A Ticking Time Bomb: TLAC and Other Attempts to Privatize Bank

... well above regulatory minimums. There is a paucity of work for the administrators at the FDIC or other regulators to do. Just two years before the last crisis developed regulatory conclaves and central bank Financial Stability Reports in 2005 dismissed the notion that banks could be a ...

... well above regulatory minimums. There is a paucity of work for the administrators at the FDIC or other regulators to do. Just two years before the last crisis developed regulatory conclaves and central bank Financial Stability Reports in 2005 dismissed the notion that banks could be a ...

Slide 1

... efficiency, competition, contestability and competitive neutrality and, in balancing these objectives, is to promote financial system stability in Australia.” APRA Act, 1998, Section 8(2) ...

... efficiency, competition, contestability and competitive neutrality and, in balancing these objectives, is to promote financial system stability in Australia.” APRA Act, 1998, Section 8(2) ...

Argentina`s Economic Crisis: Interpretations and Proposals

... most current form, it is identified with convertibility of the currency. To suppose that the crisis could be resolved by a change from the policy of convertibility is as illusionary as imagining a viability of some kind of mechanism of "popular devaluation" that avoids the depreciation of wages or t ...

... most current form, it is identified with convertibility of the currency. To suppose that the crisis could be resolved by a change from the policy of convertibility is as illusionary as imagining a viability of some kind of mechanism of "popular devaluation" that avoids the depreciation of wages or t ...

An Overview of Accredited Standards Committee X9

... Serves on the Minneapolis Bank’s senior management committee Provides executive oversight to operations, customer service, technology & payments functions, as well as to the Financial Services Policy Committee Support Office Conducts industry relations on behalf of the Federal Reserve System, servin ...

... Serves on the Minneapolis Bank’s senior management committee Provides executive oversight to operations, customer service, technology & payments functions, as well as to the Financial Services Policy Committee Support Office Conducts industry relations on behalf of the Federal Reserve System, servin ...

Financial Repression to Ease Fiscal Stress: Turning

... • There is ample evidence that financial repression is reappearing in the eurozone: policy-makers are turning back the clock on the freedom of financial markets, inter alia to reduce the burden of high public debt. • Several euro area governments have arm-twisted financial institutions, savers and i ...

... • There is ample evidence that financial repression is reappearing in the eurozone: policy-makers are turning back the clock on the freedom of financial markets, inter alia to reduce the burden of high public debt. • Several euro area governments have arm-twisted financial institutions, savers and i ...

Barry Eichengreen Kevin H. O`Rourke 6 April 2009, VOX

... outside the US, with even larger falls in manufacturing production, exports and equity prices. In fact, when we look globally, as in Figure 1, the decline in industrial production in the last nine months has been at least as severe as in the nine months following the 1929 peak. (All graphs in this c ...

... outside the US, with even larger falls in manufacturing production, exports and equity prices. In fact, when we look globally, as in Figure 1, the decline in industrial production in the last nine months has been at least as severe as in the nine months following the 1929 peak. (All graphs in this c ...

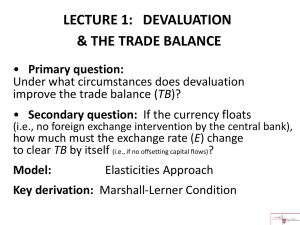

F570 International Corporate Finance

... Capital outflows occur, preventing fall in i Capital outflows lead to depreciation of country’s exchange rate Depreciation of exchange rate improves competitiveness of exports Net exports rise, Income rises Model predicts that monetary policy in an ...

... Capital outflows occur, preventing fall in i Capital outflows lead to depreciation of country’s exchange rate Depreciation of exchange rate improves competitiveness of exports Net exports rise, Income rises Model predicts that monetary policy in an ...

Slajd 1 - Uniwersytet Warszawski

... Very conservative central bank, capital protection strategy ...

... Very conservative central bank, capital protection strategy ...

The data refer to the Hong Kong Special Administrative Region

... Base Money comprises currency in circulation, clearing accounts of banking institutions in the Hong Kong Monetary Authority (HKMA) in national currency and foreign currency, and exchange funds issued by the HKMA. Currency in circulation refers to certificates of indebtedness and notes and coins issu ...

... Base Money comprises currency in circulation, clearing accounts of banking institutions in the Hong Kong Monetary Authority (HKMA) in national currency and foreign currency, and exchange funds issued by the HKMA. Currency in circulation refers to certificates of indebtedness and notes and coins issu ...

Forecasting outstanding debt securities in Europe

... EC revised EU growth downwards to 1.6% in 2011 and 0.6% in 2012 However, some recent data point to a recession in Europe (forward-looking indicatorsPMI (47), German ZEW survey, and high-frequency data) Further downward revisions of global and euro-zone growth in prospect - e.g: Roubini expects ...

... EC revised EU growth downwards to 1.6% in 2011 and 0.6% in 2012 However, some recent data point to a recession in Europe (forward-looking indicatorsPMI (47), German ZEW survey, and high-frequency data) Further downward revisions of global and euro-zone growth in prospect - e.g: Roubini expects ...

debt crisis of euro area

... private and public expenditures → current account deficits Inflow of capital and low real interest rates in countries with higher inflation rate → overheating of these economies ...

... private and public expenditures → current account deficits Inflow of capital and low real interest rates in countries with higher inflation rate → overheating of these economies ...

Paul Krugman wrote The Return of Depression Economics (1999

... assets were bought and sold internationally. As lending dried up, demand for emerging market currencies dried up, leading to exchange rate changes that harmed anyone who had borrowed in those currencies. Chapter 10 While we may not be in a depression, we are faced with what Krugman calls “depression ...

... assets were bought and sold internationally. As lending dried up, demand for emerging market currencies dried up, leading to exchange rate changes that harmed anyone who had borrowed in those currencies. Chapter 10 While we may not be in a depression, we are faced with what Krugman calls “depression ...

The REAL Story By - Seamount Financial Group

... and wages for those fortunate enough to be employed. These dollars and labor-related costs would have been much better allocated towards innovation, manufacturing and providing education and services towards the betterment of our country rather than the costs to adhere to the ever growing complex w ...

... and wages for those fortunate enough to be employed. These dollars and labor-related costs would have been much better allocated towards innovation, manufacturing and providing education and services towards the betterment of our country rather than the costs to adhere to the ever growing complex w ...

The relationships between currencies and gold

... The economic disequilibria produced by the war were so pronounced, however, that they made it hard to re-establish the gold standard. The cost, in terms of welfare, imposed by inflation, rising public debt and war reparations was so high that it prevented the rapid return to gold. The Genoa conferen ...

... The economic disequilibria produced by the war were so pronounced, however, that they made it hard to re-establish the gold standard. The cost, in terms of welfare, imposed by inflation, rising public debt and war reparations was so high that it prevented the rapid return to gold. The Genoa conferen ...

An X-ray of Economic Stagnation Review of Jack Rasmus, Systemic

... lower than goods; in sum, they yield easier and higher profits. Financial asset investment has been on the increase for decades, has expanded rapidly since 2000 and ‘from less than $100 trillion in 2007 to more than $200 in just the past 8 years’ (212). o In government policy there has been a shift ...

... lower than goods; in sum, they yield easier and higher profits. Financial asset investment has been on the increase for decades, has expanded rapidly since 2000 and ‘from less than $100 trillion in 2007 to more than $200 in just the past 8 years’ (212). o In government policy there has been a shift ...

No Slide Title - AmCham Romania

... Major change in investors’ behaviour: increasing risk aversion; from global excess liquidity to liquidity crunch. ...

... Major change in investors’ behaviour: increasing risk aversion; from global excess liquidity to liquidity crunch. ...

Second Quarter Market Summary Dear Friends, Among the quarter`s

... value for the stock market as we discounted a less stressed macro environment. For investors, though, the second quarter was positive. Larger-cap U.S. stocks were up 5.2% for the quarter and 7.0% for the year to date, after rising more than 2% in June. Smaller-company stocks again lagged as they hav ...

... value for the stock market as we discounted a less stressed macro environment. For investors, though, the second quarter was positive. Larger-cap U.S. stocks were up 5.2% for the quarter and 7.0% for the year to date, after rising more than 2% in June. Smaller-company stocks again lagged as they hav ...

Lessons from Asian Financial Experience Andrew Sheng commenTAry

... Based upon the above survey, Krueger draws the conclusion that delays in recognizing and confronting the difficulties are costly. Crisis management requires credibility, built through financial condition transparency and decisive actions. There must be consistency between exchange rate, monetary, an ...

... Based upon the above survey, Krueger draws the conclusion that delays in recognizing and confronting the difficulties are costly. Crisis management requires credibility, built through financial condition transparency and decisive actions. There must be consistency between exchange rate, monetary, an ...

Helmut Reisen

... • “Pure” contagion – (October 2008) breakdown of money and banking markets → generalised risk aversion → shedding of assets w/a public guarantees. ...

... • “Pure” contagion – (October 2008) breakdown of money and banking markets → generalised risk aversion → shedding of assets w/a public guarantees. ...

Homework assignment 7

... 15) A fixed exchange rate can be maintained by a government as long as it has sufficient a. supplies of its own currency. b. foreign reserves. c. gold and other precious metals. d. tax revenues. ...

... 15) A fixed exchange rate can be maintained by a government as long as it has sufficient a. supplies of its own currency. b. foreign reserves. c. gold and other precious metals. d. tax revenues. ...

Globalization, emerging market economies and currency crisis in Asia:

... the most open economy among the Asian-5, experienced a surge in current account deficit between 1993-1995, but brought it sharply down to 5.2% of GDP in 1996. In midst of optimism about the growth performance of the region, these indicators were not perceived to be clear signals of trouble. Real exc ...

... the most open economy among the Asian-5, experienced a surge in current account deficit between 1993-1995, but brought it sharply down to 5.2% of GDP in 1996. In midst of optimism about the growth performance of the region, these indicators were not perceived to be clear signals of trouble. Real exc ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.