Heterogeneous exits: Evidence from new firms

... firms in West Germany. These studies emphasized that firms exit the market in several ways and that each form of exit is likely to be caused by different factors. Harhoff et al. (1998), for example, found that the owner’s age affects the probability of voluntary liquidation, but it does not affect t ...

... firms in West Germany. These studies emphasized that firms exit the market in several ways and that each form of exit is likely to be caused by different factors. Harhoff et al. (1998), for example, found that the owner’s age affects the probability of voluntary liquidation, but it does not affect t ...

The Going-Public Decision and the Product Market

... to the firm of operating at a suboptimal scale, making it optimal to go public despite the fixed costs of doing so. This theory implies that firms characterized by greater productivity, output growth, and capital expenditures are more likely to go public. We will test these and other implications he ...

... to the firm of operating at a suboptimal scale, making it optimal to go public despite the fixed costs of doing so. This theory implies that firms characterized by greater productivity, output growth, and capital expenditures are more likely to go public. We will test these and other implications he ...

... Africa has experienced high and continuous economic growth in the past decade, prompting analysts to argue that the continent has reached a turning point in its development history and is poised to play a more significant role in the global economy in the twenty-first century. The average annual gro ...

WATSCO INC (Form: 10-K, Received: 02/29/2016 14:38:52)

... fluctuations in certain commodity costs; ...

... fluctuations in certain commodity costs; ...

Distress Anomaly and Shareholder Risk: International Evidence Assaf Eisdorfer

... typically rely on various financial ratios that indicate proximity to financial distress (e.g., book leverage), as well as some measures of profitability (e.g., return on assets, profit margin), liquidity (e.g., the current ratio), efficiency (e.g., asset turnover), growth prospects (e.g., market-to ...

... typically rely on various financial ratios that indicate proximity to financial distress (e.g., book leverage), as well as some measures of profitability (e.g., return on assets, profit margin), liquidity (e.g., the current ratio), efficiency (e.g., asset turnover), growth prospects (e.g., market-to ...

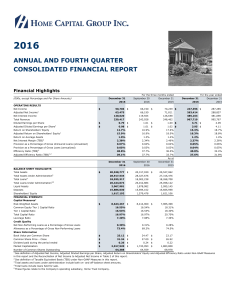

2016 Q4 Report - Home Capital Group

... unemployment rates in energy-producing regions are expected to remain elevated in 2017. Also, the Company expects inflation will generally be within the Bank of Canada’s target of 1% to 3%, leading to stable credit losses and consistent demand for the Company’s lending products in its established re ...

... unemployment rates in energy-producing regions are expected to remain elevated in 2017. Also, the Company expects inflation will generally be within the Bank of Canada’s target of 1% to 3%, leading to stable credit losses and consistent demand for the Company’s lending products in its established re ...

S0700277_en.pdf

... Applications for the right to reproduce this work are welcomed and should be sent to the Secretary of the Publications Board, United Nations Headquarters, New York, N.Y. 10017, U.S.A. Member States and their governmental institutions may reproduce this work without prior authorization, but are reque ...

... Applications for the right to reproduce this work are welcomed and should be sent to the Secretary of the Publications Board, United Nations Headquarters, New York, N.Y. 10017, U.S.A. Member States and their governmental institutions may reproduce this work without prior authorization, but are reque ...

The Separation of Ownership and Control and Corporate Tax

... Kaplan and Stromberg 2009; Masulis and Thomas 2009). However, little is known about PEbacked firms’ tax practices. Given recent criticisms of PE firm investment practices,6 and the growing significance of PE firms for the U.S. capital markets,7 our study provides new insights on the extent to which ...

... Kaplan and Stromberg 2009; Masulis and Thomas 2009). However, little is known about PEbacked firms’ tax practices. Given recent criticisms of PE firm investment practices,6 and the growing significance of PE firms for the U.S. capital markets,7 our study provides new insights on the extent to which ...

The Liquidity Premium of Near-Money Assets

... The opportunity-cost-of-money theory suggests that reserve remuneration policies of central banks could potentially change the relationship between the level of short-term interest rates and liquidity premia of near-money assets. Paying interest on reserves (IOR) drastically reduces the opportunity ...

... The opportunity-cost-of-money theory suggests that reserve remuneration policies of central banks could potentially change the relationship between the level of short-term interest rates and liquidity premia of near-money assets. Paying interest on reserves (IOR) drastically reduces the opportunity ...

EIB - EESC European Economic and Social Committee

... instability since the outbreak of the financial crisis, earlier monetary expansion programmes have provided more and more liquidity at key interest rates for European banks. ...

... instability since the outbreak of the financial crisis, earlier monetary expansion programmes have provided more and more liquidity at key interest rates for European banks. ...

TSAKOS ENERGY NAVIGATION LTD (Form: 6-K

... The Board has fixed its number at not less than five nor more than fifteen and following the 2008 Annual Meeting will consist of eight directors. Under the Company’s Bye-laws, one third (or the number nearest one third) of the Board (with the exception of any executive director) retires by rotation ...

... The Board has fixed its number at not less than five nor more than fifteen and following the 2008 Annual Meeting will consist of eight directors. Under the Company’s Bye-laws, one third (or the number nearest one third) of the Board (with the exception of any executive director) retires by rotation ...

REV Group, Inc.

... Notes to the Condensed Unaudited Consolidated Financial Statements (Dollars in thousands, unless noted otherwise) Note 1. Basis of Presentation The condensed unaudited consolidated financial statements include the accounts of REV Group, Inc. (“REV” or “the Company”) and all of its subsidiaries and a ...

... Notes to the Condensed Unaudited Consolidated Financial Statements (Dollars in thousands, unless noted otherwise) Note 1. Basis of Presentation The condensed unaudited consolidated financial statements include the accounts of REV Group, Inc. (“REV” or “the Company”) and all of its subsidiaries and a ...

Form 8-K CURRENT REPORT Pursuant to Section 13 or 15(d)

... Piedmont Office Realty Trust, Inc. (the “Registrant”) is filing this Current Report on Form 8−K (the “Form 8−K”) to update the historical financial statements, Selected Financial Data, and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in the Registra ...

... Piedmont Office Realty Trust, Inc. (the “Registrant”) is filing this Current Report on Form 8−K (the “Form 8−K”) to update the historical financial statements, Selected Financial Data, and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in the Registra ...

Off the Cliff and Back? Credit Conditions and ∗ Davin Chor

... also have to be incurred before export revenues are realized. To overcome these liquidity constraints, firms routinely rely on financing from banks or trade credit extended by their business partners. The additional risk that is faced in exporting relative to domestic sales further necessitates insu ...

... also have to be incurred before export revenues are realized. To overcome these liquidity constraints, firms routinely rely on financing from banks or trade credit extended by their business partners. The additional risk that is faced in exporting relative to domestic sales further necessitates insu ...

Xerox Corporation

... valuations is to build an investment strategy based on whether the firm is overvalued, undervalued, or fairly valued. We started with the method of comparables. These are tools based on financial ratios that value the firm based on 7 different aspects. Using these methods we found that the value of ...

... valuations is to build an investment strategy based on whether the firm is overvalued, undervalued, or fairly valued. We started with the method of comparables. These are tools based on financial ratios that value the firm based on 7 different aspects. Using these methods we found that the value of ...

The Week at a Glance

... would be little changed year-on-year. At 0.6%, this year’s deficit would be a tad smaller as a share of GDP, however. Beyond 2015-16, fiscal forecasts are limited to core government, as opposed to the broader summary account representation. When it comes to this narrower core government measure, the ...

... would be little changed year-on-year. At 0.6%, this year’s deficit would be a tad smaller as a share of GDP, however. Beyond 2015-16, fiscal forecasts are limited to core government, as opposed to the broader summary account representation. When it comes to this narrower core government measure, the ...

exam3 - Trinity University

... b. No. Paragraph 6b requires that there be little or no initial investment. The $100,000 option premium is larger than “would be required for other types of contracts that would be expected to have a similar response to changes in market factors.” The reason has nothing to do with the Paragraph 6a n ...

... b. No. Paragraph 6b requires that there be little or no initial investment. The $100,000 option premium is larger than “would be required for other types of contracts that would be expected to have a similar response to changes in market factors.” The reason has nothing to do with the Paragraph 6a n ...

dick`s sporting goods, inc. - Morningstar Document Research

... Sports HQ as well as eCommerce websites at www.DICKS.com, www.golfgalaxy.com, www.fieldandstreamshop.com and www.caliastudio.com. When used in this Quarterly Report on Form 10-Q, unless the context otherwise requires or otherwise specifies, any reference to "year" is to the Company's fiscal year. Th ...

... Sports HQ as well as eCommerce websites at www.DICKS.com, www.golfgalaxy.com, www.fieldandstreamshop.com and www.caliastudio.com. When used in this Quarterly Report on Form 10-Q, unless the context otherwise requires or otherwise specifies, any reference to "year" is to the Company's fiscal year. Th ...

The Risky Capital of Emerging Markets – A Long-Run

... Epstein and Zin (1989), asset values respond sharply to persistent shocks that are global in nature. Regions that are more sensitive to these shocks represent riskier investments and so must offer higher risk premia as compensation. Additionally, each region is exposed to both common and idiosyncrat ...

... Epstein and Zin (1989), asset values respond sharply to persistent shocks that are global in nature. Regions that are more sensitive to these shocks represent riskier investments and so must offer higher risk premia as compensation. Additionally, each region is exposed to both common and idiosyncrat ...

EIB - EESC European Economic and Social Committee

... instability since the outbreak of the financial crisis, earlier monetary expansion programmes have provided more and more liquidity at key interest rates for European banks. ...

... instability since the outbreak of the financial crisis, earlier monetary expansion programmes have provided more and more liquidity at key interest rates for European banks. ...

RADIUS GOLD INC. (Form: 20-F, Received: 05/15

... A mineral resource estimate is based on information on the geology of the deposit and the continuity of mineralization. Assumptions concerning economic and operating parameters , including cut-off grades and economic mining widths, based on factors typical for the type of deposit, may be used if the ...

... A mineral resource estimate is based on information on the geology of the deposit and the continuity of mineralization. Assumptions concerning economic and operating parameters , including cut-off grades and economic mining widths, based on factors typical for the type of deposit, may be used if the ...

Essays on international capital flows and macroeconomic stability

... Risk and risk aversion are found to affect bond and share flows to South Africa differently. Risk consistently affects bond flows more than share flows. The relationship between risk and portfolio flows is also found to be continuosly evolving and highly dependent on the macroeconomic environment. W ...

... Risk and risk aversion are found to affect bond and share flows to South Africa differently. Risk consistently affects bond flows more than share flows. The relationship between risk and portfolio flows is also found to be continuosly evolving and highly dependent on the macroeconomic environment. W ...