Chapter12Review

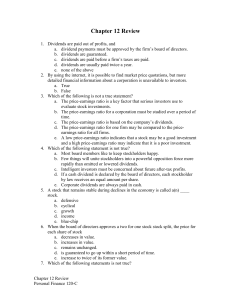

... a. dividend payments must be approved by the firm’s board of directors. b. dividends are guaranteed. c. dividends are paid before a firm’s taxes are paid. d. dividends are usually paid twice a year. e. none of the above 2. By using the internet, it is possible to find market price quotations, but mo ...

... a. dividend payments must be approved by the firm’s board of directors. b. dividends are guaranteed. c. dividends are paid before a firm’s taxes are paid. d. dividends are usually paid twice a year. e. none of the above 2. By using the internet, it is possible to find market price quotations, but mo ...

Study on the feasibility of a tool to measure the macroeconomic

... • Benefits of public interest. Financing by the public, not only by workers • Contribution rates cut by 1 percentage point financed by higher government debt or increase in VAT rate • Debt financing more expansive. Employment rises by 70Tsd workers 2 years after the shock, increase in GDP growth by ...

... • Benefits of public interest. Financing by the public, not only by workers • Contribution rates cut by 1 percentage point financed by higher government debt or increase in VAT rate • Debt financing more expansive. Employment rises by 70Tsd workers 2 years after the shock, increase in GDP growth by ...

A: An investment

... Variability in ER due to inability to trade in secondary markets. Time & price concession required to sell securities Exchange rate risk Variability in ER due to currency fluctuations. Country risk (political risk) Variability in ER due to instability of the political system. ...

... Variability in ER due to inability to trade in secondary markets. Time & price concession required to sell securities Exchange rate risk Variability in ER due to currency fluctuations. Country risk (political risk) Variability in ER due to instability of the political system. ...

Problem Sheet 1

... First, the sticky-wage theory suggests that because nominal wages are slow to adjust, a decline in the price level means real wages are higher, so firms hire fewer workers and produce less, causing aggregate supply to decline. Second, the sticky-price theory suggests that the prices of some goods an ...

... First, the sticky-wage theory suggests that because nominal wages are slow to adjust, a decline in the price level means real wages are higher, so firms hire fewer workers and produce less, causing aggregate supply to decline. Second, the sticky-price theory suggests that the prices of some goods an ...

First Quarter 2015 Securities Markets Commentary Index

... The American economy limped its way forward into 2015, chaotic yet cautious, ears perked to catch every last utterance of Federal Reserve Chair Janet Yellen. Here at home the effects of the dramatic drop in the price of oil continue to reverberate. At one point in March the price per barrel fell to ...

... The American economy limped its way forward into 2015, chaotic yet cautious, ears perked to catch every last utterance of Federal Reserve Chair Janet Yellen. Here at home the effects of the dramatic drop in the price of oil continue to reverberate. At one point in March the price per barrel fell to ...

insights - Private Ocean

... Wrong?”1 Harry Markowitz, of course, fathered Modern Portfolio Theory (MPT) in his 1952 article and 1959 book. Such questions about MPT are not new. They originated in two articles by William Jahnke (Journal of Financial Planning, February 1997 and February 1999). MPT observes that over time, differ ...

... Wrong?”1 Harry Markowitz, of course, fathered Modern Portfolio Theory (MPT) in his 1952 article and 1959 book. Such questions about MPT are not new. They originated in two articles by William Jahnke (Journal of Financial Planning, February 1997 and February 1999). MPT observes that over time, differ ...

Press release

... the top risk for businesses globally for the fourth year in succession. However, many companies are concerned that BI losses, which usually result from property damage, will ...

... the top risk for businesses globally for the fourth year in succession. However, many companies are concerned that BI losses, which usually result from property damage, will ...

Basel II and Implications for Capital Requirements in

... observed to rise causing a need to infuse more capital ...

... observed to rise causing a need to infuse more capital ...

The Problem of Over-Shooting Supplies of a Tree Crop

... ject to the revenue risks caused by overshooting and, therefore, should have a management plan in place. The choices facing an individual farmer are whether or not to produce the crop and, if so, how to manage the revenue risk over time. The choice depends on the rate of return expected on the inves ...

... ject to the revenue risks caused by overshooting and, therefore, should have a management plan in place. The choices facing an individual farmer are whether or not to produce the crop and, if so, how to manage the revenue risk over time. The choice depends on the rate of return expected on the inves ...

Surgutneftegas`s preferred shares: take a closer look!

... Warning: risk of loss. Investments in stock and any other securities may result in losses. Investments in bonds and debt instruments may result in losses due to reduced value of bonds, and unexpected loss, which may arise from full or partial default of the issuer (the enterprise's refusal to servic ...

... Warning: risk of loss. Investments in stock and any other securities may result in losses. Investments in bonds and debt instruments may result in losses due to reduced value of bonds, and unexpected loss, which may arise from full or partial default of the issuer (the enterprise's refusal to servic ...

Are your bonds really `green`?

... read carefully the “risk factors” section of the product’s prospectus and Key Investor Information Document (KIID). The prospectus in English and the KIID in the relevant local language (for all the countries referred to, in this document as a country in which a public offer of the product is author ...

... read carefully the “risk factors” section of the product’s prospectus and Key Investor Information Document (KIID). The prospectus in English and the KIID in the relevant local language (for all the countries referred to, in this document as a country in which a public offer of the product is author ...

Accounts Asst II

... government programs/projects. The accurate reporting of utilization of government resources is a key for generation of reliable national accounts. The report also provides to the people up in the hierarchy reliable accounting information that is useful for making a decision for the organization/Depa ...

... government programs/projects. The accurate reporting of utilization of government resources is a key for generation of reliable national accounts. The report also provides to the people up in the hierarchy reliable accounting information that is useful for making a decision for the organization/Depa ...

Dr. Barry Haworth University of Louisville Department of Economics

... a. heavy reliance upon private property rights in determining how resources flow b. a government that is minimally involved in its economy c. key decisions are made by the private sector d. economic decisions involve centralized decisionmaking e. all of the above 3. Which of the following statements ...

... a. heavy reliance upon private property rights in determining how resources flow b. a government that is minimally involved in its economy c. key decisions are made by the private sector d. economic decisions involve centralized decisionmaking e. all of the above 3. Which of the following statements ...

Advanced Accounting by Hoyle et al, 6th Edition

... risks and rewards may flow to Sponsoring Firm instead of to the equity investors. Control is established by agreement, not ownership. ...

... risks and rewards may flow to Sponsoring Firm instead of to the equity investors. Control is established by agreement, not ownership. ...

Grading Bonds on Inverted Curve

... Fourth-quarter earnings growth will come almost entirely from financial, basic-materials and telecommunications companies, Mr. Kaul says. Many of those companies will be helped by a 13% decline in crude-oil prices in the last quarter of 2006. That same trend, however, along with difficult-to-match c ...

... Fourth-quarter earnings growth will come almost entirely from financial, basic-materials and telecommunications companies, Mr. Kaul says. Many of those companies will be helped by a 13% decline in crude-oil prices in the last quarter of 2006. That same trend, however, along with difficult-to-match c ...

Valuation: Introduction

... In the same vein, earnings and cash flows will be affected (and not always by the same amount) by the overall level of inflation as well as relative inflation (i.e., inflation in the goods/services that the company either consumes of produces, relative to overall inflation). Finally, exchange rate m ...

... In the same vein, earnings and cash flows will be affected (and not always by the same amount) by the overall level of inflation as well as relative inflation (i.e., inflation in the goods/services that the company either consumes of produces, relative to overall inflation). Finally, exchange rate m ...