* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download A pair-wise econometric approach - International Association for

Survey

Document related concepts

History of macroeconomic thought wikipedia , lookup

International economics wikipedia , lookup

Black–Scholes model wikipedia , lookup

Economic calculation problem wikipedia , lookup

Chicago school of economics wikipedia , lookup

Royal Economic Society wikipedia , lookup

Transcript

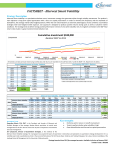

Transmissions of returns and volatility of returns in European power markets and implications for hedging Yannick Le Pen LEM, IEM de Nantes -IAE, University of Nantes, Chemin de la Censive du Tertre – BP 52231 – 44322 Nantes cedex 3 – France Email address: [email protected] Benoît Sévi GRANEM, Department of Economics, University of Angers and LEM 13 allée François Mitterrand – BP 13633 – 49036 Angers cedex 01 – France Email address: [email protected] Overview: The aim of this paper is to quantify and analyze the impact of a shock (unexpected realization of the return) in a given electricity market in Europe on the conditional volatility in another European market. Methods: The methodology follows the Generalized Impulse Response Function (GI) introduced by Koop, Pesaran and Potter [Journal of Econometrics 74, 119-147, 1996] which has been recently applied to the second moments analysis by Hafner and Herwartz [Journal of International Money and Finance 25, 719-740, 2006] in a multivariate GARCH framework. Using daily data from the British, Dutch and German forward markets (March 2001 – June 2005), we show that a shock observed in one market has a strong impact on the volatility on the other market, but that this effect is not persistent. Some economic intuitions about this phenomenon are proposed. Results and conclusions: The measured impact is high and not persistent, indicating a good efficiency and an immediate reaction to shocks from traders. An explanation for this observation may be the possibility of volatility arbitrages in different markets using derivatives products. These empirical findings allow concluding to the presence of beneficial strategies for energy traders, despite no evaluation of these strategies are provided in this paper. Some references: Engle, R.F., Ito, T., Lin, W.-L., 1990. Meteor showers or heat waves? Heteroskedastic intra-day volatility in the foreign exchange market. Econometrica 58, 525-542. Engle, R.F., Ng, V.K., 1993. Measuring and testing the impact of news on volatility. Journal of Finance 48, 1749-1778. Gallant, A.R., Rossi, P.E., Tauchen, G., 1993. Nonlinear dynamic structures. Econometrica 61, 871-907. Goto, M., Karolyi, A., 2004. Understanding electricity price volatility within and across markets. Ohio State University Working Paper. Hafner, C.M., Herwartz, H., 2006. Volatility impulse responses for multivariate GARCH models: an exchange rate illustration. Journal of International Money and Finance 25, 719-740. Hamao, Y., Masulis, R.W., Ng, V., 1990. Correlations in price changes and volatility across international stock markets. Review of Financial Studies 3, 281-307. Karolyi, G.A., 1995. A multivariate GARCH model of international transmissions of stock returns and volatility: the case of the United States and Canada. Journal of Business and Economic Statistics 13, 11-25. Koop, G.M., Pesaran, H.M., Potter, S.M., 1996. Impulse response analysis in nonlinear multivariate models. Journal of Econometrics 74, 119-147. Lin, W.-L., 1997. Impulse response function for conditional volatility in GARCH models. Journal of Business and Economic Statistics 15, 15-25. Lin, W.-L., Engle, R.F., Ito, T., 1994. Do bulls and bears move across borders? International transmission of stock returns and volatility. Review of Financial Studies 7, 507-538. Sims, C., 1980. Macroeconomics and reality. Econometrica 48, 1-48. Worthington, A., Kay-Spratley, A., Higgs, H., 2005. Transmission of prices and price volatility in Australian electricity spot markets: a multivariate GARCH analysis. Energy Economics 27, 337-350.