Bonds, Stocks, and Sources of Mispricing

... provided by both COMPUSTAT and RatingsXpress. As defined by S&P, the “long-term issuer credit rating is a current opinion of an issuer’s overall creditworthiness, apart from its ability to repay individual obligations. This opinion focuses on the obligor’s capacity and willingness to meet its long-t ...

... provided by both COMPUSTAT and RatingsXpress. As defined by S&P, the “long-term issuer credit rating is a current opinion of an issuer’s overall creditworthiness, apart from its ability to repay individual obligations. This opinion focuses on the obligor’s capacity and willingness to meet its long-t ...

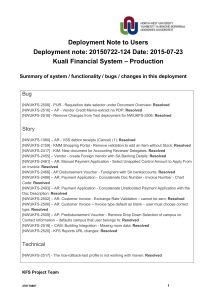

Deployment procedure

... Deployment Note to Users Deployment note: 20150722-124 Date: 2015-07-23 Kuali Financial System – Production Summary of system / functionality / bugs / changes in this deployment ...

... Deployment Note to Users Deployment note: 20150722-124 Date: 2015-07-23 Kuali Financial System – Production Summary of system / functionality / bugs / changes in this deployment ...

Monetary Policy and the Federal Reserve: Current Policy and Issues

... monetary policy, a process that will eventually lead to a higher federal funds rate and a smaller balance sheet. Instead of normalizing monetary policy by selling its assets to reduce its balance sheet quickly, the Fed plans to raise rates by increasing the interest rate it pays banks on the reserve ...

... monetary policy, a process that will eventually lead to a higher federal funds rate and a smaller balance sheet. Instead of normalizing monetary policy by selling its assets to reduce its balance sheet quickly, the Fed plans to raise rates by increasing the interest rate it pays banks on the reserve ...

intangibles - The Computer Science Department

... An asset is a claim to future benefits, such as the rents generated by commercial property, interest payments derived from a bond, or cash flows from a production facility. An intangible asset is a claim to future benefits that does not have a physical or financial (a stock or a bond) embodiment. A ...

... An asset is a claim to future benefits, such as the rents generated by commercial property, interest payments derived from a bond, or cash flows from a production facility. An intangible asset is a claim to future benefits that does not have a physical or financial (a stock or a bond) embodiment. A ...

Trade and Capital Flows: A Financial Frictions Perspective

... when …nancial frictions are an important source of heterogeneity across countries and sectors. In particular, we show that in this context trade and net capital ‡ows are complements in less …nancially developed economies. A …nancially underdeveloped economy that opens the capital account without lib ...

... when …nancial frictions are an important source of heterogeneity across countries and sectors. In particular, we show that in this context trade and net capital ‡ows are complements in less …nancially developed economies. A …nancially underdeveloped economy that opens the capital account without lib ...

Download attachment

... BAI` DAYN The bai` dayn principle has always been a point of contention among past and present Islamic jurists. However, there is no general nas or consensus (ijmak) among those who forbid it.32 In general, the majority of Islamic jurists are unanimous in allowing the activity of selling debts to th ...

... BAI` DAYN The bai` dayn principle has always been a point of contention among past and present Islamic jurists. However, there is no general nas or consensus (ijmak) among those who forbid it.32 In general, the majority of Islamic jurists are unanimous in allowing the activity of selling debts to th ...

CPI INTERNATIONAL, INC. (Form: 10-K

... Defense applications of our products include transmitting and receiving radar signals for locating and tracking threats, weapons guidance and navigation, as well as transmitting decoy and jamming signals for electronic warfare and transmitting signals for satellite communications. The U.S. Governmen ...

... Defense applications of our products include transmitting and receiving radar signals for locating and tracking threats, weapons guidance and navigation, as well as transmitting decoy and jamming signals for electronic warfare and transmitting signals for satellite communications. The U.S. Governmen ...

Client Bill of Rights

... 3. Don’t reach for unrealistically high returns. Keep expectations realistic. Any investment which is represented to provide significantly higher-than-market-rate returns generally is not legitimate. Investments such as prime bank notes, special bonds or accounts that promise double-digit interest, ...

... 3. Don’t reach for unrealistically high returns. Keep expectations realistic. Any investment which is represented to provide significantly higher-than-market-rate returns generally is not legitimate. Investments such as prime bank notes, special bonds or accounts that promise double-digit interest, ...

1 CHAPTER-1 INTRODUCTION 1.0 INDIAN STOCK MARKET

... of measures like licensing system, high tariffs and rates, limited investment in core sectors only. During 1980’s, growth of economy was highly unsustainable because of its dependence on borrowings to correct the current account deficit. To reduce the imbalances, the government of India introduced e ...

... of measures like licensing system, high tariffs and rates, limited investment in core sectors only. During 1980’s, growth of economy was highly unsustainable because of its dependence on borrowings to correct the current account deficit. To reduce the imbalances, the government of India introduced e ...

Self-Fulfilling Credit Market Freezes

... the macro economy were motivated in an influential paper by Cooper and John (1988), and have been used in other papers (e.g., Goldstein and Pauzner (2004)). Our paper complements this literature by showing how such complementarities can cause an inefficient credit freeze and analyze government polic ...

... the macro economy were motivated in an influential paper by Cooper and John (1988), and have been used in other papers (e.g., Goldstein and Pauzner (2004)). Our paper complements this literature by showing how such complementarities can cause an inefficient credit freeze and analyze government polic ...

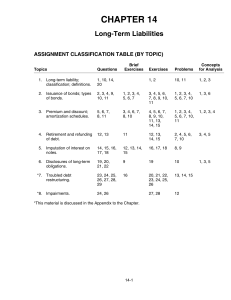

CHAPTER 14 Long-Term Liabilities

... 19. FASB Statement No. 47 requires disclosure at the balance sheet date of future payments for sinking fund requirements and the maturity amounts of long-term debt during each of the next five years. 20. Off-balance-sheet-financing is an attempt to borrow monies in such a way that the obligations ar ...

... 19. FASB Statement No. 47 requires disclosure at the balance sheet date of future payments for sinking fund requirements and the maturity amounts of long-term debt during each of the next five years. 20. Off-balance-sheet-financing is an attempt to borrow monies in such a way that the obligations ar ...

The Role of Operating Leverage in Asset Pricing

... common factor in returns related to relative profitability.” Chen and Zhang (1998) show that the value premium of value stocks is a compensation to the additional risk induced by some characteristics of value stocks. Firms with high book-to-market ratio (value firms) typically face higher degree of ...

... common factor in returns related to relative profitability.” Chen and Zhang (1998) show that the value premium of value stocks is a compensation to the additional risk induced by some characteristics of value stocks. Firms with high book-to-market ratio (value firms) typically face higher degree of ...

A Contribution to Critical Globalization Studies

... The developed world accounts for approximately 25% of the world’s population, but has accounted for almost more than 70% of the world’s wealth on a continuous basis since 1970 (Fuchs 2008a). The least developed countries’ share of wealth has dropped from above 3% to just over 1% since 1980 (Fuchs 20 ...

... The developed world accounts for approximately 25% of the world’s population, but has accounted for almost more than 70% of the world’s wealth on a continuous basis since 1970 (Fuchs 2008a). The least developed countries’ share of wealth has dropped from above 3% to just over 1% since 1980 (Fuchs 20 ...

Part I – Introduction - LSA

... - Liquidity and cash flow problems as result of high interest payments - Assumption that rate of return = $10. What if one year it is $3 then interest>return and go into default (debtholder can then sue to accelerate the loan and put you into bankruptcy) - Tax problems (tax authorities will be sus ...

... - Liquidity and cash flow problems as result of high interest payments - Assumption that rate of return = $10. What if one year it is $3 then interest>return and go into default (debtholder can then sue to accelerate the loan and put you into bankruptcy) - Tax problems (tax authorities will be sus ...

CATERPILLAR INC (Form: 10-K, Received: 02/22

... markets and sells diesel, heavy fuel and natural gas reciprocating engines for Caterpillar machinery, electric power generation systems, locomotives, marine, petroleum, construction, industrial, agricultural and other applications. In addition, Caterpillar provides industrial turbines and turbine-re ...

... markets and sells diesel, heavy fuel and natural gas reciprocating engines for Caterpillar machinery, electric power generation systems, locomotives, marine, petroleum, construction, industrial, agricultural and other applications. In addition, Caterpillar provides industrial turbines and turbine-re ...

Private Placement Financing - Informa Financial Intelligence

... unsustainable price, as DryShips not only reported Q2 and Q3 ...

... unsustainable price, as DryShips not only reported Q2 and Q3 ...

Complete issue

... inflation expectations and smoothing fluctuations in output and employment. The interest rate increases that have been implemented are now having a dampening impact on economic growth. When inflation is close to 2.5%, the normal interest rate level over time is considered to be between 5% and 6%. Th ...

... inflation expectations and smoothing fluctuations in output and employment. The interest rate increases that have been implemented are now having a dampening impact on economic growth. When inflation is close to 2.5%, the normal interest rate level over time is considered to be between 5% and 6%. Th ...

Economic Value Added (EVA), Agency Costs and Firm Performance

... As per traditional firm performance measures alone, an investor has to make the future investment decisions in the present based on the past information (Combs et al. 2005; Richard et al. 2009). At the most, the derived accounting indicators, such as certain financial ratios (e.g. ROA, ROE, debt-equ ...

... As per traditional firm performance measures alone, an investor has to make the future investment decisions in the present based on the past information (Combs et al. 2005; Richard et al. 2009). At the most, the derived accounting indicators, such as certain financial ratios (e.g. ROA, ROE, debt-equ ...

Report: Inquiry into Financial Products and Services in Australia

... 9. the need for any legislative or regulatory change. On 16 March 2009 the Senate agreed that the following additional matter be referred to the Parliamentary Joint Committee on Corporations and Financial Services as part of that committee's inquiry into financial products and services in Australia, ...

... 9. the need for any legislative or regulatory change. On 16 March 2009 the Senate agreed that the following additional matter be referred to the Parliamentary Joint Committee on Corporations and Financial Services as part of that committee's inquiry into financial products and services in Australia, ...

Moving from private to public ownership: Selling out to

... management, then this scenario might be especially true when they have made significant investments in the firm. 3.2. Growth and the need for capital We expect the growth characteristics of the private firm to influence the choice of transition method for private-firm owners. A firm may range from b ...

... management, then this scenario might be especially true when they have made significant investments in the firm. 3.2. Growth and the need for capital We expect the growth characteristics of the private firm to influence the choice of transition method for private-firm owners. A firm may range from b ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.