* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Productivity Commission 2014: Auto Report

Survey

Document related concepts

Economic growth wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Transformation problem wikipedia , lookup

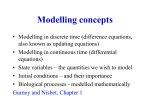

Economy of Italy under fascism wikipedia , lookup

Okishio's theorem wikipedia , lookup

Economic calculation problem wikipedia , lookup

Transcript

The Productivity Commission 2014 Auto Report – A Critique Phil Toner [email protected] Political Economy Department The University of Sydney Roni Demirbag [email protected] 1 Overview: Rationale for the PCs opposition to industry policy Modelling results and assumptions Criticism of the PC approach. 2 PC Arguments Against Assistance Misallocation of resources due industry specific assistance. Dynamic efficiency losses: ‘dulls the incentive for firms to improve productivity’ (PC 2014a:77) Crowding out: ‘one industry’s expansion usually results in another’s contraction’ (PC 2012:26), ‘Tariffs do not have any significant impact on the total level of employment in the economy as a whole’ (PC 2000:22) Adjustment costs modest compared to the benefits from reduction in distortions. All Industry specific assistance is measured by the PC as a deadweight loss. Promotes rent-seeking behaviour 3 6 Common Arguments in Support of Industry Policy Unemployed resources Distorted International Markets Increasing Returns Technological Spillovers Leontief Multipliers Excessive Exchange Rate Appreciation 4 Modelling Results -1 Table 1: Source of job losses Passenger motor Input-supply vehicle manufacturing industries(a) 9 080 23 530 Model Total 32 610 Assumed Total 40,000 Source PC 2014b: Table C.4 (a) All industries supplying inputs to the domestic passenger motor vehicle manufacturing industry (including automotive components suppliers). 5 Modelling Results - 2 Table 2: Selected Main Aggregate Long-run Effects From 2020-21 Variable Percent Change Real GDP 0.1 Real gross national 0> <0.05 expenditure Real exchange rate -0.4 Export volumes 2.3 Import volumes 2.0 Terms of trade -.3 Real unit labour cost -.2 Source PC 2014b: Table 2.2 6 Modelling Result - 3 Table 3: Selected Main Long-run Industry Effects From 2020-21 Variable Percent Change Employment 0 Held fixed by assumption. Value Added Agriculture 0.8 Mining 2.4 Manufacturing -1.6 Services 0> <0.05 Employment Agriculture 1.3 Mining 2.5 Manufacturing -1.2 Services 0> <0.05 Source PC 2014b: Table 2.1 7 Modelling Assumptions Employment is fixed in the long run: ‘employment effects of a shock to the economy are largely eliminated after 5 years’ (Dixon and Rimmer 2002, [.205) Resource allocation based on neoclassical production function. Capital is ‘malleable’ but labour is not. Different occupational groups Constant returns to scale: ‘’The model also does not capture factors such as economies of scale or scope that change the commercial viability of production units or lead firms to concentrate new production at a particular plant or in a particular location’’ (Productivity Commission 2014b: 7) Unemployment floor is determined by the natural rate. High rates of substitution of domestic production for imports and vice versa (High Armington Elasticities) High export demand elasticity with respect to prices of Australia’s commodity exports. Australia has little influence over world prices of the products they sell. 8 Lower level Assumptions for the Car Industy Modelling Under-estimating the impact of passenger car industry: Only direct and first round effects. After closure of the car industry at the end of 2017 $621m is reallocated as a lump-sum to households. Closure of the passenger car making industry and its supply chain results in the unemployment of 40,000 workers and associated capital stock. ‘These initial effects trigger changes in prices of products, labour and capital which lead to output changes throughout the economy’ (Productivity Commission 2014b: 12). 9 Criticism Two approaches: Challenge the validity of the various parameters and closures that are commonly accepted to be inherently subjective yet very crucial in the results obtained from the modelling. Investigate the broad theoretical framework of the model and assess whether or not they support the bold claims made by the PC. In this study we focus on the latter rather than the former. 10 MMRF Model Each state and territory is treated as a separate economy. 64 industries and commodities in each state 8 occupation groups in each state labour market, labour free moves interstate due to changes in 'occupationalspecific real wages'. A household sector in each state and territory 8 state and territory governments the Australian Government 11 Breakdown of 64 Industries: 6 agricultural and related industries 6 mining industries 21 Manufacturing industries 8 Utility Industries 2 Construction industries 4 trade, repair and food and accommodation industries 8 transport industries 9 finance, government and other service industries 12 Production functions 3 levels of nested production function. First level fixed proportion to output Second level is represented by the CES production function. Third level is also represented by the CES production function. The economy as a whole is represented by the Leontief Production function Difference between MMRF5 and MMRF-Auto 14 13 What is MMRF? Is it a general equilibrium model? Computable General Equilibrium (CGE) Model. Johansen 1960, Extension of the ORANI model Applied General Equilibrium (AGE) Models – Herbert Scarf Velupillai (2006) AGE non computable. Why is the difference important? Assumption of full employment and Efficient resource allocation. 14 Capital Theory Debates Three key neoclassical parables: 1. An inverse, monotonic relation between quantity of capital and rate of interest; 2. Return on capital is based on the natural or technical properties of the diminishing marginal productivity of capital; and 3. Distribution of income between capital and labour depends on relative scarcity and marginal products. Wicksell effects – ‘reswitching’ and ‘reverse capital deepening’ – Demand curve for capital is not always sloped downwards. 15 Samuelson concedes ‘The phenomenon of switching back at a very low interest rate to a set of techniques that had seemed viable only at a very high interest rate involves more than esoteric technicalities. It shows that the simple tale told by Jevons, Böhm-Bawerk, Wicksell, and other neoclassical writers—alleging that, as the interest rate falls in consequence of abstention from present consumption in favor of future, technology must become in some sense more “roundabout,” more “mechanized,” and “more productive”—cannot be universally valid.’ (Samuelson 1966a; emphasis added) 16 Two alternate paths Lowbrow: Admit the logical problems but challenge the empirical significance. Highbrow: Admit the logical problems and move on to General Equilibrium theory to avoid aggregation of capital. 17 Lowbrow ‘The Crux of the matter is that economists may be unable to make any statements concerning the relation of production to competitive input and output markets....I believe they can; but that is a statement of faith...’(Ferguson, 1969, p.269) Solow: ‘I have never thought of the macroeconomic production function as a rigorously justifiable concept. In my mind, it is either an illuminating parable, or else a mere device for handling data, to be used so long as it gives good empirical results, and to be abandoned as soon as it doesn’t, or as soon as something better comes along’ (1966, pp.1259-60). 18 Empirical verification Underlying accounting identity. Phelps Brown (1957) Shaikh (1974, 1980) – Humbug production function Herbert Simon: 'Fitted Cobb–Douglas functions are homogeneous, generally of degree close to unity and with a labor exponent of about the right magnitude. These findings, however, cannot be taken as strong evidence for the [neo]classical theory, for the identical results can readily be produced by mistakenly fitting a Cobb–Douglas function to data that were in fact generated by a linear accounting identity (value of goods equals labor cost plus capital cost' (1979, p.497). Can Neoclassical Economics afford to be roughly correct? 19 General Equilibrium Arrow-Debreu General Equilibrium Disaggregated, all goods (including capital goods) are treated separately. Hahn: representing the ‘invisible hand’ Equilibrium was proven to exist (Arrow and Debreu) Was equilibrium Unique and Stable? Sonnenschein-Mantel-Debreu theorem (SMD): Anything goes! Solow: ‘in the aggregate, the hypothesis of rational behaviour has in general no implications (Arrow 1986, p.S388). Income effect and substitution effect. 20 General Theory of the Second Best Lipsey and Lancaster (1956-1957) if the theoretically optimum cannot be attained because of one Paretian condition being unattainable due to constraints, then other Paretian conditions may be attainable, but they ‘are, in general, no longer desirable’ 21 Dynamic Efficiency Static allocative efficiency (Neoclassical theory) Dynamic efficiency PC recognises the difficulty of dynamic efficiency but ignores it in their analysis. Their model cannot capture the dynamic change let alone quantify it. Ignoring dynamic change implies that PC is ignoring productivity! Carveth Read ‘It is better to be vaguely right than exactly wrong’ (1914, p.310) 22