29 - San Francisco State University

... eventual turnaround result (Singh and Lumsden, 1990; Haveman, 1993). The relationship between size and consequence of a declining situation has been debated in the literature. Large firms are more insulated (Hannan and Freeman, 1984) and possess the stability to overcome adverse economic situations ...

... eventual turnaround result (Singh and Lumsden, 1990; Haveman, 1993). The relationship between size and consequence of a declining situation has been debated in the literature. Large firms are more insulated (Hannan and Freeman, 1984) and possess the stability to overcome adverse economic situations ...

Thesis - Kyiv School of Economics

... most of the cases. The capital flows were divided into three broad categories: government bonds, corporate bonds and corporate equities. For all of the capital categories market interest rate volatility as well as inflation volatility are significant and enter regressions with negative sign. This is ...

... most of the cases. The capital flows were divided into three broad categories: government bonds, corporate bonds and corporate equities. For all of the capital categories market interest rate volatility as well as inflation volatility are significant and enter regressions with negative sign. This is ...

11: Corporate Finance: Corporate Investing and Financing Decisions

... Using the right combination of the financing components will maximize the company’s stock price. Above normal usage of debt would be a cheaper method of financing, but it would increase the risk of the firm. The optimal capital structure seeks a balance between risk and return that maximizes the val ...

... Using the right combination of the financing components will maximize the company’s stock price. Above normal usage of debt would be a cheaper method of financing, but it would increase the risk of the firm. The optimal capital structure seeks a balance between risk and return that maximizes the val ...

The Performance of Firms Post Dividend Announcement: A

... valid hypothesis; the growth opportunities measure to test the free cash flow hypothesis, dividend yield measure to test the clientele dividend hypothesis and the unexpected dividends change measure to test the signalling hypothesis. The three measures were regressed against the cumulated abnormal r ...

... valid hypothesis; the growth opportunities measure to test the free cash flow hypothesis, dividend yield measure to test the clientele dividend hypothesis and the unexpected dividends change measure to test the signalling hypothesis. The three measures were regressed against the cumulated abnormal r ...

Dividend Policy, Strategy and Analysis

... The central issue can be stated quite simply. It is whether the surplus, freely available earnings of the company will earn more for the shareholders if left in the business or if distributed to them, either as cash dividends or by share repurchases. All the freely available earnings—what we call av ...

... The central issue can be stated quite simply. It is whether the surplus, freely available earnings of the company will earn more for the shareholders if left in the business or if distributed to them, either as cash dividends or by share repurchases. All the freely available earnings—what we call av ...

0000897101-15-000290 - Investor Relations

... On January 27, 2014, the Company sold its remaining security and certain microphone and receiver operations;, which marked the final milestone in the global strategic restructuring plan announced in 2013. Major Events in 2013 On June 13, 2013, the Company announced a global strategic restructuring p ...

... On January 27, 2014, the Company sold its remaining security and certain microphone and receiver operations;, which marked the final milestone in the global strategic restructuring plan announced in 2013. Major Events in 2013 On June 13, 2013, the Company announced a global strategic restructuring p ...

Annual Report 2016 Pico Far East Holdings Limited

... Technological revolutions are profoundly changing the world and our industry on a near-daily basis. In this environment, to effectively address our clients’ real needs and seize on emerging opportunities, Pico continuously transforms its business model in ways big and small to stay ahead – to be a l ...

... Technological revolutions are profoundly changing the world and our industry on a near-daily basis. In this environment, to effectively address our clients’ real needs and seize on emerging opportunities, Pico continuously transforms its business model in ways big and small to stay ahead – to be a l ...

the PDF

... stable in 2015. They should continue to outperform luxury homes/large-sized flats which could see a mild price correction of 5% as their demand is still suppressed by the government's cooling measures. That said, even allowing for an interest rate hike, any sharp fall in home prices seems unlikely f ...

... stable in 2015. They should continue to outperform luxury homes/large-sized flats which could see a mild price correction of 5% as their demand is still suppressed by the government's cooling measures. That said, even allowing for an interest rate hike, any sharp fall in home prices seems unlikely f ...

Form 10-K - corporate

... IDEX Health & Science. IH&S consists of the Eastern Plastics, Innovadyne, Isolation Technologies, Rheodyne, Ismatec, Sapphire Engineering, Systec and Upchurch Scientific businesses and has facilities in Rohnert Park, California (Innovadyne, Rheodyne and Systec products); Bristol, Connecticut (Easter ...

... IDEX Health & Science. IH&S consists of the Eastern Plastics, Innovadyne, Isolation Technologies, Rheodyne, Ismatec, Sapphire Engineering, Systec and Upchurch Scientific businesses and has facilities in Rohnert Park, California (Innovadyne, Rheodyne and Systec products); Bristol, Connecticut (Easter ...

Form 8-K GENERAL ELECTRIC CAPITAL SERVICES INC/CT

... factoring services. Loan transactions range in size from under $5 million to over $200 million. CF's clients are owners, managers and buyers of both public and private companies, principally manufacturers, distributors, retailers and diversified service providers. CF has industry specialists focused ...

... factoring services. Loan transactions range in size from under $5 million to over $200 million. CF's clients are owners, managers and buyers of both public and private companies, principally manufacturers, distributors, retailers and diversified service providers. CF has industry specialists focused ...

Budget Paper No. 1 2015-16

... The Australian economy is set to strengthen over coming years, as we transition from a mining investment led boom and non-mining sectors step up to drive growth. The global economic outlook is strengthening, and households and businesses are already benefiting from historically low interest rates, a ...

... The Australian economy is set to strengthen over coming years, as we transition from a mining investment led boom and non-mining sectors step up to drive growth. The global economic outlook is strengthening, and households and businesses are already benefiting from historically low interest rates, a ...

simpler, smoother, smarter business

... Enfo’s main market area for outsourced IT services is in Finland and Sweden. In Finland, outsourcing has been the dominant model of IT procurement for quite some time now, but in Sweden, procurement has been more predominantly based on purchasing consultancy services, whereas the service outsourcing ...

... Enfo’s main market area for outsourced IT services is in Finland and Sweden. In Finland, outsourcing has been the dominant model of IT procurement for quite some time now, but in Sweden, procurement has been more predominantly based on purchasing consultancy services, whereas the service outsourcing ...

Risk Weighted Capital Adequacy Framework

... overseas branch operations, as well as Labuan banking subsidiaries5; and ...

... overseas branch operations, as well as Labuan banking subsidiaries5; and ...

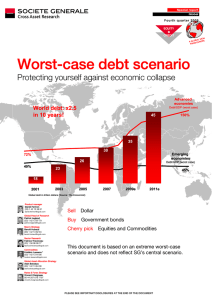

Worst-case debt scenario

... In a normal downturn, debt would naturally be reduced by higher receipts, stemming from a return to normal GDP growth. Looking at Japan, we can see that when debt started to narrow in 2006, GDP was slow to increase as consumption was impaired by lower government spending. The boom at that time in we ...

... In a normal downturn, debt would naturally be reduced by higher receipts, stemming from a return to normal GDP growth. Looking at Japan, we can see that when debt started to narrow in 2006, GDP was slow to increase as consumption was impaired by lower government spending. The boom at that time in we ...

Report of the management board for the period from 1

... our balance sheet, continued work on further improvement of the supply chain efficiency, innovative formats and the development of the scale of our Group, which is our main contribution to increase the competitiveness of independent retailers in Poland. It was a year of record cash flow generated fr ...

... our balance sheet, continued work on further improvement of the supply chain efficiency, innovative formats and the development of the scale of our Group, which is our main contribution to increase the competitiveness of independent retailers in Poland. It was a year of record cash flow generated fr ...

Case Study

... maintained the common stock dividend. With a 25% total return, including dividends, Kodak closed 2002 as the best-performing stock among companies that make up the Dow Jones Industrial Average. 2002 worldwide sales declined 3% compared with 2001 because of the continuing economic slump in the U.S., ...

... maintained the common stock dividend. With a 25% total return, including dividends, Kodak closed 2002 as the best-performing stock among companies that make up the Dow Jones Industrial Average. 2002 worldwide sales declined 3% compared with 2001 because of the continuing economic slump in the U.S., ...

One Size Fits All? Costs and Benefits of Uniform Accounting Standards

... that when this cost is small, a uniform standard is better than diverse standards. In this sense, a uniform standard and the institutional environment (captured by a low cost of investment) are complements and reinforce one another. This follows from the theory and is consistent with the literature ...

... that when this cost is small, a uniform standard is better than diverse standards. In this sense, a uniform standard and the institutional environment (captured by a low cost of investment) are complements and reinforce one another. This follows from the theory and is consistent with the literature ...

Español - Investor Relations Solutions

... Preguntas y respuestas : No hay lugar como el hogar… Aún 3 Estudios de caso 5 Preguntas y respuestas : No hay una tienda mejor que Lowe’s 12 Preguntas y respuestas : La búsqueda del crecimiento rentable 15 ...

... Preguntas y respuestas : No hay lugar como el hogar… Aún 3 Estudios de caso 5 Preguntas y respuestas : No hay una tienda mejor que Lowe’s 12 Preguntas y respuestas : La búsqueda del crecimiento rentable 15 ...