Costa_Rica_en.pdf

... into force. In November, a single free trade agreement was signed between Mexico and Central America to converge existing separate bilateral agreements. In 2011 total consumption grew at pace similar to 2010 as private consumption picked up slightly and public consumption slowed. Gross fixed investm ...

... into force. In November, a single free trade agreement was signed between Mexico and Central America to converge existing separate bilateral agreements. In 2011 total consumption grew at pace similar to 2010 as private consumption picked up slightly and public consumption slowed. Gross fixed investm ...

Sceptical US politicians slow to buy Paulson`s $700bn

... they sold even at fundamental prices underlines the main weakness in the bailout plan: It is silent on how banks will raise new capital to plug the hole. Foreign investors might inject new funds. Already, sovereign wealth funds from the Middle East and Asia have bought stakes ...

... they sold even at fundamental prices underlines the main weakness in the bailout plan: It is silent on how banks will raise new capital to plug the hole. Foreign investors might inject new funds. Already, sovereign wealth funds from the Middle East and Asia have bought stakes ...

lecture 09: the open economy

... Net capital outflows =S – I =net outflow of “loanable funds” =net purchases of foreign assets Net capital outflows The country’s purchases of foreign assets minus foreign purchases of domestic assets. When S > I, country is a net lender, when S < I, country is a net borrower. An open-economy version ...

... Net capital outflows =S – I =net outflow of “loanable funds” =net purchases of foreign assets Net capital outflows The country’s purchases of foreign assets minus foreign purchases of domestic assets. When S > I, country is a net lender, when S < I, country is a net borrower. An open-economy version ...

It`s Not About Liquidity - University of Colorado Boulder

... concerns and a resulting (2) credit freeze! • It’s really about a loss of confidence. ...

... concerns and a resulting (2) credit freeze! • It’s really about a loss of confidence. ...

Highlights of Colombia Economic analysis 2011

... The United States and the Europe Union grew about 1.5% in 2011. Asian economies showed greater energy, with rates above 6.5%, except in the case of Japan. The real estate market in the United States is still at a standstill. Fears regarding public debt sustainability continued to be felt at the Euro ...

... The United States and the Europe Union grew about 1.5% in 2011. Asian economies showed greater energy, with rates above 6.5%, except in the case of Japan. The real estate market in the United States is still at a standstill. Fears regarding public debt sustainability continued to be felt at the Euro ...

Economists try to predict trends in the world economy by applying

... The Global economy is the world economy. It is the economic activity going on in the world. It is the combined economic activity that takes place in each individual economy plus the activity between countries. It includes all production, trade, financial flows, investment, technology, labour and eco ...

... The Global economy is the world economy. It is the economic activity going on in the world. It is the combined economic activity that takes place in each individual economy plus the activity between countries. It includes all production, trade, financial flows, investment, technology, labour and eco ...

International Trade

... Free Trade Agreement (CAFTA)—2004, CAFTA has eliminated all tariffs on 80 percent of U.S. manufactured goods, with the remainder phased out over a few years. ...

... Free Trade Agreement (CAFTA)—2004, CAFTA has eliminated all tariffs on 80 percent of U.S. manufactured goods, with the remainder phased out over a few years. ...

Controversial and novel features of the Eurozone crisis as

... • Why price stability then? Holtfrerich: “found the clue” in the early German policy decisions. ...

... • Why price stability then? Holtfrerich: “found the clue” in the early German policy decisions. ...

How similar is the current crisis to the Great Depression?

... current crisis. This feature distinguishes these episodes from the many other financial crises of the past few decades, all of which occurred in small, typically emerging economies, or more gardenvariety recessions in the major economies. Given the weight of the US economy and the US financial syste ...

... current crisis. This feature distinguishes these episodes from the many other financial crises of the past few decades, all of which occurred in small, typically emerging economies, or more gardenvariety recessions in the major economies. Given the weight of the US economy and the US financial syste ...

Latin American Financial Crises and Recovery

... keep rates stable or fixed. • The possibility to relax policy provided an opening for recovery and higher growth that was experienced in all countries. Brazil and Mexico took measures to restore their prior policy stance with nominally flexible exchange rates. • Their expansions were short-lived and ...

... keep rates stable or fixed. • The possibility to relax policy provided an opening for recovery and higher growth that was experienced in all countries. Brazil and Mexico took measures to restore their prior policy stance with nominally flexible exchange rates. • Their expansions were short-lived and ...

Responding to the Crisis: Real Estate, Asia, and the Global Economy

... Infrastructure and real estate investments to “retrofit” economies all over the world to changing economic circumstances and environmental demands could be crucial element in pulling the global economy out of ...

... Infrastructure and real estate investments to “retrofit” economies all over the world to changing economic circumstances and environmental demands could be crucial element in pulling the global economy out of ...

Chapter 28 Exchange Rates and Macroeconomic Policy

... GDP, an increase in the relative interest rate in the United States, a change in tastes that makes U.S. goods more desirable to foreigners, a relative decrease in prices in the United States, and an expectation that the foreign currency will depreciate. The following shift the supply of foreign curr ...

... GDP, an increase in the relative interest rate in the United States, a change in tastes that makes U.S. goods more desirable to foreigners, a relative decrease in prices in the United States, and an expectation that the foreign currency will depreciate. The following shift the supply of foreign curr ...

Chapter 16 Exchange Rates and Macroeconomic Policy

... GDP, an increase in the relative interest rate in the United States, a change in tastes that makes U.S. goods more desirable to foreigners, a relative decrease in prices in the United States, and an expectation that the foreign currency will depreciate. The following shift the supply of foreign curr ...

... GDP, an increase in the relative interest rate in the United States, a change in tastes that makes U.S. goods more desirable to foreigners, a relative decrease in prices in the United States, and an expectation that the foreign currency will depreciate. The following shift the supply of foreign curr ...

The Hellenic Republic`s Fiscal Policies

... • helping business through the provision of high quality business support services • modernize education and upgrade skills through lifelong learning. ...

... • helping business through the provision of high quality business support services • modernize education and upgrade skills through lifelong learning. ...

FRBSF E L CONOMIC ETTER

... that have become illiquid. As a supervisor and regulator of banks, the Fed has long focused on insuring that banks hold adequate capital and that they carefully monitor and manage risks. As a consequence, banks are well-positioned to weather the financial turmoil.The Fed is carefully monitoring the ...

... that have become illiquid. As a supervisor and regulator of banks, the Fed has long focused on insuring that banks hold adequate capital and that they carefully monitor and manage risks. As a consequence, banks are well-positioned to weather the financial turmoil.The Fed is carefully monitoring the ...

Uruguay_en.pdf

... Country risk averaged approximately 253 basis points in October, representing a significant drop from the average of 608 registered the previous year, and the 341 basis points recorded in June 2009. Monetary policy remained focused on ensuring price stability. The Central Bank of Uruguay decided to ...

... Country risk averaged approximately 253 basis points in October, representing a significant drop from the average of 608 registered the previous year, and the 341 basis points recorded in June 2009. Monetary policy remained focused on ensuring price stability. The Central Bank of Uruguay decided to ...

Document

... • Budget affects growth, equity through multiple micro (supply-side) channels: incentive effects; provision of public goods, income transfers. Discussed by other speakers. • But Budget also drives the macro framework: mix of fiscal, monetary, debt and exchange rate policies which boosts growth by pr ...

... • Budget affects growth, equity through multiple micro (supply-side) channels: incentive effects; provision of public goods, income transfers. Discussed by other speakers. • But Budget also drives the macro framework: mix of fiscal, monetary, debt and exchange rate policies which boosts growth by pr ...

For Us or For Them? Bailouts Then and Now

... anxious to keep their jobs. Bailouts are heterogeneous and differ significantly in their effects. At their best, they ameliorate panic conditions and reduce human suffering, but at their ...

... anxious to keep their jobs. Bailouts are heterogeneous and differ significantly in their effects. At their best, they ameliorate panic conditions and reduce human suffering, but at their ...

Economic, financial and monetary stability in Europe: reinforcing our

... business cycles. To this end, public debt has to be put on a sustainable path and balanced positions have to be reached such that fiscal policy has sufficient margins to operate even in severe economic crises. Margins also prevent pressures on the central bank to use monetary policy for economic sti ...

... business cycles. To this end, public debt has to be put on a sustainable path and balanced positions have to be reached such that fiscal policy has sufficient margins to operate even in severe economic crises. Margins also prevent pressures on the central bank to use monetary policy for economic sti ...

The current financial and economic crisis

... • The recently published BIS, ECB and IMF ‘Handbook on Securities Statistics’ part I on debt securities issues, addresses a need for more extensive, comparable securities data • Compilation of timely world aggregates (e.g. world quarterly GDP after 60 days) with regional ...

... • The recently published BIS, ECB and IMF ‘Handbook on Securities Statistics’ part I on debt securities issues, addresses a need for more extensive, comparable securities data • Compilation of timely world aggregates (e.g. world quarterly GDP after 60 days) with regional ...

PDF Download

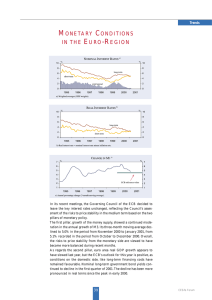

... leave the key interest rates unchanged, reflecting the Council’s assessment of the risks to price stability in the medium term based on the two pillars of monetary policy. The first pillar, growth of the money supply, showed a continued moderation in the annual growth of M3. Its three-month moving a ...

... leave the key interest rates unchanged, reflecting the Council’s assessment of the risks to price stability in the medium term based on the two pillars of monetary policy. The first pillar, growth of the money supply, showed a continued moderation in the annual growth of M3. Its three-month moving a ...

APS7

... economy of inflation. Ultimately, the economy went into a deep recession, but before it did, interest rates went to record levels. a. Explain how this policy mix led to very high interest rates. b. Show graphically the effect of the high interest rates on the foreign exchange market. What do you thi ...

... economy of inflation. Ultimately, the economy went into a deep recession, but before it did, interest rates went to record levels. a. Explain how this policy mix led to very high interest rates. b. Show graphically the effect of the high interest rates on the foreign exchange market. What do you thi ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.