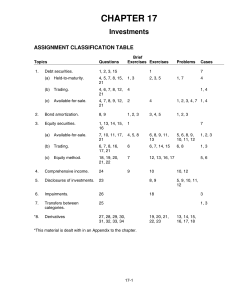

QUESTIONS

... (retained earnings) and a credit to one or more other shareholders’ equity accounts (common stock dividend distributable and paid-in capital in excess of par) for the fair value of the stock. Consequently, the declaration has no effect on total shareholders’ equity because the entry merely entails a ...

... (retained earnings) and a credit to one or more other shareholders’ equity accounts (common stock dividend distributable and paid-in capital in excess of par) for the fair value of the stock. Consequently, the declaration has no effect on total shareholders’ equity because the entry merely entails a ...

Bezp. Bank 4

... In a recent paper Haq and Heaney2 find mixed evidence on the relation between bank specific factors and bank risk measures in 15 European countries. Although their study analyses the drivers of bank specific risk measures, it does not consider determinants of leverage and liquidity risk. The second ...

... In a recent paper Haq and Heaney2 find mixed evidence on the relation between bank specific factors and bank risk measures in 15 European countries. Although their study analyses the drivers of bank specific risk measures, it does not consider determinants of leverage and liquidity risk. The second ...

New approaches to expanding the supply of affordable housing in

... equity sources. Owner occupation as the dominant tenure form has developed through the commitment of personal savings to fund the purchase deposit and debt finance supplied by banks, building societies, credit unions, the legal profession and a host of small agents. Since the mid-1990s a rapidly gro ...

... equity sources. Owner occupation as the dominant tenure form has developed through the commitment of personal savings to fund the purchase deposit and debt finance supplied by banks, building societies, credit unions, the legal profession and a host of small agents. Since the mid-1990s a rapidly gro ...

Chapter 15 The Term Structure of Interest Rates

... 67. Answer the following questions that relate to bonds. A 2-year zero-coupon bond is selling for $890.00. What is the yield to maturity of this bond? The price of a 1-year zero coupon bond is $931.97. What is the yield to maturity of this bond? Calculate the forward rate for the second year. How ca ...

... 67. Answer the following questions that relate to bonds. A 2-year zero-coupon bond is selling for $890.00. What is the yield to maturity of this bond? The price of a 1-year zero coupon bond is $931.97. What is the yield to maturity of this bond? Calculate the forward rate for the second year. How ca ...

2015 Annual Report China CITIC Bank Corporation Limited China

... Founded in 1987, the Bank is among the earliest emerging commercial banks established during China’s reform and opening up and China’s first commercial bank participating in financing at both domestic and international financial markets. It is renowned at home and abroad for brushing numerous track ...

... Founded in 1987, the Bank is among the earliest emerging commercial banks established during China’s reform and opening up and China’s first commercial bank participating in financing at both domestic and international financial markets. It is renowned at home and abroad for brushing numerous track ...

How Do Mergers Create Value? A Comparison of Taxes, Market

... synergies into two subcategories—increased operating profits and savings from reductions in investments. If mergers are undertaken due to tax reasons, we will expect them to create value primarily due to financial synergies. In contrast, mergers that result primarily in increased market power for the ...

... synergies into two subcategories—increased operating profits and savings from reductions in investments. If mergers are undertaken due to tax reasons, we will expect them to create value primarily due to financial synergies. In contrast, mergers that result primarily in increased market power for the ...

Global Fixed Income Weekly

... towards upward rather than downward revisions of the forecasts. However, such risk premium will likely remain modest without further hard evidence (so far lacking) that inflation is normalizing. Our analysis suggests that inflation should (slowly) normalize over the course of the year as wages and c ...

... towards upward rather than downward revisions of the forecasts. However, such risk premium will likely remain modest without further hard evidence (so far lacking) that inflation is normalizing. Our analysis suggests that inflation should (slowly) normalize over the course of the year as wages and c ...

Sowing the Seeds of Financial Crises

... sector. The years previous to the crisis were characterized by a rapid increase in the private production of assets that were considered safe, mostly through securitization. Many of the markets for these assets then collapsed, marking the starting point of the deepest recession in the post-war era. ...

... sector. The years previous to the crisis were characterized by a rapid increase in the private production of assets that were considered safe, mostly through securitization. Many of the markets for these assets then collapsed, marking the starting point of the deepest recession in the post-war era. ...

Stock market booms and real economic activity: Is this time different?

... horizon returns only explain a fraction of future production growth rates but this fraction gets larger the longer is the time horizon of returns. In other words, annual returns should be more powerful in forecasting future production growth rates than quarterly returns and quarterly returns more po ...

... horizon returns only explain a fraction of future production growth rates but this fraction gets larger the longer is the time horizon of returns. In other words, annual returns should be more powerful in forecasting future production growth rates than quarterly returns and quarterly returns more po ...

Download attachment

... result, if interest rates decline, the value of the swap contract increases (a gain), while at the same time the fixed-rate debt obligation increases (a loss). The swap is an effective risk management tool in this setting because its value is related to the same underlying (interest rates) that will ...

... result, if interest rates decline, the value of the swap contract increases (a gain), while at the same time the fixed-rate debt obligation increases (a loss). The swap is an effective risk management tool in this setting because its value is related to the same underlying (interest rates) that will ...

GLOBAL PAYMENTS INC

... Revenue recognition — Our two merchant services segments primarily provide payment solutions for credit cards, debit cards, electronic payments and check-related services. Revenue is recognized as such services are performed. Revenue for services provided directly to merchants is recorded net of int ...

... Revenue recognition — Our two merchant services segments primarily provide payment solutions for credit cards, debit cards, electronic payments and check-related services. Revenue is recognized as such services are performed. Revenue for services provided directly to merchants is recorded net of int ...

M.A. FINAL ECONOMICS

... First, the government diverts a portion of the circular flow. But this diversion that does not necessarily change the total amount of gross domestic product, factor payments, or national income. It merely diverts income from consumption and saving to taxes. And it diverts gross domestic product from ...

... First, the government diverts a portion of the circular flow. But this diversion that does not necessarily change the total amount of gross domestic product, factor payments, or national income. It merely diverts income from consumption and saving to taxes. And it diverts gross domestic product from ...

Supervisory Shopping in the Banking Sector: When Is It Socially

... of one primary federal supervisor. For instance, before the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank), a given conglomerate could easily become either a bank/financial holding company, which was supervised by the Federal Reserve (Fed), or a thrift ...

... of one primary federal supervisor. For instance, before the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank), a given conglomerate could easily become either a bank/financial holding company, which was supervised by the Federal Reserve (Fed), or a thrift ...

Expected Returns on Major Asset Classes

... Ibbotson and Sinquefield’s (1976a, 1976b) work exemplifies the next period, the classical period. They noted that expected returns on cash and bonds are, naturally, time varying because the expected returns for these asset classes are equal to the yield (minus an allowance for defaults in the case o ...

... Ibbotson and Sinquefield’s (1976a, 1976b) work exemplifies the next period, the classical period. They noted that expected returns on cash and bonds are, naturally, time varying because the expected returns for these asset classes are equal to the yield (minus an allowance for defaults in the case o ...

valhi, inc. - Barchart.com

... Waste management Real estate management and development Total operating income (loss) General corporate items: Securities earnings Insurance recoveries General expenses, net Interest expense Income (loss) before income taxes ...

... Waste management Real estate management and development Total operating income (loss) General corporate items: Securities earnings Insurance recoveries General expenses, net Interest expense Income (loss) before income taxes ...

Press Release

... In Norway, net sales in local currency declined 0.6 percent, equivalent of SEK 1,606 million (1,741). Billed revenues declined marginally, explained by a slowdown in the enterprise segment, while the consumer area showed positive growth. Reported sales in prior periods have been restated to reflect ...

... In Norway, net sales in local currency declined 0.6 percent, equivalent of SEK 1,606 million (1,741). Billed revenues declined marginally, explained by a slowdown in the enterprise segment, while the consumer area showed positive growth. Reported sales in prior periods have been restated to reflect ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.