bank, its Executive

Directors, or the countries they represent.

1. These eight HPAEs are the subject of the World Bank's recently completed study, The

East Asian Miracle:EconomicGrowthand Public Policy, on which this essay draws

extensively. The East Asian Miracle report is the product of a World Bank research team

led by John Page and comprising Nancy Birdsall, Ed Campos, W. Max Corden,

Chang-Shik Kim, Howard Pack, Richard Sabot, Joseph E. Stiglitz, and Marilou Uy.

William Easterly, Robert Z. Lawrence, Peter Petri, and Lant Pritchett made major

contributions. Lawrence MacDonald was the principal editor. Background papers are

available from the Policy Research Department, The World Bank. The findings, interpretations and conclusions expressed in this paper are entirely those of the author.

They do not represent the views of the World Bank, its Executive Directors, or the

countries they represent.

220. PAGE

Japan, Korea,

growth in some of the East Asian economies-especially

Singapore, and Taiwan-has raised complex and controversial questions concerning the relationship between government, the private

sector, and the market.

This essay looks at four public policy lessons of the East Asian

miracle. Section 1 argues that the eight HPAEs can be grouped together

and distinguished from other low- and middle-income countries on the

basis of their rapid, sustained, and shared growth. Section 2 examines

the controversy over the sources of growth in the HPAEs and presents

evidence on the relative roles of accumulation and total factor productivity (TFP) change. Section 3 discusses two aspects of public policy in

East Asia that conform to the conventional wisdom concerning good

management and broad-based

development policy-macroeconomic

educational policies. Section 4 examines two more controversial issues

-the significance of the HPAEs' export push strategies and industrial

policies for TFP change. It concludes that export orientation rather than

selective intervention played the dominant role in increasing economywide TFP growth rates.

1. TheNatureof the Miracle-Rapid Growth

with Equity

The HPAEs are a highly diverse group of economies, differing in

natural resources, population, culture, and economic policy. What are

the characteristics that these eight economies shared that cause them to

be grouped together and set apart from other developing economies?

First, they had rapid, sustained growth between 1960 and 1990. This in

itself is unusual among developing economies. Figure 1 shows the

relationship between relative income level in 1960 and per capita

income growth for a sample of 119 countries during the period

1960-1985. This is the standard "convergence picture" first presented in

Romer (1987). The figure also plots an estimated nonlinear relationship

between initial income and growth.2 Per capita income growth is

essentialy independent of the level of relative income in 1960. The fit of

the regression is poor and the significance of individual coefficients

low.3

2. The regression line is the result of a regression of per capita income growth (in

constant 1980 international prices) on 1960 income per capita, including nonlinear

terms up to the second power.

3. Dollar (1991) finds a similarpattern using a sample of 114 countriesand the absolute

level of per capita income in 1960. He finds a clearer pattern in which the lowest

deciles have the lowest per capita income growth rates, the middle-income deciles

have the highest, and the high-income countries are between. He also reports low

significanceof his regressionresults,however.

The East Asian Miracle 221

Figure 1 GDP GROWTHRATE,1960-1985, AND GDP PERCAPITA,1960

0.08

GDP growthrate(average,1960-85)

*an

0.0

0.06 -Korea*

r-

*

HQngKong

SSingapore

*Japan

Thailan

0.04

0.04 IndonI-

lysia

0Indon*

0.022-,

|

[3

--

?

. no

*

i

0

-0.02

ClD

economies

High-incomce

economnues

OtherdevekJping

1

-0.04

0

0.2

0.4

0.6

0.8

1

1.2

Relative per capita GDP, 1960 (percentage of U.S. GDP per capita, 1960)

Note: This figure

GDPG = 0.013

plots this regression

+ 0.062RGDP60

(0.004)

Source: Summers

(0.027)

and Heston (1991);

equation:

0.061RGDP602.

(0.033)

Barro (1989);

N World

119; R2 = 0.036.

Bank

data.

The eight HPAEs are all positive outliers in the income-growth

distribution. While Malaysia, Indonesia, and Thailand are closer to their

predicted values, the remaining five economies, Taiwan, Korea, Japan,

Singapore, and Hong Kong, are all significantly above their predicted

gross domestic product (GDP) per capital growth rates on the basis of

relative income level.4 All of the HPAEs were catching up to the more

developed countries.

Recent work on growth rate persistence suggests that growth rates

for individual economies are highly unstable over time (Easterly et al.,

1993). The HPAEs, however, appear to be an exception. Depending on

the time period selected and the definition of persistent success (in

terms of the fraction of the distribution used to define high growth), the

four tigers plus Japan consistently rank with the handful of persistently

rapidly growing economies. Indeed, Easterly et al. conclude that "the

widespread perception of strong country effects in growth is strongly

influenced by the Gang of Four."

4. Addition of a dummy variable (HPAE = 1) to the estimated equation appearing below

Figure 1 increases the R2 to .242 and greatly improves the precision of the parameter

estimates. The t value on the dummy variable (which is positive) is 4.00.

222 PAGE

AND GROWTHOF GDP, 1965-1989

Figure 2 INCOMEINEQUALITY

An llIo

GDP Growth per Capita (1965-89)

-r

tiXI

Korea*

* Bo swana

Tiwan*

ongKor

** Singapore

0.06

Japan *

Indonesia * Mauritius

iTnisia + ** Egypt

Thailand

0.04

* Gabon

*Malaysia

razil

*Italy

Isr*lAustria

Israe1

-

- Beim^pa

a *Morocco .

-rtLaSrila* Iran ?C

ni,indom

0.02V

..

bi

* Keinya

Paklstan'

ibippiaes

*Venezuela

Malawi *India

angladesho

0

M

-..

.

N A

.

......

I

*Pei

Boivi

^^p

cotedIv

pcotedIvoke

I

I

II

Ghana

Suan ?

*Za*bia

-0.02

-0.04

0I

r

I

I

I4

I

1

10

1

1

I

I

|

I

20

30

IncomeInequality

I

I

I

40

Note: Income inequality is measured by the ratio of the income shares of the richest 20% and

the poorest 20% of the population.

Source: World Bank data.

Where the HPAEs are unique in combining rapid, sustained growth

with highly equal income distributions. The positive association between growth and low inequality in the HPAEs, and the contrast with

other economies, is illustrated in Figure 2. Forty economies are ranked

by the ratio of the income share of the richest fifth of the population to

the income share of the poorest fifth and per capital real GDP growth

during 1965-1989.5

The northwest corner of Figure 2 identifies economies with high

growth (GDP per capita greater than 4.0%) and low relative inequality

(ratio of the income share of the top quintile to that of the bottom

5. Because the timing and frequency of observations on income distribution vary among

countries in the sample, the ratio of the top to bottom quintile is taken at the date

closest to the midpoint.

The East Asian Miracle ?223

quintile less than 10). All of the high-growth, low-inequality economies

are in East Asia. Seven are HPAEs; only Malaysia, which has an index of

of

inequality above 15, is excluded. Within East Asia comparisons

growth rates and Gini coefficients by decade indicate that the distribution of income was substantially more equal in the fastest-growing

HPAEs. Moreover, improvements in income distribution generally coincided with periods of rapid growth (Birdsall and Sabot, 1993).6

2. Fundamentalists,

Mystics,and the Miracle

To observe a miracle is not necessarily to understand it. As with those

attempting to explain religious phenomena, economists analyzing the

"miracle" of East Asia's growth tend to fall into two camps-fundamentalists and mystics.7 Growth fundamentalists

stress the dominant

role of factor accumulation

in explaining the HPAEs' high-income

growth rates. They frequently qualify their explanations by noting that

efficient allocation of resources, once accumulated, must also have been

a part of the East Asian success story-since

such economic laggards as

the countries of the former Soviet Union and Eastern Europe have

accumulated resources at equally impressive rates with radically different results.8

the importance of

Mystics, on the other hand, while acknowledging

accumulation, tend to place greater stress on the role of the acquisition

and mastery of technology. The dominant view-if

there is one-is

that the East Asian economies, particularly Japan, Korea, and Taiwan,

6. Two qualifications should be noted here. First, some studies of Korea have noted

increasing inequality in recent years; however, most of this is due to rising value of

assets, particularly land, rather than increased variation in incomes. Second, reductions

in inequality in Thailand have been relatively minor compared to those in the other

HPAEs, although Thailand's performance is still better than that of most developing

economies.

7. Recently a third group-predestinarians-has

begun to emerge, placing great stress on

the role of initial conditions in 1960, especially education and income equality, in

explaining East Asia's persistently superior growth performance in cross-country regressions. Rodrik (1993) provides a survey of the relevant literature and some crosscountry regressions. We do not consider their arguments further here since, if predestinarian explanations are relevant, there are few lessons for development policy. This is

perhaps why most predestinarian authors ultimately reveal themselves to be fundamentalists or mystics in their policy interpretations of the miracle (see, e.g., Rodrik,

1993).

8. One of the most prominent fundamentalist tractarians, Alwyn Young (1993), has

recently provided a succinct statement of their position. Although he subtitles his essay

a "contrarian view," it is probably the dominant view among the Anglo-American

economics establishment.

224 PAGE

have been unusually successful at catching up technologically to the

advanced economies.9 Empirical support for the mystical position is

adduced from the high rates of total factor productivity growth estimated for industry in several of the HPAEs, notable Japan, Korea, and

Taiwan.

The fundamentalist-mystic distinction is at the heart the debate on

the public policy origins of East Asia's success. Fundamentalists have

stressed East Asia's success in getting the basics right. They tend to

attribute success to policies that increased physical and human capital

per worker and that provided for efficient allocation. They argue that

the successful Asian economies have been better than others at providing a stable macroeconomic environment and a reliable legal framework

to promote domestic and international competition. They also stress

that the orientation of the HPAEs toward international trade and the

absence of price controls and other distortionary policies have led to

and

low relative price distortions. Investments in people-education

health-are important roles for government in the fundamentalist story

(World Bank, 1991).

In contrast to the fundamentalist view, which acknowledges relatively few cases of market failure, mystics contend that markets consistently fail to guide investment to industries that generate the highest

growth. In East Asia, the mystics argue, governments remedied this by

deliberately "getting the prices wrong" to promote industries that

would not otherwise have thrived (Amsden, 1989). The mystics lay

stress on the dynamic gains of activist government policies to alter

industrial structure and promote technological learning, sometimes at

the expense of static allocative efficiency. Moreover, while fundamentalists would explain growth with a standard set of relatively constant

policies, mystics note that the policy mixes used by East Asian economies

were diverse and flexible. They argue that East Asian governments

"governed the market" in critical ways (Wade, 1990). But the crucial

question remains: Have interventions, per se, accelerated growth?

The mystics have provided valuable insights into the history, role,

and extent of East Asian interventions, demonstrating convincingly the

scope of government actions to promote industrial development in

Japan, Korea, and Taiwan. They have successfully shown that East Asia

does not wholly conform to the fundamentalist model. Industrial policy

and interventions in financial markets are not easily reconciled with

9. Amsden (1989, 1993) and Wade (1990) put forward this view. Interestingly, as Young

(1993) points out, so do Balassa (1988) and Krueger (1990). They differ, of course, on the

policy origins of East Asia's presumed success at technological catching up.

TheEastAsianMiracle?225

static allocative efficiency. Policies in some economies are much more in

accord with models of state-led development.

2.1 SOURCESOF THEMIRACLE-ACCUMULATION

AND PRODUCTIVITY

CHANGE

Empirically, the fundamentalist-mystic debate can be viewed in terms

of the relative roles of factor accumulation and productivity growth in

explaining the HPAEs output growth.?0 How unusual are the HPAEs in

terms of their rates of factor accumulation? Are the East Asian economies

atypical in terms of their rates of productivity change?

2.1.1 East Asia's Recordof Accumulation The fundamentalist view of the

success of the HPAEs is that their investment levels in physical and

human capital substantially exceed those for other countries at similar

levels of development, resulting in more rapid growth of per capita

income. Figure 3 shows the relationship between income level in 1960

and the average investment rate for 1960-1985. The estimated nonlinear regression relating initial income level to investment is also shown.

There is substantially more regularity in the relationship between investment share and relative income, than in the relationship between

growth and relative income." The investment rate for all countries

increases with income up to about 70% of U.S. GDP in 1960 and then

declines.

The HPAEs conform much more strongly to the cross-country pattern

of investment rates than to the pattern of growth rates. Thailand and

Hong Kong lie close to their predicted values on the basis of the

cross-country regression. Japan, Korea, and Malaysia are the extreme

outliers among HPAEs, but they are not extreme outliers in the distribution.'2 High investment rates are part of the Asian success story, but

they cannot fully explain the extent to which per capita income growth

in the HPAEs diverges from the typical pattern.

Figure 4(ab) summarizes the pattern of variation of two measures of

human capital with initial income. Figure 4(a) plots the primary school

enrollment rate in 1960 against relative per capita income, while

10. While it is broadly correct to associate fundamentalism with policies to promote

accumulation and efficient, static allocation, some mystics of the industrial policy

school would point to such government initiatives as socialization and bounding of

private risks in Korea and Japan as important policy tools that raised accumulation.

11. The fit of the regression is markedly better, as is the variance of the estimated

coefficients.

12. Addition of a dummy variable (HPAE = 1) to the estimating equation appearing

below Figure 4 does not increase the explanatory power of the regression. The t

statistic on the dummy variable is 1.00.

226- PAGE

Figure 4(b) presents the scatter of Barro and Lee's (1993) average

measure of educational attainment over the period 1960-1985 against

initial income. Both scatters confirm that the HPAEs were relatively well

endowed with human capital but again conform more closely to the

cross-country pattern based on relative income than is the case for

income growth.

2.1.2 Productivity Change TFP is estimated in a simple neoclassical

framework by subtracting from output growth the portion of growth

due to capital accumulation, to human capital accumulation, and to

labor force growth. Assume that every economy has access to an

international cross-economy production function of the form:

Q = AF(K, E, L),

(1)

where A is total factor productivity, K is a measure of capital services,

E is a measure of human capital endowments, and L is a measure of

labor services in natural units.

TFP change can be then found as the residual of growth of output

per worker after deducting the contributions of human and physical

OF GDP,

Figure 3 AVERAGEINVESTMENTRATEAS A PERCENTAGE

1960-1985, AND GDP PERCAPITALLEVEL,1960

40

Averageinvestmentrate(percentageof GDP,1960-85)

*

.

*Japan

*aysia

l--*.

r.aysg-ia*

Singapore

30 -

*

20......- ...........

20

.*.o_

e

Oe

10

g

-

0

Kong

-

0 *e

'.

*.::

10

9

E

.

?

^ *

*DHPA-s

High-incone economies

* Otherdeveiopingeconomies

*

0*

0

0

E

;

t

a[0

D

*

?

Korea ^e *

* *'

* *

Taiwan*

?

0.2

0.4

0.6

i

0.8

Relativeper capitaGDP (percentageof U.S.GDP percapita,1960)

Note: Regression equation:

16085 = 10.125 + 59.120RGDP60 - 51.881RGDP602. N = 119; R2 = 0.295.

(12.593)

(1.383)

(10.344)

Sources: Summers and Heston (1991); Barro (1989); World Bank data.

1

1.2

The East Asian Miracle 227

Figure 4a INITIAL INCOME LEVEL AND PRIMARY ENROLLMENT RATE

PRIM6O

1.6

1.4tl

1.2 r

.

Sin lve

t

-

Korea

0.8

SI *

Inconsisa

Hong Kong

,y

""

Thaiiland*~

/

.

0.6-

I

0.2

-

*

0

0

mt ?

*

t

t

t

!

i

I

I

!

I

i

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

1.1

PER CAPITAGDP 1960 (% USA GDP/CAP 1960)

Figure 4b INITIAL INCOME LEVEL AND AVERAGE EDUCATION STOCK

12

AV. EDUCATION

(60-85)

0

0

0

00

0

10-

0

1*Japan

8 -

0

0. .0

a

0.1

/

0.2

0.3

0.4

0.5

0.6

0.7

0.8

PER CAPITAGDP 1960 (% USA GDP/CAP 1960)

0.9

1

1.1

228 PAGE

capital accumulation:

a = (q - 1) - sK(k -

) - sE(e-

1).

(2)

Under assumptions of competitive factor markets and constant returns

to scale, SK and SE are equal to the income shares of factors. Thus, most

empirical applications of Equation (2) estimate the output elasticity

coefficients with income shares.13

Because income share data are not available for most countries in our

sample, we instead estimate the output elasticities directly using a

simple, cross-economy production function. We regress annual log

output growth on log capital growth, log human capital growth, and

log labor growth between 1960 and 1990, constraining their coefficients

to sum to unity (i.e., specifying the production function to be

Cobb-Douglas). We also include economy-specific dummy variables to

estimate individual rates of TFP change for each of the sample's

economies.

We estimate TFP change for 87 high- to low-income economies. The

data set includes new constant price capital stock data (Nehru and

Dhareshwar, 1993). Measures of human capital are incorporated in the

specification using Barro and Lee's (1993) measure of educational attainment. Table 1 reports the production function parameters and the

estimated TFP growth rates.

The low elasticity of output with respect to capital from the crosscountry sample is striking but not altogether surprising. There is a

subset of developing economies in our data (13 in number) that have

positive net investment and human capital growth per worker, but

negative output per worker growth rates. In effect, the marginal product of both physical and human capital was negative in these economies,

an indication of severe allocation inefficiency. Empirically, this is reflected in a lower elasticity of output of both physical and human

capital in the production function based on the whole sample than

when only economies with nonnegative growth of output per worker

are included.

We have reestimated the production function based only on highincome economy input-output relationships. This is predicated on the

assumption that allocation efficiency in the high-income economies is

greater than in the whole sample and, hence, that TFP growth rates

estimated on the basis of the production function parameters will

contain loss "noise" due to allocation mistakes. These results and the

estimated TFP growth rates derived from standard growth accounting

13. This literature is briefly surveyed in Nishimizu and Page (1987).

TheEastAsianMiracle?229

methods are displayed in Table 1. The elasticity of output with respect

to capital in the high-income economy production function rises to

more conventional levels. TFP estimates, particularly for those

economies within rapidly growing capital stocks, are correspondingly

reduced.

Figure 5 compares the TFP growth estimates from the two production

functions. Three inferences are supported by both sets of estimates:

1. The range of TFP growth rates for high-income countries is quite

compact, especially in comparison with the low- and middle-income

countries.

2. Nearly one third (32%) of the low- and middle-income countries in

the sample had negative rates of TFP growth for the period

1960-1989, regardless of the parameter estimates used.

3. There is very little productivity based "catch-up" exhibited by the

low- and middle-income countries.

Table1 ELASTICITY

OF OUTPUTWITHRESPECTTO CAPITAL(SK),

LABOR(SL),AND HUMANCAPITAL(SH):FULLSAMPLE

AND HIGH-INCOME

ECONOMIES

Observations SK

Full sample

High-income

economies

2,093

460

(t-stat)

0.178

0.399

SL

10.895 0.669

10.237 0.332

(t-stat)

SH

(t-stat)

6.411

1.679

0.154

0.269

1.49

1.476

RESULTING

TOTALFACTORPRODUCTIVITY

GROWTHESTIMATES

FORTHEHPAES(1960-1989)

Economy

TFPgrowth

(full-sample

parameter

estimates

Hong Kong

3.6470

Indonesia

1.2543

Japan

Korea,Rep. of

3.4776

3.1021

Malaysia

Singapore

Taiwan

Thailand

Latin America

Africa

Source:World Bank data.

TFPgrowth(highincomeonly,

parameter

estimates)

2.4113

- 0.7953

1.4274

0.2355

1.0755

-1.3369

1.1911

3.7604

2.4960

-3.0112

1.2829

0.5466

0.1274

-0.9978

-0.9819

-3.0140

230- PAGE

Figure 5 COMPARISON OF TOTAL FACTOR PRODUCTIVITY ESTIMATES

TFP growth (high-income

sample parameters),

1960-89,

percent

4

2

0

-2

-4

-6

-4

-3

-2

-1

0

TFP growth (full sample parameters),

1

1980-89,

2

3

4

percent

These are not promising results for the developing world. Despite a

substantial literature on the potential for developing countries to achieve

rapid growth through the adoption of known, "best practice" technologies, very few countries appear to have realized these potential gains.14

Catch-up, where it is taking place, is due primarily to higher rates of

factor accumulation.

Three of the HPAEs are in the upper decile of the TFP distribution in

both sets of estimates-Hong

Kong, Taiwan, and Japan. Two othersThailand and Korea-are in the upper decile of the distribution based

on the full sample production function parameters, but they are unremarkable on the basis of the high-income country production function

parameters.l5 Three-Indonesia,

Malaysia, and Singapore-shift from

14. For a concise review of the arguments for technologicallybased catch-up, see Pack

(1993).

15. When we compare our estimates of TFP growth with two other independently

derived estimates for a large sample of countries (Elias, 1991; Fischer, 1993), the

pattern of productivitygrowth rates in Figure5 is remarkablyrobust to the specification of the growth accounting equation and to the capital stock series used. The IMF

The East Asian Miracle *231

modest, but positive, TFP growth to negative TFP growth when the

production function parameters are changed from those estimated from

the whole sample to those derived from the high-income sample.

Presumably in the high-income countries, most of the estimated TFP

growth is due to technical progress-advances in best practice-which

explains the relatively compact distribution of TFP growth rates between 0.5% and 1.5% per year, and the tendency among the highincome countries for TFP growth to decline with rising income (World

Bank, 1993). In low- and middle-income countries, however, changes in

TFP must reflect more than technical progress, otherwise we would

never find negative TFP growth rates.

We have already argued that TFP growth for low- and middleincome economies contains an element of catching up to (or falling

behind) best practice technologies. But TFP growth rates in a one-sector, cross-country estimate will also contain an element of allocative

efficiency; economies that allocate physical and human capital to low

yielding investments will have low or negative estimated TFP growth

rates. The clearest demonstrations of this are the 13 economies with

negative output growth and positive accumulation.

In an attempt to look at patterns of technologically based catch-up,

we assume that the elasticities of output that should be used to

calculate TFP change are those that apply to the high-income economies

only. We subtract the average rate of TFP change for the high-income

economies, which we associate with movements in international best

practice, from TFP change to get an estimate of technical efficiency

change. Using this method Hong Kong (2.0%), Japan (1.0%), Taiwan

(0.8%), and Thailand (0.1%) are the only HPAEs catching up to international best practice. Korea (-0.2%) was essentially just keeping pace

with technological progress in the high-income economies, while the

investment driven economies of Indonesia, Malaysia, and Singapore

were falling behind international best practice at rates of 1.2% (Indonesia) to 3.5% (Singapore) per year (Table 2).16

(1993) WorldEconomicOutlook,contrastingAsia with other developing economies,

reaches similar conclusions, both with respect to the estimated magnitudes of TFP

change and the relative contributionof TFP change to output growth. Thomas and

Wang (1993) and Edwards (1992) also reach broadly similar results concerning the

pattern of productivitychange in the HPAEscomparedwith other economies.

16. Friedberg,Khamis,and Page (1993),using a cross-countrystochasticfrontierproduction function to estimate movements in international best practice, reach similar

conclusions with respect to the pattern of technical efficiency change among the

HPAEs.

232 PAGE

Table2 TECHNICAL

EFFICIENCY

CHANGE

ESTIMATES

FORTHEHPAES

Economy/ Region

Hong Kong

Indonesia

Japan

Korea, Rep. of

Malaysia

Technicalefficiencychange,

1960-1989

1.9714

-1.2352

0.9876

- 0.2044

-1.7767

Singapore

- 3.4510

Latin America

-1.4217

Africa

- 3.4539

Taiwan

Thailand

0.8431

0.1067

Source:World Bank data.

When the HPAEs are contrasted with other developing regions,

however, their ability to keep pace with international best practice

seems somewhat more remarkable. Using the same method, we have

estimated the average rate of technical efficiency change for Latin

America (-1.4%) and Africa (-3.5%). Against these benchmarks, all of

the HPAEs except Singapore stand up well in terms of their ability to

keep pace with the world's shifting technological frontier.17

What, then, are we to make of the fundamentalist-mystic debate?

Figure 6 suggests that each camp can claim partial victory. The diagram

shows the relative contribution to output growth of factor accumulation

(share-weighted total input growth) and TFP growth.

When the TFP estimates based on the high-income country sample

are used, the dichotomy between investment driven and productivity

driven economies is dramatic.18 Rapid growth in Indonesia, Malaysia,

17. Alwyn Young (1992) in a well-known paper finds similarly disappointing results with

respect to Singapore's TFP performance. Some caution is needed in interpreting these

results, however. Much of Singapore's investment between 1960 and 1990 was in

housing and social infrastructure, output of which are notoriously difficult to measure. It is possible that we have undervalued the rate of growth of output and, hence,

the rate of TFP change. Similar detailed criticisms could be made for other economies,

both HPAE and non-HPAE, and our TFP results are best regarded as indicative of

broad international trends.

18. Despite the low elasticities of output with respect to capital in the full sample

production function, only 10 of the 60 non-HPAE low- and middle-income economies

have contributions of TFP growth exceeding 30%. Among the HPAEs, the

to a

investment-driven economies-Indonesia,

Malaysia, and Singapore-conform

typical developing economy pattern with a low (but positive) TFP contribution to

output growth. The productivity-driven economies-Japan, Korea, Taiwan, China,

Hong Kong, and Thailand-on the other hand are more unusual and look more like

advanced economies with a relatively high contribution of TFP to output growth of

above 30%.

The East Asian Miracle ?233

and Singapore is wholly due to high rates of factor accumulation.

Indeed, their productivity performance, like that of the vast majority of

developing economies, detracted from the potential output growth that

could have been achieved, based on their rates of factor accumulation.

Hong Kong, Taiwan, and Japan in contrast had relatively high TFP

growth rates and derived from 15% to 30% of their output growth from

TFP growth, a characteristic shared by only four other developing

economies. Thailand and Korea had rates and relative contributions of

were

TFP growth that were atypical for developing economies-they

for

The

than

the

relative

share

advanced

economies.

less

positive-but

and

of

of

sources

Korea,

Hong

Kong,

growth

Singapore, all

contrasting

of which shared essentially the same rate of growth, are a good

illustration of the varying roads to rapid growth among the HPAEs.

The East Asian success story is, then, primarily a fundamentalist one.

Depending on the estimates used, between 60% and 120% of their

output growth derives from accumulation of physical and human

capital and labor force growth. The results also suggest that the HPAEs

were unusually successful in allocating these factors of production. The

estimates of TFP growth based on the full sample address the following

question: Based on the average efficiency with which physical and

GROWTHAND PARTOF

Figure6 TOTALFACTORPRODUCTIVITY

GROWTHDUE TO GROWTHOF FACTORINPUTS,1960-1989

(HIGH-INCOMESAMPLEPARAMETERS)

4

TFP GROWTH

(percent p.a.)

30%

20%,

2

2* wan

Tai

C Japa

*1

-4

-2

0

2

4

6

Total Factor Input Growth (percent p.a.)

8

~

10

12

234 PAGE

human capital are used in the world economy, does accumulation overor underpredict income growth? The answer is that for most low- and

middle-income economies, it overpredicts growth, while for the HPAEs

it underpredicts. Even when the production function is estimated from

the high-income sample only, accumulation underpredicts growth for

five of the eight.

Nevertheless, mystics can claim some victories. The subset of productivity-driven HPAEs are unusual among developing economies because

of the relatively important role of TFP in their growth, even when

attempts are made, as here, to correct for the gains from superior

accumulation.9 They are also among the very few developing countries

keeping pace with or catching up to the moving target of international

and

best practice. Two of the productivity-driven economies-Taiwan

with

identified

economies

most

the

East

Asian

Japan-are among

activist policies to promote technological learning. Hong Kong-the

most productivity driven of all of the HPAEs-in contrast is the least

interventionist of the group. Taiwan, Korea, and Japan are economies in

which activist policies to allocate resources were undertaken, yet apparently without the deleterious effects that characterized the performance

of other economies with similar policies.

2.2 THEPOLICYORIGINSOF SUCCESS

The HPAEs have achieved rapid growth through successful attainment

of both fundamentalist and mystic objectives. They have performed

better than most low- and middle-income countries three critical funcallocation, and technological catch-up. They did

tions-accumulation,

this with combinations of policies ranging from market-oriented to state

led that varied both across economies and over time.

Despite the diversity there are a number of common policy threads

that bind the HPAEs. Macroeconomic management was unusually good

and macroeconomic performance unusually stable, providing the essential framework for private investment. Policies to increase the integrity

of the banking system, and to make it more accessible to nontraditional

savers, increased the levels of financial savings. Education policies that

focused on primary and secondary education generated rapid increases

in labor force skills. Agricultural policies stressed productivity change

toward best practice-should be free of the

19. Technical efficiency change-movement

allocative gains characteristic of TFP estimates by growth accounting methods (see

Nishimizu and Page, 1982). Friedberg, Khamis, and Page (1993), using a stochastic

frontier production function, find that the HPAEs are the only regional grouping of

developing countries that have consistently closed the gap with international best

practice.

The East Asian Miracle *235

and did not tax the rural economy excessively. All of the HPAEs kept

price distortions within reasonable bounds and were open to foreign

ideas and technology.

But these fundamental policies do not tell the entire story. In most of

these economies, in one form or another, the government intervened

and through multiple channels-to

foster develop-systematically

ment, and in some cases the development of specific industries. Policy

interventions took many forms-targeted and subsidized credit to selected industries, low deposit rates and ceilings on borrowing rates to

increase profits and retained earnings, protection of domestic import

substitutes, subsidies to declining industries, the establishment and

financial support of government banks, public investments in applied

research, firm- and industry-specific export targets, development of

export marketing institutions, and wide sharing of information between

public and private sectors. Some industries were promoted, while

others were not. These strategies of selective promotion were closely

associated with high rates of private investment and, in some of the

HPAEs, high rates of productivity growth.

The relative importance of policy fundamentals and selective interventions has been and will continue to be at the center of the debate

over the policy origins of East Asia's success. To consider in any depth

the catalogue of policies outlined earlier exceeds the scope of this essay.

Rather, we examine four possible lessons for public policy arising from

the HPAEs success.

3. ConventionalWisdom-Macroeconomic

Management

and EducationalStrategy

Among fundamental economic policies that have contributed to East

Asia's superior record of accumulation and allocation of resources, two

stand out-good macroeconomic management and emphasis on broadly

based education.20 The nature of the policies pursued and their impact

on growth in the HPAEs are described briefly in the following.

3.1 MAINTAININGMACROECONOMIC

STABILITY

In contrast with many other developing economies, the HPAEs have

been remarkably successful in creating and sustaining macroeconomic

20. World Bank (1993) enumeratesa number of other "policy fundamentals"that have

acted primarilyto increase accumulationand improve allocation.These are omitted

here to allow for a fuller discussion of the two described.Of the omitted fundamentals, perhaps the most significant is the focus on building secure, bank-based financial

systems.

236 PAGE

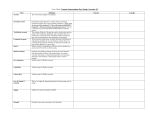

Table3 CONSOLIDATED

PUBLICSECTORDEFICITS,

SELECTED

EASTASIANAND OTHERECONOMIES

Economy/ Region

Averagepublic deficit,

percentageof GDP,

1980-1988

Rankamong 40

developingcountries

(1 = highest deficit)

1.89

10.80

5.80

6.39

2.82

34

6

23

HPAEs

Korea,Rep. of

Malaysia

Thailand

Average,40 developing economies

Average,OECDeconomies

Other economies

Argentina

Brazil

Mexico

Philippines

9.62

4.02

6.73

4.40

Source:Easterly, Rodriguez, and Schmidt-Hebbel (forthcoming).

stability. Here we consider the HPAEs' successful management of three

macroeconomic variables: budget deficits, external debt, and exchange

rates.

3.1.1 Budget Deficits and Inflation International experience suggests that

the macroeconomic consequences of public sector deficits depends on

how they are financed. Although the HPAEs' budget deficits are not

dramatically smaller as a group than those of other developing

economies, they were better at keeping deficits within the limits imposed by their ability to finance them without destabilizing the macroeconomy.21 The financing limits themselves were also higher due to the

more rapid growth of the HPAEs.

Table 3 shows consolidated public sector deficits for the 1980s for

three developing country HPAEs that have good data compared with a

sample of OECD and other developing economies. As a percentage of

21. The analysis in this section draws on W. Easterly and K. Schmidt-Hebbel, "The

Macroeconomics of Public Sector Deficits: a Synthesis" in W. Easterly, C. Rodriguez,

and K. Schmidt-Hebbel, eds., Public Sector Deficits and MacroeconomicPerformance,

Oxford University Press (forthcoming). The data on consolidated public deficits, as

well as the rest of the data in this section except where otherwise indicated, are from

the same source. Consolidated public deficits, though less widely available than

central government deficits, are a much more reliable indicator of fiscal management,

because they include operating deficits of public enterprises that have played a critical

role in some macroeconomic crises.

TheEastAsianMiracle?237

GDP, Korea's budget deficits were below even the OECD average.

Malaysia and Thailand are more complicated. Thailand's budget deficits

were about average for developing economies in the 1980s, while

deficits in Malaysia were substantially bigger than average. Both ran

larger budget deficits than such troubled economies as the Philippines,

Brazil, Argentina, and Mexico.

Unlike these and other economies that encountered difficulties, however, Malaysia and Thailand successfully financed their deficits. This

was possible for the following reasons:

* First, there was feedback from high growth. Because rapid growth

increased the demand for financial assets, Malaysia and Thailand

were able to absorb higher levels of monetary financing without a

rapid rise in inflation. Moreover, rapid growth in GDP raised the level

of sustainable domestic and external borrowing.

* Second, there was feedbackfrom high financial savings. Savings rates

were high in Malaysia and Thailand, and much of this saving went

into the domestic financial system (as opposed to real assets or capital

flight as in Latin America). This further increased the demand for

money and other domestic financial assets, making increased domestic financing of the deficit possible without resort to inflationary

financing. In Malaysia, the government Provident Fund mobilized

domestic saving for the government's use in noninflationary financing of the deficit.

* Third, there were low initial debt ratios. In Thailand, the initial level of

external debt to GDP was very low, which meant that external

financing was available when needed.

By holding public deficits within the bounds of prudent financing,

the HPAEs have avoided the inflation-inducing bursts of money creation that afflict other developing economies. Figure 7 shows money

creation as a ratio to GDP in Korea, Malaysia, and Thailand and in three

unstable comparators, Argentina, Mexico, and Zaire. The contrast is

striking: While money creation has been relatively constant among the

HPAEs, each of the comparators experienced two episodes of rapid

money creation when fiscal balances deteriorated or external financing

dried up.

Moderate inflation was a corollary of fiscal prudence (Table 4) .22 East

Asian governments never had to rely heavily on the inflation tax

22. Recentresearchsuggests that inflationbelow 20%,a level not breachedby any of the

HPAEs during their rapid growth periods, can be maintained for long periods

without generatingmacroeconomicinstability(Dombusch and Fischer,1993).

238 PAGE

because their deficits were within financable limits. In general, HPAE

governments have been strong enough to alter public spending and

foreign borrowing as needed, although in Thailand this has been a

continuous struggle (Warr and Nadhiprabha, 1993).

One result of low-to-moderate inflation rates particularly welcome to

business is stable real interest rates. Figure 8 shows real interest rates in

Korea, Malaysia, Thailand, Argentina, Ghana, and Mexico. As with

money creation, the contrast is remarkable. In the East Asian cases, low

inflation and flexible financial policies kept real interest rates within a

narrow range.

OF

Figure 7 REVENUESFROMMONEY CREATIONAS A PERCENTAGE

GDP:EXAMPLES

FROMEASTASIAAND OTHERSELECTED

ECONOMIES

14

(Percent)

.

12

Rep,of Kora_...

-Thailand

--.....

10

tsii

6

-

---

i

!

4

2

0

igII

\n---I

t

-2

iI

i

i

1970197219741976197819801982198419861988

14

1-^

I_pi

I-?--t-t

g

_____

___

/\

--TA~ire

{

j__

I

2

o

A

1970 1972 1974 1976 1978 1980 1982 1984 1986

Note: Revenues from money creation as a percentage

change in high-powered money to nominal GDP.

Source: World Bank data.

of GDP is defined as ratio of nominal

TheEastAsianMiracle?239

3.1.2 Managing Foreign Debt Of the seven developing HPAEs, only

Indonesia, Korea, Malaysia, and Thailand have public or publicly guaranteed foreign debt. The governments of the others-Singapore, Hong

Kong, and Taiwan-have not borrowed abroad. None of the four with

foreign debt has faced a crisis in the sense of having to reschedule debt,

but sharp increases in debt have led to rapid adjustment.

In Korea in 1980-1985, Malaysia in 1982-1988, and Indonesia since

1987, debt to GNP ratios have been quite high compared with other

indebted economies (Table 5). As with fiscal deficits, however, favorable

feedback from other policies enabled the HPAE debtors to sustain

higher ratios of external debt to GDP than other economies. In particular, high levels of exports have meant that foreign exchange was readily

available to service the foreign debt. For example, when Mexico faced

severe problems with its creditors in 1982, it had a much lower debt to

GNP ratio than Korea in 1984 but a much higher debt to export ratio.

3.1.3 ExchangeRate Management The evolution of exchange rate regimes

in the HPAEs has been broadly similar. Most moved from long-term

fixed rate regimes to fixed-but-adjustable rate regimes with occasional

steep devaluations to managed floating rate regimes. Due to the combination of moderate inflation and active exchange rate management, the

HPAEs avoided the severe exchange rate appreciation that beset Africa

Table4 INFLATIONRATES

/ Region

Economy

AverageCPI,

1961-1991

HPAEsa

7.5

Hong Kongb

8.8

Indonesiac

Korea,Rep. of

Malaysia

Singapore

Taiwan

Thailand

All low- and middle-incomeeconomies

South Asia

Sub-SaharanAfrica

LatinAmericaand Caribbean

12.4

12.2

3.4

3.6

6.2

5.6

61.8

8.0

20.0

192.1

aAverages are unweighted

b1972-91 only.

c1969-91 only.

Sources: World Bank data; World Bank (1992); Taiwan (1992).

240- PAGE

Figure 8 REAL INTEREST RATES:EXAMPLESFROM EAST ASIA AND OTHER

SELECTED ECONOMIES

20

Real Interest Rate (percent)

rCi

O

I

T

-20

,,/

-30

70,

-80

r--..

,

---

o or

r

alysiw'-.

T

I

-90

ffd----------.-i

-100

1970

20/

1972

1974

1976

1978

1980

1984

1982

1986

Real Interest Rate (percent)

i

V

i

-40

-50

-60

t

1

~~~~i-70

--ArPgeniar

;hn

-80

-90

i

-100

I

1970

1972

1974

1976

1978

M

co

I

1980

1982

1984

1986

Note: Real interest rates are defined as the deposit rate deflated by the consumer price index.

Bank data.

data.

Source:

Source:World

World Bank

TheEastAsianMiracle*241

and Latin America (Table 6) and achieved unusual stability of the real

exchange rate. The HPAEs' success at maintaining stable real exchange

rates is apparent in Figure 9, which contrasts real exchange rates since

1970 in Korea, Malaysia, and Thailand with those in Sri Lanka, Argentina, and Peru.

RESPONDINGEFFECTIVELY

SHOCKS One important

TO MACROECONOMIC

element of the HPAEs' capacity to maintain macroeconomic stability

has been their prompt and effective response to macroeconomic shocks.

The HPAEs made definite policy decisions to keep the macroeconomy

under control, rather than simply benefiting from a feedback from rapid

growth to macroeconomic stability. These decisions are illustrated by

the experiences of Korea and Thailand in adjusting to rather different

macroeconomic shocks.

KOREA

RETRENCHES

In 1979, Korea encountered a variety of problems

that threatened to undercut the 1970s impressive growth. Rising oil

prices depressed the terms of trade, the world recession dampened

export demand, and high interest rates increased debt service costs.

Real appreciation during the 1974-1979 fixed exchange rate regime had

made exports less competitive, the rice crop had failed, and the assassination of President Park Chung-Hee had exacerbated political uncertainty (Collins and Park, 1989). Korea responded with an aggressive

1980 stabilization package backed by IMF standby credits. The governTable 5 INTERNATIONAL INDEBTEDNESS

Ratioof totaldebt

to GNP

Economy/ Region

Peak yeara

Ratioof totaldebtto

exported

goods

andservices

1991

Peak yeara

1991

225.6

HPAEs

Indonesia

69

66.4

263.5

Korea,Rep. of

52.5

15.0

142.4

86.5

47.6

138.4

54.2

47.8

39.0

171.7

94.8

Malaysia

Thailand

All low- and middle-income

economies

South Asia

Sub-Saharan Africa

LatinAmericaand Caribbean

45.2

38.4

176.2

29.6

106.1

293.3

340.8

37.4

268.0

a1987 for Indonesia, and 1985 or 1986 for the other three countries.

Source:World Bank data.

242 PAGE

ment ended the fixed exchange rate regime, devalued the won by 17%,

and tightened monetary and fiscal policy. In 1980, output fell 5%,

inflation exceeded 25%, and the current account deficit approached 9%

of GDP. By 1982 inflation dropped to 7% and in 1983 to 3.4%. The

current account deficit fell to 2% of GDP in 1983.

IN THAILANDThailand only partially adjusted to

GRADUAL

ADJUSTMENT

the first oil shock and in the late 1970s engaged in a mild private and

public spending boom. By 1980-1981, the consolidated public sector

deficit was 7% of GDP, nearly half of which was the deficit of the

nonfinancial public enterprises, and the current account deficit was also

about 7%. Because past foreign borrowing had been moderate-the

debt/GDP ratio was only 35% in 1982-Thailand continued to have

access to international capital markets. Even so, the new government

that took over in 1980 perceived that macroeconomic adjustment was

needed.

Monetary policy options were limited by the fixed exchange rate and

the relatively open capital market. Therefore, the government took the

alternative path, fiscal contraction, moving gradually but consistently

Table6 AVERAGEAPPRECIATION

INDEX,1976-1985

Economy

HPAEs

Hong Kong

Index(highervalue

meansmore

appreciated)a

rank(100

Percentage

meansmost

0 least)

appreciated,

64

1

98

25

Korea,Rep. of

Malaysia

Singapore

Taiwan

Thailand

110

88

87

116

75

41

12

11

47

5

Otherselectedeconomies

Argentina

Bolivia

113

181

45

89

Cote d'Ivoire

185

90

Ghana

248

99

Nigeria

Zaire

277

201

100

95

Indonesia

aDollar's index is based on Summers-Heston purchasing power parity comparisons. An index

value of 100 signifies that the economy's deviation from PPP is where it should be given its per

capita income.

Source: Dollar (1992).

The East Asian Miracle 243

Figure 9 EXAMPLES OF REAL EXCHANGE RATE VARIABILITYIN EAST

ASIA AND OTHER SELECTED ECONOMIES

350

Real E-xchangze

Rate (percent)

300

~~

~

~

~

otKorei

i-Rep

200

150

0

1970 1972 1974 1976 1978 1980 1982 1984 1986 1988

350

Real ExchangeRate (percent)

300

L

L

--Argentina

~~~~~-Mexidco

-?eru

150

100

.......

0

1970 1972 1974 1976 1978 1980 1982 1984 1986 1988

Note: Index of real exchange rate: 1980

Source:World Bank data.

100; real depreciation

is down.

244. PAGE

over the next several years to cut expenditures and increase revenues.

Policymakers steeply cut deficits of the nonfinancial public enterprises,

then gradually reduced the central government deficit. As a result, the

consolidated government deficit declined from 8% of GDP in 1981-1982

to 1.6% in 1986-1987, when adjustment was essentially complete.

Meanwhile, steeper tax rates and tougher collection efforts boosted

central government tax revenue from 13% of GDP in 1982 to 16% in

1988.

3.1.4 MacroeconomicManagementand Rapid Growth It cannot be a coincidence that all of these seven economies have been exceptional highgrowth economies by world standards, and all have had unusual

success managing their macro economies over the long run. Cross-economy, econometric studies generally find that higher inflation, larger

budget deficits, and distorted foreign exchange markets reduce growth

(Fischer, 1993; Rodrick, 1993). All of the HPAEs but Indonesia and

Korea have been long-period, low-inflation economies, while Indonesia

and Korea fall into the moderately low-inflation category.

The channels by which inflation and budget deficits reduce growth

are also of some interest. Fischer (1993) concludes that high inflation

and high-budget deficits reduce both the rate of capital accumulation

and the rate of productivity change. Uncertainty, arising primarily from

the variability of inflation and the inconsistency of relative price signals,

reduces both private investment and the efficiency of resource allocation.

The HPAEs provide at least partial confirmation of this hypothesis.

Figure 10 shows private and public investment as a share of GDP for a

sample of 47 low- and middle-income countries (including five of the

developing country HPAEs) for which consistent data are available.23

The HPAEs are remarkable for their high share of private investment.

Private investment is about seven percentage points higher in the

HPAEs than in other middle-income economies. It rose from about 15%

of GDP in 1970 to nearly 22% in 1974, then declined and held at about

18% between 1975 and 1984. Private investment contracted sharply

between 1984 and 1986, reflecting the global recession, then recovered

by 1988.24 In contrast, private investment in other low- and middle-income countries has remained relatively stable at about 11% of GDP.

23. The data are drawn from Pfeffermann and Madarassy (1992).

24. This basic pattern is observed in four individual economies-Korea, Thailand, Singapore, and Malaysia. The pattern for Indonesia differs; real private investment declined

continuously during the 1980s from a peak of 20% of GDP to a low of 13% in 1989.

The East Asian Miracle ?245

One important element of the HPAEs' capacity to maintain macroeconomic stability has been their prompt and effective response to macroeconomic shocks. This has been greatly facilitated by two characteristics.

First, by limiting transfers to public enterprises and tightly supervising

banks, governments reduced the spillover from the real sector into the

financial sector that in other economies exacerbated fiscal woes. Second,

flexible labor and capital markets enabled the real sector to react quickly

to government initiatives, setting off new growth cycles that eased the

recessionary impact of stabilization measures.

Effective responses to macroeconomic shocks may also have contributed to the HPAEs' long-run growth. Relatively cautious fiscal and

foreign borrowing policies meant that serious debt crises were avoided,

Figure 10 PUBLICAND PRIVATEINVESTMENT

0.25

PrivateInvestment(as share of GDP)

0.2

0.15

0.1

i

0.05

tHPAS (w/oJapan)

-_ otherLMIEs

t

A

11

1974

1969

0.2

1979

1984

1989

PublicInvestment(as shareof GDP)

0.150.1-

0.05

ll

1969

1969

*HPA3s (w/o Japan)

-e-otheriLMIEs

l,,~~~~~~~~~~~~~~~~~~~~~~~~~~

1974

1979

Note: LMIEs = low- and middle-income

Source: World Bank data.

1984

economies.

1989

246 PAGE

which reduced the stop-go pattern of crisis and response that characterized many developing economies in the 1980s. Avoiding crisis and

the need for rescheduling meant that credit-worthiness was maintained, and it was easier to borrow in the short term and to avoid very

deep cuts, especially in investment.

In the 1970s overall levels of public investment did not differ markedly

between the HPAEs and other developing economies; over the decade

public investment rates in all economies rose from about 7% to 10%

(Figure 10). During the 1980s, public investment was higher in the

HPAEs than in other developing economies, but it had declined to

historical levels by the end of the decade. The HPAEs as a group

responded to the economic contraction of the 1980s by increasing public

investment above historically maintained levels. Sudden reductions in

aggregate demand and in investment compelled by debt crises were

major causes of the sharp declines in growth rates in many of the

heavily indebted economies of Latin America and elsewhere.

Better responses to macroeconomic shocks may also have resulted in

better measured productivity growth. A recent examination of the

sources of TFP change in developing countries concludes that in Latin

America and Africa, productivity levels increased relative to international best practice until 1973 and declined from 1973 onward, primarily

due to the inability of these economies to adapt to external shocks. The

decline was large enough in Latin America (and nearly large enough in

Africa) to offset gains due to technical progress (Friedberg, Khamis, and

Page, 1993).

The HPAEs, in contrast, are the only regional grouping of developing

economies that show steady improvement in productivity levels relative to international best practice. While macroeconomic contractions

are clearly visible in the HPAEs' pattern of movement of productivity

levels over time, the difference is the more rapid return to prior

productivity levels following the period of adjustment.

STRATEGIES

3.2 BROADLYBASEDEDUCATIONAL

In most of the economies of East Asia, public investments in education

were not only larger than elsewhere in absolute terms-they were also

better. They responded more appropriately to failures in the market for

education. Social rates of return to education are probably highest at

the primary level, where there are many positive externalities associated with literacy (Psacharopoulos, 1993). Capital market imperfections

and information problems, moreover, are also most severe at the primary level, reducing the scope for self-financed private systems. Returns from training at the university level, on the other hand, are

TheEastAsianMiracle?247

almost fully captured by the higher income of university graduates. All

of this argues for universal primary and broadly based secondary

education combined with restraint of public subsidies to higher education.

3.2.1 EducationalPerformancein the HPAEs This was precisely the educational strategy adopted by the HPAEs. Figures 11 and 12 present a

stylized summary of the results of regressing primary and secondary

enrollment rates on per capita national income for more than 90

developing economies for the years 1965 and 1987.25 Enrollment rates

are higher at higher levels of per capita income. But HPAE enrollment

rates have tended to be higher than predicted for their level of income.

At the primary level, this was most obvious in 1965, when Hong Kong,

Korea, Singapore, and Taiwan had already achieved universal primary

education, well ahead of other developing economies, and even Indonesia with its vast population had a primary enrollment rate above

70%.

By 1987, East Asia's superior education systems were evident at the

secondary level. Indonesia had a secondary enrollment rate of 46%,

well above other economies with roughly the same level of income, and

Korea had moved from 35% to 88%, maintaining its large lead in

relative performance. Only in Thailand was the 28% secondary enrollment rate well below the income-predicted 36% and the 54% mean for

middle-income economies.26 In recent years Thailand's weak educational performance has been felt, as serious shortages of educated

workers have begun to threaten continued very rapid growth. In part

as a function of their success in increasing enrollment, the East Asian

economies have also been faster to close the gap between male and

female enrollments.

A common, though imperfect measure of educational quality, is

expenditures per pupil. Between 1970 and 1989, real expenditures per

pupil at the primary level rose by 355% in Korea. In Mexico and Kenya,

expenditures rose by 64% and 38%, respectively, over the same time

period, and in Pakistan expenditures rose by only 13% between 1970

and 1985 (Birdsall and Sabot, 1993). These dramatic differences reflect

25. Behrman and Schneider (1992). The regressions control for a polynomial in average

per capita income in the relevant year. The authors used per capita GNP at official

exchange rates as the measure of income.

26. Despite increasing its secondary enrollment rate from 29% to 74%, Hong Kong also

fell well below the predicted level in 1987. This is because, at $15,000, the per capita

income of Hong Kong was so high that the OECD countries were now its comparators.

Figure 11 CROSS-ECONOMY REGRESSION FOR PRIMARYENROLLMENT RA

140

120 -

lindonesa (118)

137.01

Braz (10)

ial i

Singapore (105)

ip 21.91

Rep. ol Korea(1i

" 100

K

H

H15K

103)

)

129.2)f1i

3

Thaanad(95

1 P(

* -0

1.

Malaysa (90)

(179)

IC

E

/

80

e.0

H 1 --

60

' '

/

ngIadesh(59)

Pa

Thaian

.(40 d(7)

/

40 _

Pakistan

(52)

Bangladesh

(49)

1-14.9 1

1-14.91

iII/ *I Pakistan

I I (40)i II

1-24.5

',",'I,,'

20

0

*

A

1

'I,l ,'',tll

l l^^A I,lI,

I,l . . .

,,

vY

500

750

1,750

2,000

-

250

1-27.91

"I%#

.

iI

I

.I

I

?

i

i I i

500

PercapitaIncome(in1988U.S.dollars)

Note: Figures in parentheses are enrollment rates; bracketed numbers show residuals.

Source:Behrman and Schneider (1992).

I?

FORSECONDARY

REGRESSION

ENROLLMENT

Figure12 CROSS-ECONOMY

RA

E

c

J

o sla (46)

119.51

'P

0

0

t)

/

Pakslan(19)

Ia i-9.

/el

Bangladesh (18)

l-3.61

t

0

250

500

750

1,750

I

I

2,000

*

I

t

.

*

i

l

.

500

PercapitaIncome(in1988U.S.dollars)

Note: Figures in parentheses are enrollment rates; bracketed numbers show residuals.

Source: Behrman and Schneider (1992).

ll

250 PAGE

mostly differential changes over the period in income growth and in

the number of children entering schools, both of which favored the East

Asian economies. A somewhat better measure of school quality is the

performance of children on tests of cognitive skills, standardized across

economies. In the relatively few international comparisons available

from such tests, East Asian children tend to perform better than children from other developing regions-and

even, recently, better than

children from high income economies.27 Table 7 offers some comparative data on expenditures per pupil in the HPAEs and other countries

between 1965 and 1989.

3.2.2 Focusing Educational Spending Higher shares of national income

devoted to education cannot fully explain the larger accumulation of

human capital in the HPAEs. In both 1960 and 1989, public expenditure

on education as a percentage of GNP was not much higher in East Asia

than elsewhere (Table 8). In 1960 the share was 2.2% for all developing

economies, 2.4% for sub-Saharan Africa, and 2.5% for East Asia. Over

the three decades that followed, governments of East Asia markedly

increased the share of national output they invested in formal education. But so did governments in other developing regions. In 1989 the

share in Africa, 4.1%, was higher than the East Asian share, 3.7%, which

barely exceeded the average share for all developing economies, 3.6%.28

The allocation of public expenditure between basic and higher education is the major public policy factor that accounts for East Asia's

extraordinary performance with regard to the quantity of basic education provided. The share of public expenditure on education allocated

to basic education has been consistently higher in East Asia than

elsewhere. The share of public funds allocated to tertiary education in

East Asia has tended to be low, averaging roughly 15% over the

last three decades.29 In Latin America the share has been roughly

27. Birdsall and Sabot (1993) cite Stevenson and Stigler (1992), among others, who report

results of tests in cities of Japan, the United States, and Taiwan.

28. Government expenditure on education, expressed as a percentage of GNP, was used

as an explanatory variable in a cross-country regression in which expected years of

schooling of the school-age cohort (essentially an aggregate of enrollment rates) is the

independent variable. For a sample of 15 Asian and Latin American countries, the

expenditure variable was insignificant. See Tan and Mingat (1992).

29. In Korea and Taiwan the share of public expenditure on education allocated to higher

education has increased over the last decade or so for two reasons. On the one hand,

universal and near universal enrollment rates have been achieved at the primary and

secondary levels, respectively. On the other hand, the increase has been consistent

with the shift in the structure of production and exports to more technologically

sophisticated and skill-intensive products, and the consequent increase in the demand

for engineers and other skilled workers.

Table 7 PUBLIC EXPENDITURE PER STUDENT ON PRIMARYAND SECONDARY

1965

Economy

HPAEs

Hong Kong

Korea, Rep. of

Malaysia

Singapore

Thailand

Primary

198

1975

Secondary

Primary

Secondary

Primary

558.1

389.8

351.2

834.0

133.0

9.9

14.7

192.3

51.2

180.5

32.9

17.6

67.7

193.3

49.0

314.7

74.8

Other selectedeconomies

Brazil

Ghana

22.3

India

5.3

28.9

Kenya

Mexico

23.8

Pakistan

5.9

76.9

179.1

122.0

71.3

336.7

56.6

7.1

17.5

30.9

110.2

15.9

315.2

33.4

Note: Cells are empty where data are unavailable.

Source:Computed from UNESCO and World Bank data.

155.4

27.9

38.1

50.3

101.9

21.1

252 PAGE

Table 8

PUBLIC EXPENDITUREON EDUCATION

AS A PERCENTAGEOF GNP

1960

1989

HPAEs

Hong Kong

Korea, Rep. of

Singapore

Malaysia

Thailand

Indonesiaa

Averageb

2.0

2.8

2.9

2.3

2.5

2.5

2.8

3.6

3.4

5.6

3.2

0.9

3.7

Other

Brazil

Pakistan

Less developed

1.9

1.1

1.3

3.7

2.6

3.1

2.4

4.1

Economy/Region

economiesc

Sub-Saharan Africa

aAlternativesources of data indicate that expenditure on public

education as a percentage of GDP was 3.0%in Indonesia in 1989.

Average does not include Indonesia.

CLower-and middle-income economies.

Source:United Nations Development Program (1991).

24%.30In South Asia the share is close to the Latin American level. This

had been the case in Africa as well, but in recent years the share has

declined to East Asian levels.

The broad base of human capital was critically important to rapid

growth in the HPAEs. Because the HPAEs attained universal primary

education early, literacy was high and cognitive skill levels were substantially above those in other developing economies. Basic education

in the HPAEs is highly oriented to the acquisition of general academic

skills, while postsecondary education tends to be oriented toward

vocational skills. Some HPAEs have also been unusually large-scale

importers of educational services, particularly in vocationally and technologically sophisticated disciplines. Firms, therefore, had an easier

time upgrading the skills of their workers and mastering new technology. In addition, rapid human capital accumulation reduced income

inequality by increasing the relative abundance of educated workers,

thereby lowering the scarcity rents associated with cognitive skills.

30. Given the smaller size of the basic education age cohort in East Asia than in Latin

America, this difference underestimates the gap between the two regions in the

strength of the public sector's commitment to basic education.

The East Asian Miracle ?253

These benefits were particularly evident in the countryside (Birdsall

and Sabot, 1993).

4. UnconventionalWisdom-The ExportPush

and IndustrialPolicies

Most East Asian governments have pursued sector-specific industrial

policies to some degree. The best known instances include Japan's

heavy industry promotion policies of the 1950s and the subsequent

imitation of these policies in Korea. These policies included import

protection as well as subsidies for capital and other imported inputs.

Malaysia, Singapore, Taiwan, and even Hong Kong have also established programs-typically

with more moderate incentives-to

accelerate development of advanced industries. In the capital market,

governments intervened systematically both to control interest rates

and to direct credit.

Industrial targeting could have resulted in extensive rent seeking and

great inefficiency. Because it apparently did not, the success or failure of

selective interventions are among the most controversial aspects of the

East Asian success story. Some of the reasons why selective interventions do not appear to have had the disastrous results of those pursued

in other developing economies are straightforward. Labor market policies in the HPAEs tended to emphasize flexibility and competitive

determination of wages (Fields, 1993). Directed credit programs were

undertaken within a framework of generally low subsidies to borrowers

and careful monitoring (Vittas and Cho, 1993). As a consequence, the

relative prices of labor and capital in the HPAEs were closer to their

scarcity values than in other developing economies (World Bank, 1993).

Nevertheless, abundant evidence exists that, especially in the cases of

Japan, Korea, and Taiwan, governments made systematic efforts to alter

industrial structure for the purpose of accelerating productivity change.

The impact of these policies on the HPAEs growth remains a topic of

heated debate.31 This section proposes two policy lessons: first, that

promotion of manufactured exports was a significant source of measured TFP change, and second, that industrial policies mattered relatively little in the overall record of East Asia's extraordinary growth.

The upshot of these propositions is that export-not industrial-promotion was at the heart of the HPAEs' productivity performance.