CHAPTER 11

... b. Only incremental cash flows are relevant in project analysis and the proper incremental cash flows are the reported accounting profits because they form the true basis for investor and managerial decisions. c. It is unrealistic to expect that increases in net operating working capital required at ...

... b. Only incremental cash flows are relevant in project analysis and the proper incremental cash flows are the reported accounting profits because they form the true basis for investor and managerial decisions. c. It is unrealistic to expect that increases in net operating working capital required at ...

EXIDE TECHNOLOGIES - Nasdaq`s INTEL Solutions

... of that year (e.g., “ fiscal 2014 ” refers to the period beginning April 1, 2013 and ending March 31, 2014 ). Unless the context indicates otherwise, the “Company,” “Exide,” “we,” "our," or “us” refers to Exide Technologies and its subsidiaries. Chapter 11 Case On June 10, 2013 (“Petition Date”), Ex ...

... of that year (e.g., “ fiscal 2014 ” refers to the period beginning April 1, 2013 and ending March 31, 2014 ). Unless the context indicates otherwise, the “Company,” “Exide,” “we,” "our," or “us” refers to Exide Technologies and its subsidiaries. Chapter 11 Case On June 10, 2013 (“Petition Date”), Ex ...

Accelerating Emerging Capital Markets Development Corporate Bond

... sustained growth of the real economy and stability of the financial system. Wellfunctioning corporate bond markets efficiently mobilize savings to fuel the private sector and finance valuable projects, diversify credit and funding risk from the banking system, and facilitate the maturity transformat ...

... sustained growth of the real economy and stability of the financial system. Wellfunctioning corporate bond markets efficiently mobilize savings to fuel the private sector and finance valuable projects, diversify credit and funding risk from the banking system, and facilitate the maturity transformat ...

Kenon Holdings Ltd.

... Holdings Ltd., together with our subsidiaries and associated companies. This Proxy Statement and the AGM Notice are each being published for the benefit of all holders of Kenon’s ordinary shares, no par value (“ Kenon Shares ”) (“ Kenon Shareholders ”), are being posted on Kenon’s website, will be f ...

... Holdings Ltd., together with our subsidiaries and associated companies. This Proxy Statement and the AGM Notice are each being published for the benefit of all holders of Kenon’s ordinary shares, no par value (“ Kenon Shares ”) (“ Kenon Shareholders ”), are being posted on Kenon’s website, will be f ...

DOC - Investor Relations

... We also periodically consider whether there are any indications of impairment of our indefinite and long-lived assets and determined, except as noted below, that the undiscounted cash flows expected from the use of our assets exceeded the carrying amounts of such assets, and thus were not impaired d ...

... We also periodically consider whether there are any indications of impairment of our indefinite and long-lived assets and determined, except as noted below, that the undiscounted cash flows expected from the use of our assets exceeded the carrying amounts of such assets, and thus were not impaired d ...

Financial Accounting II

... had made a payment of RM168 to K Leek to close his account. It was correctly entered in the cash the cash book, but was not entered in K Leek account. K Leek ...

... had made a payment of RM168 to K Leek to close his account. It was correctly entered in the cash the cash book, but was not entered in K Leek account. K Leek ...

FRANKLIN ELECTRIC CO INC (Form: 10-K, Received: 03

... The Company's products are sold worldwide by its employee sales force and independent manufacturing representatives. The Company offers normal and customary trade terms to its customers, no significant part of which is of an extended nature. Special inventory requirements are not necessary, and cust ...

... The Company's products are sold worldwide by its employee sales force and independent manufacturing representatives. The Company offers normal and customary trade terms to its customers, no significant part of which is of an extended nature. Special inventory requirements are not necessary, and cust ...

NBER WORKING PAPER SERIES INTERNATIONAL RESERVE HOLDINGS WITH Joshua Aizenman

... in international financial markets and faced new challenges. In the aftermath of the 199798 Asian financial crises, some observers have called on emerging markets to reduce short-term external debt relative to international reserve holdings in order to lower their vulnerability to crisis. Countries ...

... in international financial markets and faced new challenges. In the aftermath of the 199798 Asian financial crises, some observers have called on emerging markets to reduce short-term external debt relative to international reserve holdings in order to lower their vulnerability to crisis. Countries ...

NBER WORKING PAPER SERIES GROWTH? M. Ayhan Kose

... -2capital flows such as foreign direct investment (FDI) can yield productivity gains in recipient countries directly through transfers of technology and managerial expertise. The nature of the relationship between financial openness and TFP growth has important welfare implications, especially in l ...

... -2capital flows such as foreign direct investment (FDI) can yield productivity gains in recipient countries directly through transfers of technology and managerial expertise. The nature of the relationship between financial openness and TFP growth has important welfare implications, especially in l ...

Full Year Results 2015

... The Group maintains a well diversified funding profile and has raised approximately $26.5 billion of term wholesale funding in the 2015 financial year. The weighted average term to maturity of the funds raised by the Group over the 2015 financial year was 4.7 years. The stable funding index was 92.3 ...

... The Group maintains a well diversified funding profile and has raised approximately $26.5 billion of term wholesale funding in the 2015 financial year. The weighted average term to maturity of the funds raised by the Group over the 2015 financial year was 4.7 years. The stable funding index was 92.3 ...

Consolidated financial statements

... CONSOLIDATED INCOME STATEMENT................................................................................................. - 5 CONSOLIDATED STATEMENT OF RECOGNIZED INCOME AND EXPENSES ............................... - 6 CONSOLIDATED BALANCE SHEET.................................................. ...

... CONSOLIDATED INCOME STATEMENT................................................................................................. - 5 CONSOLIDATED STATEMENT OF RECOGNIZED INCOME AND EXPENSES ............................... - 6 CONSOLIDATED BALANCE SHEET.................................................. ...

the determinants of capital structure: the evidence from the

... have more opportunities to achieve greater sales and consequently retain earnings. Kouki and Said (2012) find significant negative relation between size and company’s book leverage. Hall et al. (2000) find that size is positive related to short – term debt and negatively to long-term debt. Another evid ...

... have more opportunities to achieve greater sales and consequently retain earnings. Kouki and Said (2012) find significant negative relation between size and company’s book leverage. Hall et al. (2000) find that size is positive related to short – term debt and negatively to long-term debt. Another evid ...

interim report first quarter 2017

... Given currency rates at end of March 2017 the effect on operating profit from transaction and translation would be +400 MSEK for Q2 2017 ...

... Given currency rates at end of March 2017 the effect on operating profit from transaction and translation would be +400 MSEK for Q2 2017 ...

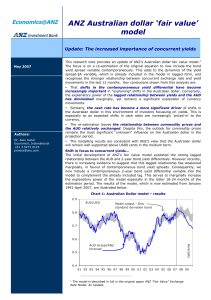

ANZ Australian dollar `fair value` model

... other remuneration in relation to the sale of such financial products, securities or other investments), or may perform services for, or solicit business from, any company the subject of this document. If you have been referred to ANZBGL, ANZ NZ, ANZ S or their affiliated companies by any person, th ...

... other remuneration in relation to the sale of such financial products, securities or other investments), or may perform services for, or solicit business from, any company the subject of this document. If you have been referred to ANZBGL, ANZ NZ, ANZ S or their affiliated companies by any person, th ...

Capital Adequacy in Insurance / Reinsurance

... also create risk. For long-tail covers, such as general liability, ultimate claims may not be known for many years after policies are priced and written, giving rise in some cases to enormous reserve risk long after policies have been sold (as has been vividly documented in the asbestos and environm ...

... also create risk. For long-tail covers, such as general liability, ultimate claims may not be known for many years after policies are priced and written, giving rise in some cases to enormous reserve risk long after policies have been sold (as has been vividly documented in the asbestos and environm ...

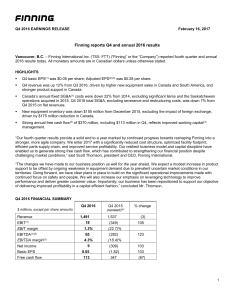

Q4 and Annual 2016 Results

... knows and expects today to make a statement about the future. Forward-looking statements may include words such as aim, anticipate, assumption, believe, could, expect, goal, guidance, intend, may, objective, outlook, plan, project, seek, should, strategy, strive, target, and will. Forward-looking st ...

... knows and expects today to make a statement about the future. Forward-looking statements may include words such as aim, anticipate, assumption, believe, could, expect, goal, guidance, intend, may, objective, outlook, plan, project, seek, should, strategy, strive, target, and will. Forward-looking st ...

chapter 1 - MM 27 Unsoed

... b. Corporations have unlimited liability. c. Because of their size, large corporations face fewer regulations than smaller corporations and sole proprietorships. d. Reducing the threat of corporate takeover increases the likelihood that managers will act in shareholders’ interest. e. Bond covenants ...

... b. Corporations have unlimited liability. c. Because of their size, large corporations face fewer regulations than smaller corporations and sole proprietorships. d. Reducing the threat of corporate takeover increases the likelihood that managers will act in shareholders’ interest. e. Bond covenants ...

LINK Global Economic Outlook 2014-2015

... Even after more than five years since the global financial crisis erupted, the world economy has not yet fully recovered. Most developed economies are still toiling up a bumpy path in the aftermath of the financial crisis, struggling, in particular, to find the right policy actions. A number of emer ...

... Even after more than five years since the global financial crisis erupted, the world economy has not yet fully recovered. Most developed economies are still toiling up a bumpy path in the aftermath of the financial crisis, struggling, in particular, to find the right policy actions. A number of emer ...

12.6.2014 EN Official Journal of the European Union L 173/349

... that clients or potential clients are reasonably able to understand the nature and risks of the investment service and of the specific type of financial instrument that is being offered and, consequently, to take investment decisions on an informed basis. Member States may allow that information to ...

... that clients or potential clients are reasonably able to understand the nature and risks of the investment service and of the specific type of financial instrument that is being offered and, consequently, to take investment decisions on an informed basis. Member States may allow that information to ...

expected returns

... presentations at investor forums over the past six months, we would be inclined to think that the answer is yes. Although we can’t prove it, our impression is that the general sentiment among professional investors has never been as weak as it is right now. In a poll held earlier this year, more tha ...

... presentations at investor forums over the past six months, we would be inclined to think that the answer is yes. Although we can’t prove it, our impression is that the general sentiment among professional investors has never been as weak as it is right now. In a poll held earlier this year, more tha ...