DOC - World bank documents

... reducing both macroeconomic and financial vulnerabilities, curbed credit expansion and reduced to a certain extent foreign borrowing. Several actions were taken by the CNB to maintain confidence in the currency stability. An increase of the foreign exchange component of the reserve requirement alloc ...

... reducing both macroeconomic and financial vulnerabilities, curbed credit expansion and reduced to a certain extent foreign borrowing. Several actions were taken by the CNB to maintain confidence in the currency stability. An increase of the foreign exchange component of the reserve requirement alloc ...

Slide 1

... Activity is beginning to recover after the slowdown in 2012 Industrial Production and World Trade (annualized percent change of three-month moving average over previous three-month moving average) ...

... Activity is beginning to recover after the slowdown in 2012 Industrial Production and World Trade (annualized percent change of three-month moving average over previous three-month moving average) ...

Mah Hui Lim

... Need finance to serve real economy but NOT financialization which drives speculation and bubbles Finance needs to be better regulated because finance is an industry with high negative externalities ...

... Need finance to serve real economy but NOT financialization which drives speculation and bubbles Finance needs to be better regulated because finance is an industry with high negative externalities ...

Slide 1

... Changes to European passport system Changes that would prevent a repeat of the Icesave episode: – Deposit insurance in domestic currency. – If a host supervisor provides deposit insurance that exceeds deposit insurance in the home country it should have shared supervisory responsibilities. – System ...

... Changes to European passport system Changes that would prevent a repeat of the Icesave episode: – Deposit insurance in domestic currency. – If a host supervisor provides deposit insurance that exceeds deposit insurance in the home country it should have shared supervisory responsibilities. – System ...

Paul Samuelson, 1915 -

... • Economics of public goods • Turnpike theorem for growth • Overlapping generations framework • Randomness of speculative prices efficient market hypothesis ...

... • Economics of public goods • Turnpike theorem for growth • Overlapping generations framework • Randomness of speculative prices efficient market hypothesis ...

APS7 - Cornell

... attempt to rid the economy of inflation. Ultimately, the economy went into a deep recession, but before it did, interest rates went to record levels. a. Explain how this policy mix led to very high interest rates. b. Show graphically the effect of the high interest rates on the foreign exchange mark ...

... attempt to rid the economy of inflation. Ultimately, the economy went into a deep recession, but before it did, interest rates went to record levels. a. Explain how this policy mix led to very high interest rates. b. Show graphically the effect of the high interest rates on the foreign exchange mark ...

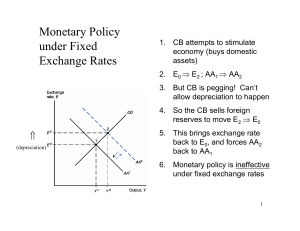

Fixed Exchange Rates and Macroeconomic Policy

... policy is exchange controls to prevent traders buying or selling domestic currency • But exchange controls reduce trade and foreign direct investment, and present opportunities for corruption ...

... policy is exchange controls to prevent traders buying or selling domestic currency • But exchange controls reduce trade and foreign direct investment, and present opportunities for corruption ...

Presentazione standard di PowerPoint

... • Beginning of European crisis: nationalizaton of Anglo-Irish Bank. ...

... • Beginning of European crisis: nationalizaton of Anglo-Irish Bank. ...

The Global Context of Business

... 2. Explain how differences in import-export balances, exchange rates, and foreign competition determine the ways in which countries and businesses respond to the international ...

... 2. Explain how differences in import-export balances, exchange rates, and foreign competition determine the ways in which countries and businesses respond to the international ...

Slayt 1

... The rise of Neo-Liberal Order: Deregulation, end of nation states as unit of analysis. Governance Structures and Institutional Foundation of market under attack ...

... The rise of Neo-Liberal Order: Deregulation, end of nation states as unit of analysis. Governance Structures and Institutional Foundation of market under attack ...

Financial Crisis in Central and Southern Europe: The World Bank`s

... Southern Europe: The World Bank’s Instruments and Policies ...

... Southern Europe: The World Bank’s Instruments and Policies ...

Power Point Presentation

... Capitalist markets increasingly govern food supplies, water and other basic necessities: global hunger and starvation mediated by the capitalist market in ways that resemble 19th century capitalism. ...

... Capitalist markets increasingly govern food supplies, water and other basic necessities: global hunger and starvation mediated by the capitalist market in ways that resemble 19th century capitalism. ...

Document

... developed into private waterfronts, making it increasingly difficult for watermen to earn a living. • Cheaper imports, inexpensive foreign labor and consumers looking for a deal are taking a toll on the industry. ...

... developed into private waterfronts, making it increasingly difficult for watermen to earn a living. • Cheaper imports, inexpensive foreign labor and consumers looking for a deal are taking a toll on the industry. ...

Revolt Against Big

... The anger in US against bailouts of not only banks but Big Motors (General Motors, Ford, and Chrysler) even if it meant protection of million of auto jobs is palpable – it is no longer, what is good for General Motors is good for America. Similarly, there is growing frustration with Big Governme ...

... The anger in US against bailouts of not only banks but Big Motors (General Motors, Ford, and Chrysler) even if it meant protection of million of auto jobs is palpable – it is no longer, what is good for General Motors is good for America. Similarly, there is growing frustration with Big Governme ...

Downlaod File

... now develop contacts with potential customers overseas by having a website. It is making it easier for parent to monitor the actions and performance of its foreign subsidiaries. For example the website may show the product and price that is selling at which allows to: easily advertise their products ...

... now develop contacts with potential customers overseas by having a website. It is making it easier for parent to monitor the actions and performance of its foreign subsidiaries. For example the website may show the product and price that is selling at which allows to: easily advertise their products ...

The Political Economy of Finance: Greece from Postwar to EMU

... financial system: cheap credit, at negative real lending rates, and uninhibited government access to finance, notably through debt monetization. A generation of overindebted ailing firms, including public enterprises, and a swelling public debt were the visible results of the abuse of financial inte ...

... financial system: cheap credit, at negative real lending rates, and uninhibited government access to finance, notably through debt monetization. A generation of overindebted ailing firms, including public enterprises, and a swelling public debt were the visible results of the abuse of financial inte ...

Learnings from the Global Financial Crisis

... Reserve Bank of New Zealand: Bulletin, Vol. 75, No. 3, September 2012 ...

... Reserve Bank of New Zealand: Bulletin, Vol. 75, No. 3, September 2012 ...

what the dollar`s surge means to investors

... growth, as the benefits of weaker currencies of our trading partners enables those economies to eventually post stronger growth, a long-term benefit to our trade figures over time. Healthy trading partners benefit us in the long run. Still, it can cause some employers – not just those who export, bu ...

... growth, as the benefits of weaker currencies of our trading partners enables those economies to eventually post stronger growth, a long-term benefit to our trade figures over time. Healthy trading partners benefit us in the long run. Still, it can cause some employers – not just those who export, bu ...

fbar fatca - GSTWC 大西雅圖台灣婦女會

... --non-willful violation : up to $10,000 for each violation --Willful violation: greater of $100K or 50% of the balance in the account at the time of violation Both Civil and criminal penalties can be imposed ...

... --non-willful violation : up to $10,000 for each violation --Willful violation: greater of $100K or 50% of the balance in the account at the time of violation Both Civil and criminal penalties can be imposed ...

1 The Oxford Companion to American Politics Matthias

... Given the ongoing process of globalization in the 1960s with the gradual liberalization of capital flows and the increasing importance of international trade, a very large ‘Eurodollar’ market developed in London and the pressure on the Bretton Woods system threatened to spiral out of control (Eichen ...

... Given the ongoing process of globalization in the 1960s with the gradual liberalization of capital flows and the increasing importance of international trade, a very large ‘Eurodollar’ market developed in London and the pressure on the Bretton Woods system threatened to spiral out of control (Eichen ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.