Thoumi. CFA. FRM-144-144

... fuel deforestation. Well-intentioned shareholders lack sufficient information to channel their investments to companies with transparent supply chains, and reformers inside major companies lack the information needed to find and end deforestation. Opaqueness enables corporate behavior such as self-d ...

... fuel deforestation. Well-intentioned shareholders lack sufficient information to channel their investments to companies with transparent supply chains, and reformers inside major companies lack the information needed to find and end deforestation. Opaqueness enables corporate behavior such as self-d ...

(DOC file) No 177/2006 amending Rules No 530/2004

... capital adequacy ratios above the statutory minimum, with later amendments 1 Article 1 These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the need to request capital adequacy ratios above 8% for financial undertakings. Article 2 ...

... capital adequacy ratios above the statutory minimum, with later amendments 1 Article 1 These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the need to request capital adequacy ratios above 8% for financial undertakings. Article 2 ...

Business and Financial Literacy for Young Entrepreneurs

... • Highly motivated – small group of 117 that actually took the training , 39% of sample that had indicated interest in training • People who had been late on at least one payment were more interested • Women were less interested ...

... • Highly motivated – small group of 117 that actually took the training , 39% of sample that had indicated interest in training • People who had been late on at least one payment were more interested • Women were less interested ...

Speech to the Silicon Valley Chapter of Financial Executives International

... credit losses on subprime mortgages, but the concern about credit losses has since spread to other kinds of loans. The banking system has dealt with large credit losses at times in the past, but this episode has a novel element. Many of the new financial instruments used in mortgage finance, and in ...

... credit losses on subprime mortgages, but the concern about credit losses has since spread to other kinds of loans. The banking system has dealt with large credit losses at times in the past, but this episode has a novel element. Many of the new financial instruments used in mortgage finance, and in ...

Personal Finance

... Economic Conditions (continued) 1) Consumer prices Inflation: the sustained rise in the level of prices for goods and services Question: What does inflation do to the value of a currency? ...

... Economic Conditions (continued) 1) Consumer prices Inflation: the sustained rise in the level of prices for goods and services Question: What does inflation do to the value of a currency? ...

Weekly Commentary 09-23-13 PAA

... * The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. * The DJ Equity All REIT TR Index measures the total return performance of t ...

... * The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. * The DJ Equity All REIT TR Index measures the total return performance of t ...

CIO Weekly Letter - Merrill Lynch Wealth Management

... of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defa ...

... of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defa ...

United States - Lazard Asset Management

... rebounded from lower readings in the fourth quarter, rising from a three-month average of 148,000 jobs gained per month as of December to 209,000 as of February. By Congressional Budget Office (CBO) estimates, jobs growth in 2016 reduced the number of jobs required to reach full employment from 3.2 ...

... rebounded from lower readings in the fourth quarter, rising from a three-month average of 148,000 jobs gained per month as of December to 209,000 as of February. By Congressional Budget Office (CBO) estimates, jobs growth in 2016 reduced the number of jobs required to reach full employment from 3.2 ...

Study on Financial Market Segmentation in China: Evidence from Stock Market

... the background of transitional economy, China is transferring form planned economy to market economy, and the competition is insufficient because of path dependence, so it causes market failure. Market segmentation is a specific reflection of incomplete competition and market failure. Market segment ...

... the background of transitional economy, China is transferring form planned economy to market economy, and the competition is insufficient because of path dependence, so it causes market failure. Market segmentation is a specific reflection of incomplete competition and market failure. Market segment ...

It is not appropriate to discount the cash flows of a bond by the yield

... It is possible for a security market participant such as a bond dealer to either borrow or lend at the implied forward rates. Transacting at the long term rate “locks-in” the forward rate for the forward period. The term structure of interest rates is affected by the interaction between implied forw ...

... It is possible for a security market participant such as a bond dealer to either borrow or lend at the implied forward rates. Transacting at the long term rate “locks-in” the forward rate for the forward period. The term structure of interest rates is affected by the interaction between implied forw ...

lect6

... If prices are fixed and shortage (i.e. , excess demand) exists, then other mechanisms (e.g., queues, black markets) have to be used to ration available supply. If queues are used, then the effective price is P = P0 + wt, where P0 is the fixed price, t is the time spent in a queue, and w is the value ...

... If prices are fixed and shortage (i.e. , excess demand) exists, then other mechanisms (e.g., queues, black markets) have to be used to ration available supply. If queues are used, then the effective price is P = P0 + wt, where P0 is the fixed price, t is the time spent in a queue, and w is the value ...

Prof. Giovanni Petrella

... This course covers two main topics from an empirical standpoint: price efficiency and market liquidity. The course includes trading simulations to provide in-class demonstrations of relevant concepts and hands-on experience in making trading decisions in different market structures. Students - on a ...

... This course covers two main topics from an empirical standpoint: price efficiency and market liquidity. The course includes trading simulations to provide in-class demonstrations of relevant concepts and hands-on experience in making trading decisions in different market structures. Students - on a ...

Carbon Tracker Report Debunks ExxonMobil`s Denial

... Carbon Tracker Report Debunks ExxonMobil’s Denial of Carbon Asset Risks Exxon underperforms vs. S&P 500 by 8% for past five years due to overspending on risky replenishment of reserves OAKLAND – September 10, 2014 – Today, the Carbon Tracker Initiative (CTI) issued a report finding that ExxonMobil ( ...

... Carbon Tracker Report Debunks ExxonMobil’s Denial of Carbon Asset Risks Exxon underperforms vs. S&P 500 by 8% for past five years due to overspending on risky replenishment of reserves OAKLAND – September 10, 2014 – Today, the Carbon Tracker Initiative (CTI) issued a report finding that ExxonMobil ( ...

Unit 1 study guide - Paulding County Schools

... bag. How many cans did he have total? Solve. Represent the story problem. Explain your answer. ...

... bag. How many cans did he have total? Solve. Represent the story problem. Explain your answer. ...

FedViews

... The cyclically adjusted price-earnings ratio (P/E10) for the S&P 500 stock market index is a metric that economist Robert Shiller has advocated to help judge whether the stock market is overvalued. The ratio is computed as the real, or inflation-adjusted, value of the S&P 500 index divided by real e ...

... The cyclically adjusted price-earnings ratio (P/E10) for the S&P 500 stock market index is a metric that economist Robert Shiller has advocated to help judge whether the stock market is overvalued. The ratio is computed as the real, or inflation-adjusted, value of the S&P 500 index divided by real e ...

Presentation to Securities Analysts of San Francisco and Global Association... Risk Professionals San Francisco, California

... short-term interest rates eventually have to go up to prevent an increase in inflation. The policy challenge is to consider two questions: “how far?” and “how fast?” To begin to answer the question “how far,” economists compare the funds rate to a benchmark called the long-run equilibrium or “neutra ...

... short-term interest rates eventually have to go up to prevent an increase in inflation. The policy challenge is to consider two questions: “how far?” and “how fast?” To begin to answer the question “how far,” economists compare the funds rate to a benchmark called the long-run equilibrium or “neutra ...

Investment Seminar

... consider active allocation methods described in “The Four Pillars”. This is technique where you overweight asset classes that have recently had significant declines. If you must invest in actively managed funds (Lack of Index options in 401K) try to keep expense ratios below 0.5%, look for long te ...

... consider active allocation methods described in “The Four Pillars”. This is technique where you overweight asset classes that have recently had significant declines. If you must invest in actively managed funds (Lack of Index options in 401K) try to keep expense ratios below 0.5%, look for long te ...

Lecture 11: Real Estate

... bankruptcy in 1997 had nine months’ income in credit card debt. – Credit card debt continues to be extended after initial application – Debt is incurred a little at a time – Payment schedules are different, can become ever more indebted while paying the minimum amount each month. ...

... bankruptcy in 1997 had nine months’ income in credit card debt. – Credit card debt continues to be extended after initial application – Debt is incurred a little at a time – Payment schedules are different, can become ever more indebted while paying the minimum amount each month. ...

Stock Market Analysis and Personal Finance Mr. Bernstein Bonds

... maturity date. Face value = final payout ( ~ loan amount) Bonds are traded Over the Counter (OTC) – there is no meaningful exchange ...

... maturity date. Face value = final payout ( ~ loan amount) Bonds are traded Over the Counter (OTC) – there is no meaningful exchange ...

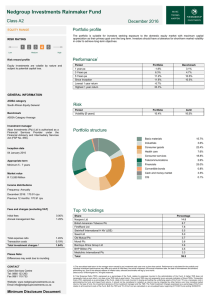

Fact sheets - Nedgroup Investments

... The JSE All Share Index recorded a gain of 1.0% in December and 2.6% for the 2016 calendar year. For the month of December, Financials gained 3.5% and Industrials +1.8%. Resources lagged in December (-3.6%) but still ended the year well ahead of the other major sectors in performance terms. Our hold ...

... The JSE All Share Index recorded a gain of 1.0% in December and 2.6% for the 2016 calendar year. For the month of December, Financials gained 3.5% and Industrials +1.8%. Resources lagged in December (-3.6%) but still ended the year well ahead of the other major sectors in performance terms. Our hold ...