Task force on Climate-Related Disclosures

... indicate clearly that responsibility for climate assessment, particularly footprinting and scenario analysis, needs to be taken across the investment chain by all key actors, not only asset owners. The guidance should clarify how multi-managers disclose. Portfolio footprinting: while carbon footpr ...

... indicate clearly that responsibility for climate assessment, particularly footprinting and scenario analysis, needs to be taken across the investment chain by all key actors, not only asset owners. The guidance should clarify how multi-managers disclose. Portfolio footprinting: while carbon footpr ...

Chp 9 Slides 09_Ch_9_Slides

... A lease is a contractual agreement in which the owner of an asset (lessor) allows another party (lessee) to use the asset for a period of time at an agreed price. Some advantages of leasing 1. Reduced risk of obsolescence. 2. Little or no down payment. 3. Shared tax advantages. 4. Assets and liabili ...

... A lease is a contractual agreement in which the owner of an asset (lessor) allows another party (lessee) to use the asset for a period of time at an agreed price. Some advantages of leasing 1. Reduced risk of obsolescence. 2. Little or no down payment. 3. Shared tax advantages. 4. Assets and liabili ...

0000950123-08-005299 - Investor Relations

... At March 31, 2008, options outstanding and options vested and exercisable had aggregate intrinsic values of $78.0 million and $68.0 million, respectively. ...

... At March 31, 2008, options outstanding and options vested and exercisable had aggregate intrinsic values of $78.0 million and $68.0 million, respectively. ...

The Mirage of Triangular Arbitrage in the Spot Foreign Exchange

... data. In [1], Aiba et al. investigate triangular arbitrage using quote data provided by information companies, for the set of exchange rates {EUR/USD, USD/JPY, EUR/JPY}, over a roughly eight week period in 1999. They find that, over the studied period, arbitrage opportunities appear to exist about 6 ...

... data. In [1], Aiba et al. investigate triangular arbitrage using quote data provided by information companies, for the set of exchange rates {EUR/USD, USD/JPY, EUR/JPY}, over a roughly eight week period in 1999. They find that, over the studied period, arbitrage opportunities appear to exist about 6 ...

Financial Liberalization and Allocative Efficiency (April 2011)

... accumulation.2 Such aggregate TFP gains are associated with a sectoral reallocation of resources. Following liberalization, sectors that are more dependent on external …nance typically grow more — but then crash more severely during a crisis and su¤er a greater decline during the subsequent credit c ...

... accumulation.2 Such aggregate TFP gains are associated with a sectoral reallocation of resources. Following liberalization, sectors that are more dependent on external …nance typically grow more — but then crash more severely during a crisis and su¤er a greater decline during the subsequent credit c ...

English

... these risks, the goal of profit maximizing may not be as sensible as selecting an enterprise that produces a lower but more stable profit. These considerations limit the extent to which profit is the main driving force. The use of profit in farming, however, does have a common purpose: it allows all ...

... these risks, the goal of profit maximizing may not be as sensible as selecting an enterprise that produces a lower but more stable profit. These considerations limit the extent to which profit is the main driving force. The use of profit in farming, however, does have a common purpose: it allows all ...

PPT - Ave Maria University

... Allocation of Saving to Productive Uses Bonds Corporations and governments sell bonds to raise funds. Bonds have to pay higher interest rates if: • They repay the principal farther into the future; • They are more difficult to resell to other people; • They are more likely to not be paid back. ...

... Allocation of Saving to Productive Uses Bonds Corporations and governments sell bonds to raise funds. Bonds have to pay higher interest rates if: • They repay the principal farther into the future; • They are more difficult to resell to other people; • They are more likely to not be paid back. ...

The Effect of the Quality of Rumors On Market Yields

... concerning a future event relating to the company) and a single rumor company (a company with only one rumor as to a future event) we can say that there is no significant difference between the two cases in the period before the event. This continues to be the case on the day that the rumor enters t ...

... concerning a future event relating to the company) and a single rumor company (a company with only one rumor as to a future event) we can say that there is no significant difference between the two cases in the period before the event. This continues to be the case on the day that the rumor enters t ...

Point of paper: - Society for the Advancement of Economic Theory

... The driving force of the pecuniary externality can be understood in three steps as follows. Note first that under asymmetric information when costs are high the pricecost margin tends to be low. This is so since the error term in the cost signal of a firm is positively correlated with the margin (sa ...

... The driving force of the pecuniary externality can be understood in three steps as follows. Note first that under asymmetric information when costs are high the pricecost margin tends to be low. This is so since the error term in the cost signal of a firm is positively correlated with the margin (sa ...

Prudential Requirements Consultation Paper

... economic growth should also encourage private enterprises in the industrial, agricultural and service sectors to raise capital in the public markets via issues of shares and corporate bonds on the Jamaica Stock Exchange. This will provide greater opportunities for generating fee income from traditio ...

... economic growth should also encourage private enterprises in the industrial, agricultural and service sectors to raise capital in the public markets via issues of shares and corporate bonds on the Jamaica Stock Exchange. This will provide greater opportunities for generating fee income from traditio ...

Behavioral Simulations: Using agent

... Actuaries (SOA) has conducted workshops and published papers that demonstrate the application of behavioral economics in analyzing retirement savings, modeling lapse rates in insurance products, projecting when policyholders might exercise options, and determining how customers react to changing eco ...

... Actuaries (SOA) has conducted workshops and published papers that demonstrate the application of behavioral economics in analyzing retirement savings, modeling lapse rates in insurance products, projecting when policyholders might exercise options, and determining how customers react to changing eco ...

Intermediate Accounting

... What are the Characteristics of Property, Plant, And Equipment? (Slide 1 of 3) • Property, plant, and equipment (alternatively called plant assets, fixed assets, or operational assets) are the tangible noncurrent assets that a company uses in the normal operations of its business. • To be included ...

... What are the Characteristics of Property, Plant, And Equipment? (Slide 1 of 3) • Property, plant, and equipment (alternatively called plant assets, fixed assets, or operational assets) are the tangible noncurrent assets that a company uses in the normal operations of its business. • To be included ...

Contemporaneous Loan Stress and Termination Risk in Please share

... Keenan and Kim (1994), Riddiough and Thompson (1993), Riddiough and Wyatt(1994) and Brown, Ciochetti and Riddiough (2005) also present models in which there is negotiation rather than instant foreclosure upon delinquency. In each case the model relies on a different explanation – for example, the cr ...

... Keenan and Kim (1994), Riddiough and Thompson (1993), Riddiough and Wyatt(1994) and Brown, Ciochetti and Riddiough (2005) also present models in which there is negotiation rather than instant foreclosure upon delinquency. In each case the model relies on a different explanation – for example, the cr ...

Auto Callable Contingent Interest Notes Linked to the Lesser

... Because the closing level of each Index on the fourth Review Date is greater than or equal to its Initial Value, the notes will be automatically called for a cash payment, for each $1,000 principal amount note, of $1,014.50 (or $1,000 plus the Contingent Interest Payment applicable to the fourth Rev ...

... Because the closing level of each Index on the fourth Review Date is greater than or equal to its Initial Value, the notes will be automatically called for a cash payment, for each $1,000 principal amount note, of $1,014.50 (or $1,000 plus the Contingent Interest Payment applicable to the fourth Rev ...

IPSAS 26 Impairment of Cash-Generating Assets

... place during the period, or will take place in the near future, in the technological, market, economic, or legal environment in which the entity operates, or in the market to which an asset is dedicated; (c) Market interest rates or other market rates of return on investments have increased during t ...

... place during the period, or will take place in the near future, in the technological, market, economic, or legal environment in which the entity operates, or in the market to which an asset is dedicated; (c) Market interest rates or other market rates of return on investments have increased during t ...

exam3a - Trinity University

... 31. (03 Points) The following contract does not have a SFAS 133 Paragraph 6 notional in a clear sense. Company C pays $100,000 for an option to receive $2 million if the average LIBOR for the next 12 months exceeds 8%. Is this option contract subject to SFAS 133 rules? a. No. Paragraph 6a requires a ...

... 31. (03 Points) The following contract does not have a SFAS 133 Paragraph 6 notional in a clear sense. Company C pays $100,000 for an option to receive $2 million if the average LIBOR for the next 12 months exceeds 8%. Is this option contract subject to SFAS 133 rules? a. No. Paragraph 6a requires a ...

SASB: a call to the industry to get material sustainability into US

... changed or influenced by the inclusion or correction of the item.” Link to SEC Bulletin 99 SASB aims to challenge and widen the interpretation of the SEC’s ‘reasonable investor’ label to cover what Rogers says should be “indisputably financially material sustainability issues”, that will by definiti ...

... changed or influenced by the inclusion or correction of the item.” Link to SEC Bulletin 99 SASB aims to challenge and widen the interpretation of the SEC’s ‘reasonable investor’ label to cover what Rogers says should be “indisputably financially material sustainability issues”, that will by definiti ...

american capital senior floating, ltd. - corporate

... Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registra ...

... Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registra ...

The Effect of Economic Factors on the Performance of the Australian

... 4.6.2. The Stock Market the Commodity Price Index .................................................... 131 4.7. Foreign Exchange Market and Stock Market .............................................................. 134 4.7.1. Exchange Rate and Macroeconomic Variables ............................... ...

... 4.6.2. The Stock Market the Commodity Price Index .................................................... 131 4.7. Foreign Exchange Market and Stock Market .............................................................. 134 4.7.1. Exchange Rate and Macroeconomic Variables ............................... ...

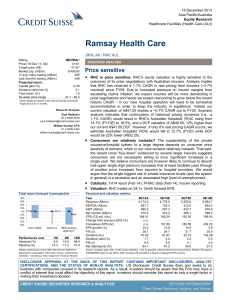

Ramsay Health Care 2013 12 18 - Price sensitive

... our current A$41.50 DCF. However, if only 0% real pricing CAGR occurs, we estimate Australian hospitals' ROIC would fall to 12.7% (FY20) while DCF would be 22% lower (A$32.20). ■ Consumers are relatively inelastic? The sustainability of the private insurance/hospital system to a large degree depends ...

... our current A$41.50 DCF. However, if only 0% real pricing CAGR occurs, we estimate Australian hospitals' ROIC would fall to 12.7% (FY20) while DCF would be 22% lower (A$32.20). ■ Consumers are relatively inelastic? The sustainability of the private insurance/hospital system to a large degree depends ...