Property Rights and the Rise of the Western World

... Many banks had several write-downs in various periods (earnings quarters). These are billion dollar losses (e.g., $5-15 billion is common, and some have multiple write-downs). ...

... Many banks had several write-downs in various periods (earnings quarters). These are billion dollar losses (e.g., $5-15 billion is common, and some have multiple write-downs). ...

To Buy or Not to Buy? – That is the question

... Management fee of circa 65 bps of asset value and market standard cost recovery Performance fee of 20% of returns above a 10% per annum ...

... Management fee of circa 65 bps of asset value and market standard cost recovery Performance fee of 20% of returns above a 10% per annum ...

Document

... bases (underlying asset, index or reference rate ), in a contractual manner. The underlying asset can be equity , forex commodity or any other asset. In the Indian context the securities contracts (Regulation)Act, 1956(SC(R)A) defines “Derivative” to include : A security derived from a debt instrume ...

... bases (underlying asset, index or reference rate ), in a contractual manner. The underlying asset can be equity , forex commodity or any other asset. In the Indian context the securities contracts (Regulation)Act, 1956(SC(R)A) defines “Derivative” to include : A security derived from a debt instrume ...

Supply Contracts

... Minimum purchase quantity of KN over N periods How much should the retailer purchase when he has a starting inventory level of In and remaining commitment of Kn Result: a modified base stock policy is optimal ...

... Minimum purchase quantity of KN over N periods How much should the retailer purchase when he has a starting inventory level of In and remaining commitment of Kn Result: a modified base stock policy is optimal ...

ECON 337901 FINANCIAL ECONOMICS

... But first-order stochastic dominance remains quite a strong condition. Since an asset that displays first-order stochastic dominance over all others will be preferred by any investor with vN-M utility who prefers higher payoffs to lower payoffs, the price of such an asset is likely to be bid up unti ...

... But first-order stochastic dominance remains quite a strong condition. Since an asset that displays first-order stochastic dominance over all others will be preferred by any investor with vN-M utility who prefers higher payoffs to lower payoffs, the price of such an asset is likely to be bid up unti ...

options markets - AUEB e

... transaction with an option of the same series (same characteristics, underlying, strike, maturity) • Assume you have bought a call option on the FTSE-ASE20 that matures in December, with a strike price of 400 index points. You paid for the option 20 index points. • To close the position you must sel ...

... transaction with an option of the same series (same characteristics, underlying, strike, maturity) • Assume you have bought a call option on the FTSE-ASE20 that matures in December, with a strike price of 400 index points. You paid for the option 20 index points. • To close the position you must sel ...

Five Over Five - Research and Perspectives

... multi-pronged post financial crisis one-off response? The answer to this question depends on whether one expects a U.S. recession and how many rate hikes away we are from a “normal” policy (see the next section). Europe’s long-term recovery is essential to the sustainability of Italy's and Spain's p ...

... multi-pronged post financial crisis one-off response? The answer to this question depends on whether one expects a U.S. recession and how many rate hikes away we are from a “normal” policy (see the next section). Europe’s long-term recovery is essential to the sustainability of Italy's and Spain's p ...

Intangible assets

... assets to be measured using historical cost. The balance sheet amounts for intangible assets often differ from their real value. Changes in the amount of capitalized interest from one period to another can distort earnings trends. When comparing return on assets (ROA) ratios across firms, reme ...

... assets to be measured using historical cost. The balance sheet amounts for intangible assets often differ from their real value. Changes in the amount of capitalized interest from one period to another can distort earnings trends. When comparing return on assets (ROA) ratios across firms, reme ...

Risk Management and Financial Institutions

... $0.5 billion in 1940 to over $10 trillion in 2008 Most common type of fund is open-ended This means that the number of shares in the fund goes up as investors buy more shares and down as they redeem shares All purchases and sales of shares are at the 4pm net asset value (NAV) of the fund ...

... $0.5 billion in 1940 to over $10 trillion in 2008 Most common type of fund is open-ended This means that the number of shares in the fund goes up as investors buy more shares and down as they redeem shares All purchases and sales of shares are at the 4pm net asset value (NAV) of the fund ...

“The Impact of Financial Institutions and Financial ‘Liquidity Lock’ ”

... securities will have no credit risk, it also provides a lower expected return. Prime funds, by holding non-government high-grade debt instruments, have somewhat more risk but also provide a somewhat higher expected return. Some funds invest in state and municipal debt. Following the failure of Lehma ...

... securities will have no credit risk, it also provides a lower expected return. Prime funds, by holding non-government high-grade debt instruments, have somewhat more risk but also provide a somewhat higher expected return. Some funds invest in state and municipal debt. Following the failure of Lehma ...

other economic flows

... of the accounting period. • Flows other than transactions comprise two major categories of other economic flows that change the values of assets, liabilities, and net worth: holding gains and losses and other changes in the volume of assets. • A holding gain or loss is a change in the monetary value ...

... of the accounting period. • Flows other than transactions comprise two major categories of other economic flows that change the values of assets, liabilities, and net worth: holding gains and losses and other changes in the volume of assets. • A holding gain or loss is a change in the monetary value ...

Supply of loanable funds

... Savers make a sacrifice of current consumption, that is their opportunity cost. Interest earned on their saving is the reward for sacrificing current consumption; that is they get greater future consumption. So we would expect that the higher the interest rate the more households would be willing to ...

... Savers make a sacrifice of current consumption, that is their opportunity cost. Interest earned on their saving is the reward for sacrificing current consumption; that is they get greater future consumption. So we would expect that the higher the interest rate the more households would be willing to ...

ROCKY FORD CURRICULUM GUIDE SUBJECT: Economics

... We will list four different types of financial asset markets. We will compile and research five stocks for viability. We will participate in a five week on-line stock market game. b. Evaluate factors to consider when managing savings and investment accounts I, M ...

... We will list four different types of financial asset markets. We will compile and research five stocks for viability. We will participate in a five week on-line stock market game. b. Evaluate factors to consider when managing savings and investment accounts I, M ...

Principles Underlying Asset Liability Management

... Two portfolios are said to be 100% positively correlated relative to a set of scenarios if the ratio of the economic values of the two portfolios is the same in each scenario in the set at each time period. Linear relationships between variables are often assumed in finance and economics but true in ...

... Two portfolios are said to be 100% positively correlated relative to a set of scenarios if the ratio of the economic values of the two portfolios is the same in each scenario in the set at each time period. Linear relationships between variables are often assumed in finance and economics but true in ...

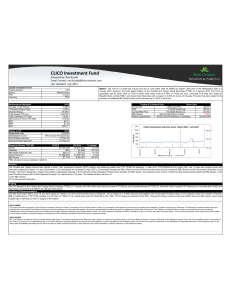

CLICO Investment Fund

... RBL's market price is TTD115.00 resulting in a CIF NAV of TTD26.17. At a listed share price of TTD22.65 on the TTSE, CIF is trading at a discount to the NAV. Through the listing, investors will have indirect access to RBL shares, which have usually high in demand but short in supply on the market. ...

... RBL's market price is TTD115.00 resulting in a CIF NAV of TTD26.17. At a listed share price of TTD22.65 on the TTSE, CIF is trading at a discount to the NAV. Through the listing, investors will have indirect access to RBL shares, which have usually high in demand but short in supply on the market. ...

The Rise and Fall of the US Housing Market

... With mortgage loans becoming somewhat harder to secure from distressed financial institutions, and lenders becoming more cautious across the board, regardless of credit history, the demand for houses softened. The result was that prices moved lower as sellers tried to find a level that would prove ...

... With mortgage loans becoming somewhat harder to secure from distressed financial institutions, and lenders becoming more cautious across the board, regardless of credit history, the demand for houses softened. The result was that prices moved lower as sellers tried to find a level that would prove ...

Prudential Jennison 20/20 Focus Fund Fact Sheet

... Without such, returns would be lower. All returns 1-year or less are cumulative. Class Q and Z shares may be available to group retirement plans and institutional investors through certain retirement, mutual fund wrap and asset allocation programs and to institutions at an investment minimum of $5,0 ...

... Without such, returns would be lower. All returns 1-year or less are cumulative. Class Q and Z shares may be available to group retirement plans and institutional investors through certain retirement, mutual fund wrap and asset allocation programs and to institutions at an investment minimum of $5,0 ...

Chapter 5 Understanding Risk - McGraw Hill Higher Education

... • Leverage adds to risks in the financial system. • Leverage is the practice of borrowing to finance part of an investment. • Although leverage does increase the expected return, it increases the standard deviation. • Leverage magnifies the effect of price changes. • If you borrow to purchase an as ...

... • Leverage adds to risks in the financial system. • Leverage is the practice of borrowing to finance part of an investment. • Although leverage does increase the expected return, it increases the standard deviation. • Leverage magnifies the effect of price changes. • If you borrow to purchase an as ...

Energy derivatives

... in which g is the proportional emission cost and c some operation costs (as start-up costs) Here, we still neglect dynamic operational constraints : ramp-up time (when they have just been started/turned off, power plants cannot be shut down/started up immediately), minimum power (arbitrage between s ...

... in which g is the proportional emission cost and c some operation costs (as start-up costs) Here, we still neglect dynamic operational constraints : ramp-up time (when they have just been started/turned off, power plants cannot be shut down/started up immediately), minimum power (arbitrage between s ...