Investment Style and Process - Qualified Financial Services

... be eligible for inclusion in composites as defined by the firm’s policies. Numbers may not equal 100% due to rounding. AUM may also include advisory accounts with or without trading authority. In addition, the Firm may provide asset allocation advisory services, and if the assets are not allocated t ...

... be eligible for inclusion in composites as defined by the firm’s policies. Numbers may not equal 100% due to rounding. AUM may also include advisory accounts with or without trading authority. In addition, the Firm may provide asset allocation advisory services, and if the assets are not allocated t ...

Accounting vs. Market-based Measures of Firm Performance

... addition, there is a temptation for managers to consider lots of performance measures; consequently they believe with confidence that everything vital is being monitored. However, this is not realistic because of the time and cost of producing such large quantities of information, and also with so m ...

... addition, there is a temptation for managers to consider lots of performance measures; consequently they believe with confidence that everything vital is being monitored. However, this is not realistic because of the time and cost of producing such large quantities of information, and also with so m ...

Examining the Bond Premium Puzzle with a DSGE Model

... example, central banks around the world use the yield curve to help assess market expectations about future interest rates and inflation as well as to evaluate the overall stance of monetary policy, but they have long recognized that such information can be obscured by time-varying risk premiums.1 I ...

... example, central banks around the world use the yield curve to help assess market expectations about future interest rates and inflation as well as to evaluate the overall stance of monetary policy, but they have long recognized that such information can be obscured by time-varying risk premiums.1 I ...

real-world economics review

... (standard deviation of average growth rates over the average) for the first decade was 0.215; for the last (2001-2010) decade 3.27. Of course one may bear in mind that the short-lived recessions in 1975 and 1981 could have been the aftermaths of the oil embargoes (1974, 1979) and the associated shor ...

... (standard deviation of average growth rates over the average) for the first decade was 0.215; for the last (2001-2010) decade 3.27. Of course one may bear in mind that the short-lived recessions in 1975 and 1981 could have been the aftermaths of the oil embargoes (1974, 1979) and the associated shor ...

NBER WORKING PAPER SERIES EFFICIENT BAILOUTS? Javier Bianchi Working Paper 18587

... that imposes a minimum dividend payment that firms must make each period. In the stochastic steady state of the model, firms are able to finance the desired level of investment during normal economic conditions. However, when leverage is sufficiently high and an adverse financial shock hits the eco ...

... that imposes a minimum dividend payment that firms must make each period. In the stochastic steady state of the model, firms are able to finance the desired level of investment during normal economic conditions. However, when leverage is sufficiently high and an adverse financial shock hits the eco ...

SUBPriME MOrTGAGE CriSiS iN THE UNiTED STATES iN 2007–2008

... subprime mortgage lending practices; 2) causes related to the subprime mortgage securitizations; 3) causes related to the ability of financial institutions and public authorities to assess the systemic risks. As the first part of the paper essentially dealt with the first two groups of causes, the ...

... subprime mortgage lending practices; 2) causes related to the subprime mortgage securitizations; 3) causes related to the ability of financial institutions and public authorities to assess the systemic risks. As the first part of the paper essentially dealt with the first two groups of causes, the ...

The Importance of Asset Management

... The asset management industry is a key part of the financial services industry, acting as a central means by which capital flows from those who wish to invest to those who require investment. Acting as agents, asset managers provide a crucial service across the savings and investment markets. The as ...

... The asset management industry is a key part of the financial services industry, acting as a central means by which capital flows from those who wish to invest to those who require investment. Acting as agents, asset managers provide a crucial service across the savings and investment markets. The as ...

Our Favorite Charts of 2016

... away from home and entertainment, underscoring the current nonmaterial nature of Millennial spending. There are some early signs however that this trend may be reversing as home ownership and transportation spending have begun to recover. It is difficult to say for certain how much of the overall tr ...

... away from home and entertainment, underscoring the current nonmaterial nature of Millennial spending. There are some early signs however that this trend may be reversing as home ownership and transportation spending have begun to recover. It is difficult to say for certain how much of the overall tr ...

estimating systematic risk: the choice of return

... The fundamental premise of the CAPM is that the risk of a stock can be decomposed into two components. The first component is systematic risk, which is related to the overall market. The second component is non-systematic risk, which is specific to the individual stock. The CAPM approach further ass ...

... The fundamental premise of the CAPM is that the risk of a stock can be decomposed into two components. The first component is systematic risk, which is related to the overall market. The second component is non-systematic risk, which is specific to the individual stock. The CAPM approach further ass ...

Editorial 2012

... 2007). Moreover, increased contextual learning may act as a mechanism for achieving sufficient comparability and consistency over time and between entities. Following this reflection on principles-based accounting standards, we will now return to the agenda set for this editorial, hence (2) the Coun ...

... 2007). Moreover, increased contextual learning may act as a mechanism for achieving sufficient comparability and consistency over time and between entities. Following this reflection on principles-based accounting standards, we will now return to the agenda set for this editorial, hence (2) the Coun ...

Fintech and Disruptive Business Models in Financial Products

... revolutions are especially relevant to the development of financial innovation by non-incumbents who may pioneer or kick start new products, processes, interfaces and markets altogether.17 Further, the patterns of market demand also drive financial innovation, as it is suggested that investors’ dema ...

... revolutions are especially relevant to the development of financial innovation by non-incumbents who may pioneer or kick start new products, processes, interfaces and markets altogether.17 Further, the patterns of market demand also drive financial innovation, as it is suggested that investors’ dema ...

expected returns

... Much like last year, we are not particularly positive on government bond returns. We have even lowered our five-year expected return on AAA European government bonds to -3.5%. Yields have dropped to even lower levels than last year, which means that the buffer against adverse price moves has shrunk ...

... Much like last year, we are not particularly positive on government bond returns. We have even lowered our five-year expected return on AAA European government bonds to -3.5%. Yields have dropped to even lower levels than last year, which means that the buffer against adverse price moves has shrunk ...

Market Funds and Trust-Investment Law

... long-term fixed-return obligations such as mortgages and bonds. This approach to investment by trustees may have made sense in the eighteenth and nineteenth centuries in light of two facts which are not true today. First, the capital markets were relatively undeveloped and the opportunities to make ...

... long-term fixed-return obligations such as mortgages and bonds. This approach to investment by trustees may have made sense in the eighteenth and nineteenth centuries in light of two facts which are not true today. First, the capital markets were relatively undeveloped and the opportunities to make ...

Are the GMO Predictions of Asset Style Returns Accurate

... Exhibit 2 is the same graph except the 8 asset classes are obtained by sorting the stock and bond funds together. Here the correlation falls to 0.677. In 5 cases the predictions are too pessimistic and in 3 they are two optimistic. It is not surprising that when all the assets are lumped together th ...

... Exhibit 2 is the same graph except the 8 asset classes are obtained by sorting the stock and bond funds together. Here the correlation falls to 0.677. In 5 cases the predictions are too pessimistic and in 3 they are two optimistic. It is not surprising that when all the assets are lumped together th ...

In this paper, we develop a theory for the time varying takeover

... (annual) returns on stocks over a 20-year horizon to their volatility estimates over the same horizon. Using Extreme Value Theory to model these expectations within each subject, we show that even for the most thin-tailed distribution that we consider (the normal distribution), about two thirds of t ...

... (annual) returns on stocks over a 20-year horizon to their volatility estimates over the same horizon. Using Extreme Value Theory to model these expectations within each subject, we show that even for the most thin-tailed distribution that we consider (the normal distribution), about two thirds of t ...

enterpreneurship defination and

... This he does by creating innovations which introduce new combinations and production Entrepreneurial activity is a destabilizing force that starts the process of creative destruction, the essence of economic development Entrepreneurs are not manage who undertake routine activities on the basis ...

... This he does by creating innovations which introduce new combinations and production Entrepreneurial activity is a destabilizing force that starts the process of creative destruction, the essence of economic development Entrepreneurs are not manage who undertake routine activities on the basis ...

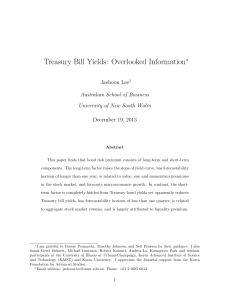

Treasury Bill Yields: Overlooked Information

... the excess returns of holding Treasury bonds over the next one year, exrt,t+1y , in which riskfree short interest rates are estimated as one-year T-bond yields. Since Fama and Bliss (1987), it has been a norm to use annual excess returns for the test of risk premium factors’ forecastability. The exc ...

... the excess returns of holding Treasury bonds over the next one year, exrt,t+1y , in which riskfree short interest rates are estimated as one-year T-bond yields. Since Fama and Bliss (1987), it has been a norm to use annual excess returns for the test of risk premium factors’ forecastability. The exc ...

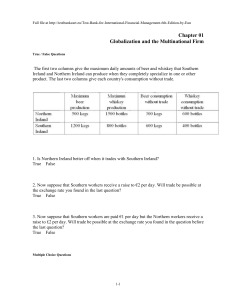

PDF

... the supply curve intersects ethanol demand curve 1 at the E10 blend wall, resulting in an ethanol price less than the price of gasoline and an equilibrium quantity of ethanol equal to the E10 blend wall volume. This scenario resembles the actual pricing of ethanol relative to gasoline most of the ti ...

... the supply curve intersects ethanol demand curve 1 at the E10 blend wall, resulting in an ethanol price less than the price of gasoline and an equilibrium quantity of ethanol equal to the E10 blend wall volume. This scenario resembles the actual pricing of ethanol relative to gasoline most of the ti ...

The Handbook of Mortgage-Backed Securities, 7th Edition

... purchased from originators by an arranger who bundles the underlying loans together into a pool. The arranger could be the Government National Mortgage Association (Ginnie Mae, a federal agency) or one of the government-sponsored enterprises (GSEs)—Freddie Mac and Fannie Mae—but could also be a priv ...

... purchased from originators by an arranger who bundles the underlying loans together into a pool. The arranger could be the Government National Mortgage Association (Ginnie Mae, a federal agency) or one of the government-sponsored enterprises (GSEs)—Freddie Mac and Fannie Mae—but could also be a priv ...

COVENTRY GROUP LTD ANNUAL REPORT

... major locations across Australia to ascertain how the Company’s female workforce was being managed and how to ensure that their opportunity for advancement in the Company was optimised. Initiatives raised by the focus groups included that management identify talented people and train them and to rec ...

... major locations across Australia to ascertain how the Company’s female workforce was being managed and how to ensure that their opportunity for advancement in the Company was optimised. Initiatives raised by the focus groups included that management identify talented people and train them and to rec ...

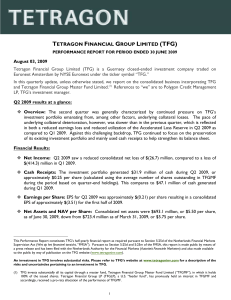

press release

... among market participants. JP Morgan estimates that more than $2.8 billion of CLO bid lists were announced since early May 2009 with $1.5 billion in the last two weeks of June.(19) Although the pickup in traded volumes and price improvements in CLO debt may signal some near-term stabilization in the ...

... among market participants. JP Morgan estimates that more than $2.8 billion of CLO bid lists were announced since early May 2009 with $1.5 billion in the last two weeks of June.(19) Although the pickup in traded volumes and price improvements in CLO debt may signal some near-term stabilization in the ...

Financial development in 205 economies, 1960 to 2010

... conclude that the preponderance of evidence suggests a positive, first-order relationship between financial development and economic growth. In other words, well-functioning financial systems play an independent role in promoting long-run economic growth: economies with better-developed financial sy ...

... conclude that the preponderance of evidence suggests a positive, first-order relationship between financial development and economic growth. In other words, well-functioning financial systems play an independent role in promoting long-run economic growth: economies with better-developed financial sy ...