* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 12 - JonathanHeller

Investment fund wikipedia , lookup

Negative gearing wikipedia , lookup

Systemic risk wikipedia , lookup

Investment management wikipedia , lookup

Pensions crisis wikipedia , lookup

Financial literacy wikipedia , lookup

Stock valuation wikipedia , lookup

Household debt wikipedia , lookup

Conditional budgeting wikipedia , lookup

Systemically important financial institution wikipedia , lookup

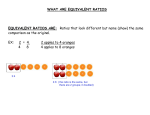

CHAPTER Financial Ratios & Break-Even Analysis Section 12.1 Financial Ratios Section 12.2 Break-Even Analysis SECTION Financial Ratios OBJECTIVES Explain what a financial ratio is Describe how income statements are used for financial analysis Compare operating ratios and return-on-sales ratios Describe the ratios developed by using balance sheets Explain the importance of return on investment Section 12.1: Financial Ratios 2 What Are Financial Ratios? Financial ratios are relationships between important financial data that are expressed as fractions or as percentages. One way entrepreneurs can see relationships, patterns, and trends is by using charts. Pie charts and bar graphs are very helpful in illustrating financial ratios. A pie chart has “slices” that represent portions of the whole. A bar graph uses vertical or horizontal bars to show data. 3,500 3,000 Cost of Goods Sold $2,000 2,500 2,000 $5,000 $3,000 Operating Expenses 1,500 Net Income 1,000 500 - January February March Section 12.1: Financial Ratios April May 3 Analysis Based on an Income Statement Entrepreneurs use income statements to show how their businesses are performing. With Sales Data Analysis, an income statement is used to review monthly sales totals in order to determine how much the business can afford to spend. Monthly income statements are also used to forecast future sales. Entrepreneurs also use income statements to measure how cost of goods sold and operating expenses affect profits. Same-size analysis is a comparison of total revenue or other financial data against that same data converted into percentages. 4 Section 12.1: Financial Ratios Income Statement Ratios Some financial ratios provide a “snapshot” of a specific aspect of a business and are used to monitor expenses, compare performance with the competition, to measure profitability. The operating ratio is the percentage of each dollar of revenue, or sales, needed to cover expenses. (Expenses ÷ Sales) x 100 = Operating Ratio (%) Return on sales (ROS) is the financial ratio calculated by dividing net income by sales. (Net Income ÷ Sales) x 100 = Return on Sales (%) Section 12.1: Financial Ratios 5 Ratios from Balance Sheets Entrepreneurs create ratios from the data on the balance sheets to monitor debt, compare debt with equity, and make sure the business has sufficient cash to pay its debts. The debt ratio is used to monitor the debts of a business. This is the ratio of a business’s total debt divided by its total assets. (Total Debts ÷ Total Assets) x 100 = Debt Ratio (%) The debt-to-equity ratio is the ratio of the total debts (liabilities) of the business divided by its owner’s equity. (Total Debts ÷ Owner’s Equity) x 100 = Debt-to-Equity Ratio (%) Section 12.1: Financial Ratios 6 Ratios from Balance Sheets The quick ratio is the comparison of cash to debt. (Cash + Marketable Securities ) ÷ Current Liabilities = Quick Ratio The current ratio is current assets divided by current liabilities. Current Assets ÷ Current Liabilities = Current Ratio Section 12.1: Financial Ratios 7 Return on Investment (ROI) Return on investment (ROI) is a financial ratio used to determine how well the business is doing in relation to the amount of money invested. Return on investment (ROI) shows the profit on the investment expressed as a percentage of the total invested (when expressed as a percentage, it is also referred to as the rate of return). (Net Income ÷ Investment) x 100 = Return on Investment (%) Section 12.1: Financial Ratios 8 SECTION Break-Even Analysis OBJECTIVES Explain the importance of the break-even point Perform a break-even analysis Section 12.2: Break Even Analysis 9 What Is a Break-Even Point? On an income statement, if the costs and expenses were exactly equal to the sales, there would be neither a profit nor a loss and net income would be zero. This is called the break-even point, because the business has sold exactly enough units to cover costs. Break-even analysis examines the income statement to identify the break-even point for a business. A breakeven analysis examines how many units of a product (or hours of a service) a business must sell to pay all its costs. Section 12.2: Break Even Analysis 10 Break-Even Analysis Use break-even analysis to determine how many units of a product a business must sell to pay all its expenses. The gross profit of the business (Total Sales - Total COGS) is used to pay operating expenses. Break-even units are the number of units of sale a business needs to sell to arrive at the break-even point (where the bottom line is zero). Operating Expenses ÷ Gross Profit per Unit = Break-Even Units Section 12.2: Break Even Analysis 11