* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Heikki Vitie

Peer-to-peer lending wikipedia , lookup

Moral hazard wikipedia , lookup

Land banking wikipedia , lookup

Syndicated loan wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Interbank lending market wikipedia , lookup

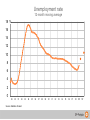

Interest rate ceiling wikipedia , lookup

How is the financial crisis affecting OP-Pohjola Group? Finnish Cooperative Movement Conference: The Competitiveness of Cooperatives in Changing Business Environment 24 September 2009 Heikki Vitie Structure of the OP-Pohjola Group Owner-members 221 member cooperative banks OP-POHJOLA GROUP CENTRAL COOPERATIVE POHJOLA BANK PLC OP Fund Management Company Ltd Helsinki OP Bank Plc OP Life Assurance Company Ltd Other subsidiaries Banking Services Investment Services SUBSIDIARIES Non-life Insurance Non-Group shareholders Business volumes in Finland 350 € Bn. 300 250 100 50 158 160 66 41 46 30 28 28 127 114 200 150 141 82 16 20 92 22 22 101 31 24 45 61 27 29 83 95 107 108 2006 2007 2008 6/2009 68 72 76 81 2002 2003 2004 2005 0 Deposits Life insurance savings Mutual fund savings Loans The OP-Pohjola Group’s core values People-first approach Responsibility Prospering together OP-Pohjola Group is for people. A genuine concern for customers and co-workers is the starting point of our operations. We operate locally, regionally and nationally as an exemplary and ethically responsible company. Bolstered by our strong professional skills, we bear responsibility for the high quality and reliability of our services. Prospering together with our customers both points the way to the development of our operations and services. Operating as a unified group gives our customers greater security and improves our service capabilities. Best loyal customer benefits Cooperative basis OP-Pohjola Group’s competitive advantages Finnish origin Close to customers Total financial services offering Effects of the Financial Crisis on the Banking and Insurance Sector 1st phase: Shock (August 2007–2008) • Materialisation of market risk: stock market crash • Lack of confidence reflected in strong growth in risk premiums (funding price) • Insurance companies record plummeting investment income, decreasing solvency and more expensive reinsurance 2nd phase: Economic recession (2009–10) • Materialisation of interest-rate risk: monetary policy easing, governments are launching large-scale support measures to revive the economy and banks are facing narrowing interest margins • Banks are providing for loan losses • Transient improvement in insurance profitability as a result of a reduction in the incidence of loss 3rd phase: Economic recovery (from 2010) • Materialisation of credit risk: growing unemployment, increasing bankruptcies, and loan losses materialise with a lagging effect • Weaker insurance profitability due to falling premiums written 7 000 Ind. OMX Helsinki CAP 6 000 5 000 4 000 3 000 2 000 2005 Source: Reuters Ecowin 2006 2007 2008 2009 Spread between secured and unsecured interest rates 2007- 2009 2,4 % 2,2 euribor-eurepo (12 m) 2,0 1,8 1,6 1,4 1,2 1,0 0,8 0,6 0,4 euribor-eurepo (3 m) 0,2 0,0 1/07 4/07 7/07 10/07 1/08 4/08 7/08 10/08 1/09 4/09 7/09 Source: Reuters EcoWin Euribor rates 6,0 % 5,0 4,0 12-month euribor 3,0 2,0 3-month euribor 1,0 0,0 99 00 Source: Reuters EcoWin 01 02 03 04 05 06 07 08 09 Unemployment rate 12-month moving average 18 % 16 14 12 10 8 6 4 2 0 89 90 91 92 Source: Statistics Finland 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09f 10f Stability through Operating on a Cooperative Basis • • • The strong capital base of cooperative banks serves as a strong buffer against the financial crisis. • Long-term view does not require doing business with the minimum possible level of capital, but maintaining higher capital adequacy is acceptable. • Drastic economic downturns affect bank's earnings performance and capital adequacy. • During the crisis, OP-Pohjola Group's capital base has remained strong and earnings power at least satisfactory. Funding based on deposits to a great extent provides business stability, and customer confidence has also been reflected in growth in deposits. We have continued customer financing and in this way borne responsibility for developments in our operating environment. Total lending 12-month change 18 % 16 14 OP-Pohjola Group 12 10 8 6 4 Other MFIs 2 2007 Source: Bank of Finland 2008 2009 Corporate lending 12-month change 30 % OP-Pohjola Group 25 20 15 10 Other MFIs 5 0 2007 Source: Bank of Finland 2008 2009 Housing loans 12-month change 17 % 16 15 14 13 12 11 10 9 8 7 6 5 4 OP-Pohjola Group Other MFIs 2007 Source: Bank of Finland 2008 2009 Total deposits 12-month change 25 % OP-Pohjola Group 20 15 10 Other MFIs 5 0 2007 Source: Bank of Finland 2008 2009 OP-Pohjola Group: ROA 1,4 % 1,2 1,0 0,8 0,6 0,4 0,2 0,0 2004 2005 2006 2007 2008 1-6/2009 OP-Pohjola Group: Tier 1 capital (Basel II from 2008) 6 000 EUR m 5 000 4 000 3 000 2 000 1 000 0 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 6/09 Change in GDP volume 6 % Finland 4 2 0 -2 -4 -6 -8 98 99 00 01 Source: Reuters EcoWin, OP-Pohjola Group 02 03 04 05 06 07 08 09f 10f Loan losses for banks in Finland 4 000 EUR m 3 500 % 8 7 3 000 6 2 500 5 2 000 4 1 500 3 1 000 2 500 1 0 0 -500 -1 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 1-6 /09 Loan losses Loan losses as % of lending Source: Bank of Finland, The Finnish Financial Supervision Authority, company data The data in the time series are not fully comparable. Loan loss % 1-6/2009 converted to full-year figure. Loan losses as % of lending 5,0 % 4,0 3,0 2,0 1,0 0,0 -1,0 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 1-6/ 09 OP-Pohjola Group Finnish banking sector, total Source: Finnish Financial Supervisory Authority, OP-Pohjola Group Data in the time series are not fully comparable. Total operating profit for banks in Finland 3,0 EUR bn 2,0 1,0 0,0 -1,0 -2,0 -3,0 -4,0 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 16/09 Source: Company data