1 Two periods market

... The key proof is the Minkowski separation theorem: if C1 C2 are non empty convex subset of Rk , C1 being closed and C2 being compact, there exists a ∈ Rk , non null, b1 , b2 ∈ R such that ha, xi ≤ b1 < b2 ≤ ha, yi, ∀x ∈ C1 , y ∈ C2 . P Let us denote the simplex ∆n = {y ∈ (R+ )n+1 , i yi = 1}. Proof: ...

... The key proof is the Minkowski separation theorem: if C1 C2 are non empty convex subset of Rk , C1 being closed and C2 being compact, there exists a ∈ Rk , non null, b1 , b2 ∈ R such that ha, xi ≤ b1 < b2 ≤ ha, yi, ∀x ∈ C1 , y ∈ C2 . P Let us denote the simplex ∆n = {y ∈ (R+ )n+1 , i yi = 1}. Proof: ...

Capital structure: the Modigliani and Miller theorem, impact of taxes

... outsiders in a firm and maximize the overall efficiency of a firm’s decisions. We will also look at how the market for corporate control (takeovers) helps (or fails) to ensure that firms are governed by the most able managers (or controlling owners) and that their incentives are best aligned with sh ...

... outsiders in a firm and maximize the overall efficiency of a firm’s decisions. We will also look at how the market for corporate control (takeovers) helps (or fails) to ensure that firms are governed by the most able managers (or controlling owners) and that their incentives are best aligned with sh ...

AWM 2011 Second Quarter Newsletter

... As we’ve already men oned, the Fed’s controversial $600 billion bond‐buying program known as Quan ta ve Easing, or QE2, ended on June 30th with mixed opinions about its success. Quan ta ve Easing pumped money into the banking system through the purchase of approximat ...

... As we’ve already men oned, the Fed’s controversial $600 billion bond‐buying program known as Quan ta ve Easing, or QE2, ended on June 30th with mixed opinions about its success. Quan ta ve Easing pumped money into the banking system through the purchase of approximat ...

THE EXTRAORDINARY DIVIDEND

... compound annual growth rate of 5.4% – this is an attractive growth rate in itself but, with dividends reinvested, the total return from UK equities compounds at an annual growth rate of 10.4%. This is a product of what Einstein observed to be the 8th wonder of the world – compound interest! Of cours ...

... compound annual growth rate of 5.4% – this is an attractive growth rate in itself but, with dividends reinvested, the total return from UK equities compounds at an annual growth rate of 10.4%. This is a product of what Einstein observed to be the 8th wonder of the world – compound interest! Of cours ...

Lecture Notes

... Therefore it is able to value the two derivative contracts from a risk-neutral perspective rather than from its subjective perception of the impact of future price scenarios to its future income. (One issue with this example is why would the investor and the airline company be convinced to do these ...

... Therefore it is able to value the two derivative contracts from a risk-neutral perspective rather than from its subjective perception of the impact of future price scenarios to its future income. (One issue with this example is why would the investor and the airline company be convinced to do these ...

The 4% Withdrawal Rule—Have Planners Been Wrong?

... This innate complexity forces most planners to customize their approaches to individual client cases. Ironically, the application of such customization may bring planning closer to the theoretical ideals of the financial economists mentioned here. For example, if a risk-averse client needs funding f ...

... This innate complexity forces most planners to customize their approaches to individual client cases. Ironically, the application of such customization may bring planning closer to the theoretical ideals of the financial economists mentioned here. For example, if a risk-averse client needs funding f ...

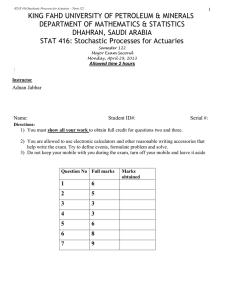

Exam2 - Academic Information System (KFUPM AISYS)

... If no claim are made in one year, the policyholder moves to the next higher level, or remain at the 75% level. If one claim is made in one year, the policyholder moves down one level, or remains at the 0% level. If two or more claims are made, the policyholder moves straight down to, or remains at, ...

... If no claim are made in one year, the policyholder moves to the next higher level, or remain at the 75% level. If one claim is made in one year, the policyholder moves down one level, or remains at the 0% level. If two or more claims are made, the policyholder moves straight down to, or remains at, ...

The Causes of the Japanese Lost Decade: An Extension of

... then corporate bonds market and equities market. Moreover, in 1980, the Foreign Exchange and Control Act was reformed and there was a relaxation of foreign exchange controls. By 1984, several deregulation moves allowed Japanese firms to raise funds abroad. Greater choices for sources of funding mea ...

... then corporate bonds market and equities market. Moreover, in 1980, the Foreign Exchange and Control Act was reformed and there was a relaxation of foreign exchange controls. By 1984, several deregulation moves allowed Japanese firms to raise funds abroad. Greater choices for sources of funding mea ...

Jamie Arimany

... A rate applicable to a financial transaction that will take place in the future. Forward rates are based on the spot rate, adjusted for the cost of carry and refer to the rate that will be used to deliver a currency, bond or commodity at some future time. It may also refer to the rate fixed for a fu ...

... A rate applicable to a financial transaction that will take place in the future. Forward rates are based on the spot rate, adjusted for the cost of carry and refer to the rate that will be used to deliver a currency, bond or commodity at some future time. It may also refer to the rate fixed for a fu ...

The Dividend Controversy

... who want higher dividends sell some shares to get cash. Those who want lower dividends use high dividends to buy more shares. ...

... who want higher dividends sell some shares to get cash. Those who want lower dividends use high dividends to buy more shares. ...

Satrix Balanced Index Fund

... depending on the initial fees applicable, the actual investment date, and the date of reinvestment of income as well as dividend withholding tax. Forward pricing is used. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The performance of th ...

... depending on the initial fees applicable, the actual investment date, and the date of reinvestment of income as well as dividend withholding tax. Forward pricing is used. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The performance of th ...

Capital Structure Decision

... are no taxes, and capital markets function well, the expected rate of return on the common stock of a levered firm increases in proportion to the debt-equity ratio (D/E), expressed in market values. The WACC is independent of how the firm is ...

... are no taxes, and capital markets function well, the expected rate of return on the common stock of a levered firm increases in proportion to the debt-equity ratio (D/E), expressed in market values. The WACC is independent of how the firm is ...

20 Dec 15 AGNC stock price appreciation in 2016

... $(107) million of interest rate swap periodic interest costs; $(25) million of net losses on interest rate swaptions; $(19) million of net losses on U.S. Treasury positions; $73 million of TBA dollar roll income; $140 million of net mark-to-market gains on TBA mortgage positions; and $19 million of ...

... $(107) million of interest rate swap periodic interest costs; $(25) million of net losses on interest rate swaptions; $(19) million of net losses on U.S. Treasury positions; $73 million of TBA dollar roll income; $140 million of net mark-to-market gains on TBA mortgage positions; and $19 million of ...

Private Information

... Managing Risk in Financial Markets Diversification to Lower Risk Suppose you can invest $100,000 in one of two projects. Each project promises you an equal chance of $50,000 profit or a $25,000 loss. The expected return on each project is ($50,000 0.5) + (–$25,000 0.5), which is $12,500. Suppos ...

... Managing Risk in Financial Markets Diversification to Lower Risk Suppose you can invest $100,000 in one of two projects. Each project promises you an equal chance of $50,000 profit or a $25,000 loss. The expected return on each project is ($50,000 0.5) + (–$25,000 0.5), which is $12,500. Suppos ...

Uncertainty and Risk

... Managing Risk in Financial Markets Diversification to Lower Risk Suppose you can invest $100,000 in one of two projects. Each project promises you an equal chance of $50,000 profit or a $25,000 loss. The expected return on each project is ($50,000 0.5) + (–$25,000 0.5), which is $12,500. Suppos ...

... Managing Risk in Financial Markets Diversification to Lower Risk Suppose you can invest $100,000 in one of two projects. Each project promises you an equal chance of $50,000 profit or a $25,000 loss. The expected return on each project is ($50,000 0.5) + (–$25,000 0.5), which is $12,500. Suppos ...

STEP TWO:

... If the economy is doing well, then the industry should be doing well. If the industry is doing well, then the individual sectors should also be doing well and hence the companies and the share price. In other words, you want to see growth in the economy. There are many factors that would affect the ...

... If the economy is doing well, then the industry should be doing well. If the industry is doing well, then the individual sectors should also be doing well and hence the companies and the share price. In other words, you want to see growth in the economy. There are many factors that would affect the ...

Jin Says 5% GDP Growth Possible in 2002

... Deputy prime minister Jin Nyum said Saturday that if Korea makes significant progress in the current policies for stimulating the economy and the global situation improves, the country will achieve five percent economic growth next year. Jin made the remarks in a keynote speech he delivered at the 8 ...

... Deputy prime minister Jin Nyum said Saturday that if Korea makes significant progress in the current policies for stimulating the economy and the global situation improves, the country will achieve five percent economic growth next year. Jin made the remarks in a keynote speech he delivered at the 8 ...

October 8, 2014

... Stocks, bonds and commodities were all impacted. The greater the potential for risk, the more fear and poor performance. High yield bonds were the worst performing bond sector, while small cap stocks were at bottom of the equity market performance matrix. In addition, there was concern over potentia ...

... Stocks, bonds and commodities were all impacted. The greater the potential for risk, the more fear and poor performance. High yield bonds were the worst performing bond sector, while small cap stocks were at bottom of the equity market performance matrix. In addition, there was concern over potentia ...

The Fed`s 405% problem

... 100% of GDP is unsustainable, according to the latest IMF Article IV report. Growth is, and will likely continue to be anaemic because the economy is drowning in debt. If interest rates rise, the debt burden could move from tolerable to unbearable. Yet no one talks about debt. Why? The reason is tha ...

... 100% of GDP is unsustainable, according to the latest IMF Article IV report. Growth is, and will likely continue to be anaemic because the economy is drowning in debt. If interest rates rise, the debt burden could move from tolerable to unbearable. Yet no one talks about debt. Why? The reason is tha ...

Financial System Reform and Economic Development, presentation

... each another; wobbly if they are not level. Each type has its advantages and limitations and each is associated with an important set of functions and rules of the game. In a balanced economy with long-term sustained growth economy, we must develop all three in complementarity. Budgetary finance is ...

... each another; wobbly if they are not level. Each type has its advantages and limitations and each is associated with an important set of functions and rules of the game. In a balanced economy with long-term sustained growth economy, we must develop all three in complementarity. Budgetary finance is ...