* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

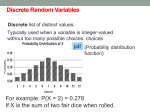

Download Chapter 2: Discrete Random Variables

Birthday problem wikipedia , lookup

Random variable wikipedia , lookup

Ars Conjectandi wikipedia , lookup

Inductive probability wikipedia , lookup

Probability interpretations wikipedia , lookup

German tank problem wikipedia , lookup

Conditioning (probability) wikipedia , lookup