* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download original Powerpoint file

Survey

Document related concepts

Transcript

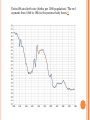

THE ABC’S OF BUSINESS VALUATION Jim Turner, C.P.A. CVA Turner Business Appraisers & Advisors SEMINAR OBJECTIVES You will learn how to utilize the 3 established approaches to value a business and we will estimate the value employing a good rule of thumb By the end of our session you will understand the basic steps required to calculate the value of a business….Valuation is both an Art and a Science We will discuss the nuances of valuing businesses; including marketability discounts, normalizing adjustments and the concept of control BUSINESS VALUATION & THE BABY BOOMERS 75 Million baby boomers 7 Million own privately held businesses It is forecasted that between 1.36 and 2 million firms will be for sale in the next five to ten years United States birth rate (births per 1000 population). The red segment from 1946 to 1964 is the postwar baby boom.[2] WHY VALUE A BUSINESS? Buy/Sell decisions Gift or Estate Tax (IRS) Shareholder actions Equitable distribution Key man or Key Woman Life insurance WHO ARE THE EXPERTS ABV = Accredited in Business Valuation CVA = Certified Valuation Analyst is a CPA, MBA, Ph.d or Degreed Financial Professional ASA = An Accredited Senior Appraiser APPROACHES TO VALUING A BUSINESS The established approaches to value IRS Revenue Ruling 59-60 Income Approach Market Approach Asset Approach Sanity Check/Quick estimate Rules of thumb SAMPLE BUSINESS VALUATION Purpose of the valuation – The owner is contemplating selling the business; so he wants to know the fair market value of the business in exchange Common deal terms of a small business transaction Asset Sale Includes: Equipment, inventory and goodwill Does not include: Cash or accounts receivable THE AMERICAN DREAM Living the Dream! OUR ENTREPRENEURS SAMPLE BUSINESS VALUATION SAMPLE BUSINESS VALUATION SAMPLE BUSINESS VALUATION INCOME APPROACH SAMPLE BUSINESS VALUATION IBBOTSON BUILD-UP METHOD Source: 2013 Ibbotson® Stocks, Bonds, Bills and Inflation Valuation Yearbook, Morningstar, Inc., Chicago, Illinois. SAMPLE BUSINESS VALUATION INCOME APPROACH SAMPLE BUSINESS VALUATION MARKETABILITY DISCOUNT (INCOME APPROACH) SAMPLE VALUATION MARKET APPROACH PRATTS STATTS® DATABASE SIC:5812/NAICS:722515 SAMPLE VALUATION MARKET APPROACH SAMPLE VALUATION ADJUSTED NET ASSET VALUE APPROACH The appraised fair market value of the equipment was $60 SAMPLE BUSINESS VALUATION Summarized results table Based upon the results of the 3 approaches to value; our opinion of value for the subject company is $1,500 SANITY TEST SANITY TEST CONTINUATION USING RULES OF THUMB RULES OF THUMB The single best source for rules of thumb for small business is the, “Business Reference Guide,” published by Business Brokerage Press Pricing multiples: multiples of EBITDA or SDE Sellers discretionary earnings is earnings before interest, taxes, depreciation and amortization plus one owners salary or “EBITDAOC “ – Multiple of sales RULES OF THUMB Restaurants --- Limited Service (NAICS 722211) Rules of Thumb 30 to 40 percent of annual sales for independents; 45 to 60 percent for many franchises---plus inventory 1.5 to 2.5 SDE (Sellers Discretionary Earnings) plus inventory Source: West, Thomas L., 2013 Business Reference Guide, “Published by Business Brokerage Press.” Page-689 RULES OF THUMB *Rule of Thumb #1 is in harmony with the results of the income approach and our opinion of value - $1,500. PART II – THE FUTURE AFFECTS VALUE TODAY INDUSTRY INDICATORS US consumer spending on services, a measure of demand for specialty eateries, rose 1.9 percent in August 2013 compared to the same month in 2012. US personal income, which drives consumer spending at specialty eateries, rose 3.7 percent in August 2013 compared to the same month in 2012. US retail sales for food services and drinking places, an indicator of specialty eatery sales, increased 3.8 percent in the first nine months of 2013 compared to the same period in 2012. http://subscriber.hoovers.com.proxy183.nclive.org/H/industry360/overview.html?industryId=1445 INDUSTRY GROWTH FORECAST First Research forecasts are based on INFORUM forecasts that are licensed from the Interindustry Economic Research Fund, Inc. (IERF) in College Park, MD. INFORUM's "interindustry-macro" approach to modeling the economy captures the links between industries and the aggregate economy. Source:http://subscriber.hoovers.com.proxy183.nclive.org/H/industry360/overview.html?industryId=1445 FEDERAL RESERVE BEIGE BOOK Fifth District--Richmond Beige Book -October 16, 2013 District economic conditions improved modestly, on balance, since our last report. Source: http://www.federalreserve.gov/monetarypolicy/beigebook/beigebook201310.htm?richmond NORTH CAROLINA ECONOMIC OUTLOOK SUMMER 2013 Executive Summary: A Return to Growth, and the Old Issues Economic improvement is expected to continue in North Carolina in the second half of 2013 and in 2014. Nationally, 2 million payroll jobs will be added in 2013, and 2.5 million payroll jobs will be added in 2014, thereby lowering the jobless rate to 6.8% at the end of 2013 and 6.2% at the close of 2014. Source: http://ag-econ.ncsu.edu/sites/agecon.ncsu.edu/files/faculty/walden/nceconomicoutlooksummer2013.pdf CHARLOTTE MSA ECONOMY The Charlotte-Concord-Gastonia area economy grew by nearly five percent in real terms in 2012 making it the 29th fastest growing out of 381 metropolitan areas in the country. This growth was broad-based and propelled by strengthening financial services and durable goods manufacturing among others. Source:http://www.nccommerce.com/LinkClick.aspx?fileticket=5USMpqUbpJU%3d&tabid=3466&mid=9134 THE ABC’S OF BUSINESS VALUATION SAMPLE #2 What if the business is expected to experience revenue and profit growth in subsequent years? Sample 2 revenue & expense growth assumptions: SAMPLE-2 WITH 4-5% ANNUAL GROWTH SAMPLE -2 DCF WITH FORECASTED 4-5 % ANNUAL GROWTH RATE PART III – “APPLES TO APPLES ” COMMON SIZE ANALYSIS COMMON SIZE BALANCE SHEET *Source: https://www.profitcents.com/USEN/runreport/generatereport.aspx?GUID=40b10acb-4149-4d43-9b7ccbd4b6e1e2f2 COMMON SIZE INCOME STATEMENTS *Source: https://www.profitcents.com/USEN/runreport/generatereport.aspx?GUID=40b10acb-4149-4d43-9b7ccbd4b6e1e2f2 Checking the pulse of a business: Key Financial Ratios LIQUIDITY A measure of the company's ability to meet obligations as they come due. = (Cash + Accounts Receivable) / Total Current Liabilities PROFITS & PROFIT MARGIN A measure of whether the trends in profit are favorable for the company. = Gross Profit / Sales ASSETS A measure of how effectively the company is utilizing its gross fixed assets. = Net Income / Total Equity OVERVIEW OF I&N, LLC. RATIOS COMPARED TO INDUSTRY PEERS Rating Metric LIQUIDITY PROFITS & PROFIT MARGIN SALES BORROWING ASSETS Source: https://www.profitcents.com/USEN/runreport/generatereport.aspx?GUID=40b10acb-4149-4d43-9b7ccbd4b6e1e2f2 PART IV – “NORMALIZING” IS AN EFFORT TO ADJUST TAX OR GAAP BASIS FINANCIALS INTO ECONOMIC REALITY It is widely accepted that most financial statements often paint a picture that is different from economic reality* Highly aggressive expensing policies to reduce income taxes Excessive or insufficient compensation to owner(s) Lavish perquisites (perks) paid to the owner(s) Leases (Capital vs. Operating) Source: “Business Valuations: Fundamentals, Techniques and Theory,” 1995-2009 National Association of Certified Valuation Analysts 2009.v3, page-3-3 SAMPLE #3 NORMALIZING ADJUSTMENT TO OWNERS COMPENSATION NORMALIZED NET CASH FLOW SAMPLE #3 CAPITALIZATION OF EARNINGS METHOD W/WAGE NORMALIZING CONCLUSION Fifty-one percent is usually one-hundred percent better than forty-nine percent. Peanuts, popcorn, cotton-candy, cigarettes….discount for a lack of marketability Render unto Caesar that which is Caesars (normalizing adjustments) OUR ENTREPRENEURS AFTER THE SALE