NBER WORKING PAPER SERIES TRANSPARENCY AND INTERNATIONAL INVESTOR BEHAVIOR R. Gaston Gelos

... international financial institutions have actively promoted more transparency among their member countries as well as made strides to become more transparent in their own operations. The strive for more transparency presupposes that destabilizing behavior by individual investors can be avoided or at ...

... international financial institutions have actively promoted more transparency among their member countries as well as made strides to become more transparent in their own operations. The strive for more transparency presupposes that destabilizing behavior by individual investors can be avoided or at ...

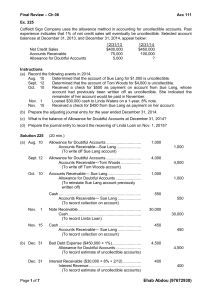

Final Review – Ch 08 Acc 111 Ex. 225 Coffeldt Sign Company uses

... (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's provision for uncollectible accounts. (c) Assume that the company has ...

... (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's provision for uncollectible accounts. (c) Assume that the company has ...

PNC Capital Advisors, LLC

... Unless they have executed an investment advisory agreement with PNC Capital Advisors, shareholders in Funds advised by PNC Capital Advisors will not be advisory clients of PNC Capital Advisors (with respect to their investment in such Fund(s)), and PNC Capital Advisors will not provide investment a ...

... Unless they have executed an investment advisory agreement with PNC Capital Advisors, shareholders in Funds advised by PNC Capital Advisors will not be advisory clients of PNC Capital Advisors (with respect to their investment in such Fund(s)), and PNC Capital Advisors will not provide investment a ...

Is It Time for an Infrastructure Push?

... amount invested is converted into productive public capital stock—increased public investment leads to more limited long-term output gains. •• For economies with clearly identified infrastructure needs and efficient public investment processes and where there is economic slack and monetary accommoda ...

... amount invested is converted into productive public capital stock—increased public investment leads to more limited long-term output gains. •• For economies with clearly identified infrastructure needs and efficient public investment processes and where there is economic slack and monetary accommoda ...

Cowen Group, Inc. - Investor Overview

... We have made statements in this Quarterly Report on Form 10-Q (including in “Management's Discussion and Analysis of Financial Condition and Results of Operations”) that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can ...

... We have made statements in this Quarterly Report on Form 10-Q (including in “Management's Discussion and Analysis of Financial Condition and Results of Operations”) that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can ...

long-term portfolio guide - Responsible Investment Association

... then other key players—asset managers, corporate boards, and company executives—will likely follow suit”.2 In a recent survey of public and private pension plans and sovereign-wealth fund managers, respondents overwhelmingly agreed that while the ability to invest long term is an advantage, they do ...

... then other key players—asset managers, corporate boards, and company executives—will likely follow suit”.2 In a recent survey of public and private pension plans and sovereign-wealth fund managers, respondents overwhelmingly agreed that while the ability to invest long term is an advantage, they do ...

Planet Fitness, Inc.

... Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, and other future conditions. Forward-looking statements can be ...

... Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, and other future conditions. Forward-looking statements can be ...

Uncertainty Shocks in a Model of E↵ective Demand Susanto Basu Brent Bundick ⇤

... Economists and the financial press often discuss uncertainty about the future as an important driver of economic fluctuations, and a contributor in the Great Recession and subsequent slow recovery. For example, Diamond (2010) says, “What’s critical right now is not the functioning of the labor marke ...

... Economists and the financial press often discuss uncertainty about the future as an important driver of economic fluctuations, and a contributor in the Great Recession and subsequent slow recovery. For example, Diamond (2010) says, “What’s critical right now is not the functioning of the labor marke ...

Naughty Firms, Noisy Disclosure

... industry trade links with that particular country. We argue that when more countries with which U.S. industry trades pass the laws antitrust authorities find it easier to cooperate and convict members of international cartels, increasing the costs of collusion for the industry. To ascertain the val ...

... industry trade links with that particular country. We argue that when more countries with which U.S. industry trades pass the laws antitrust authorities find it easier to cooperate and convict members of international cartels, increasing the costs of collusion for the industry. To ascertain the val ...

How expensive are cost savings?

... public-private partnerships offer real benefits through higher productive efficiency at the project level. It is against this background that the paper analyses the microeconomic pros and cons of public-private partnerships by identifying the sources of both higher benefits and higher costs associated wi ...

... public-private partnerships offer real benefits through higher productive efficiency at the project level. It is against this background that the paper analyses the microeconomic pros and cons of public-private partnerships by identifying the sources of both higher benefits and higher costs associated wi ...

Securities fraud and corporate board turnover

... Although directors rarely participate in financial settlements, there may be other costs that directors experience as a result of service on the board of a firm in which a fraud occurs. One cost is the loss of their position on the board of directors of the firm that is named as the defendant in a l ...

... Although directors rarely participate in financial settlements, there may be other costs that directors experience as a result of service on the board of a firm in which a fraud occurs. One cost is the loss of their position on the board of directors of the firm that is named as the defendant in a l ...

research paper series Research Paper 2007/33

... market, and are more likely to enter export markets. A further result is that through market diversification, exports tend to stabilize firms’ total sales. The rest of the paper is laid out as follows. In Section 2, we outline our model, in the closed economy case. Section 3 focuses on the open econ ...

... market, and are more likely to enter export markets. A further result is that through market diversification, exports tend to stabilize firms’ total sales. The rest of the paper is laid out as follows. In Section 2, we outline our model, in the closed economy case. Section 3 focuses on the open econ ...

Issues In-Depth FASB`s Proposed Chagnes to Not-for

... During the project, the FASB performed outreach activities with stakeholders in addition to the NAC. These stakeholders included members of the National Association of College and University Business Officers’ (NACUBO) Accounting Principles Committee; the Healthcare Financial Management Association’ ...

... During the project, the FASB performed outreach activities with stakeholders in addition to the NAC. These stakeholders included members of the National Association of College and University Business Officers’ (NACUBO) Accounting Principles Committee; the Healthcare Financial Management Association’ ...

Basel III Leverage Ratio Framework and Disclosure Requirements

... safe and sound banking practices. The Associations urge the Committee to carefully consider this perverse incentive, especially in light of the objective that “the capital adequacy framework should . . . take into account the effects of capital requirements on banks’ risk-taking incentives, e.g. whe ...

... safe and sound banking practices. The Associations urge the Committee to carefully consider this perverse incentive, especially in light of the objective that “the capital adequacy framework should . . . take into account the effects of capital requirements on banks’ risk-taking incentives, e.g. whe ...

Keeping BT ahead of the game

... (including a summary financial statement) for the year ended 31 March 2008 has been issued to all shareholders. In this Annual Report, references to ‘BT Group’, ‘BT’, ‘the group’, ‘the company’, ‘we’ or ‘our’ are to BT Group plc (which includes the continuing activities of British Telecommunicatio ...

... (including a summary financial statement) for the year ended 31 March 2008 has been issued to all shareholders. In this Annual Report, references to ‘BT Group’, ‘BT’, ‘the group’, ‘the company’, ‘we’ or ‘our’ are to BT Group plc (which includes the continuing activities of British Telecommunicatio ...

BELK INC - Investis

... Consumer research conducted by the Company has identified significant sales opportunities with customers seeking modern and trendy merchandise. As a result, a focus is being placed on expanding assortments of this type of merchandise across all categories. The Company is also seeking to enhance its ...

... Consumer research conducted by the Company has identified significant sales opportunities with customers seeking modern and trendy merchandise. As a result, a focus is being placed on expanding assortments of this type of merchandise across all categories. The Company is also seeking to enhance its ...

2014 ANNUAL REPORT Financial and Corporate Responsibility

... & Security, which has grown earnings over the last four years while increasing margins from 9.9 percent in 2010 to 16.5 percent in 2014. It also continued progress on improving the growth trajectory of Otis, where equipment orders have risen 22 percent over the last two years, including 7 percent in ...

... & Security, which has grown earnings over the last four years while increasing margins from 9.9 percent in 2010 to 16.5 percent in 2014. It also continued progress on improving the growth trajectory of Otis, where equipment orders have risen 22 percent over the last two years, including 7 percent in ...

1 How was the Quantitative Easing Program of the 1930s Unwound

... the start of the recession in 2008, short-term interest rates quickly hit the zero lower bound and central banks considered non-traditional monetary policies to stimulate their economies. These policies led to a massive buildup of excess reserves and have not quickly dispersed after QE ended. Since ...

... the start of the recession in 2008, short-term interest rates quickly hit the zero lower bound and central banks considered non-traditional monetary policies to stimulate their economies. These policies led to a massive buildup of excess reserves and have not quickly dispersed after QE ended. Since ...

Finance Circular 2006/xx

... such as leasehold improvements. The incentive is accounted for the same as above but an asset recorded instead of a relocation expense. This asset will then be accounted for using the applicable accounting standard. ...

... such as leasehold improvements. The incentive is accounted for the same as above but an asset recorded instead of a relocation expense. This asset will then be accounted for using the applicable accounting standard. ...