* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

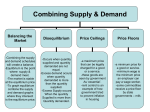

Download Chapter 3 - Demand, Supply, and Market Equilibrium

Survey

Document related concepts

Transcript