Fear and loathing of negative yielding debt: bond investor`s

... Unless there is a miraculous turnaround in oil prices there is likely to be a lot of defaults. The rating agencies’ approach isn’t capturing the fact that a large part of the economy is far out of step with the overall picture of the market. At least 185 bonds issued by North American energy compani ...

... Unless there is a miraculous turnaround in oil prices there is likely to be a lot of defaults. The rating agencies’ approach isn’t capturing the fact that a large part of the economy is far out of step with the overall picture of the market. At least 185 bonds issued by North American energy compani ...

developments in budget deficit and its financing before and after the

... resources is usually higher than the existing funds, the elaborations of budgets at any level is one of the primary issues, particularly as regards the principle of budgetary balance. As provided by economic theory, the budget balance varies depending on the evolution of economic cycle, as a result ...

... resources is usually higher than the existing funds, the elaborations of budgets at any level is one of the primary issues, particularly as regards the principle of budgetary balance. As provided by economic theory, the budget balance varies depending on the evolution of economic cycle, as a result ...

http://www.rastanews.eu/PWA_uploads/eurozone-flaws-final.pdf

... argue that the current decision-making mechanism has two basic flaws: first, countries tend to choose rules too often; second, decisions come too late. When a member country adopts policies and behaviors potentially harmful to others (say excessive deficit), the Union tends to prevent such behaviors ...

... argue that the current decision-making mechanism has two basic flaws: first, countries tend to choose rules too often; second, decisions come too late. When a member country adopts policies and behaviors potentially harmful to others (say excessive deficit), the Union tends to prevent such behaviors ...

Monetary policy of the ECB: strategy and tools

... securities excluding equity, and pension liabilities, net of inter-company loans (credit market instruments in the US), debt by governments are loans and ...

... securities excluding equity, and pension liabilities, net of inter-company loans (credit market instruments in the US), debt by governments are loans and ...

PDF

... borrowing, epitomized by the collapse of Lehman Brothers in September 2008. As a response, central banks in the United States and Europe cut their lending rates, substantially increased the assets on their own balance sheets, and provided the banking sector with large amounts of liquidity. Governmen ...

... borrowing, epitomized by the collapse of Lehman Brothers in September 2008. As a response, central banks in the United States and Europe cut their lending rates, substantially increased the assets on their own balance sheets, and provided the banking sector with large amounts of liquidity. Governmen ...

Examining Eurozone Divergence - Sound Ideas

... Another key feature of the Maastricht treaty, which was further enforced by the Lisbon treaty in 2007, was that under no circumstances could there be a bailout of a country facing a default on its debt. This rule was supposed to reduce the likelihood of free-rider problems. If members knew they cou ...

... Another key feature of the Maastricht treaty, which was further enforced by the Lisbon treaty in 2007, was that under no circumstances could there be a bailout of a country facing a default on its debt. This rule was supposed to reduce the likelihood of free-rider problems. If members knew they cou ...

INTOSAI Public Debt Working Group Mexico Meeting 2010

... increase in debt has been used to purchase financial assets as part of programs to stabilize financial markets and stimulate the economy. The value of these financial assets has not been subtracted from the total debt held by public in our simulations. ...

... increase in debt has been used to purchase financial assets as part of programs to stabilize financial markets and stimulate the economy. The value of these financial assets has not been subtracted from the total debt held by public in our simulations. ...

Ending Over-Lending Avoiding Financial Calamities

... bankruptcy. Simplistically, the Debt/CF ratio measures the number of years of savings required to retire an entity’s outstanding debt. I examine the merits of this tool in measuring the indebtedness of nations and as an early warning signal to avert financial crises of nations. Current popular debt ...

... bankruptcy. Simplistically, the Debt/CF ratio measures the number of years of savings required to retire an entity’s outstanding debt. I examine the merits of this tool in measuring the indebtedness of nations and as an early warning signal to avert financial crises of nations. Current popular debt ...

INTOSAI Public Debt Working Group Mexico Meeting 2010

... increase in debt has been used to purchase financial assets as part of programs to stabilize financial markets and stimulate the economy. The value of these financial assets has not been subtracted from the total debt held by public in our simulations. ...

... increase in debt has been used to purchase financial assets as part of programs to stabilize financial markets and stimulate the economy. The value of these financial assets has not been subtracted from the total debt held by public in our simulations. ...

Three quite distinct difficulties that were built into the monetary union

... recognizing the moral hazard problem early, because fiscal policy constraints had not previously been featured in the scholars’ lists of Optimum Currency Area criteria. Two huge qualifications, however, negate that kudos: (i) The elites were forced politically to do it by voters in Germany [often us ...

... recognizing the moral hazard problem early, because fiscal policy constraints had not previously been featured in the scholars’ lists of Optimum Currency Area criteria. Two huge qualifications, however, negate that kudos: (i) The elites were forced politically to do it by voters in Germany [often us ...

Stocks Volatile in Near-term with Greek Election Uncertainty, Euro

... written assurances to the EU/IMF about implementing the austerity measures secured just 32% of the vote between them in the May election. While opinion polls show that 78% of Greeks want to remain in the Eurozone and keep the Euro, less than 40% support the two major pro-Euro parties (the ND and Pas ...

... written assurances to the EU/IMF about implementing the austerity measures secured just 32% of the vote between them in the May election. While opinion polls show that 78% of Greeks want to remain in the Eurozone and keep the Euro, less than 40% support the two major pro-Euro parties (the ND and Pas ...

Austerity: The Answer to Europe`s Crisis

... generic example of the structure of production. When there is a disparity between rates of return in different stages, entrepreneurs will reallocate their investments into higher stages of production, therefore the production structure will lengthen. Any “signals” the entrepreneurs receive are ones ...

... generic example of the structure of production. When there is a disparity between rates of return in different stages, entrepreneurs will reallocate their investments into higher stages of production, therefore the production structure will lengthen. Any “signals” the entrepreneurs receive are ones ...

Eurobonds: a crucial step towards political union and an engine for

... insurance for the participating countries. • Since countries are collectively responsible for the joint debt issue, an incentive is created for countries to rely on this implicit insurance and to issue too much debt. • This creates a lot of resistance in the other countries that behave responsibly. ...

... insurance for the participating countries. • Since countries are collectively responsible for the joint debt issue, an incentive is created for countries to rely on this implicit insurance and to issue too much debt. • This creates a lot of resistance in the other countries that behave responsibly. ...

Eurozone, Greece and catastrophic debt crises

... Eurozone, Greece and catastrophic debt crises Zdenek Kudrna University of Salzburg EMUchoices.eu ...

... Eurozone, Greece and catastrophic debt crises Zdenek Kudrna University of Salzburg EMUchoices.eu ...

(Please check against delivery) EMBARGOED

... contributes to Greece regaining debt sustainability. This makes the ESM better equipped to deal with the crisis in Europe than the IMF, particularly on the debt side, and this is what we have been debating in the past few months. The IMF has a different ...

... contributes to Greece regaining debt sustainability. This makes the ESM better equipped to deal with the crisis in Europe than the IMF, particularly on the debt side, and this is what we have been debating in the past few months. The IMF has a different ...

political or economic project?

... – Common low interest rate – cheap debt financing – Transfers (and SGP violation by decisive countries) provided a psychological effect that undermined fiscal discipline – Very slow REAL convergence (even divergence) ...

... – Common low interest rate – cheap debt financing – Transfers (and SGP violation by decisive countries) provided a psychological effect that undermined fiscal discipline – Very slow REAL convergence (even divergence) ...

Financial Repression to Ease Fiscal Stress: Turning

... ECB responded to the crisis by pursuing an exceptional monetary easing while addressing financial stability risks, financial market fragmentation, bank funding needs, and fears of a euro break-up. The scope of these monetary policy actions triggered intense debate inside the Governing Council of the ...

... ECB responded to the crisis by pursuing an exceptional monetary easing while addressing financial stability risks, financial market fragmentation, bank funding needs, and fears of a euro break-up. The scope of these monetary policy actions triggered intense debate inside the Governing Council of the ...

Rise and Fall of the KLCI Index (1984 - 2014)

... The financial crisis of 2007–2008, is considered by many economists to have been the worst financial crisis since the Great Depression of the 1930s. It threatened the total collapse of large financial institutions, which was prevented by 11 Jan 2008 - 29 Oct 2008 the bailout of banks by national gov ...

... The financial crisis of 2007–2008, is considered by many economists to have been the worst financial crisis since the Great Depression of the 1930s. It threatened the total collapse of large financial institutions, which was prevented by 11 Jan 2008 - 29 Oct 2008 the bailout of banks by national gov ...

1 Discussion: From Chronic Inflation to Chronic Deflation Gita

... the 2012 debt crisis in the Eurozone. As yields on government debt rose rapidly in Greece and spilled over to Ireland, Portugal, Spain and Italy, the European Central Bank’s (ECB) president Mario Draghi promised to do whatever it takes to save the euro including possibly buying stressed governme ...

... the 2012 debt crisis in the Eurozone. As yields on government debt rose rapidly in Greece and spilled over to Ireland, Portugal, Spain and Italy, the European Central Bank’s (ECB) president Mario Draghi promised to do whatever it takes to save the euro including possibly buying stressed governme ...

Talking Points - Austrian Marshall Plan Foundation

... package of 1790 did not endure ( Bordo,Jonung and Markiewicz 2013). The early fiscal union was very rudimentary. The Federal government had limited power over national defense and public works but no transfer power. Hamilton created a national bond by consolidating the states’ debts serviced by cust ...

... package of 1790 did not endure ( Bordo,Jonung and Markiewicz 2013). The early fiscal union was very rudimentary. The Federal government had limited power over national defense and public works but no transfer power. Hamilton created a national bond by consolidating the states’ debts serviced by cust ...

Macro and Micro Dimensions in the Politics of Austerity

... ♦People who were worse off before the crisis, e.g. less educated, lower social class. ♦People who live in EU countries with low GDP. ♦Pensioners more secure than educated. employed . ...

... ♦People who were worse off before the crisis, e.g. less educated, lower social class. ♦People who live in EU countries with low GDP. ♦Pensioners more secure than educated. employed . ...

Recent changes in the debt sustainability framework

... Debt relief under HIPC and MDRI has substantially alleviated debt burdens in recipient countries and has enabled them to increase their povertyreducing expenditure by almost three and a half percentage points of GDP between 2001 and 2012 ...

... Debt relief under HIPC and MDRI has substantially alleviated debt burdens in recipient countries and has enabled them to increase their povertyreducing expenditure by almost three and a half percentage points of GDP between 2001 and 2012 ...

Financialisation and Greece: another Greek exceptionalism?

... months 1.600.000 domestic investors entered the stock market, who accounted for 27% of economically active population: from those 700.000 were (probably are still) stuck in the market, since 67% of them reported loses –often of enormous scale-, 19% reported no losses or gains (in 2001), and only 14% ...

... months 1.600.000 domestic investors entered the stock market, who accounted for 27% of economically active population: from those 700.000 were (probably are still) stuck in the market, since 67% of them reported loses –often of enormous scale-, 19% reported no losses or gains (in 2001), and only 14% ...

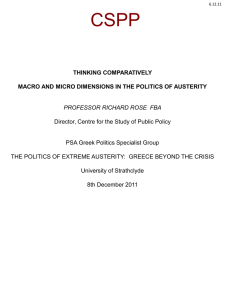

images/uploads/SPL Beware Greeks Bearing Gifts

... and the International Monetary Fund (IMF) have to demand quantifiable proof that reform has been and will continue to be implemented. After all it is only by the largesse of the troika worth some EUR240Bn that Greece has been able to stay inside the Euro tent and that accommodation has helped keep t ...

... and the International Monetary Fund (IMF) have to demand quantifiable proof that reform has been and will continue to be implemented. After all it is only by the largesse of the troika worth some EUR240Bn that Greece has been able to stay inside the Euro tent and that accommodation has helped keep t ...

Bailout Comments Those without source are all BBC monitoring

... optimistic" about the fate of the euro. President Tuerk agreed, noting that the reaction of financial markets suggested the markets perceive it as such as well. The president also expressed regret at the late realization by the EU that the International Monetary Fund (IMF) can be useful in assessing ...

... optimistic" about the fate of the euro. President Tuerk agreed, noting that the reaction of financial markets suggested the markets perceive it as such as well. The president also expressed regret at the late realization by the EU that the International Monetary Fund (IMF) can be useful in assessing ...

European debt crisis

.png?width=300)

The European debt crisis (often also referred to as the Eurozone crisis or the European sovereign debt crisis) is a multi-year debt crisis that has been taking place in the European Union since the end of 2009. Several eurozone member states (Greece, Portugal, Ireland, Spain and Cyprus) were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of third parties like other Eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF).The detailed causes of the debt crises varied. In several countries, private debts arising from a property bubble were transferred to sovereign debt as a result of banking system bailouts and government responses to slowing economies post-bubble. The structure of the eurozone as a currency union (i.e., one currency) without fiscal union (e.g., different tax and public pension rules) contributed to the crisis and limited the ability of European leaders to respond. European banks own a significant amount of sovereign debt, such that concerns regarding the solvency of banking systems or sovereigns are negatively reinforcing.As concerns intensified in early 2010 and thereafter, leading European nations implemented a series of financial support measures such as the European Financial Stability Facility (EFSF) and European Stability Mechanism (ESM). The ECB also contributed to solve the crisis by lowering interest rates and providing cheap loans of more than one trillion euro in order to maintain money flows between European banks. On 6 September 2012, the ECB calmed financial markets by announcing free unlimited support for all eurozone countries involved in a sovereign state bailout/precautionary programme from EFSF/ESM, through some yield lowering Outright Monetary Transactions (OMT).Return to economic growth and improved structural deficits enabled Ireland and Portugal to exit their bailout programmes in July 2014. Greece and Cyprus both managed to partly regain market access in 2014. Their bailout programme is scheduled to end in March 2016. Spain never officially received a bailout programme. It's rescue package from the ESM was earmarked for a bank recapitalization fund and did not include financial support for the government itself.The crisis had significant adverse economic effects and labour market effects, with unemployment rates in Greece and Spain reaching 27%, and was blamed for subdued economic growth, not only for the entire eurozone, but for the entire European Union. As such, it can be argued to have had a major political impact on the ruling governments in 9 out of 19 eurozone countries, contributing to power shifts in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, and the Netherlands.