High Level Seminar No.4 Financial Crisis and Access to Finance

... Among the pool of SSA names, both middle and low income countries, only “frontier emerging markets” would have had access anyway, so loss of access is not going to affect many countries. But those without access will be even more aid-dependent. ...

... Among the pool of SSA names, both middle and low income countries, only “frontier emerging markets” would have had access anyway, so loss of access is not going to affect many countries. But those without access will be even more aid-dependent. ...

Slides

... Sources: and monthly average for three-month mortgage rate for institutions’ new lending. ...

... Sources: and monthly average for three-month mortgage rate for institutions’ new lending. ...

here - University Senate - The Ohio State University

... The Financial State of the University “Even before the recession struck, it was evident that expanding our funding streams would protect our academic core as nothing else possible could.” President Gee, Address to Faculty, October 18, 2012 ...

... The Financial State of the University “Even before the recession struck, it was evident that expanding our funding streams would protect our academic core as nothing else possible could.” President Gee, Address to Faculty, October 18, 2012 ...

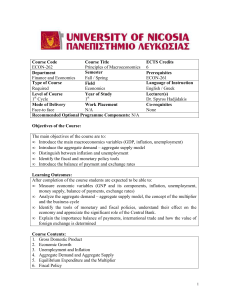

ECON-262 Principles of Macroeconomics

... • Identify the fiscal and monetary policy tools • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payment ...

... • Identify the fiscal and monetary policy tools • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payment ...

Challenges for the Future of the Global Economy

... • And will be made slower by Europe’s shared austerity – If Greece alone cut back, global effects would be limited ...

... • And will be made slower by Europe’s shared austerity – If Greece alone cut back, global effects would be limited ...

Price Stability Erdem Ba 2nd KPMG Turkey Financial Risk Management Conference

... The second point that I would like to underline is that the concept of stability should be considered from a holistic view. Attaining stability in several markets requires the stability of each single market concurrently with the others. The Walras Law, underlying the general equilibrium theory, ass ...

... The second point that I would like to underline is that the concept of stability should be considered from a holistic view. Attaining stability in several markets requires the stability of each single market concurrently with the others. The Walras Law, underlying the general equilibrium theory, ass ...

Global Financial Development Report 2013. Rethinking the Role of

... State as regulator and supervisor • Area where role of state undisputed • Crisis: major shortcomings in market discipline and R&S • How to best ensure that R&S supports sound financial development? – Important trade-offs (too much/too little R&S) – Calls for not “more”, but for “right” type of regul ...

... State as regulator and supervisor • Area where role of state undisputed • Crisis: major shortcomings in market discipline and R&S • How to best ensure that R&S supports sound financial development? – Important trade-offs (too much/too little R&S) – Calls for not “more”, but for “right” type of regul ...

Slide 1

... • Direct: savings, cost of capital, and transfer of technology, • Indirect: development of domestic financial market, more specialization, and better policies ...

... • Direct: savings, cost of capital, and transfer of technology, • Indirect: development of domestic financial market, more specialization, and better policies ...

The adjustment of China’s growth strategy and

... Tiger is out (in April 170 billion household depoists left banks and entered the equity market ...

... Tiger is out (in April 170 billion household depoists left banks and entered the equity market ...

SYLLABUS COURSE TITLE Managerial Finance Faculty/Institute

... COURSE OBJECTIVES Students are acquainted with: fundamental concepts in Financial Management, (dis-) advantages of forms of business organization, linkage between stock price and intrinsic value, capital structure and dividend policy, investing in long-term assets. PREREQUISITES Basic acco ...

... COURSE OBJECTIVES Students are acquainted with: fundamental concepts in Financial Management, (dis-) advantages of forms of business organization, linkage between stock price and intrinsic value, capital structure and dividend policy, investing in long-term assets. PREREQUISITES Basic acco ...

World economy to shrink by 2.6% this year by

... long-run sustainable development goals. Between September 2008 and May 2009, the market capitalization of banks in the United States and Europe declined by 60% (or $2 trillion). But despite enormous write-downs and massive financial sector rescue operations by Governments, problems have not gone awa ...

... long-run sustainable development goals. Between September 2008 and May 2009, the market capitalization of banks in the United States and Europe declined by 60% (or $2 trillion). But despite enormous write-downs and massive financial sector rescue operations by Governments, problems have not gone awa ...

Economic Advantages of America

... Meanwhile, Japan and East Asia experienced by far the worst economic developments of its last three decades. Relationship banking and other aspects of their economies became features to be altered or avoided, rather than to be emulated. In truth, I do not much like the sport of figuring out “who is ...

... Meanwhile, Japan and East Asia experienced by far the worst economic developments of its last three decades. Relationship banking and other aspects of their economies became features to be altered or avoided, rather than to be emulated. In truth, I do not much like the sport of figuring out “who is ...

Change of Korean Financial System : from miracle to debacle

... while real wages rose 7% a year. Though the Korea people were burdened with an authoritarian and repressive military government for much of the era, there is no doubt that Korea’s economic system achieved a superb development record. Korea’s “miracle” triggered a debate between mainstream and hetero ...

... while real wages rose 7% a year. Though the Korea people were burdened with an authoritarian and repressive military government for much of the era, there is no doubt that Korea’s economic system achieved a superb development record. Korea’s “miracle” triggered a debate between mainstream and hetero ...

Why global currency investing still makes sense

... Currency: The value of foreign currencies as measured in U.S. dollars will fluctuate and may be unpredictably affected by changes in foreign currency rates and exchange control regulations, application of foreign tax laws, governmental administration of economic or monetary policies, intervention by ...

... Currency: The value of foreign currencies as measured in U.S. dollars will fluctuate and may be unpredictably affected by changes in foreign currency rates and exchange control regulations, application of foreign tax laws, governmental administration of economic or monetary policies, intervention by ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.