Diario de Noticias, 14 April 2015 Interview with ESM MD Klaus

... This is the result of monetary policy action. For other countries, like Germany, interest rates are negative or zero in segments up to ten years. Also for us, at the EFSF and ESM, we now issue bonds for 2 or 3 years with negative interest rates. All of this is rather exceptional. The ECB is catching ...

... This is the result of monetary policy action. For other countries, like Germany, interest rates are negative or zero in segments up to ten years. Also for us, at the EFSF and ESM, we now issue bonds for 2 or 3 years with negative interest rates. All of this is rather exceptional. The ECB is catching ...

slides wolf 2012 - Oxonia - The Oxford Institute for Economic Policy

... – In the long run, it is hard to believe that the catch-up process will not continue, provided the world avoids huge shocks; – But it is not going to be smooth, as we can see from past performance; ...

... – In the long run, it is hard to believe that the catch-up process will not continue, provided the world avoids huge shocks; – But it is not going to be smooth, as we can see from past performance; ...

Evaluating the responses to the EZ crisis

... electorates, and to minimise moral hazard: – If we forgive debt now without being sufficiently harsh, another cycle of borrowing and default will ensue ...

... electorates, and to minimise moral hazard: – If we forgive debt now without being sufficiently harsh, another cycle of borrowing and default will ensue ...

Varieties of capitalism and financial crisis responses: the European

... GDP growth, with further worsening of social indicators. However, this growth in US was led by finance which caused the big crash and the Great recession of 2007-2009. On this light, the US model led by finance raises many doubts and should be radically reformed. I suggested this has to be done on t ...

... GDP growth, with further worsening of social indicators. However, this growth in US was led by finance which caused the big crash and the Great recession of 2007-2009. On this light, the US model led by finance raises many doubts and should be radically reformed. I suggested this has to be done on t ...

How to reduce procyclicality in the Eurozone?

... ‘Austerity has certainly caused low growth but may itself be the result of the poor and unbalanced growth performance before the crisis, which was due to the lack of reform. The postponement of reforms to improve growth potential has left countries with only one solution, austerity. Austerity is thu ...

... ‘Austerity has certainly caused low growth but may itself be the result of the poor and unbalanced growth performance before the crisis, which was due to the lack of reform. The postponement of reforms to improve growth potential has left countries with only one solution, austerity. Austerity is thu ...

financemalta 6th annual financial services conference

... six years on, become a severe economic recession and a storm of a sovereign debt crisis. Across Europe, countries and their citizens are facing some of their most difficult times ever. Oncegreat economies are struggling. GDP growth across Europe is anaemic, with some countries seeing a contraction i ...

... six years on, become a severe economic recession and a storm of a sovereign debt crisis. Across Europe, countries and their citizens are facing some of their most difficult times ever. Oncegreat economies are struggling. GDP growth across Europe is anaemic, with some countries seeing a contraction i ...

The shift and the shocks: prospects for the world economy

... – Rebalancing the world economy, to give over-leveraged economies to enjoy export-led growth, necessary when their private sectors run huge financial surpluses; – Reducing fiscal deficits in high-income countries, without killing the recovery; and – Avoiding excesses in emerging countries, despite e ...

... – Rebalancing the world economy, to give over-leveraged economies to enjoy export-led growth, necessary when their private sectors run huge financial surpluses; – Reducing fiscal deficits in high-income countries, without killing the recovery; and – Avoiding excesses in emerging countries, despite e ...

Slide 1

... principal or interest payment on the due date (or within the specified grace period). • These are often called “restructuring” or “repudiation” but have the same effect. ...

... principal or interest payment on the due date (or within the specified grace period). • These are often called “restructuring” or “repudiation” but have the same effect. ...

Non-performing loans: Peripheral countries finally on

... as well as asset quality – then gradually improved: Ireland experienced a drop in its NPL ratio from roughly 26% in Q4 2013 to 17.5% at end-2014. This coincided with a boom in the economy and an increase in house prices of 16% in 2014. Likewise, Spain turned the corner in 2014. With the economy retu ...

... as well as asset quality – then gradually improved: Ireland experienced a drop in its NPL ratio from roughly 26% in Q4 2013 to 17.5% at end-2014. This coincided with a boom in the economy and an increase in house prices of 16% in 2014. Likewise, Spain turned the corner in 2014. With the economy retu ...

Topic B : The Greece Debt Crisis

... a time of major political shifts and massive spending to integrate the newly formed democratic government. Although the spending was toward the newly established government system, there was more spending than what Greece actually had. In 2001, Greece joined the Euro zone. At that time, the introduc ...

... a time of major political shifts and massive spending to integrate the newly formed democratic government. Although the spending was toward the newly established government system, there was more spending than what Greece actually had. In 2001, Greece joined the Euro zone. At that time, the introduc ...

(Il Sole 24 Ore Radiocor) -

... themselves for such crises and augment their institutional framework. We could build on experience gained from use of the EU’s facility for medium-term financial aid to non-eurozone member states. In May 2009, the funding was topped up substantially on account of the considerable economic difficult ...

... themselves for such crises and augment their institutional framework. We could build on experience gained from use of the EU’s facility for medium-term financial aid to non-eurozone member states. In May 2009, the funding was topped up substantially on account of the considerable economic difficult ...

Slide 1

... Fourteen EU Member States had government debt ratios higher than 60% of GDP at the end of 2011: Greece (165.3%), Italy (120.1%), Ireland (108.2%), Portugal (107.8%), Belgium (98.0%), France (85.8%), the United Kingdom (85.7%), Germany (81.2%), Hungary (80.6%), Austria (72.2%), Malta (72.0%), Cyprus ...

... Fourteen EU Member States had government debt ratios higher than 60% of GDP at the end of 2011: Greece (165.3%), Italy (120.1%), Ireland (108.2%), Portugal (107.8%), Belgium (98.0%), France (85.8%), the United Kingdom (85.7%), Germany (81.2%), Hungary (80.6%), Austria (72.2%), Malta (72.0%), Cyprus ...

Document

... The main rules of the Fiscal Compact are: National “debt brakes”/”golden rules”: The FC Member States commit to pass a national law or an amendment of the national constitution that limits the structural budget deficit to 0.5% of GDP, from which a deviation is only allowed in “exceptional circumst ...

... The main rules of the Fiscal Compact are: National “debt brakes”/”golden rules”: The FC Member States commit to pass a national law or an amendment of the national constitution that limits the structural budget deficit to 0.5% of GDP, from which a deviation is only allowed in “exceptional circumst ...

Debt crisis hits Europe`s retail credit markets

... 5. Deleveraging of non-financial companies reflects low business confidence in Europe’s periphery In 2011, the loans to non-financial companies increased in real terms for the first time since 2008 in the EA core and in new member states. However, corporations in countries hit by the sovereign crisi ...

... 5. Deleveraging of non-financial companies reflects low business confidence in Europe’s periphery In 2011, the loans to non-financial companies increased in real terms for the first time since 2008 in the EA core and in new member states. However, corporations in countries hit by the sovereign crisi ...

Lessons from the European Economic and Financial Great Crisis: A

... government is able to refinance itself and roll over its debt - This requires public debt and the interest burden to grow more slowly than the economy and the tax base; this is not the case in the PIIGS countries - The economic crisis in these countries is a competitiveness and growth crisis that ha ...

... government is able to refinance itself and roll over its debt - This requires public debt and the interest burden to grow more slowly than the economy and the tax base; this is not the case in the PIIGS countries - The economic crisis in these countries is a competitiveness and growth crisis that ha ...

Word

... financial markets at the end of 2011 when the first round of quantitative easing was launched.3 Limited by its mandate that did not allow the banks to provide direct loans to governments, it provided 523 institutions, mostly commercial banks, with cheap loans in the form of 3-year bonds at a total a ...

... financial markets at the end of 2011 when the first round of quantitative easing was launched.3 Limited by its mandate that did not allow the banks to provide direct loans to governments, it provided 523 institutions, mostly commercial banks, with cheap loans in the form of 3-year bonds at a total a ...

Economic Perspectives

... trim their budget deficits and reduce reliance on foreign capital. In the broader scheme, however, this crisis has helped to define the Eurozone. For example, it was assumed that the European Central Bank’s staunch independence and monetarist roots would preclude it from buying the bonds of member c ...

... trim their budget deficits and reduce reliance on foreign capital. In the broader scheme, however, this crisis has helped to define the Eurozone. For example, it was assumed that the European Central Bank’s staunch independence and monetarist roots would preclude it from buying the bonds of member c ...

Forecasting outstanding debt securities in Europe

... Financial assistance to the banking system, automatic stabilizers and discretionary countercyclical policies lead to an increase in the government deficits and the level of public debt across the Euro zone... ...in some countries even to unsustainable levels.... ...questioning the solvency of the pu ...

... Financial assistance to the banking system, automatic stabilizers and discretionary countercyclical policies lead to an increase in the government deficits and the level of public debt across the Euro zone... ...in some countries even to unsustainable levels.... ...questioning the solvency of the pu ...

Il futuro dell*Eurozona nel contesto internazionale Cosa fare per

... financial stability in Europe The EFSF is authorized to borrow up to €440 billion. ESM (European Stability Mechanism) The ESM is a permanent crisis resolution mechanism for the countries of the euro area. The ESM issues debt instruments in order to finance loans and other forms of financial assistan ...

... financial stability in Europe The EFSF is authorized to borrow up to €440 billion. ESM (European Stability Mechanism) The ESM is a permanent crisis resolution mechanism for the countries of the euro area. The ESM issues debt instruments in order to finance loans and other forms of financial assistan ...

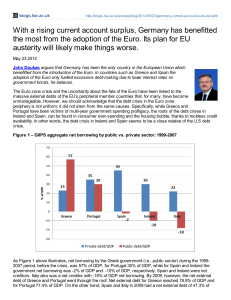

With a rising current account surplus, Germany has benefitted the

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

The current financial crisis began in the United States` subprime

... Credit is the lifeblood of the economy. When banks cannot or will not financing finance the economy, trade is paralyzed, small and medium-sized enterprises cannot invest, and households can’t consume— in other words, economic activity simply cannot take place without credit. To keep economies from b ...

... Credit is the lifeblood of the economy. When banks cannot or will not financing finance the economy, trade is paralyzed, small and medium-sized enterprises cannot invest, and households can’t consume— in other words, economic activity simply cannot take place without credit. To keep economies from b ...

PDF Download

... aggregate production in most of the crisis-afflicted countries looks set to shrink. Fiscal policy in these countries will be far more restrictive than in the rest of Europe. Although financing conditions in the crisis-afflicted countries have already started to improve, and despite a more expansiona ...

... aggregate production in most of the crisis-afflicted countries looks set to shrink. Fiscal policy in these countries will be far more restrictive than in the rest of Europe. Although financing conditions in the crisis-afflicted countries have already started to improve, and despite a more expansiona ...

Read Article - Longwave Group

... Fitch Ratings affirms the United Kingdom’s AAA sovereign credit rating, but warned: “Since the United Kingdom’s credit rating is underpinned by a high income, diversified and flexible economy; as well as robust institutions and a high degree political and social stability, the risk of a fiscal finan ...

... Fitch Ratings affirms the United Kingdom’s AAA sovereign credit rating, but warned: “Since the United Kingdom’s credit rating is underpinned by a high income, diversified and flexible economy; as well as robust institutions and a high degree political and social stability, the risk of a fiscal finan ...

Download pdf | 2048 KB |

... – Internal devaluation, but no training or matching help • Some liberalization of trade and other sectors – Key sector: professional services, untouched • Key issue here: retraining the “lost generation” (nothing right now) – Human capital ignored ...

... – Internal devaluation, but no training or matching help • Some liberalization of trade and other sectors – Key sector: professional services, untouched • Key issue here: retraining the “lost generation” (nothing right now) – Human capital ignored ...

Addicted to the Apocalypse

... Consider, for example, Stanley Druckenmiller, the billionaire investor, who has lately made a splash with warnings about the burden of our entitlement programs. (Gee, why hasn’t anyone else thought of making that point?) He could talk about the problems we may face a decade or two down the road. But ...

... Consider, for example, Stanley Druckenmiller, the billionaire investor, who has lately made a splash with warnings about the burden of our entitlement programs. (Gee, why hasn’t anyone else thought of making that point?) He could talk about the problems we may face a decade or two down the road. But ...

European debt crisis

.png?width=300)

The European debt crisis (often also referred to as the Eurozone crisis or the European sovereign debt crisis) is a multi-year debt crisis that has been taking place in the European Union since the end of 2009. Several eurozone member states (Greece, Portugal, Ireland, Spain and Cyprus) were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of third parties like other Eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF).The detailed causes of the debt crises varied. In several countries, private debts arising from a property bubble were transferred to sovereign debt as a result of banking system bailouts and government responses to slowing economies post-bubble. The structure of the eurozone as a currency union (i.e., one currency) without fiscal union (e.g., different tax and public pension rules) contributed to the crisis and limited the ability of European leaders to respond. European banks own a significant amount of sovereign debt, such that concerns regarding the solvency of banking systems or sovereigns are negatively reinforcing.As concerns intensified in early 2010 and thereafter, leading European nations implemented a series of financial support measures such as the European Financial Stability Facility (EFSF) and European Stability Mechanism (ESM). The ECB also contributed to solve the crisis by lowering interest rates and providing cheap loans of more than one trillion euro in order to maintain money flows between European banks. On 6 September 2012, the ECB calmed financial markets by announcing free unlimited support for all eurozone countries involved in a sovereign state bailout/precautionary programme from EFSF/ESM, through some yield lowering Outright Monetary Transactions (OMT).Return to economic growth and improved structural deficits enabled Ireland and Portugal to exit their bailout programmes in July 2014. Greece and Cyprus both managed to partly regain market access in 2014. Their bailout programme is scheduled to end in March 2016. Spain never officially received a bailout programme. It's rescue package from the ESM was earmarked for a bank recapitalization fund and did not include financial support for the government itself.The crisis had significant adverse economic effects and labour market effects, with unemployment rates in Greece and Spain reaching 27%, and was blamed for subdued economic growth, not only for the entire eurozone, but for the entire European Union. As such, it can be argued to have had a major political impact on the ruling governments in 9 out of 19 eurozone countries, contributing to power shifts in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, and the Netherlands.