NBER WORKING PAPER SERIES ECONOMIC INTERPRETATIONS OF INTERGENERATIONAL CORRELATIONS Nathan D. Grawe

... But this observation may simply represent the covariance of child ability and parent income. Indeed, Cameron and Heckman (1998) find no relationship between parent income and child education, controlling for cognitive ability.7 In addition, Mulligan (1999) finds a strong positive correlation between ...

... But this observation may simply represent the covariance of child ability and parent income. Indeed, Cameron and Heckman (1998) find no relationship between parent income and child education, controlling for cognitive ability.7 In addition, Mulligan (1999) finds a strong positive correlation between ...

Corporate Governance

... non-executive directors. It acts as the focal point for and custodian of corporate governance. Its aim is to balance the creation of higher standards for all stakeholders, while still generating maximum returns for shareholders. The Board is chaired by Mr A Tugendhaft, a non-executive director. Mr T ...

... non-executive directors. It acts as the focal point for and custodian of corporate governance. Its aim is to balance the creation of higher standards for all stakeholders, while still generating maximum returns for shareholders. The Board is chaired by Mr A Tugendhaft, a non-executive director. Mr T ...

shortfall savings: the all-important financial

... payments ($10 for every $20 saved for six months) to small-dollar savers.31 EARN’s proprietary platform is currently being used by over 30,000 low-income consumers in all 50 states.32 EARN recently received a sizeable grant from the W.K. Kellogg Foundation for the explicit purpose of “address[ing] t ...

... payments ($10 for every $20 saved for six months) to small-dollar savers.31 EARN’s proprietary platform is currently being used by over 30,000 low-income consumers in all 50 states.32 EARN recently received a sizeable grant from the W.K. Kellogg Foundation for the explicit purpose of “address[ing] t ...

Bubbles and Self-enforcing Debt (November 2007, with Guido Lorenzoni)

... In contrast to what happens in BR, we show that under some conditions positive levels of debt are sustainable in an environment with multilateral lack of commitment.3 In the process, we identify an unexpected connection between the sustainability of debt by reputation and the sustainability of ratio ...

... In contrast to what happens in BR, we show that under some conditions positive levels of debt are sustainable in an environment with multilateral lack of commitment.3 In the process, we identify an unexpected connection between the sustainability of debt by reputation and the sustainability of ratio ...

Global Financial Stability Report

... “Basis points” refers to hundredths of 1 percentage point (for example, 25 basis points are equivalent to ¼ of 1 percentage point). If no source is listed on tables and figures, data are based on IMF staff estimates or calculations. Minor discrepancies between sums of constituent figures and totals ...

... “Basis points” refers to hundredths of 1 percentage point (for example, 25 basis points are equivalent to ¼ of 1 percentage point). If no source is listed on tables and figures, data are based on IMF staff estimates or calculations. Minor discrepancies between sums of constituent figures and totals ...

Global Financial Stability Report

... “Basis points” refers to hundredths of 1 percentage point (for example, 25 basis points are equivalent to ¼ of 1 percentage point). If no source is listed on tables and figures, data are based on IMF staff estimates or calculations. Minor discrepancies between sums of constituent figures and totals ...

... “Basis points” refers to hundredths of 1 percentage point (for example, 25 basis points are equivalent to ¼ of 1 percentage point). If no source is listed on tables and figures, data are based on IMF staff estimates or calculations. Minor discrepancies between sums of constituent figures and totals ...

Corporate Governance, Organizational Structure, and Research of

... Not suitable when mutuals involve Efficiency scores ...

... Not suitable when mutuals involve Efficiency scores ...

Pillar 3 Disclosures Quantitative Disclosures As at 31

... These Pillar 3 quantitative disclosures are made pursuant to the Monetary Authority of Singapore (“MAS”) Notice to Banks No. 637 “Notice on Risk Based Capital Adequacy Requirements for Banks incorporated in Singapore” (“Notice 637”). The Group views the Basel framework as part of continuing efforts ...

... These Pillar 3 quantitative disclosures are made pursuant to the Monetary Authority of Singapore (“MAS”) Notice to Banks No. 637 “Notice on Risk Based Capital Adequacy Requirements for Banks incorporated in Singapore” (“Notice 637”). The Group views the Basel framework as part of continuing efforts ...

Network capacity sharing with QoS as a financial derivative

... vision. First, the network must support new services, such as sending traffic down the right path, which requires configuring the signaling and traffic control in parts of today’s networks. Second, the markets must be fast and efficient, so that the emerging trading does not choke the network. And t ...

... vision. First, the network must support new services, such as sending traffic down the right path, which requires configuring the signaling and traffic control in parts of today’s networks. Second, the markets must be fast and efficient, so that the emerging trading does not choke the network. And t ...

NBER WORKING PAPER SERIES PREDICTABLE RETURNS AND ASSET ALLOCATION:

... both the unexplained variance of returns and on the variance of the predictor variable, we create a direct mapping from the investor’s prior beliefs on model parameters to a well-defined prior over the R2 . In our empirical implementation, we consider returns on a stock index and on a long-term bond. ...

... both the unexplained variance of returns and on the variance of the predictor variable, we create a direct mapping from the investor’s prior beliefs on model parameters to a well-defined prior over the R2 . In our empirical implementation, we consider returns on a stock index and on a long-term bond. ...

Credit Risk Assessment Revisited

... the definitions of default in use, one must not forget that even failure events may differ from one country to another because of differences between judicial procedures. Many other players use what could be named “default on marketable debt instruments”. This is namely the approach which is impleme ...

... the definitions of default in use, one must not forget that even failure events may differ from one country to another because of differences between judicial procedures. Many other players use what could be named “default on marketable debt instruments”. This is namely the approach which is impleme ...

IAS33 suggestions

... understanding of users who do not have English as mother tongue. Besides, on 11A, I included the note you put on exposure draft. The idea is to simplify the text, to facilitate the understanding of users who do not have English as mother tongue. (b) profit or loss attributable to the parent entity 2 ...

... understanding of users who do not have English as mother tongue. Besides, on 11A, I included the note you put on exposure draft. The idea is to simplify the text, to facilitate the understanding of users who do not have English as mother tongue. (b) profit or loss attributable to the parent entity 2 ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to s ...

... Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to s ...

CHAPTER 2 1) When the market is in equilibrium, a) Total surplus is

... b) Involuntary trade generates no wealth c) If one person makes money, someone else must be losing it d) Voluntary trade ensures gains for both consumers and producers ANS: C 30) Price ceilings are primarily targeted to help a) No one b) Consumers c) Producers d) Government ANS: B 31) Price floors a ...

... b) Involuntary trade generates no wealth c) If one person makes money, someone else must be losing it d) Voluntary trade ensures gains for both consumers and producers ANS: C 30) Price ceilings are primarily targeted to help a) No one b) Consumers c) Producers d) Government ANS: B 31) Price floors a ...

Shaping change in insurance - Analysts` conference 2017

... 1 All shown figures do not include transitionals or long-term-guarantee (LTG) measures. As at 31.12.2016. 2 Parallel shift until last liquid point, extrapolation to unchanged UFR. 3 Based on CPI inflation. 4 Based on 200-year event. 5 Due to diversification, spread sensitivity simultaneously stressi ...

... 1 All shown figures do not include transitionals or long-term-guarantee (LTG) measures. As at 31.12.2016. 2 Parallel shift until last liquid point, extrapolation to unchanged UFR. 3 Based on CPI inflation. 4 Based on 200-year event. 5 Due to diversification, spread sensitivity simultaneously stressi ...

Advances in Environmental Biology

... them looks at subject of corporate governance differently. Theory of agency looks at problem of broker (agent), employer, while theory of beneficiaries looks at problem of broker and beneficiaries. The corporate governance has targeted the life of economic enterprises in long run more than anything ...

... them looks at subject of corporate governance differently. Theory of agency looks at problem of broker (agent), employer, while theory of beneficiaries looks at problem of broker and beneficiaries. The corporate governance has targeted the life of economic enterprises in long run more than anything ...

Examining Random Number Generators used in Stochastic Iteration

... coordinate is increasing. It is less obvious, but is also true for the Halton sequence. Due to its construction using radical inversion, the subsequent points in the sequence are rather far, thus the subsequent pairs will not cover region close to the diagonal of the square. A truly random sequence ...

... coordinate is increasing. It is less obvious, but is also true for the Halton sequence. Due to its construction using radical inversion, the subsequent points in the sequence are rather far, thus the subsequent pairs will not cover region close to the diagonal of the square. A truly random sequence ...

An Empirical Analysis of the Canadian Term Structure of Zero

... Data filtering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Sample and subsample periods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 ...

... Data filtering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Sample and subsample periods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 ...

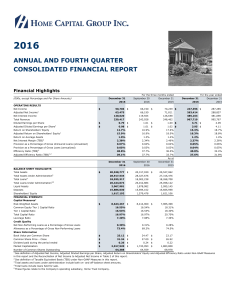

2016 Q4 Report - Home Capital Group

... “anticipate,” “intend,” “should,” “estimate,” “plan,” “forecast,” “may,” and “could” or other similar expressions. By their very nature, these statements require the Company to make assumptions and are subject to inherent risks and uncertainties, general and specific, which may cause actual results ...

... “anticipate,” “intend,” “should,” “estimate,” “plan,” “forecast,” “may,” and “could” or other similar expressions. By their very nature, these statements require the Company to make assumptions and are subject to inherent risks and uncertainties, general and specific, which may cause actual results ...

Going mainstream – how absolute return is moving into the

... are rising. A long/short manager can therefore make profits from two set of convictions: which securities, sectors or markets s/he believes are going to rise and which s/he believes are going to fall. ii. Reduces reliance on market returns An absolute return approach that strips out beta-driven retu ...

... are rising. A long/short manager can therefore make profits from two set of convictions: which securities, sectors or markets s/he believes are going to rise and which s/he believes are going to fall. ii. Reduces reliance on market returns An absolute return approach that strips out beta-driven retu ...