* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Franchise Business Economic Outlook for 2016

Survey

Document related concepts

Transcript

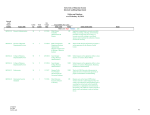

Franchise Business Economic Outlook for 2016 Prepared for: International Franchise Association Educational Foundation By: IHS Economics January 2016 No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. About IHS Economics IHS Economics is one of the leading economic analysis and forecasting firms in the world. With over 600 economists and industry specialists in 25 offices worldwide, IHS Economics offers market intelligence for over 200 countries and coverage of over 170 industries that helps more than 3,800 clients to monitor, analyze, and interpret conditions affecting their business. IHS Economics has an established track record for providing rigorous, objective forecast analysis and data to businesses, governments, and industry associations around the world. About IHS (www.ihs.com) IHS (NYSE: IHS) is a leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk, and security; environmental, health and safety, and sustainability; country and industry forecasting; and commodities, pricing and cost. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, United States, IHS employs more than 5,500 people in more than 30 countries around the world. For more information, contact: John Reynolds President, IFA Educational Foundation [email protected] Alisa Harrison Senior Vice President, Communications and Marketing [email protected] James Gillula Managing Director, IHS Economics [email protected] For press information, contact: Katherine Smith Media Relations Manager, IHS [email protected] (C) Copyright 2016. IFA Educational Foundation. ALL RIGHTS RESERVED. All information contained herein is obtained by IHS Economics from sources believed by it to be accurate and reliable. All forecasts and predictions contained herein are believed by IHS Economics to be as accurate as the data and methodologies will allow. Because of the possibilities of human and mechanical error, however, as well as other factors such as unforeseen and unforeseeable changes in political and economic circumstances beyond IHS Economics control, the information herein is provided “as is” without warranty of any kind, and IHS Economics, AND ALL THIRD-PARTY PROVIDERS, MAKE NO REPRESENTATIONS OR WARRANTIES EXPRESS OR IMPLIED TO ANY SUBSCRIBER OR ANY OTHER PERSON OR ENTITY AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY, OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY OF THE INFORMATION OR FORECASTS CONTAINED HEREIN. No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Table of Contents EXECUTIVE SUMMARY .................................................................................................................................. 1 Franchise Business Index .......................................................................................................................... 3 INTRODUCTION ............................................................................................................................................. 5 THE ECONOMIC OUTLOOK............................................................................................................................ 6 OUTLOOK FOR FRANCHISE BUSINESS ........................................................................................................... 8 Outlook Summary ..................................................................................................................................... 8 Establishments by Business Line ............................................................................................................. 14 Employment by Business Line................................................................................................................. 15 Output by Business Line.......................................................................................................................... 17 Franchise Businesses' Contribution to GDP ............................................................................................ 18 Distribution by Sector ............................................................................................................................. 18 Output per Employee.............................................................................................................................. 20 Composition of Franchise Business Lines ............................................................................................... 22 Methodology........................................................................................................................................... 23 No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. EXECUTIVE SUMMARY This report presents a forecast of the franchise sector of the US economy in 2016 prepared by IHS Economics for the International Franchise Association Educational Foundation. The US economy still faces headwinds from a weak global economy and a strong dollar, but recent data confirm the mostly sound foundations of the US economic recovery led by solid growth in consumer spending and housing. IHS expects that real GDP growth will accelerate between the fourth quarter of 2015 and the end of 2016. Consumer spending will rebound from a weak fourth quarter, and the inventory cycle that depressed growth in 2015 will likely come to an end in the first half of 2016. In addition, the drag from the plunge in energy-sector capital spending will wind down, and the recent congressional agreement on taxes and spending will add 0.1-0.2 percentage point to growth over the coming year. As expected, the Federal Reserve Board raised the federal funds rate by 25 basis points in December. We expect the Fed to continue to raise rates by 25 basis points in each quarter of 2016. But this will not hinder the durability of the recovery. We expect real GDP growth to accelerate from 2.4% in 2015 to 2.7% in 2016. With data for 2015 now nearly complete, we estimate that the franchise sector finished the year slightly stronger than projected in our September 2015 report. We estimate that the number of franchise establishments increased 1.7% in 2015, franchise employment was up 3.0%, and franchise output grew 5.6%. All of these figures are higher than our mid-2015 forecasts, and all represent an improvement over rates of growth in 2014. We see further improvement in the pace of growth of the franchise sector in 2016 as consumer spending remains strong and business spending accelerates: We expect the number of franchise establishments to increase by 1.7% in 2016, matching the pace of growth in 2015. Employment growth in the franchise sector will continue to outpace the growth of employment in all businesses economy-wide, as it has in each of the last five years. We expect franchise employment to increase 3.1% in 2016, while total private nonfarm employment will increase 1.9%. Over the six-year period, 2011-2016, average annual job growth in the franchise sector, at 2.7%, will be 0.5 percentage points higher than for all businesses economy-wide. Growth of the output of franchise businesses in nominal dollars will accelerate to 5.8% in 2016 – ahead of the 5.6% gain ion 2015 – as output per worker in the franchise sector increases slightly. The gross domestic product (GDP) of the franchise sector will increase by 5.6% to $552 billion in 2016. This will exceed the growth of US GDP in nominal dollars, which is projected at 4.4%. The franchise sector will contribute approximately 3% of US GDP in nominal dollars. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 1 Franchise Business Growth by Year, 2009-2016: January 2016 Forecast 8% 6% 4% Establishments Employment 2% Output 0% GDP -2% -4% 2009 2010 2011 2012 2013 2014 2015 2016 Our analysis is based on a grouping of franchise businesses into 10 broad business lines. The growth outlook differs among the groups, with output growth in 2016 ranging from a low of 4.4% in the commercial & residential services business line to 6.6% in lodging. Other highlights of the industry forecast for 2016 are: As overall consumer spending maintains a 3% growth pace in 2016, the outlook for the retail products & services franchises will remain strong. The retail business line is projected to rank first in employment growth at 3.7% and second in output growth at 6.4%. Business spending will also accelerate in 2016, giving a boost to business services franchises, which are projected to rank first in growth of the number of establishments and tied for second in employment growth with a 3.3% gain. Both the quick service and table service restaurant business lines will continue to be among the growth leaders, each with 3.3% employment growth and 6.3% output growth in 2016. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 2 Franchise Business Economic Outlook 2016: January 2016 Forecast Employment (thousands) Establishments Output ($Billions) Percent Amount Change Over Previous Year Percent Amount Change Over Previous Year Percent Amount Change Over Previous Year Automotive Business Services Commercial & Residential Services Lodging Personal Services Quick Service Restaurants Real Estate Retail Food Retail Products & Services Table/Full Service Restaurants 31,968 99,029 64,670 27,479 115,783 159,839 91,950 63,840 103,130 38,244 1.5% 2.0% 1.6% 1.8% 1.8% 1.5% 1.7% 1.5% 1.9% 1.6% 199.3 1,026.7 384.5 771.7 720.5 3,446.8 327.8 535.5 547.0 1,152.2 3.0% 3.3% 2.8% 2.8% 2.6% 3.3% 2.4% 3.2% 3.7% 3.3% 43.84 175.60 59.31 96.33 101.53 248.28 57.44 44.61 46.58 70.09 4.6% 5.9% 4.4% 6.6% 4.9% 6.3% 5.7% 4.7% 6.4% 6.3% TOTAL 795,932 1.7% 9,111.9 3.1% 943.60 5.8% Franchise Business Index The estimates of output, employment and the number of establishments in the franchise industry reported here provide valuable measures of the size and growth of the industry. But, because most of the key data inputs required to make these estimates are published only on an annual basis, the estimates are made only at an annual frequency. A more timely reading of the business environment for franchise operations in the US is provided by the Franchise Business Index (FBI) – a monthly index of franchise activity that was developed for IFA by IHS. The FBI combines indicators of the growth or decline of industries where franchise activity has historically been concentrated with measures of the demand for franchise business services and the general business environment. The components of the index are: Employment in Franchise Businesses (ADP) Number of Self Employed (BLS) Unemployment Rate (BLS) Retail Sales of Franchise-Intensive Industries (Census Bureau) Small Business Optimism Index (NFIB) Small Business Credit Conditions Index (NFIB) The Franchise Business Index increased by an average 0.3% per month over the last three months (September through November), and the index was up 2.5% in November compared to November 2014. All components of the index made positive contributions to the FBI over this 3-month period. Among individual components, strong gains in employment (as measured by ADP’s franchise employment series) and retail sales of franchise-intensive retailers contributed most. Small business optimism IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 3 improved steadily over the period. Month-to-month changes in credit conditions and were mixed but still positive on balance over the 3-month period. Franchise Business Index Percent Change August 2015 Sept 2015 Oct 2015 Nov 2015 12-month Nov-Nov 116.2 -0.1% 116.7 0.4% 116.9 0.2% 117.4 0.4% 2.5% IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 4 INTRODUCTION This report presents a first look at the outlook for the franchise sector of the US economy in 2016 prepared by IHS Economics for the International Franchise Association Educational Foundation. The following section presents a summary of the current IHS forecast of the US economy in 2016, with attention to economic indicators that relate to sectors of the economy where there is a significant concentration of franchising. We then present an overview of our estimates and forecasts of franchising for 10 business lines: 1 1. Automotive 2. Business Services 3. Commercial & Residential Services 4. Lodging 5. Personal Services 6. Quick Service Restaurants 7. Table/Full Service Restaurants 8. Real Estate 9. Retail Food 10. Retail Products and Services For each of the 10 business format lines, the projections include estimates through 2015 and an initial forecast for 2016 of: Franchise establishments2 Franchise employment3 Franchise nominal output4 1 This report does not include estimates for product-distribution franchises, such as automotive and truck dealers, gasoline service stations without convenience stores, and beverage bottlers. 2 An establishment is a single physical location at which business is conducted or services or industrial operations are performed. A business may consist of more than one establishment. An establishment may be owned by the franchisor or the franchisee. 3 Positions filled by part-time and full-time employees or by self-employed individuals. 4 Nominal output is the gross value of goods and services produced -- a concept that is comparable with "sales" for most industries. In government input-output accounts, the output of goods-producing industries is measured by the value of shipments. For most other industries, output is measured by receipts or revenues from goods and services sold. A special case is the output of the wholesale and retail industries, which is measured generally as the difference between receipts or revenues and the cost of goods sold—this difference is referred to as "margin." IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 5 THE ECONOMIC OUTLOOK Recent data confirm the mostly sound foundations of the US economic recovery—solid growth in consumer spending and housing, but pain in parts of the manufacturing sector because of a strong dollar and an inventory cycle. Although real GDP grew 2.0% in the third quarter and is expected to advance only 1.2% in the fourth quarter, the corresponding growth rates of real final sales to domestic purchasers (GDP less inventories and less exports) are 2.7% and 2.3%. IHS expects that real GDP growth will accelerate between the fourth quarter of 2015 and the end of 2016, as some of the drags on growth ease. First, the inventory cycle will likely come to an end in the first half of 2016. Second, the drag from the plunge in energy-sector capital spending will wind down. Third, the recent congressional agreement on taxes and spending will add 0.1-0.2 percentage point to growth over the coming year. Together, this means that growth will improve from 2.4% in 2015 to 2.7% in 2016. Real GDP Growth (Percent change, annual rate) 5% 4% 3% 2% 1% 0% -1% -2% 2013Q1 2014Q1 2015Q1 2016Q1 IHS Economics, January 2016 Forecast As expected, the Federal Reserve raised its overnight federal funds rate by 25 basis points at its December policy meeting, signaling confidence in the recovery’s sustainability. This was the first rate hike in more than nine years—and seven years since rates were pushed to zero. We expect there will be four more 25-basis-point rate increases in 2016, but this gradual pace of rising short-term interest rates will not slow the recovery. The consumer outlook for 2016 remains positive. Real disposable income is expected to increase 3.1% in 2016 after a 3.6% gain in 2015. Real consumer spending growth is expected to increase 3.1% in 2015 and 3.0% in 2016. Auto sales still remain a bright spot, but less dependent on pent-up demand than in the early years of the recovery. We expect light-vehicle sales to increase from 17.4 million units in 2015 to 17.8 million units in 2016. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 6 The pending home sales index that measures contract signing activity has fallen in three of the last four months, which suggests that there is underlying softness in the market for existing homes. Thus, existing home sales are expected to improve modestly to 5.3 million units in 2016, up only 1.7%. However, the outlook for housing starts is stronger. We expect starts to surpass a 1.3-million-unit annualized rate by the end of 2016 – up 14% for the year. New home sales will follow, averaging 588,000 units in 2016, the highest level since 2007. Nonresidential construction, which grew at a spectacular 42.8% annual rate in the second quarter as spending on manufacturing plants soared, has plateaued. Manufacturing construction, which is at elevated levels, is set to contract significantly in 2016. The trade-weighted dollar exchange rate was 10% higher at the end of 2015 than it was at the start. IHS expects the dollar to strengthen further over the first half of this year because of tightening Fed policy and accelerating US growth. Thereafter, as world growth picks up and other countries start to raise interest rates, the dollar should begin a slow multiyear descent. Exports and imports will respond to the stronger dollar, taking small slices off growth every quarter, but not enough to keep overall growth from accelerating in 2016. The Economic Outlook for 2016 (Annual percent change) 2012 2013 2014 2015 2016 Real Gross Domestic Product 2.2% 1.5% 2.4% 2.4% 2.7% Total Nonfarm Employment 1.7% 1.7% 1.9% 2.1% 1.7% Accommodations and Food Services 3.2% 3.6% 3.1% 3.1% 1.7% Personal Services 1.3% 1.0% 1.6% 1.2% 0.3% Real Disposable Income 3.1% -1.4% 2.7% 3.6% 3.1% Real Personal Consumption 1.5% 1.7% 2.7% 3.1% 3.0% Food Services 2.1% 1.3% 3.1% 4.6% 3.6% Accommodations 5.5% 3.0% 2.6% 3.8% 2.5% Personal Services 1.7% 0.4% 3.7% 3.2% 2.3% Retail Sales (nominal dollars) 4.9% 3.9% 3.9% 2.1% 3.7% Existing Home Sales 8.9% 9.0% -3.0% 5.9% 1.7% 13.2% 6.8% 12.6% 11.1% 6.3% Com'l & Indus. Loans Outstanding, Com'l.Banks IHS Economics, January 2016 Forecast IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 7 OUTLOOK FOR FRANCHISE BUSINESS Outlook Summary Many of the factors that have been creating a drag on real GDP growth, such as weak exports, flat government spending and an inventory correction, are of less direct relevance for the health of the franchise sector of the economy. As summarized above, the fundamentals of consumer spending are positive and business investment (outside the oil industry) is beginning to accelerate. Thus, many franchise businesses saw good business conditions in 2015 and will continue to see good business conditions in 2016. By most measures, the franchise sector will continue to grow at rates that exceed the economy-wide growth of industries where franchises are concentrated: We estimate that the number of franchise establishments increased by 1.7% in 2015, and we expect this pace of establishment growth to be maintained in 2016. Franchise employment was up an estimated 3.0% in 2015, and we project a comparable gain of 3.1% in 2016. In comparison, total non-farm private sector employment is projected to increase 1.9% in 2016 after a 2.4% gain in 2015. Growth of the output of franchise businesses in nominal dollars will accelerate from an estimated 5.6% in 2015 to 5.8% in 2016 as output per worker in the franchise sector increases in several business lines. The gross domestic product (GDP) of the franchise sector will increase by 5.6% to $552 billion in 2016. This will exceed the growth of US GDP in nominal dollars, which is projected at 4.4%. The franchise sector will contribute approximately 3% of US GDP in nominal dollars. Franchise Business Economic Outlook: January 2016 Forecast 2008 Establishments Percent change Estimates 2009 2010 2011 2012 2013 2014 774,016 746,646 740,098 736,114 747,359 757,857 769,782 0.4% -3.5% -0.9% -0.5% 1.5% 1.4% 1.6% Forecast (Jan. 2016) 2015 2016 782,573 1.7% 795,932 1.7% Employment ('000) Percent change 8,028 0.4% 7,800 -2.8% 7,780 -0.3% 7,940 2.1% 8,127 2.3% 8,334 2.5% 8,573 2.9% 8,834 3.0% 9,112 3.1% Output ($Billions) Percent change 696 3.2% 674 -3.2% 699 3.6% 734 5.0% 768 4.7% 804 4.7% 845 5.0% 892 5.6% 944 5.8% GDP ($Billions) Percent change 410 1.8% 405 -1.2% 414 2.2% 434 4.8% 453 4.4% 473 4.4% 496 4.8% 523 5.5% 552 5.6% IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 8 The following chart shows how the franchise economy has fared over the last three years, along with our 2016 forecast, by various measures. Growth rates of output and GDP are in nominal dollars. Franchise Business Growth, 2013-2016: January 2016 Forecast 8% 6% 2013 4% 2014 2% 2015 0% 2016 -2% -4% Establishments Employment Output GDP To provide background for our view of how different segments of the franchise sector will fare in 2016, we review IHS forecasts of employment and output in the industries where there is a large concentration of franchise businesses. Key drivers of the franchise economy drawn from the IHS US Industry and US Macroeconomic forecasts are summarized below. Automotive: On the commercial vehicle side, capacity in the trucking industry is tight and getting tighter. As the economy continues to recover and grow, the demand for shipping has roared back. The American Trucking Association reported their advanced seasonally adjusted For-Hire Truck Tonnage Index equaled 135.1 (2000=100) in September, which was the second highest level on record; the alltime high of 135.8 occurred in January 2015. Trucking companies will need to make investments in new fleet capacity as well as try to maintain the current fleet. Thus, it will also behoove fleets and individual owner operators to step up their equipment maintenance. The growth of light vehicle sales is forecast to slow to 2.1% in 2016 after growing an estimated 5.8% in 2015. However, the age of the average vehicle on the road is near record highs. The continued improvement in the labor market, along with continued low interest rates in the near term, should help boost confidence for bigger ticket item purchases. Economy-wide, consumer spending on auto parts is expected to increase 4.3% in 2016. We estimate that output of the automotive franchise business line increased 4.6% in 2015, and the forecast for 2016 shows growth continuing at this pace. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 9 Employment in the automotive business line is expected to be up 3.0% in 2015 and to continue this pace in 2016. While this will outpace the overall auto parts and tire sales industry, it will keep the automotive business line among the slowest growing of the 10 franchise business lines, ranking sixth in employment growth and ninth in output growth. Commercial & Residential Services: Nominal spending on household services is expected to rise 4.4% in 2016 after increasing 4.7% in 2015. Existing home sales grew an estimated 5.9% in 2015, but growth is expected to slow to 1.7% in 2016. However, housing starts increased an estimated 11% in 2015 and are forecast to grow 14% in 2016. This should boost such businesses as architectural, project management and contracting firms and special trade contractors. Our estimates of employment and output of the commercial & residential services business line in 2015 show growth of 2.8% and 4.4%, respectively, which is slightly stronger growth than we forecast in our September report. We expect a similar pace of growth for this business line in 2016. Table/Full Service Restaurants: As the job market continues to improve, gasoline prices remain low and wages are starting to see some modest pick-up, consumers are able to spend more on food away from home. It appears that one area where consumers have spent some of their windfall in purchasing power from lower gasoline prices is in eating out, as economy-wide sales in both segments of the industry are on a pace to finish the year with growth rates near 8-9%. Full service restaurant sales growth outpaced the QSR segment in three of four years during 2011-2014 and likely did so again in 2015. Within the franchise full service restaurants business line, we have boosted our forecast of 2015 sales slightly, and it now shows a 6.1% increase in 2015. We project 6.3% growth of sales in 2016. This will translate into higher productivity, as we project a 3.3% increase in employment in 2016. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 10 Quick Service Restaurants: Improving employment and wage growth in the overall economy is particularly good for the QSR industry as time for meals becomes crunched with more people working and spending time commuting. As reported above, we expect total nonfarm employment growth (including government employment) of 1.7% in 2016 – slightly lower than the 2.1% growth in 2015. The improving economy along with prospective increases in the minimum wage in many states is tightening the labor market – especially for the restaurant industry. Some QSR restaurants have increased their benefits in efforts to attract employees. We estimate the number of QSR establishments increased by 1.4% in 2015, and we expect a slight uptick in 2016 to 1.5% growth. The QSR business line will remain among the leaders of the franchise sector in employment growth in 2016, with a 3.3% gain, and we expect QSR output (sales) to grow by 6.3% in 2016. Retail Food: A sharp increase in spending on food away from home has come to some extent at the expense of slower growth of consumer purchases of food for off-premises consumption. Economy-wide consumer spending on food and beverages for off-premises consumption grew an estimated 1.3% in nominal dollars in 2015 – below the average pace of 2.1% of the previous three years. The retail food franchise business line ranked last in establishment growth of the ten industries in 2015 and this ranking is expected to hold in 2016 with establishment growth of 1.5%. Retail sales of food stores of all types (including their sales of non-food items) grew by 2.7% in 2015, and their sales growth is expected to increase to 3.1% in 2016. We expect franchise employment and output within the retail food business line to outpace these industry-wide growth trends. Our forecast for this business line shows a 3.2% increase in employment and sales (output) growth of 4.7% in 2016. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 11 Lodging: The lodging industry has posted several years of solid growth, with sales gains continually outpacing the annual increase in employment. Employment growth in the industry in 2015 is estimated at 1.3%, and it is expected to slow to less than half a percent in 2016. Recent data on the lodging industry from the ADP National Franchise Report and our industry data indicate that the franchise segment of the industry has shared in these trends. We estimate that franchise employment in the lodging business line grew 2.8% in 2015 and will show a similar increase in 2016. Output growth in the lodging business line is expected to slow to 6.6% in 2016, but it will remain the fastest growing business line based on output. Real Estate: As noted above in discussing the commercial & residential services business line, we expect existing home sales to show further gains in 2016, but at a somewhat slower pace than in 2015. Despite the recent action by the Federal Reserve to begin what will likely be a series of increases in the federal funds rate, we do not expect mortgage interest rates to rise enough to derail the housing market recovery. The federal funds rate will likely be more than 1 percentage point higher in the fourth quarter of 2016 than in the fourth quarter of 2015. But we expect the 30-year conventional mortgage rate to increase by only 0.7 points over the year, from 3.9% in 2015:Q4 to 4.6% in 2016:Q4. We estimate that the output of the franchise real estate business line increased 5.2% in 2015, and we expect a 5.7% increase in 2016 – near the average for the franchise sector as a whole. Employment in the real estate business line is expected to increase 2.4% in 2016. Retail Products & Services: Retail sales excluding food and automotive products grew an estimated 3.4% in 2015 and are expected to grow 4.5% in 2016. However, growth will slow in two categories of retailers – sporting goods and hobby stores where growth is projected to slow to 3.2% growth in 2016 after seeing 6% growth in 2015, and clothing and accessory stores where growth will slow to 2.0% growth in 2016 after 2.9% growth in 2015. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 12 Employment data from the ADP National Franchise Report indicate that the franchise retail products & services business line continues to outperform the franchise sector as a whole and other retail industries. This business line will rank number one in terms of employment growth in 2016 (at 3.7%) as it did in 2015. This will support strong sales growth of 6.4% in 2016 and establishment growth of 1.9% ranking it second in terms of growth by both measures. Business Services: The IHS US Industry Service forecasts healthy growth in 2016 in a wide range of business services. Employment in all professional and technical services is expected to be up 4.5%, including accounting and bookkeeping services up 2.0%, and architectural and engineering services up 4.4%. The franchise business services industry has been one of the leaders among franchise business lines in establishment and employment growth, with increases of 2.0% and 3.3%, respectively, in 2015. We project similar growth rates in 2016, and this will support output growth of franchise business services of 5.9%, ranking it fifth among business lines. Personal Services: The personal services business line includes a diverse array of services such as educational services, health care, entertainment and recreation, personal and laundry services, and selected financial activities. Economy-wide personal consumption spending in the category that includes most of these personal services grew by an estimated 3.6% in 2015 – down slightly from our mid-year forecast. However, 2016 growth in spending on these personal services is expected to improve to 4.5%. We estimate that employment in franchise personal services increased 2.6% in 2015, with output up 4.9%. We expect similar growth rates by both measures for this business line in 2016. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 13 Establishments by Business Line Historically, total US establishments have exhibited growth of 1 to 2% in the initial years of a recovery and then accelerated. However, during the current recovery business formation has lagged, as has growth of the number of establishments. IHS estimates that growth of the number of establishments economy-wide has improved only slightly since 2012. We estimate that the number of franchise establishments increased 1.7% across all 10 business-format lines in 2015 and growth will match this pace in 2016. The business services line will take the lead with 2.0% growth, followed closely by the retail products & services line at 1.9% growth. Franchise Establishments by Business Line, 2009-2016: January 2016 Forecast Estimates 2009 2010 Automotive 30,012 Percent change Business Services Percent change Commercial & Residential Services Percent change Lodging Percent change Personal Services Percent change Quick Service Restaurants Percent change Real Estate Percent change Retail Food Percent change 29,687 2011 2012 2013 2014 29,984 30,344 30,648 31,002 Forecast (Jan. 2016) 2015 2016 31,481 31,968 -5.2% -1.1% 1.0% 1.2% 1.0% 1.2% 1.5% 1.5% 89,691 89,147 90,035 91,746 93,581 95,268 97,130 99,029 -6.9% -0.6% 1.0% 1.9% 2.0% 1.8% 2.0% 2.0% 62,650 61,272 60,169 60,951 61,804 62,666 63,660 64,670 -4.1% -2.2% -1.8% 1.3% 1.4% 1.4% 1.6% 1.6% 25,588 25,410 25,003 25,553 25,987 26,490 26,980 27,479 -3.7% -0.7% -1.6% 2.2% 1.7% 1.9% 1.8% 1.8% 106,510 106,100 105,463 107,572 109,293 111,728 113,739 115,783 -3.8% -0.4% -0.6% 2.0% 1.6% 2.2% 1.8% 1.8% 150,316 149,547 147,902 151,156 152,970 155,189 157,429 159,839 -1.0% -0.5% -1.1% 2.2% 1.2% 1.5% 1.4% 1.5% 88,372 86,153 84,947 86,221 87,687 88,945 90,383 91,950 -6.6% -2.5% -1.4% 1.5% 1.7% 1.4% 1.6% 1.7% 60,374 60,173 60,474 60,776 61,323 62,070 62,924 63,840 -3.0% -0.3% 0.5% 0.5% 0.9% 1.2% 1.4% 1.5% Retail Products & Services 97,519 96,921 96,630 96,823 97,840 99,321 101,187 103,130 Percent change Table/Full Service Restaurants -1.0% 35,614 -0.6% 35,688 -0.3% 35,507 0.2% 36,217 1.1% 36,724 1.5% 37,103 1.9% 37,660 1.9% 38,244 Percent change Total -1.7% 0.2% -0.5% 2.0% 1.4% 1.0% 1.5% 1.6% 746,646 740,098 736,114 747,359 757,857 769,782 782,573 795,932 IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 14 Franchise Business Establishments Growth: January 2016 Forecast 4% 3% 2% 1% 0% -1% -2% -3% -4% 2009 2010 2011 2012 2013 2014 2015 2016 Employment by Business Line We estimate that total franchise employment grew 3.0% in 2015, and we expect a similar pace of employment growth in 2016 (3.1%). Six of the business lines will maintain their growth pace of 2015, while four business lines – quick service and full service restaurants, real estate and retail food – will see slightly higher growth in employment in 2016. Our forecast shows retail products & services maintaining its 2015 lead in employment growth in 2016 at 3.7%, followed closely by business services, which will take over second place from quick service restaurants. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 15 Franchise Employment by Business Line, 2009-2016: January 2016 Forecast Automotive Percent change Business Services Percent change Commercial & Residential Services Percent change Lodging Percent change Personal Services Percent change Quick Service Restaurants Percent change Real Estate Percent change Retail Food Percent change Retail Products & Services Percent change Table/Full Service Restaurants Percent change Total Forecast (Jan. 2016) 2015 2016 Estimates 2009 2010 2011 2012 2013 2014 174,889 173,546 177,885 180,198 183,802 187,875 193,510 -5.4% -0.8% 2.5% 1.3% 2.0% 2.2% 3.0% 3.0% 889,721 874,087 883,702 903,143 933,850 961,927 993,766 1,026,669 199,316 -6.8% -1.8% 1.1% 2.2% 3.4% 3.0% 3.3% 3.3% 343,531 336,317 342,034 347,849 355,502 363,999 374,089 384,462 -3.9% -2.1% 1.7% 1.7% 2.2% 2.4% 2.8% 2.8% 671,702 674,953 691,827 699,437 709,229 730,264 750,681 771,673 -3.6% 0.5% 2.5% 1.1% 1.4% 3.0% 2.8% 2.8% 618,069 622,864 635,321 647,392 661,635 684,503 702,304 720,524 -3.8% 0.8% 2.0% 1.9% 2.2% 3.5% 2.6% 2.6% 2,887,550 2,882,638 2,951,821 3,046,279 3,140,714 3,238,075 3,337,993 3,446,816 -1.1% -0.2% 2.4% 3.2% 3.1% 3.1% 3.1% 3.3% 295,954 290,329 294,974 301,168 308,095 313,541 320,223 327,801 -6.6% -1.9% 1.6% 2.1% 2.3% 1.8% 2.1% 2.4% 468,868 468,172 473,790 481,844 490,035 503,450 518,819 535,491 -3.0% -0.1% 1.2% 1.7% 1.7% 2.7% 3.1% 3.2% 464,036 468,883 476,385 483,531 494,169 508,635 527,240 546,958 -1.1% 1.0% 1.6% 1.5% 2.2% 2.9% 3.7% 3.7% 985,999 988,044 1,012,745 1,036,038 1,056,759 1,080,731 1,115,369 1,152,235 -1.7% 0.2% 2.5% 2.3% 2.0% 2.3% 3.2% 3.3% 7,800,319 7,779,833 7,940,484 8,126,879 8,333,790 8,573,000 8,833,994 9,111,945 Franchise Business Employment Growth: January 2016 Forecast 6% 4% 2% 0% -2% -4% 2009 2010 2011 2012 2013 2014 2015 2016 IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 16 Output by Business Line We estimate that total output across all franchise business lines grew 5.6% in 2015 – up from 5.0% growth recorded in 2014. We expect further improvement in the pace of growth in 2016 to 5.8%. The lodging business line was the growth leader in 2015, and it is expected to maintain that position in 2016, with growth of 6.6% in both years. Retail products & services is projected to maintain its second place among business lines with expected 2016 growth of 6.4% – up from 6.2% in 2015. Both restaurant business lines are also projected to see output growth rates over 6% in 2016. Franchise Output by Business Line, 2009-2016: January 2016 Forecast ($billions) Automotive Percent change Business Services Estimates 2009 2010 2011 2012 2013 2014 Forecast (Jan. 2016) 2015 2016 31.16 33.56 36.32 37.62 38.72 40.08 41.92 43.84 -7.2% 7.7% 8.2% 3.6% 2.9% 3.5% 4.6% 4.6% 175.60 128.62 132.61 137.38 142.60 149.45 156.49 165.77 Percent change -4.1% 3.1% 3.6% 3.8% 4.8% 4.7% 5.9% 5.9% Commercial & Residential Services 46.32 46.55 48.23 50.20 52.36 54.40 56.80 59.31 Percent change -4.3% 0.5% 3.6% 4.1% 4.3% 3.9% 4.4% 4.4% 62.79 67.62 72.83 75.82 79.23 84.80 90.38 96.33 Lodging Percent change Personal Services Percent change Quick Service Restaurants Percent change Real Estate Percent change Retail Food Percent change Retail Products & Services Percent change Table/Full Service Restaurants Percent change Total -7.6% 7.7% 7.7% 4.1% 4.5% 7.0% 6.6% 6.6% 74.43 77.85 82.29 85.42 88.15 92.22 96.77 101.53 -2.3% 4.6% 5.7% 3.8% 3.2% 4.6% 4.9% 4.9% 173.55 179.51 187.48 197.23 209.26 220.77 233.55 248.28 1.2% 3.4% 4.4% 5.2% 6.1% 5.5% 5.8% 6.3% 44.83 42.18 42.82 46.16 49.29 51.63 54.34 57.44 -8.7% -5.9% 1.5% 7.8% 6.8% 4.7% 5.2% 5.7% 31.92 34.12 36.47 37.75 39.11 40.74 42.60 44.61 -7.9% 6.9% 6.9% 3.5% 3.6% 4.2% 4.6% 4.7% 31.89 34.19 36.41 37.94 39.37 41.24 43.79 46.58 1.0% 7.2% 6.5% 4.2% 3.7% 4.8% 6.2% 6.4% 70.09 48.78 50.64 53.48 57.22 59.28 62.15 65.94 -0.8% 3.8% 5.6% 7.0% 3.6% 4.8% 6.1% 6.3% 674.30 698.84 733.71 767.97 804.22 844.52 891.85 943.60 IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 17 Franchise Business Output Growth: January 2016 Forecast 8% 6% 4% 2% 0% -2% -4% 2009 2010 2011 2012 2013 2014 2015 2016 Franchise Businesses' Contribution to GDP By analyzing the components of value added in each of the industries where franchise businesses are concentrated and calculating the relationship between gross output (sales) and value added in these industries, IHS Economics developed estimates of the contribution to US GDP by the franchise sector as a whole. We estimate that franchise businesses accounted for approximately 3% of US GDP or a total of $523 billion in 2015. Based on our employment and output forecasts for franchising in 2016, we project that nominal GDP of the franchise sector will increase by 5.6% to $552 billion in 2016. This will exceed the growth of total US GDP in nominal dollars, which – with moderately low inflation – is projected at only 4.4% in 2016. Distribution by Sector This section focuses on the distribution of the 10 franchise business lines in terms of the number of establishments, employment, and output, based on our forecast for 2016. The quick service restaurants business line is the largest category, with 20% of all franchise establishments, and accounts for 38% of franchise employment. This business line is expected to contribute 26% of total output in 2016. Second in size in terms of the number of establishments is the personal services line, with 15% of the total. However, these are generally smaller businesses. The personal services group will account for only 8% of franchise employment and 11% of output. The table/full service restaurants group occupies the second-largest share of employment, accounting for 13% of the total. The business services segment, which has higher ratios of output per establishment and per employee, is the second-largest contributor to the value of output in the franchise sector, with 19% of the total. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 18 IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 19 Output per Employee Average output per employee in franchise businesses is projected to increase to $103,557 in 2016 – up 2.6% compared to 2.5% growth in 2015. In 2015, this output-per-worker ratio varied among the 10 franchise business lines from a low of $59,116 (table/full service restaurants) to a high of $216,624 (automotive). The average output per worker in the franchise sector has grown since 2009, increasing at a compound annual growth rate of 2.6%, and will continue to rise in 2016. The productivity pattern of franchise businesses during and after the recession is consistent with other US industries, where revenues initially fell at a greater rate than worker lay-offs, and later rose at a faster pace because employers started to rehire workers only slowly. In 2010, average productivity rose by nearly 4% as the economy began to bounce back from the recession. We estimate that franchise sector productivity gained 2.9% in 2011 and 2.3% in 2012. Productivity growth continued to show modest gains in 2013 and 2014 with annual increases of 2.1%, and accelerated to 2.5% growth in 2015. The lodging business line and the automotive line were the fastest growing in terms of output per worker over the 2010-2016 timeframe, with compound annual growth rates of 4.3% and 2.3% respectively. The real estate sector, which experienced declines in 2010 and 2011, had the slowest growth of output per worker over this period. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 20 Franchise Productivity by Business Line, 2009-2016: January 2016 Forecast (Dollars per worker) Automotive Percent change Business Services Estimates 2009 2010 Forecast (Jan. 2016) 2015 2016 2011 2012 2013 2014 178,197 193,404 204,158 208,793 210,635 213,348 216,624 -1.9% 8.5% 5.6% 2.3% 0.9% 1.3% 1.5% 1.5% 144,563 151,710 155,461 157,895 160,033 162,685 166,810 171,040 219,949 Percent change 3.0% 4.9% 2.5% 1.6% 1.4% 1.7% 2.5% 2.5% Commercial & Residential Services 134,835 138,416 141,002 144,329 147,295 149,438 151,830 154,262 Percent change Lodging Percent change Personal Services Percent change Quick Service Restaurants Percent change Real Estate Percent change Retail Food -0.5% 2.7% 1.9% 2.4% 2.1% 1.5% 1.6% 1.6% 93,477 100,190 105,273 108,397 111,710 116,122 120,396 124,827 -4.2% 7.2% 5.1% 3.0% 3.1% 3.9% 3.7% 3.7% 120,430 124,994 129,528 131,943 133,234 134,723 137,789 140,915 1.5% 3.8% 3.6% 1.9% 1.0% 1.1% 2.3% 2.3% 60,102 62,273 63,514 64,745 66,629 68,180 69,967 72,033 2.4% 3.6% 2.0% 1.9% 2.9% 2.3% 2.6% 3.0% 151,469 145,293 145,151 153,254 159,996 164,662 169,682 175,234 -2.3% -4.1% -0.1% 5.6% 4.4% 2.9% 3.0% 3.3% 68,074 72,879 76,984 78,347 79,811 80,927 82,105 83,298 Percent change -5.1% 7.1% 5.6% 1.8% 1.9% 1.4% 1.5% 1.5% Retail Products & Services Percent change 68,733 2.0% 72,920 6.1% 76,437 4.8% 78,470 2.7% 79,660 1.5% 81,074 1.8% 83,061 2.4% 85,160 2.5% Table/Full Service Restaurants 49,477 51,248 52,805 55,231 56,098 57,507 59,116 60,826 0.9% 3.6% 3.0% 4.6% 1.6% 2.5% 2.8% 2.9% 86,445 89,827 92,401 94,497 96,501 98,509 100,956 103,557 Percent change Total IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 21 APPENDIX Composition of Franchise Business Lines 1. Automotive: Includes motor-vehicle parts and supply stores, tire dealers, automotive equipment rental and leasing, and automotive repair and maintenance. 2. Commercial & Residential Services: Includes building, developing, and general contracting; heavy construction; special trade contractors; facilities support services; services to buildings and dwellings; and waste management and remediation services. 3. Quick Service Restaurants: Includes limited-service eating places, cafeterias, fast-food restaurants, beverage bars, ice cream parlors, pizza-delivery establishments, carryout sandwich shops, and carryout service shops with on-premises baking of donuts, cookies, and bagels. 4. Table/Full Service Restaurants: Establishments primarily engaged in providing food services to patrons who order and are served while seated (i.e., waiter/waitress services) and pay after eating 5. Retail Food: Includes food and beverage stores; convenience stores; food-service contractors; caterers; retail bakeries; and beer, wine, and liquor stores; as well as gas stations with convenience stores. 6. Lodging: Includes hotels, motels, and other accommodations. 7. Real Estate: Includes lessors of buildings, self-storage units, and other real estate; real estate agents and brokers; and property management and other related activities. 8. Retail Products & Services: Includes furniture and home furnishings stores, electronics and appliance stores, building-material and garden-equipment and supplies dealers, health and personal-care stores, clothing and general merchandise stores, florists and gift stores, consumer-goods rentals, photographic services, and book and music stores. 9. Business Services: Includes printing, business transportation, warehousing and storage, dataprocessing services, insurance agencies and brokerages, office administrative services, employment services, investigation and security services, tax-preparation and payroll services, and heavy equipment leasing. 10. Personal Services: Includes educational services, health care, entertainment and recreation, personal and laundry services, veterinary services, loan brokers, credit intermediation and related activities, and personal transportation. IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 22 Methodology The statistics in this report were derived from various published sources as well as IHS Economics propriety databases. The primary source for the report was the 2007 Economic Census Franchise Report. This report provides US estimates of establishments, employment, and annual payroll and output from business with paid employees by detailed sector for 2007. Data were aggregated to the 10 Business Format Lines. The 2007 Economic Census only covers businesses with paid employees; the data were integrated with other data sources to include franchise businesses without paid employees. Other data sources were: The 2007 Survey of Business Owners – The US Census Bureau publishes the 2007 Survey of Business Owners (SBO). From this data source we were able to determine the number of franchised businesses for businesses without paid employees. 2007 Nonemployer Statistics –The US Census Bureau publishes the 2007 Nonemployer Statistics (NES). NES includes the number establishments and total annual receipts by industry of businesses without paid employees that are subject to federal income tax. Most often, nonemployers are self-employed individuals. IHS Economics determined the total number of businesses without paid employees and combined it with the SBO data to derive franchise businesses without paid employees and the number of independent contractors working out of franchised establishments owned by others. IHS Economics Business Market Insights (BMI) – This is a database that is based on the Census Bureau’s County Business Patterns. It contains information on establishments, employees, and sales at the country level at six-digit North American Industry Classification System (NAICS). The data were integrated with the SBO to determine the number of businesses with paid employees in NAICS 55, which was not included in the 2007 Economic Census Franchise Report. To develop our estimates and forecasts, we reviewed and replicated previous studies done by PWC, which had made estimates of franchise businesses for 2007-2010. Our estimates were largely in agreement with theirs. We present our revised estimates, which are based on our work with the 2007 Economic Census and more up-to-date data from the Survey of Business Owners and Nonemployer Statistics. We also acquired and reviewed data from Dun & Bradstreet on the number of franchise businesses in various years. These data did not cover all franchise establishments, but in some cases could be used to assess recent growth in the number of franchise establishments. IHS Economics estimated econometric models to create forecasts for establishments, employment, and output of each of the 10 business lines. The models include both macroeconomic (credit availability) and industry-specific variables, using a nested modeling approach (i.e., franchise establishment formation affects employment requirements, which further influences output forecasts). IHS Economics No portion of this report may be reproduced, reused, or otherwise distributed in any form without prior written consent. Page 23