* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Advanced Business Math

Survey

Document related concepts

Transcript

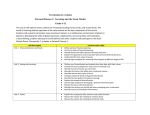

Investing Advanced Business Math Notes (Notes Given and Discussed on Monday, April 02, 2007) (no assignment given today) Advanced Business Math The Road to Investing Wave II After completion of Checking…Savings…MM Savings….CDs BONDS – debt obligations of corporations and governments Two types of Bonds: 1. corporate bonds – when a corporation “borrows” money from an investor 2. gov’t bonds – when a government “borrows” money from an investor Corporate Bonds Pay a fixed interest Pay every 6 months At maturity (10 years) they pay the principal Face Value – (par value) what the bond is worth at maturity Sold on the open market by brokers Interest reported on a 1099 is considered income and must be reported. No compounding When corporations need money to build, inventory, new products, whatever Government Bonds 1. Federal 2. State 3. Local Federal EE Savings Bonds – a loan to the government like a Patriot Bond Common gifts You buy it ½ the face value (maturity value) Can mature in 10 years up to 30 years Must hold it for 1 year Stops earning interest after 30 years. Interest accumulates every 6 months Interest is exempt from state and local taxes, not federal Not taxed until you cash them Buy at a bank for paper version Buy on internet for paperless version Payroll deduction is a nice way to buy Good/safe investment Liquid College bonds are tax free If lost or stolen or destroyed, they can be replace without penalty Page 1 Investing Advanced Business Math Notes EE Bonds $25.00 $50.00 $75.00 $100.00 $200.00 $500.00 1000.00 5000.00 10,000 You cannot buy more than $30,000 face value each year. Buy at a bank or through the Internet Bonds State and Local Called “munies” or municipal bonds – used to help a city government build a building, sewer, water, swimming pool Fixed Safe Wednesday Notes We’ve talked about Corporate Bonds and Gov’t Bonds Treasury Securities- U U.S. Treasury bills (called t-bills) are available in denominations of $10,000 and then in increments of $5,000 more. A treasury bill matures in one year or less. Usually a three month, six month, or one year government obligation Treasury notes Issued in unit of $1,000 or $5,000 Mature in 2 years to 10 years Higher interest rates than Treasury bills Treasury bonds $1,000 minimum mature from 10 to 30 years higher interest rates than t-bills or treasury notes interest is paid every 6 months taxed by the federal government, but not by state and local Page 2 Investing Advanced Business Math Notes THAT SUMMS UP THE LOW INVESTMENT LOW RETURN INVESTMENTS Medium Risk Investments Stocks – is a unit of ownership in a corporation. Owner is called a stockholder Owner receives a stock certificate A stockholder shares in a corporations profits which are paid to you as dividends. You can earn money two ways. o Dividends o Increased value of stock which you can sell Variable interest Stocks in well established companies are relatively safe Stocks in less established companies are risky A diversified portfolio can make the whole thing medium risk The Stock Market More than 34,000 public corporations We call this open trade Stockholders are called shareholders Dividends are the part of the corporation’s profits paid to stockholders. Capital gain is a way to earn money. It means the stock is worth more now than when you paid for it. The capital gain is only on paper. You must sell it which means you need to find a buyer. Capital loss. When the stock is worth less than what you paid for it. You could lose all of your money, but no more than your initial investment. DON’T GAMBLE/INVEST WHAT YOU CAN’T AFFORD TO LOSE! Types of Stock Common Stock o Pays a variable dividend and gives voting rights Voting consists of issue additional stock, sell the company, or change the board of directors Vote using a proxy…mail…written which allows someone of authority to vote for you. Most sign the proxy instead of attend the meetings. o The board of directors decides the dividend each year Page 3 Investing Advanced Business Math Preferred Stock o Pays a fixed dividend and carries no voting rights. o They make money regardless of how the company is doing o Less risky than common stock o If the company fails, you still get paid. o However, the initial fixed amount is relatively low. STOCK MARKET GAME BEGINS ON THURSDAY April 5, 2007 1. 2. 3. 4. 5. GO TO WWW.STOCKSQUEST.COM SIGN UP WITH A USERNAME AND PASSWORD JOIN A CONTEST USE hancock08 for name and owls08 for password BEGIN TRADING Page 4 Notes Investing Advanced Business Math Notes Mutual Funds Mutual Funds Characteristics A large, professionally managed group of investments. A Mutual Fund pools the money of many investors and buys a large selection of securities. Two major advantages: professional management and diversification Small investors could not otherwise invest in the stock market Range from risky speculative category to low risk category, But most specialize in broad medium range for risk and return Fastest growing segment of the American financial services To get started many funds require $500 to $3000 to get started, then you can make small contributions like $50 a month Easy to sell..call broker or sell on-line Liquid Page 5 Investing Advanced Business Math Notes Types of Mutual Funds Growth Fund Income Fund Growth and Income Fund Money Market Fund Global Fund Index Fund Net Asset Value – Unlike stocks, mutual funds are not determined by what people are willing to pay for them. They are determined by net asset value (NAV). The NAV is the total value of a fund’s investment portfolio minus its liabilities, divided by the number of outstanding shares of the fund: NAV = Value of Portfolio – Liabilities / Number of Shares For Example: Suppose the value of all stocks in a fun’s portfolio is currently $100,000. The fund has $90,000 in liabilities and has sold 500 shares of its funds to investors. The price for one of its shares, or its net asset value, would be $20 at this time: $100,000 – $90,000/500 = $20 Prospectus – detailed information about the funds which is a legal document that offers securities or mutual funds shares for sale. Page 6 Investing Advanced Business Math What do they cost you? Load – a sales fee. A front-end load is a sales charge paid when you buy an investment A back-end load is a sales charge paid when you sell an investment Range from 2% to 8% No-load fund – no charge for the sales fee if you buy directly through the investment company. Telephone Mail Email Website They make money by: Charging a fee for their services of 1 to 1/5% Where to find: Forbes Fortune Money www.morningstar.com Vanguard Fidelity Dreyfus http://finance.yahoo.com www.mfea.com Page 7 Notes Investing Advanced Business Math Notes Best way to buy your mutual funds is through an IRA Traditional Individual Retirement Account Set aside money for retirement IRAs-tax sheltered $4000 per year Delay paying tax on the earning until they begin w/d at 59 ½ Penalty for early withdrawl 10% Then taxable too Have to take a contribution at 73 ½ If your work has a pension plan for you, you may not be able to invest the maximum or any to an IRA You can deduct your contribution each year from your taxable income. Pay no taxes now When you retire, you will be in a lower tax bracket and pay less taxes anyway. Roth IRA Your money is taxed same as it ever was However, the money is not taxed at retirement Can contribute up to $4000 but not more unless you are over 50 Do not have to be 59 ½ You may w/draw before 59 ½ without penalty if you’ve held it for 5 years and it qualifies for education or first time home buyers. Do not have to w/d at 73 ½ You never have to w/draw it, especially if you have quite a bit of money coming in and it would increase your tax base. It could be “willed” to your children w/out fees. Senator William Roth – Delaware – (D) in 1998 Created it because of “fear” of Social Security disappearing Part of the Tax Payer Relief Act of 1997 You can contribute to a Roth IRA even if your job already contributes to a retirement plan for you If you are over 50 you can contribute $5000 this year to “catch up” Page 8 Investing Advanced Business Math Notes Joel Flaten May 30, 2007 Works for Prairie Community Services for 17 years 70 Group Homes Degrees in Sociology and Psychology Masters in School Psychology On the Hancock School Board Founded the Hancock Foundation What Detroit Lakes Alumni said to this question: “What do you wish you would have had more of in school? 1. How to save money and use credit cards—more financial literacy 2. career planning and placement Facts: 70% of Americans live paycheck to paycheck 1.5 million annual bankruptcy’s in 2001 and getting worse more people will file bankruptcy than will graduate from college leading to foreclosures on homes 3.3 trillion dollars in personal American debt Finances if the number one reason for Divorce i. 50 percent of marriages fail ii. 80 percent of those failed marriages are because of money 78 million Americans have no savings $ is highest reason for depression 90% of people buy things they cannot afford Page 9 Investing Advanced Business Math Notes Personal Savings Rate of American’s 7% in the 1970s 8% in the 1980s 9% in the 1990s -2% in the 2000s Americans who have: food, clothes, house/apt., transportation are in the top 15% of the worlds richest people. 5.1 million people are worse off that that. Americans who have: money saved hobby with equipment variety of clothes 2 cars live in own home are in the top 5% of the worlds richest category. 5.7 billion people are worse that you. Store Credit Cards No payment or interest for 1 year, etc. The Catch is that 80% of people do not pay before the due date. FICO-Fair Isaac Credit Organization 300 to 850 Score above 650 is good below 600 is bad it is a record of every loan type of activity you have ever had shows late payments outstanding loans everything! Page 10 Investing Advanced Business Math Notes How do you get a good score? 1. Make your payments on time 2. Have low balances compared to how much you are allowed to spend 3. Do not exceed 30% of you income for all debt 4. Have a long credit history 5. Limit new credit and many inquiries Dave Ramsey 7 Steps of Success 1. Have $1000 in Savings 2. Be debt free except for house and that should be under a 15 year mortgage and be no more than 25% of your net income or 35% of your gross income. 3. Should have 3-6 months emergency money 4. 10 – 15% of your income going to a retirement account every month. 5. Avoid lots of credit inquiries 6. ? 7. ? Page 11